How to Find Liquidity in Forex

How to Find Liquidity in Forex

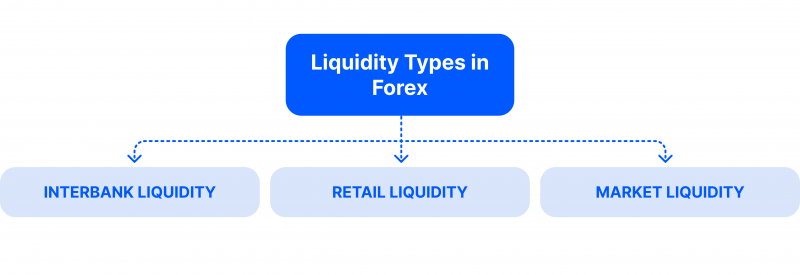

To determine FX liquidity, brokers use various indicators and techniques like trading volume, bid/ask spreads, market depth, and the number of participants in the market. Thus, higher transacting volume and narrower spreads indicate greater liquidity, market depth indicates the quantity of buy/sell orders at different price levels, and more active participants indicate increased liquidity. Traders must have a good knowledge of the various channels through which foreign exchange funds can move in the market. This can make it easier or harder for them to buy and sell currencies at the right times. Here are the most common types of liquidity in the Forex market.

Traders must have a good knowledge of the various channels through which foreign exchange funds can move in the market. This can make it easier or harder for them to buy and sell currencies at the right times. Here are the most common types of liquidity in the Forex market.

- Interbank liquidity is the highest level of forex market liquidity, provided by large finance institutions to other institutions through direct or electronic communication networks, characterised by deep order books and narrow bid-ask spreads.

- Retail liquidity refers to the one offered by retail brokers, acting as intermediaries between traders and the interbank market, offering varying levels of liquidity to cater to different traders’ needs.

- Market liquidity is determined by trade volume, with higher values indicating more elevated liquidity. Traders should be aware of market liquidity conditions to avoid wider spreads and slippage.

Brokers come across such elements as bid-and-ask spread and slippage in the FX market — the key components affecting its liquidity.

The bid-ask spread in Forex is the dissimilarity between the highest price a customer is willing to buy and the lowest price a seller is willing to sell. It represents the cost of trading and is a key component of liquidity. Tight spreads indicate high liquidity, while wider spreads suggest its lower level. Major currency pairs like EUR/USD and USD/JPY have tighter spreads due to their high liquidity.

Slippage in Forex occurs when a trade’s execution occurs at a different price than expected and can be positive or negative. High liquidity reduces the chances of slippage.

Where Does Liquidity Come From?

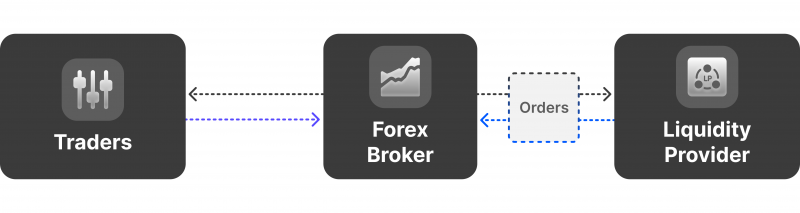

Brokers must have the broadest available liquidity pool to meet client expectations and satisfy their clients’ expectations. The question remains about how the brokers gain liquidity.

FX broker liquidity providers (LPs), including market brokers and professional market makers, contribute to the FX market’s liquidity. They aggregate rates from major banks and hedge funds, displaying them in a broker’s order book, ensuring a smooth trading experience.

FX liquidity distributors act as counterparties in global transactions, matching customers with buyers or assets. They facilitate transactions, acting as market makers and influencing market volatility. FX LPs are financial institutions that own or have access to a large pool of currencies and lend them to smaller firms for trade execution. LPs in the forex market are essential for efficient currency exchanges. There are various types of LPs in the market:

LPs in the forex market are essential for efficient currency exchanges. There are various types of LPs in the market:

- Banks – They amass large amounts of assets to offer competitive pricing to their clients.

- Electronic communication networks (ECNs) – They match algorithmic buy and sell orders from traders, banks, and hedge funds.

- Market makers – They buy and sell assets from their inventories to supply liquidity in global markets, even in volatile situations.

- Hedge funds – They buy up large quantities of financial assets to boost their liquidity and offer competitive pricing to market participants.

- Retail brokers – They provide liquidity primarily to retail traders, serving as intermediaries between financial institutions and retail traders to maximise liquidity pools and reduce slippage.

LPs can be categorised into Tier-1 and Tier-2 suppliers, which act as Market Makers, offering liquidity to clients, setting prices and commissions, and being counterparties of trades.

Tier-1

Tier 1 LPs, such as large banks and financial entities (Deutsche Bank and Barclays Capital, for example), accept large-volume orders that smaller brokers cannot obtain.

Tier-2

Tier-2 suppliers, also known as Prime of Prime (PoP) or liquidity aggregators, act as a bridge between smaller market participants and Tier-1 liquidity providers.

PoP firms are non-bank liquidity providers that aggregate numerous small-volume orders from small forex brokers to send big-volume orders to Tier 1 providers. Tier 2 LPs, such as B2Prime, FXCM and Swissquote, are large, well-known, and reliable forex brokers that can aggregate orders from smaller brokers.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)