Loopring: A Layer-2 DEX Scaling Protocol

Loopring is a Layer-2 scaling protocol for decentralized exchanges (DEXs) built on the Ethereum blockchain

It enables high-throughput, low-cost, non-custodial decentralized exchange and payments.

Loopring leverages Zero-Knowledge Proofs (ZKPs) to allow anyone to build a high-throughput, non-custodial DEX.

Loopring's Zero-Knowledge Rollups (zk-Rollups)

Many DEXs use automated market makers (AMMs) to match buyers and sellers. Loopring, on the other hand, uses zk-Rollups, a Layer-2 function that integrates with the Ethereum network to improve scalability. A zk-Rollup can bundle hundreds of transactions together and transform them into a single data-light Zero-Knowledge Proof that is then confirmed in a batch on the Ethereum network. This allows for significantly higher transactional throughput than Ethereum can currently handle alone.

Loopring Crypto Tech Unboxed: OCDA, Ring Miners, Order Rings, Order Sharing

Loopring features an on-chain/off-chain switch called OCDA that enables significantly faster transactions in instances where data is available to move off-chain for computation.

Loopring also utilizes a high-throughput arbitrage mechanism that uses a system of order rings, order miners, and order sharing to achieve near-instant, internet-scale liquidity.

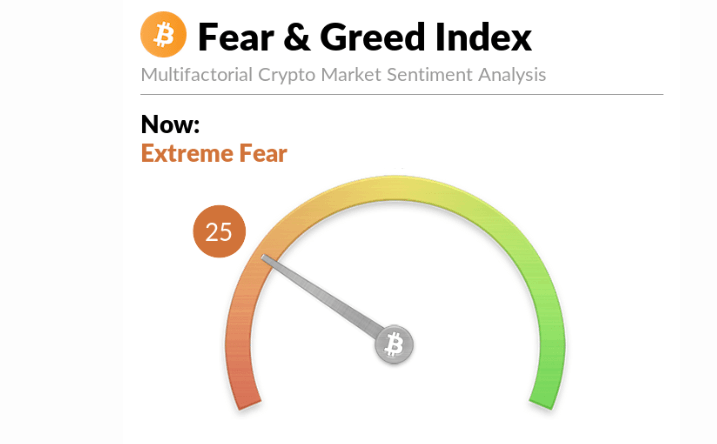

On-chain data availability (OCDA): Loopring's OCDA allows users to choose whether their data is stored on-chain or off-chain. When OCDA is switched off, data is stored on-chain and the network can achieve 2,025 transactions per second (TPS). However, if OCDA is switched on and data is stored off-chain, throughput can reach 16,400 TPS.

Ring miners: Loopring uses a unique consensus protocol that circumvents traditional order books and the AMM mechanisms governing liquidity pools. Instead, network participants called ring miners are responsible for rapidly filling orders before they're executed or canceled.

Order rings: When a ring miner completes an order ring, the Loopring smart contract determines how to fill it. If it can execute the order on either side of the trade, the smart contract will execute an atomic swap — a direct transfer from the smart contract to the user's wallet. Order rings also facilitate ring-matching, which is the process of fulfilling orders by stringing them together and settling multiple trades through multiple users.

Order sharing: Order sharing is made possible via order rings on the Loopring protocol. In the instance that the Loopring DEX smart contract cannot execute an order in a single trade, order sharing is used to split orders into partial components until the full original order amount is fulfilled.

Loopring Tokenomics and Beyond

Loopring's native token, LCR, has been integrated into the Loopring protocol since inception as a reward for liquidity providers and zk-Rollup operators. The Loopring roadmap calls for an expansion of token utility, and the Loopring team is currently using the LRC token as a reward to incentivize the continued development of Loopring and the wider Layer-2 ecosystem.

Loopring is a promising Layer-2 scaling protocol for DEXs that has the potential to revolutionize the way digital assets are traded. Its zk-Rollup technology, combined with its innovative features like OCDA, ring miners, order rings, and order sharing, makes it a strong contender in the race to scale Ethereum

As the DeFi ecosystem continues to grow, Loopring is well-positioned to play a major role in its future.

References:

Loopring’s Layer-2 DEX Scaling Solution: zk-Rollups | Gemini. (n.d.). Retrieved from https://www.gemini.com/cryptopedia/loopring-coin-dex-decentralized-exchange

elegant_solution. (n.d.). Retrieved January 13, 2024, from https://www.freepik.com/author/user28432665

Freepik - Goodstudiominsk. (n.d.). Retrieved January 5, 2024, from https://www.freepik.com/author/goodstudiominsk

My links