What is a Spot Bitcoin ETF? What opportunities will the adoption of ETF bring?

On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) approved the spot Bitcoin ETF application, and at the same time, the ETF applications of 11 institutions were approved. Bitcoin has ushered in an epoch-making development, and the encryption industry has opened a new chapter.

The entire crypto market is celebrating this historic moment, and the spot Bitcoin ETF finally passes!

The news of the adoption of the Bitcoin ETF has caused several misunderstandings.

Some people say that institutions or individuals intentionally manipulate the market. Some are interns, and some are hackers. The news is mixed between true and false, and each time it brings huge fluctuations to the market.

On the contrary, this time the ETF really passed, and the boots were on the ground. BTC is relatively calm anyway, and the current price is $46,000. Bitcoin ETF officially passes

Bitcoin ETF officially passes

1. What is a spot Bitcoin ETF?

A Bitcoin ETF is a financial product that tracks the price of Bitcoin and is an investment fund that enables investors to buy and sell on traditional stock exchanges.

Investors can participate in Bitcoin transactions on traditional stock exchanges, which is a convenient way to participate in cryptocurrencies without the need to manage digital assets. More importantly, it is regulated and has no policy risks.

The approval of the Bitcoin ETF application establishes a connection between the traditional financial system and decentralized cryptocurrencies, allowing more ordinary people to have channels to participate in cryptocurrencies, allowing traditional investment assets to enter the crypto market, and bringing benefits to the Bitcoin market. More liquidity.

The idea of Bitcoin ETF first appeared in early 2010. At that time, cryptocurrency was favored by investors, but was rejected by the mainstream market; the supervision of cryptocurrency by relevant agencies has also been in a relatively tense state.

The development of BTC has also experienced ups and downs, once rising to $69,000, and once experiencing an annual decline of more than 85%.

The Bitcoin ETF application was full of ups and downs along the way. It was always rejected and never given up. After 14 years of hard work, the Bitcoin ETF finally passed. Bitcoin ETF passes

Bitcoin ETF passes

2. How to buy Bitcoin ETF?

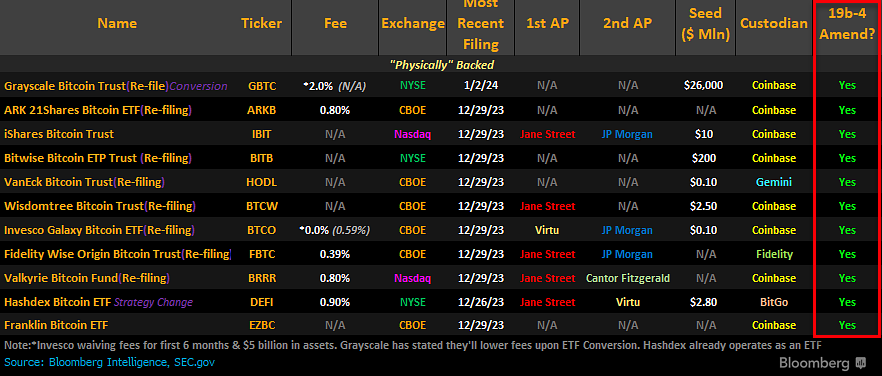

This time, 11 Bitcoin ETF applications were approved, including Grayscale, iShares, ARK Invest, WisdomTree and other institutions;

Among them, Grayscale (GBTC) has an asset management scale of approximately US$46 billion, and Blackrock’s iShares has an asset management scale of US$9.42 trillion, ranking first in the industry.

Six of the ETFs will be listed on the Chicago Board Options Exchange (CBOE), three will be listed on the New York Stock Exchange (NYSE) and two will trade on Nasdaq.

No wonder various communities are joking about it today. Everyone’s status has jumped up and become respected decentralized financial investment research consultant analysts of Nasdaq and New York Stock Exchange, Chicago Board of Trade and US stock traders.

Of course, for domestic players, opening accounts for U.S. stocks such as the Chicago Board Options Exchange, New York Stock Exchange, and Nasdaq may require some twists and turns.

