The Evolution of Cryptocurrency: Tracing Its Roots Before Bitcoin Existence

Cryptocurrency has become a significant force within the financial world, promising decentralization, privacy, and efficiency. While Bitcoin is often credited as the first cryptocurrency, the journey of digital currency dates back decades, with origins in concepts that began to take shape long before Bitcoin’s launch in 2009.

These early innovations laid the groundwork for a transformation in how money and value are perceived in the digital age.

From David Chaum’s pioneering “eCash” in the 1980s to the revolutionary ideas of Satoshi Nakamoto, the evolution of cryptocurrency reflects a fascinating journey driven by technological and ideological shifts.

eCash: Laying the Foundation in the 1980s

The first glimpses of cryptocurrency took form in the 1980s, well before the advent of blockchain technology. David Chaum, a computer scientist with a deep interest in privacy and cryptography, created “eCash” in 1983.

His vision was to develop a secure, digital form of currency that would allow for anonymous transactions an idea far ahead of its time. Chaum’s concept prioritized privacy, a fundamental feature that would later be echoed in Bitcoin’s design. While eCash wasn’t a blockchain-based currency, it introduced cryptographic security principles that would become essential to modern cryptocurrencies.

Chaum’s ideas were particularly revolutionary because they challenged the centralized banking systems. eCash was intended to provide an alternative method for exchanging digital currency that wouldn’t require a traditional bank as an intermediary, thus offering users greater privacy and control. However, technological limitations of the time meant that eCash didn’t achieve widespread use, but its core ideas would influence future advancements.

B-Money and the Growth of Decentralized Concepts

The next significant milestone in cryptocurrency’s development occurred in 1998 when Wei Dai, a computer engineer, published his proposal for “b-money.” Dai’s idea was to create a decentralized form of digital currency—one that didn’t rely on a central authority, like a bank or government, to operate. Although b-money was never implemented as a functional currency, Dai’s proposal introduced several foundational concepts still essential to cryptocurrency today, such as the use of distributed databases and anonymity in transactions.

Dai envisioned a world where financial transactions would be conducted through a network of individuals rather than through institutions, which would enhance privacy and reduce dependency on banks. His proposal also discussed the potential for contracts to be enforced via cryptographic methods, an early precursor to what we now know as smart contracts. Even though b-money remained a theoretical concept, it highlighted the potential of a decentralized digital currency system.

In an interesting twist, Dai’s ideas became widely recognized after the creation of Bitcoin. Satoshi Nakamoto’s Bitcoin whitepaper cites Dai’s b-money as an inspiration, showing that Dai’s ideas were foundational in developing the cryptocurrency model that would eventually gain global traction.

The Bitcoin Revolution: A New Era Begins

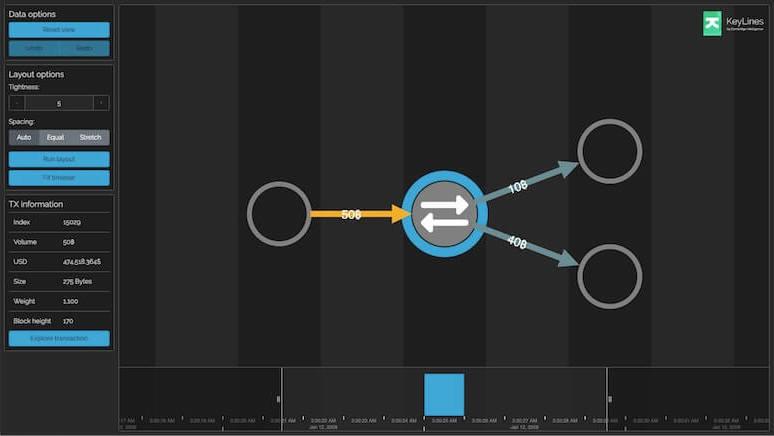

In 2008, the cryptocurrency landscape changed forever when a mysterious figure known as Satoshi Nakamoto published the whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document outlined a decentralized digital currency system based on a blockchain, a distributed ledger technology.

Unlike previous concepts, Bitcoin offered a fully developed system for secure, irreversible transactions that did not require a central authority. Nakamoto’s whitepaper ignited the modern era of cryptocurrency, introducing a peer-to-peer financial network where transactions are verified and recorded across a global network of computers.

