NEW RESEARCH ZKSYNC PART 2

Let’s go back onchain to see which applications are driving the most gas fees, transactions, and users on zkSync.

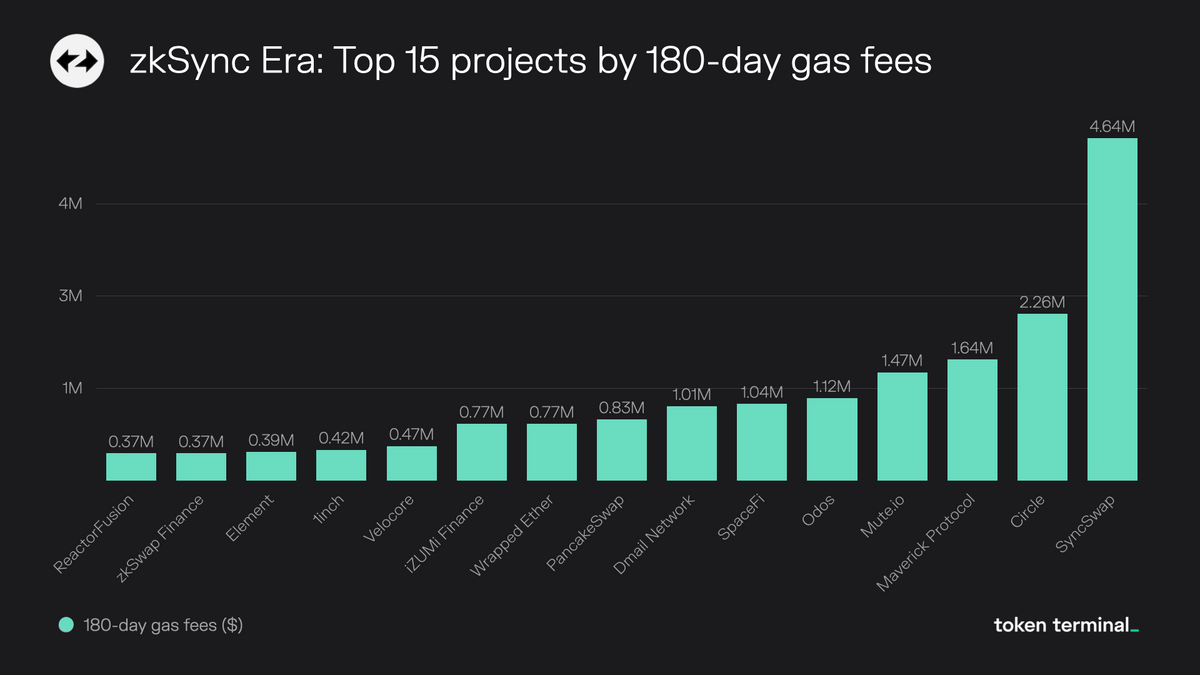

Top projects by 180-day gas fees

- SyncSwap is the largest DEX with $48m in value locked currently and about $15-20m in daily trading volume. The protocol has stiff competition within the ecosystem as Maverick Protocol, Mute.io, iZUMI Finance, SpaceFi, Pancakeswap, Odos, and Velocore are all competing to control the DEX market on zkSync.

- Circle is the company behind USDC - the second-largest dollar-backed stablecoin.

- Dmail Network is an AI-powered decentralized communication infrastructure built to provide encrypted emails, unified notifications, and targeted marketing across multiple chains. It has 4.82 million users to date.

- Reactor Fusion and Era Lend are nascent decentralized lending protocols.

Takeaway:

zkSync is a DeFi chain right now. We think this makes sense as DeFi protocols are typically the first to market on new blockchains — creating foundational infrastructure for the build-out of the rest of the ecosystem. We expect to hear about many new projects building on zkSync this year.

One challenge for DeFi in its current onchain state is lack of privacy — which makes it impossible for institutions to enter the space today. If zkSync can make all transactions private, we think it could give them a first-mover advantage for financial use cases.