But does the approval of the U.S. SEC’s application for a Bitcoin ETF mean that other countries’ policies towards cryptocurrencies are loosening, and will the entire crypto market usher in a new situation? After all, it was recognized. 11 approved Bitcoin ETF applications

11 approved Bitcoin ETF applications

3. The impact of Bitcoin ETF adoption on the crypto industry

The Bitcoin ETF passed, but the price of BTC did not experience the phenomenon of explosive growth. It may be due to the previous “crying wolf” that consumed a lot of market sentiment and liquidity.

However, the ETF has driven other tokens to surge, especially the various tokens in the Ethereum ecosystem, which have different increases. ETH has increased by 10 points, and ARB has increased by more than 20 points.

With the passage of the Bitcoin ETF, cryptocurrency regulation has changed from blockage to loosening. BTC has a legal identity, which has also opened the door to traditional investment institutions, bringing liquidity and stability to the entire crypto market.

Bitcoin will also usher in another halving in 2024, and each halving is accompanied by a price increase. In 2024, the encryption market will usher in a milestone development. BTC current price is $46,000

BTC current price is $46,000

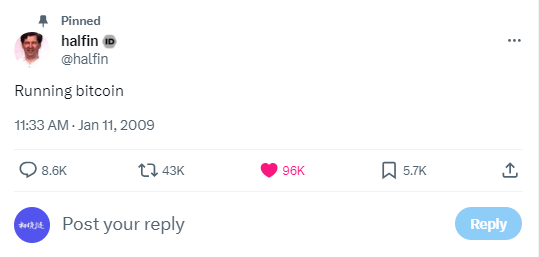

In the past two days, Hal Finley, who had email exchanges with Satoshi Nakamoto and assisted Satoshi Nakamoto in testing the Bitcoin mining software, was found to have tweeted on January 11, 2009, which read: “Running Bitcoin “.

Today, 15 years later, BTC has finally been recognized by mainstream society. With its official status, the development of Bitcoin will usher in a new era. Early Bitcoin supporter Hal Finley

Early Bitcoin supporter Hal Finley

And we are witnessing and participating in this historical moment, and BTC will continue to change the world; although this process is full of risks and may return to zero, it also truly affects each of us.

The above is just my personal opinion, no investment advice. I’m CryptoLola and I follow the crypto market and web3.

Bitcoinetf

Etf

Btc

Follow

Follow

Written by CryptoLola

1K Followers

·

Writer for

Coinmonks

I am a content creator, a self-media. I mainly focus on NFTs, Metaverse, Blockchain, etc.

More from CryptoLola and Coinmonks

CryptoLola

CryptoLola

in

Coinmonks

What are BRC20 and ARC20?

After ORDI was listed on Binance, brc20 quickly emerged from the circle. Ordinary players who do not understand on-chain casting can also…

