BlackRock Updates S-1 Filing for Spot Ethereum ETF

BlackRock Updates S-1 Filing for Spot Ethereum ETF

BlackRock has reportedly revised its S-1 form for the iShares Ethereum Trust (ETHA), fueling speculation that a spot Ethereum ETF will soon trade in the United States. In the filing, BlackRock disclosed details about initial capital investors, entities allocating funds to commence trading.

"On May 21, 2024, the Initial Capital Investor, subject to requirements, purchased Seed Creation Baskets, consisting of 400,000 Shares at a price per Share of $25.00," stated the BlackRock filing.

This filing comes a week after the US Securities and Exchange Commission (SEC) approved form 19b-4 for eight Ethereum ETF applications, including the proposed iShares Ethereum Trust by BlackRock. Issuers still need their S-1 statements approved before trading their products.

An S-1 form is a document used by companies in the US to register their securities with the SEC before trading them publicly on US exchanges. In this context, issuers must submit their S-1 Forms to launch an Ethereum ETF in the country. On the other hand, form 19b-4 is used by US exchanges to record rule changes with the SEC.

Predicted Ethereum ETF Launch in June

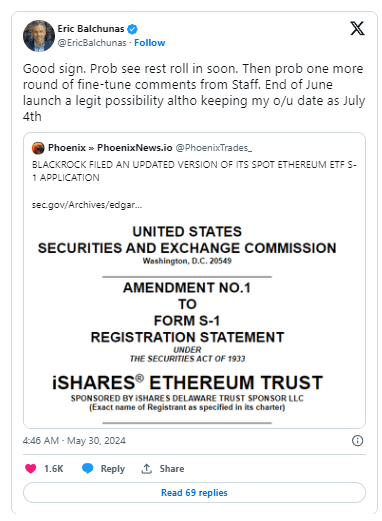

Bloomberg Intelligence ETF analyst Eric Balchunas called BlackRock's S-1 filing a "good sign." He noted that SEC staff would likely provide one round of refinement comments before the form can be approved. If so, Balchunas predicts the spot Ethereum ETF could launch by the end of June.

Meanwhile, another Bloomberg ETF analyst, James Seyffart, said BlackRock's updated S-1 filing "almost certainly indicates the engagement we've been looking for. Issuers and the SEC are working to launch an Ethereum ETF."

Seyffart previously predicted that demand for a spot Ethereum exchange-traded fund (ETF) could surge by 20% to 25% after its launch. The ETF's debut is expected to be significant, though not as sensational as the spot Bitcoin ETF launch last January.

Conclusion

BlackRock's recent revision of its S-1 filing for the iShares Ethereum Trust (ETHA) signals a strong likelihood that a spot Ethereum ETF will soon be available for trading in the United States. This move, coupled with the SEC's approval of form 19b-4 for multiple Ethereum ETF applications, suggests that the regulatory groundwork is being laid for the launch. Analysts from Bloomberg Intelligence are optimistic, predicting a potential launch by the end of June and anticipating a substantial increase in demand. The introduction of a spot Ethereum ETF marks a significant development in the cryptocurrency market, reflecting growing institutional interest and regulatory acceptance.

Read Too : Singapore's Largest Bank Holds ETH Worth IDR 10.5 Trillion

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.