We should also note that Optimism (optimistic rollup) is currently moving forward with two proposals to add zk-proofs natively — which would revamp the tech stack and add privacy to the OP Mainnet. We understand that Coinbase is pushing for this as Base is currently built on the OP stack. Per Jesse Pollak (protocols lead at Coinbase) expects to see multiple implementations of zk rollups included in the OP stack in 2024 and has hinted that starting with optimistic implementations was simply the path of least resistance initially.

As ever, these systems continue to evolve and expand.

What we see today will be different tomorrow. The teams that can consistently iterate, pivot, and execute will ultimately be the long-term winners in our opinion.

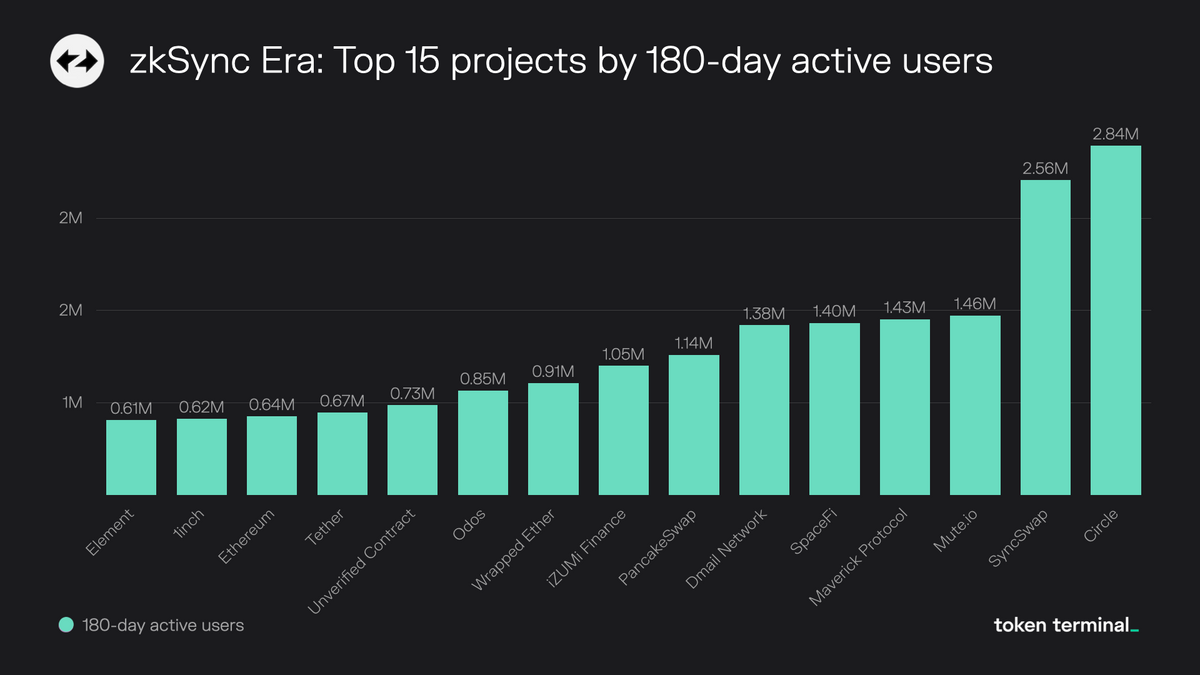

Top projects by 180-day active users

zkSync Name Service is the only new protocol when compared to gas fees above. Similar to Ethereum Name Service — the protocol enables human-readable wallet addresses/web3 domains.

zkSync Name Service is the only new protocol when compared to gas fees above. Similar to Ethereum Name Service — the protocol enables human-readable wallet addresses/web3 domains.

Note that ENS is building a general-purpose layer 2 bridge that makes cross-chain interoperability possible for both ENS and other applications that need to be able to retrieve data from a variety of sources (including Optimism, Abritrum, Starknet, zkSync, etc). Therefore, it’s unclear if a naming service such as zkSync Name Service will be needed long-term.

