BlackRock Proposes Bitcoin ETF Directly to Investors

Instead of selling Bitcoin for cash, BlackRock's Bitcoin ETF would transfer BTC directly to authorized investors and redeem shares from them.

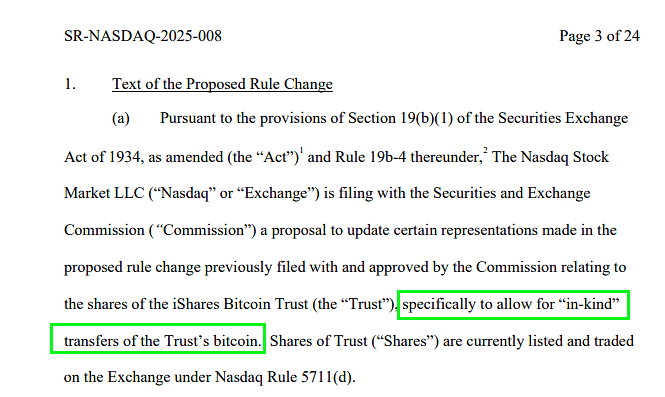

On January 25, the US stock exchange Nasdaq announced that on behalf of asset manager BlackRock, it has filed a 19b-4 filing with the US Securities and Exchange Commission (SEC) to change the trading mechanism of the iShares Bitcoin Trust (IBIT).

NEW: BlackRock/iShares just filed to allow in-kind creation and redemption on their Bitcoin ETF $IBIT pic.twitter.com/Hy0tIEK81h

— James Seyffart (@JSeyff) January 24, 2025

According to Nasdaq, the amended filing would add an "in-kind redemption" mechanism to the iShares Bitcoin Trust, allowing the fund to process transactions without using cash.

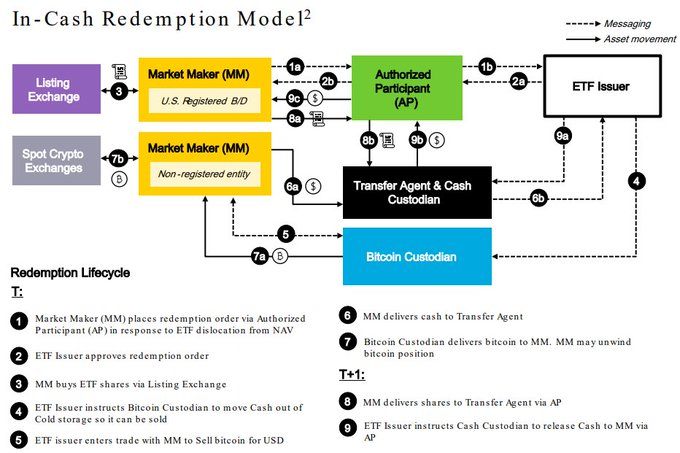

When Bitcoin ETFs were approved by the SEC in the past, stakeholders debated the best way to handle the conversion process between customer assets and BTC. The SEC at the time favored a cash-to-cash model, so every time a customer wanted to withdraw their funds, BlackRock and other companies would have to:

- Sell the Bitcoin that the ETF was holding.

- Convert that Bitcoin into cash.

- Return the cash to investors.

While this process ensures transparency, it creates unnecessary complexity, especially with large-volume transactions.

With the new method proposed by Nasdaq, instead of directly selling Bitcoin for cash, BlackRock's Bitcoin ETF would transfer BTC directly from its vaults to authorized participants, and the ETF would redeem shares from them.

However, BlackRock notes that the new process will not apply to individual investors, but only to institutions authorized to use the fund's share conversion mechanism.

The new process will help eliminate intermediaries, speed up processing, reduce transaction costs, and most importantly, optimize the efficiency of ETF operations. James Seyffart, an ETF analyst at Bloomberg, commented:

"The in-kind method will make ETFs trade much smoother and more efficient. The trading process will be streamlined, reducing unnecessary costs. In my opinion, this should have been applied from the beginning, but the Democratic-leaning SEC commissioners opposed this idea."

Wow. Way too many questions and this stuff goes pretty deep in the weeds. So i'll keep it high level and answer "What does this mean?"

Not all that much for individual retail investors. Mostly what it means is that ETFs should trade even more efficiently than they already do… pic.twitter.com/LWYsKmo5sH

— James Seyffart (@JSeyff) January 24, 2025

In addition, James Seyffart also shared that the SEC's move to revoke SAB 121 regulation is the key to the proposed change to the trading mechanism of the iShares Bitcoin Trust, emphasizing: "The side effects from abolishing SAB 121 are likely only just beginning."

Yes sir. The side effects from abolishing SAB 121 are likely only just beginning

— James Seyffart (@JSeyff) January 24, 2025

SAB 121 regulation once required banks and financial companies to record crypto assets held for customers as a liability on their balance sheets, creating many legal and accounting burdens. However, with the SEC officially withdrawing SAB 121, crypto ETFs have deployed a variety of custody methods and supported many types of transactions such as direct conversion (in-kind redemption). Thereby reducing costs and attracting active participation from long-standing financial institutions.

In the context of the crypto industry's legal environment becoming more "breathable" under President Donald Trump, this is considered an important boost to promote the development of crypto ETFs and the crypto market in general.

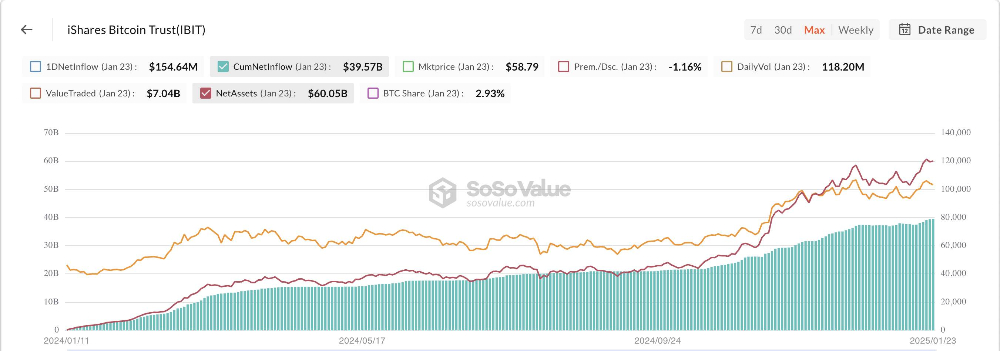

Meanwhile, BlackRock's IBIT fund is currently the largest Bitcoin ETF with total net assets exceeding the $60 billion mark, while recording a total inflow of up to $39.75 billion.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)