𝗜 𝗲𝘅𝗽𝗲𝗰𝘁 𝘁𝗵𝗲 𝔹𝕋ℂ 𝕋𝕠𝕡 𝕥𝕙𝕚𝕤 𝔹𝕦𝕝𝕝 ℝ𝕦𝕟 𝗧𝗼 𝗕𝗲 𝗯𝗲𝗹𝗼𝘄 𝟭𝟱𝟬𝗞

I think it´s the name, I think just because I am called BitcoinBaby I should know about Bitcoin.

Why is that, like if I call my Daughter Angel she can tell me about God?

But to live up to the expectations and because I am a curious baby I do try to have at least a bit of an idea about the King Crypto. Just in case people ask me stuff like:

Does it still make sense to DCA into btc right now?

I mean like that ever happens, right? Who would want financial advice from, a baby? I am full it I know, but I do have a clear and simple reasoning behind that number.

I am full it I know, but I do have a clear and simple reasoning behind that number.

To understand where I am coming from we need to look back:

June 2011: From a price measured in just cents the year before, Bitcoin made a meteoric rise to $32

December 2013: By the end of the year, Bitcoin experienced an almost 10-times price increase between October and December. At the beginning of October, BTC was trading at $125 before reaching its peak of $1,160.

December 2017: After starting at roughly $1,000 in January 2017, Bitcoin saw a meteoric rise in price to just under $20,000 by December 17, 2017.

November 2021: The corona dip on 13 Mar 2020 dropped the king crypto below $4,000 only to rise up to $68,000 by November 2021,

Now let´s see what that does if you just take it from the Top, does that tell us anything?

From Top To Top

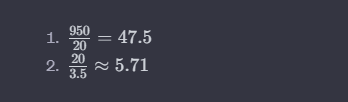

- 2011 $1 to 2013 $950 = 950X

- 2013 $950 to 2017 $20,000 = 20X

- 2017 $20.000 to 2021 $68.000 = 3.5X

It´s of course a bit early and we lack data to understand the diminishing sequence but let´s do it anyway The trend for that sequence would be 0.7 (0.6852) in 2025, but as 1 is given it would be 1.7 * 68K )the last top) = 115K

The trend for that sequence would be 0.7 (0.6852) in 2025, but as 1 is given it would be 1.7 * 68K )the last top) = 115K

Now what do those numbers tell me, that the trend is going down?

What Else?

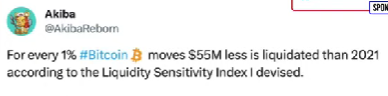

The trend goes down really fast each cycle as there is growing selling pressure, and less room for price discovery. or in other words, older coins stabilize over time. They are becoming more resilient just look at this: Bitcoin is becoming a stable coin well at least as stable as digital gold should be, but for the next few years it will still be much more volatile.

Bitcoin is becoming a stable coin well at least as stable as digital gold should be, but for the next few years it will still be much more volatile.

Second Opinion

I don´t base myself on one perspective, even though I like things simple I will use two

Let´s also take into account the reduced increases from the bear market bottom to the bull market top:

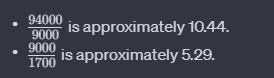

- 2011 $1 to 2013´s $950 is 95000%

- 2015´s bottom was around $222 and then up 9000% to the 20K in 2017

- 2020 Bottomed out at 4K and 2021 ended at 68K 1700%

As most of you remember the lovely day in 2022 when BTC reached 16K thanks to Sam. Now that was I day worth buying and so I did...but it´s not about me it´s about the Math.

And by following the above sequence the logical next number would be: Just about 2.1!

Just about 2.1!

This means 800% from Bottom to top which is 8 times 16K = $128K

Based on both these cycle trends the logical next number sits between 115 & 128K.

Now I know your favorite YouTuber promised you the biggest bull run ever, and he or she might be right...next time.

Next Time?

Yes, the decreasing gains happen to tokens and people when they get older.

For BTC there is one big butt, and that is that it´s the biggest coin on the Block(chain) and therefore will probably be the first to fall victim to mass adoption.

Now if Mass Adoption would happen this cycle those that scream for 250K and beyond will get it their way.

However my expectation is not taking into account that mass adoption will happen this cycle, but if it does it will change the story entirely.

I am not a pessimist and I do expect that we will get a sticking big supply squeeze when the world is truly in a fiat-induced financial crisis.

The thing is:

- I think the money-printing game can hold out for a couple of more years.

- I think that the normies will not see the value of $BTC in 2025.

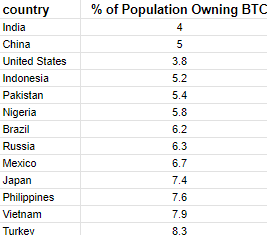

ATM even in the most crypto-developed countries less than 10% is holding Bitcoin. In addition, the Global Macro Economic Market Makers can hide the fiat fuck up for another couple of years till the inevitable recession hits.

In addition, the Global Macro Economic Market Makers can hide the fiat fuck up for another couple of years till the inevitable recession hits.

That is why I expect this market to increase adoption by 100-200%. It would be amazing if 10-15% of the world would hold crypto at the peak of this bull run in 2025.

The global crypto ownership rate is currently (2023) around 4.2%, with over 320 million crypto users worldwide. It reported that the United States was top with 46 million crypto holders, followed by India, Pakistan, and Nigeria.

Now I thought comparing that to holding stocks, but that is like apples and pears. Stocks are found in wealthy countries. In developed countries, such as the United States, the United Kingdom, and Canada, about half of the population owns stocks.

In India and China, it´s around 10%, and in Africa....

In Africa, they are way more likely to hold crypto than stocks.

But for the sake of a false comparison according to a 2022 report by the World Bank, the global average for stock market ownership is 23%.

As Crypto is more accessible I would expect mass adoption to start at 23%, and that Dear Reader will be the start of the last Bull Run. Probably around 2029

Bikini Bottom Line

This is no financial advice, I am just trying to make sense of the trends, and combine that with macroeconomics and adoption numbers. To give me some guidance on when I think the top is close.

Because near the top it´s time to sell, or at least turn my alt bags into $PAXG and some real gold & silver just to not be a bag holder after the bull run is done.

No super cycle, no prolonged run, just get out on time and invest the profits wisely this time around.

Thank goodness you made it till the end Pees, Love and I am out of here!

[Source Pic](All pictures are by MyI & AI unless source is listed)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)