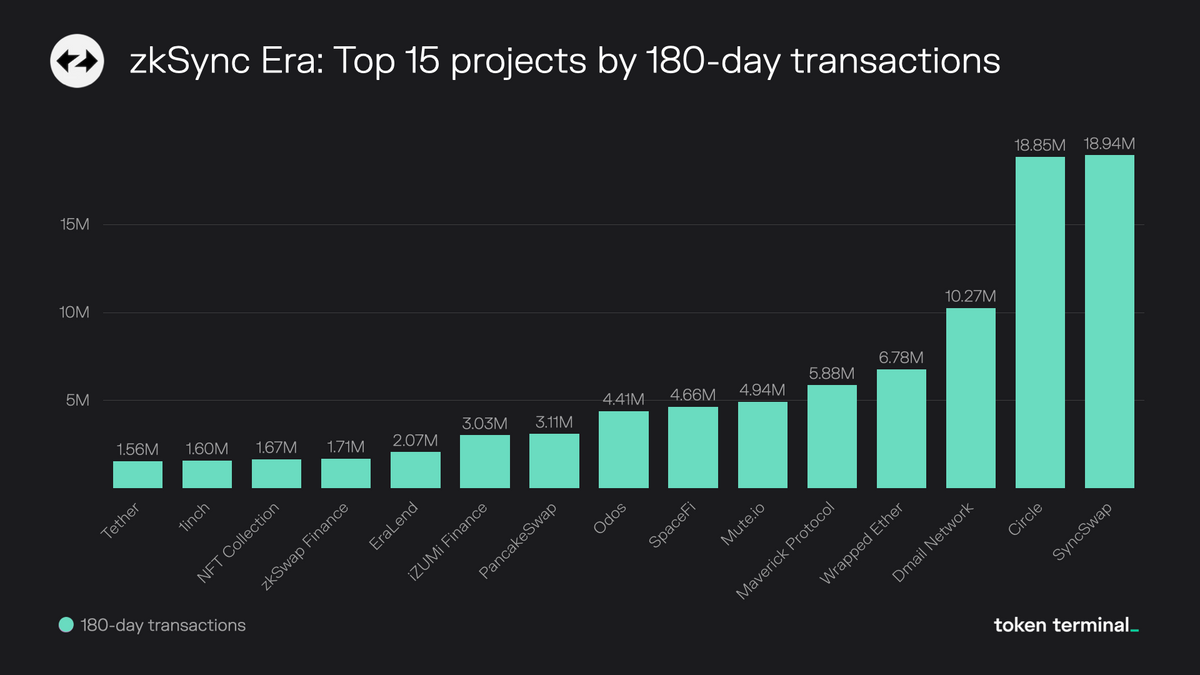

Top projects by 180-day transactions

Transaction volumes on zkSync are high. For reference, Uniswap did 22.2 million transactions on Ethereum over the last 180 days (compared to 18.9m for Syncswap on zkSync).

Transaction volumes on zkSync are high. For reference, Uniswap did 22.2 million transactions on Ethereum over the last 180 days (compared to 18.9m for Syncswap on zkSync).

Circle did 4.2m transactions on Ethereum over the same period and 8.4m on Arbitrum and Optimism combined (compared to 18.8m on zkSync!).

