Crypto and the Psyche Navigating Trust, Volatility, and Financial Liberation in the Digital Frontier

"In the realm of Crypton, trust is the currency of the digital frontier, and volatility is the heartbeat of innovation."

Summary

The text highlights the transformative nature of Crypto, portraying trust as the cornerstone in the cryptocurrency realm and volatility as the driving force of innovation. It invites readers to contemplate the dynamic and evolving landscape of Crypto, where decentralized technologies redefine traditional notions and shape the future of finance.

Crypto and the Psyche

Crypto, the revolutionary digital currency, has become a focal point of interest not only for financial analysts but also for psychologists seeking to understand the intricate relationship between technology and human behavior. This essay delves into the multifaceted ways in which Crypto influences psychology, exploring dimensions such as trust, volatility, financial autonomy, societal change, and privacy.

One of the most striking features of Crypto's impact on psychology is its redefinition of trust. Unlike traditional currencies that derive trust from established institutions and tangible backing, Crypto operates on the principles of decentralization and blockchain technology. This shift challenges the conventional understanding of trust, demanding users to place their faith in a distributed network rather than centralized authorities. The psychological adjustment required to embrace this decentralized trust is not only a cognitive process but also an emotional one, marking a fundamental shift in how individuals perceive and trust financial systems.

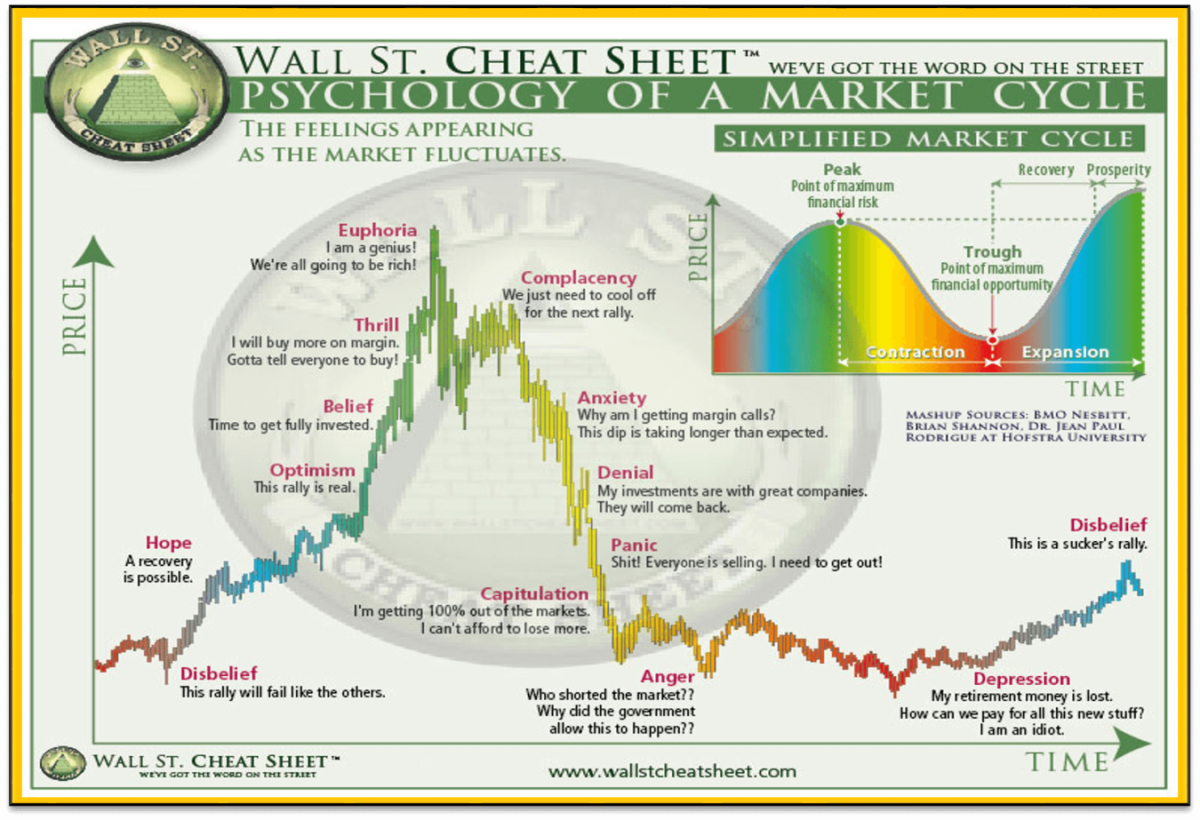

The inherent volatility of Crypto's value adds a layer of complexity to its psychological impact. The cryptocurrency market is notorious for its price fluctuations, leading to a rollercoaster of emotions for investors. The fear of missing out (FOMO) during bullish trends and the fear of loss during bearish periods significantly influence investor decision-making. Understanding and managing these emotional responses are critical for individuals navigating the dynamic landscape of Crypto, highlighting the psychological challenges inherent in participating in a market characterized by constant price volatility.

Furthermore, Crypto's introduction has prompted discussions on the psychological implications of financial autonomy. The concept of being one's own bank, facilitated by Crypto's decentralized nature, prompts individuals to reassess their relationship with financial responsibility. This introspection raises questions about risk tolerance, self-management, and the psychological aspects of controlling one's wealth. Crypto, therefore, acts as a catalyst for redefining the psychological dimensions of financial independence and responsibility.

The adoption of Crypto also triggers broader societal reflections on cultural change and the psychology of technology adoption. Embracing a digital currency is not merely a financial decision; it signifies a cultural shift in how individuals perceive and interact with money, trust, and authority. The psychological factors influencing the acceptance of Crypto extend beyond economic considerations, encompassing societal values, attitudes, and the evolving dynamics of trust in a technologically-driven world.

On a more profound level, Crypto raises ethical questions related to privacy and security. The anonymity offered by Crypto transactions prompts a nuanced exploration of the psychological aspects of privacy in financial transactions. Individuals weigh the desire for financial privacy against concerns about potential illicit activities, leading to an ethical dilemma with psychological implications. The intricate interplay between technology, privacy, and ethics in the context of Crypto highlights the complexity of its impact on societal psychology.

In conclusion, Crypto's influence on psychology is extensive, reaching into dimensions of trust, volatility, financial autonomy, societal change, and privacy. As this digital currency continues to shape the financial landscape, its psychological ramifications will likely evolve, challenging individuals and societies to navigate the intricate intersections of technology and human behavior. Understanding these psychological nuances is crucial for comprehending the profound influence Crypto exerts on our perceptions and decisions in the ever-evolving world of finance.

References

References:

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

- Tapscott, D., & Tapscott, A. (2016). Blockchain revolution: how the technology behind bitcoin is changing money, business, and the world. Penguin.

- Thaler, R. H. (2015). Misbehaving: The Making of Behavioral Economics. W. W. Norton & Company.

- Gigerenzer, G. (2015). Simply Rational: Decision Making in the Real World. Oxford University Press.

- Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction. Princeton University Press.

- Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

- Swan, M. (2015). Blockchain: blueprint for a new economy. O'Reilly Media, Inc.

- Greenspan, G. (2020). The Age of Cryptocurrency: How Bitcoin and Digital Money are Challenging the Global Economic Order. St. Martin's Publishing Group.

- Antonopoulos, A. M. (2014). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. O'Reilly Media, Inc.

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)