Solana Blockchain

INTRODUCTION

Exploring the Vibrant Solana Blockchain Token Ecosystem

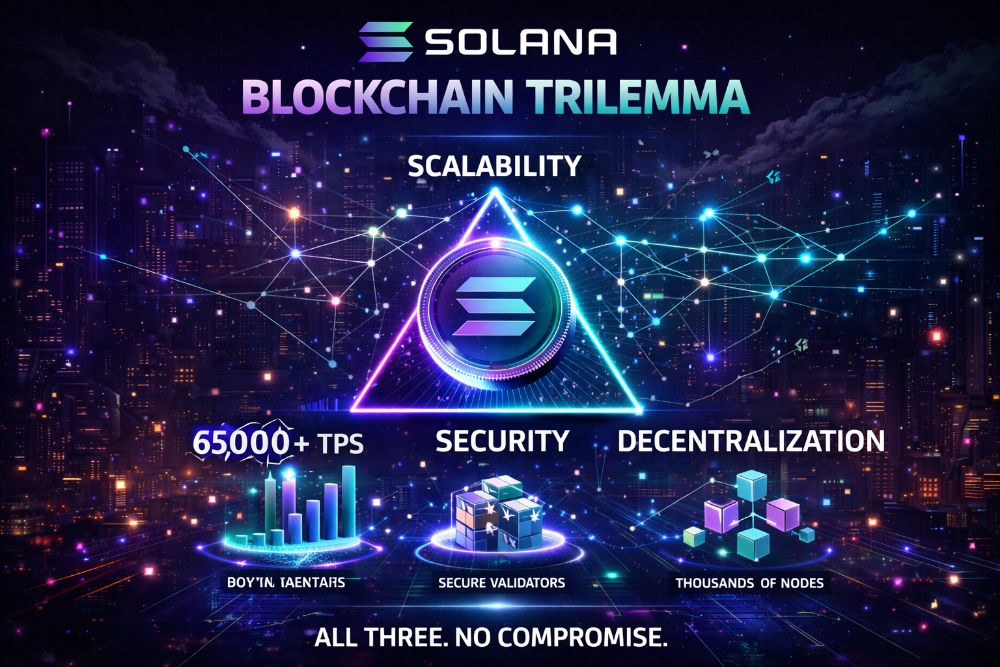

The Solana blockchain has quickly emerged as a leading player in the cryptocurrency and decentralized finance (DeFi) space. Known for its lightning-fast transaction speeds and low fees, Solana has attracted a growing number of developers and projects building innovative applications on its platform.

At the heart of the Solana ecosystem are the various tokens that power its diverse range of use cases. Let's dive into the world of Solana blockchain tokens and explore the key players in this thriving ecosystem.

1. Solana (SOL) - The Native Token

Solana's native token, SOL, is the backbone of the network. SOL is used for a variety of purposes, including paying transaction fees, staking to validate the network, and participating in governance decisions. As the Solana ecosystem expands, the demand for SOL is expected to grow, potentially driving up its value.

2. Decentralized Finance (DeFi) Tokens

Solana has become a popular choice for DeFi projects, with a wide range of tokens powering various lending, borrowing, and trading platforms. Examples include Serum (SRM), Raydium (RAY), and Saber (SBR), which are integral to the Solana DeFi ecosystem.

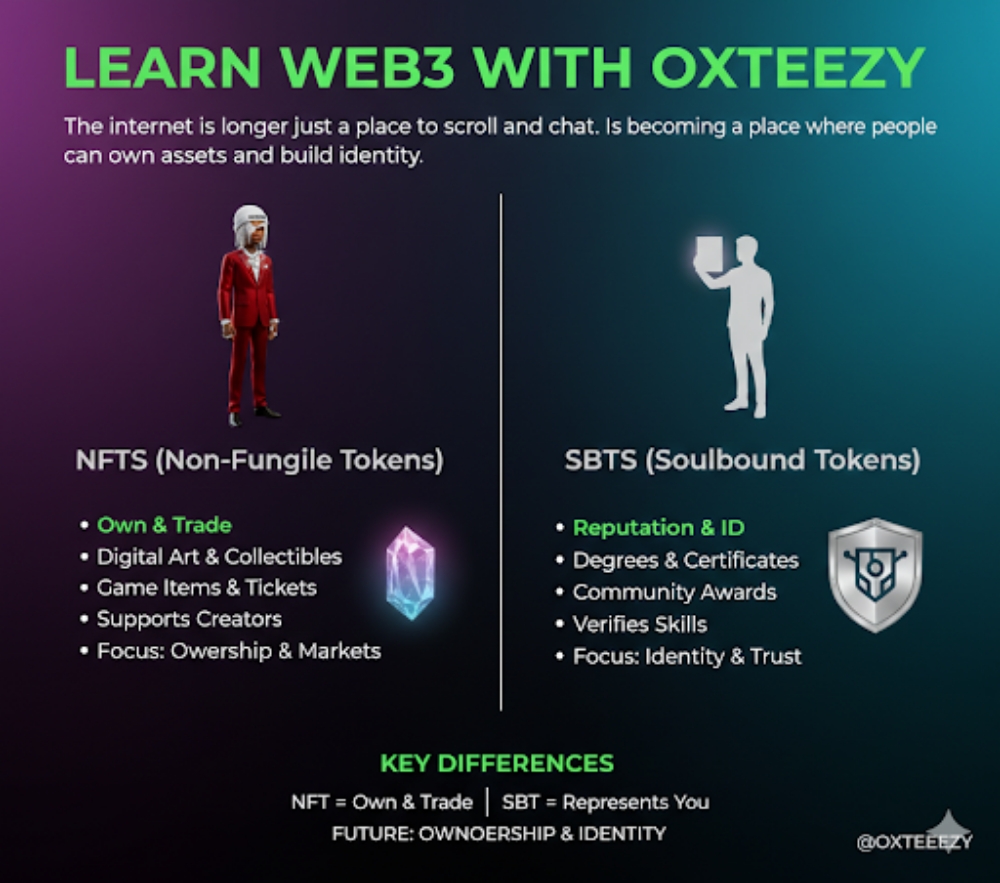

3. Non-Fungible Tokens (NFTs)

Solana has also emerged as a leading blockchain for NFT projects. Tokens like Solana Monkey Business (SMB), Degenerate Ape Academy (APE), and Aurory (AURY) have gained significant attention in the Solana NFT space, showcasing the network's potential for digital art and collectibles.

4. Decentralized Applications (dApps) Tokens

Solana's fast and affordable transactions have attracted a diverse range of decentralized applications, each with its own native token. These include gaming platforms like Stepn (GMT), decentralized exchanges like Serum (SRM), and social media platforms like Bonfida (FIDA).

5. Ecosystem Utility Tokens

Beyond DeFi and NFTs, Solana also hosts a range of utility tokens that power various services and applications within the ecosystem. Examples include Saber (SBR) for cross-chain asset swaps, Bonfida (FIDA) for domain name services, and Serum (SRM) for decentralized trading.

CONCLUSION

The Solana token ecosystem is rapidly evolving, with new projects and use cases emerging regularly. As the network continues to gain traction and adoption, the demand for Solana-based tokens is likely to increase, potentially creating opportunities for investors and users alike.

However, it's important to note that the cryptocurrency market, including the Solana ecosystem, can be highly volatile. Investors should conduct thorough research, understand the risks, and diversify their portfolios accordingly before allocating funds to Solana-based tokens.