Bitcoin officially launched on January 3, 2009, with the mining of its first block, known as the “Genesis Block.” This marked the beginning of what we now recognize as the cryptocurrency movement. By employing a consensus mechanism known as Proof of Work (PoW), Bitcoin’s blockchain could ensure that transactions were secure, immutable, and free from censorship. With this breakthrough, Nakamoto established Bitcoin as the first practical and widely adopted cryptocurrency, sparking a global phenomenon.

Bitcoin’s initial appeal was its promise of financial freedom and privacy, especially for individuals in regions where traditional banking options were limited or unavailable. This ability to transact without relying on financial institutions attracted a wide range of users, from technology enthusiasts to individuals in developing countries seeking alternatives to unstable local currencies.

The Expansion of Cryptocurrency and the Rise of Altcoins

Bitcoin’s success quickly inspired the creation of numerous alternative cryptocurrencies, or “altcoins,” each aiming to address perceived limitations of Bitcoin or introduce unique features. Ethereum, for instance, launched in 2015 and introduced the concept of “smart contracts,” programmable contracts that execute automatically when predefined conditions are met.

This opened the door for a broad range of decentralized applications (DApps), greatly expanding the potential use cases for blockchain technology beyond simple transactions.

Another example is Ripple (XRP), designed to facilitate fast, cross-border payments with minimal fees. Ripple’s focus on improving international transactions quickly attracted interest from financial institutions, positioning itself as a viable tool for banks seeking more efficient ways to process international transfers.

These altcoins underscore the diversification of cryptocurrency, as developers and entrepreneurs continue to explore new applications for blockchain technology. Each alternative currency brings unique attributes to the table, broadening cryptocurrency’s appeal and utility.

Advantages and Challenges of Cryptocurrency Adoption

The rise of cryptocurrency offers numerous advantages, including privacy, lower transaction costs, and the promise of financial inclusion. For example, cryptocurrencies enable users to make cross-border transactions without incurring the high fees and delays associated with traditional banking. This has proven especially beneficial in regions with limited access to banking infrastructure, where cryptocurrencies have become an accessible way for individuals to participate in the digital economy.

However, cryptocurrency also faces significant challenges. For instance, its decentralized nature can make it difficult for governments and regulators to track illicit activities. According to some reports, a considerable portion of Bitcoin transactions have been linked to illegal activities, raising questions about whether the technology’s benefits outweigh these risks. Regulatory bodies worldwide continue to grapple with how to handle cryptocurrency, striving to balance the protection of investors while allowing innovation to flourish.

Additionally, cryptocurrencies like Bitcoin rely on energy-intensive mining processes that contribute to environmental concerns. Bitcoin’s Proof of Work consensus mechanism requires significant computational power, leading to high energy consumption. In response, newer cryptocurrencies have adopted less resource-intensive mechanisms, such as Proof of Stake (PoS), but the environmental impact of cryptocurrency mining remains a controversial topic.

Cryptocurrency’s Future and Its Global Impact

Cryptocurrency’s future will likely be shaped by ongoing technological innovation and evolving regulatory landscapes. In developing nations, digital currencies have already made significant strides, providing access to financial services for the unbanked. This potential to democratize finance could transform economies, offering more people a chance to participate in global financial markets. Many argue that this aspect of cryptocurrency is what truly fulfills the vision that David Chaum and Wei Dai envisioned—a decentralized, inclusive financial system.

The question remains: can cryptocurrency achieve widespread adoption without compromising its decentralized principles? Critics warn that the volatility of cryptocurrencies poses a risk to investors and undermines its usability as a stable financial asset. However, proponents argue that volatility will decrease as the technology matures and gains broader acceptance.

As of now, resources like CoinDesk and CoinTelegraph offer a wealth of information for those interested in tracking the latest developments in cryptocurrency. The landscape of digital currencies continues to evolve, and it’s clear that cryptocurrency’s impact on global finance will only deepen in the years to come.

Conclusion

The evolution of cryptocurrency, from the early ideas of eCash and b-money to the revolutionary impact of Bitcoin, represents an extraordinary journey of innovation. Each milestone in this journey has contributed to a greater understanding of what digital currencies can achieve. As cryptocurrency continues to integrate into the financial system, it presents both challenges and opportunities, influencing economies and offering new possibilities for financial inclusion.

In an increasingly digital world, the promise of a decentralized, secure, and inclusive financial system keeps cryptocurrency at the forefront of financial evolution. While obstacles remain, the continuing evolution of cryptocurrency signals a transformation in how we conceive and use money in a digital age.

Reference Link To Source Article

https://kriptomat.io/cryptocurrencies/history-of-cryptocurrency/