7 min read

·

Nov 21, 2023

15

1

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

591

2

Sovereign Crypto

Sovereign Crypto

in

Coinmonks

30–50X Altcoin Portfolio

2024 Update — Bull Run Ready Portfolio

11 min read

·

Dec 23, 2023

472

12

CryptoLola

CryptoLola

in

Coinmonks

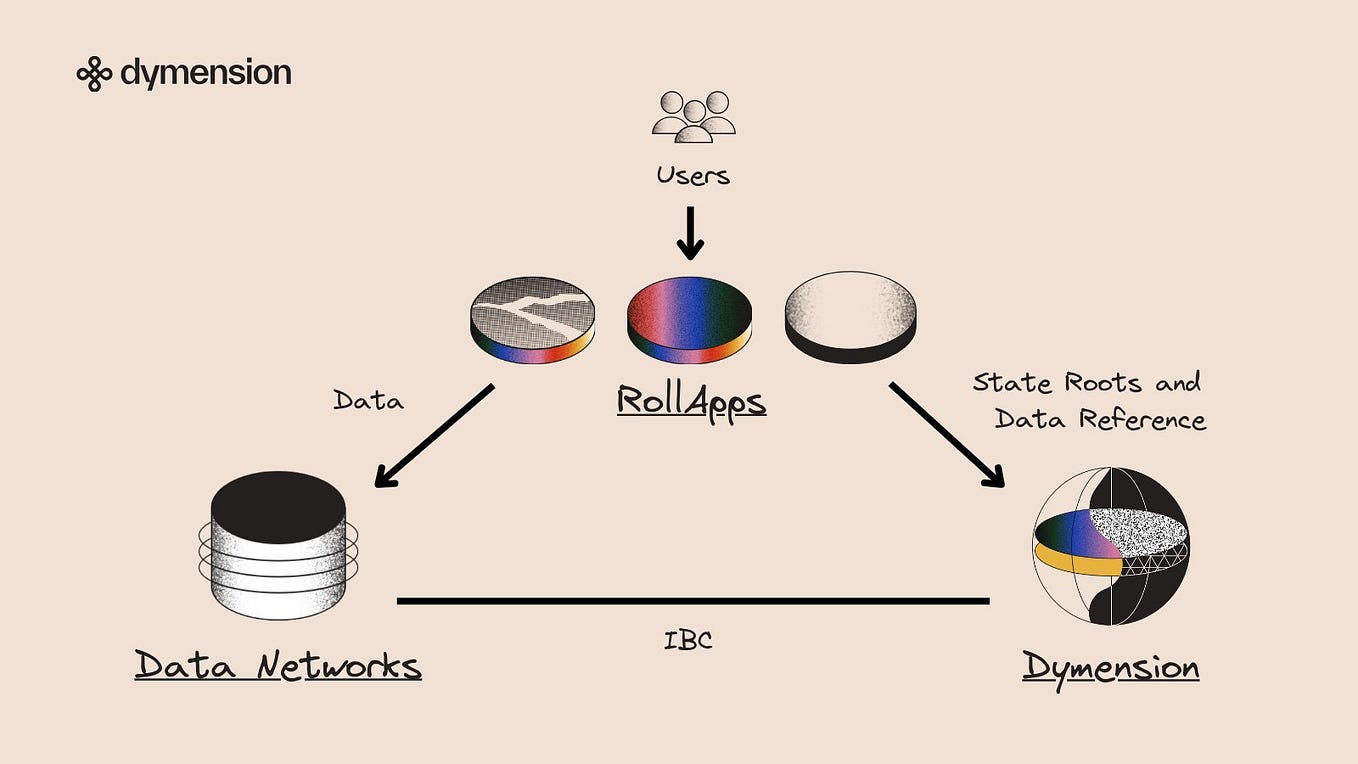

What is Dymension? How to receive DYM airdrop

Yesterday, the Dymension project launched an airdrop, targeting users who staked TIA and ATOM on the Celestia and Cosmos networks, and…

4 min read

·

Jan 4

2

Recommended from Medium

Jayden Levitt

Jayden Levitt

in

Level Up Coding

Your One Job Is To Not Part With Your Bitcoin, Ethereum, or Solana Until 2025.

Getting distracted by parabolic rises in meme coins is how you mess this trade up.

·

7 min read

·

Jan 4

602

6

CryptoHunters100X.com

CryptoHunters100X.com

Crypto Hunters 100x Q4 Review

10 min read

·

Jan 3

55

Lists

Staff Picks555 stories

Staff Picks555 stories

·

623

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

410

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1181

saves

Productivity 10120 stories

Productivity 10120 stories

·

1080

saves

Michel Marchand

Michel Marchand

in

Coinmonks

The Bull Is Back? Top 10 Cryptos to Buy on Coinbase in 2024

well . . . I’M back, shouldn’t that be enough?

21 min read

·

Dec 31, 2023

341

7

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

3 days ago

49

2 Luis Diaz

Luis Diaz

SEI NETWORK : Is The Next SOLANA!!!

Sei Network, often known as SEI in the market world, is a new kind of blockchain built on the Cosmos system. Its big goal is to become the…

·

4 min read

·

Jan 3

208

4

Shogun Saski

Top 5 Crypto Gems with Potential 100x-1000x Gains in 2024

Within the ever-evolving realm of cryptocurrencies, enthusiasts all share the goal of making significant gains. Many want to improve their…

3 min read

·

4 days ago

89

1

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)