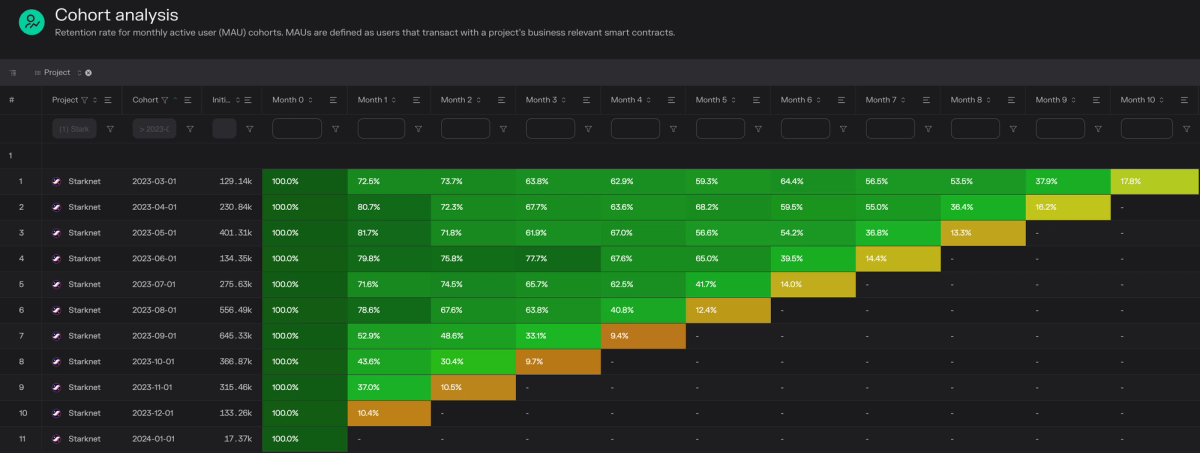

User Retention

We’ve seen some L2s gain users due to token incentives and airdrops — which is not the same as organic product/market fit.

Does zkSync fall into this category?

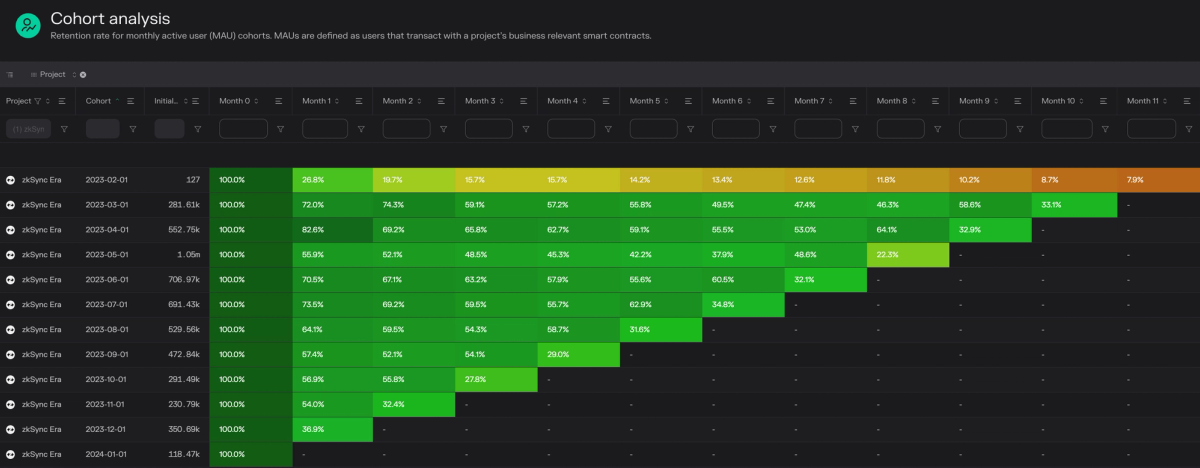

Given that zkSync does not have a token just yet, many users will “farm for airdrops” by bridging assets and engaging with various projects. We can typically identify these “mercenary users” in the cohort data available via Token Terminal Pro.

Let’s have a look at user retention cohorts over the last 10 months: The data here reveals a pretty sticky user base for those onboarded at the beginning of 2023. A quick rundown:

The data here reveals a pretty sticky user base for those onboarded at the beginning of 2023. A quick rundown:

- 281k users onboarded in February with 33.1% remaining as monthly active users in December.

- 552k users onboarded in March with 32.9% still using zkSync through December.

- 1 million users were onboarded in April with the network retaining 22.3% through year end.

Between 100k and 700k users have been onboarded each month since April. Retention rates are now dropping slightly compared to earlier in 2023, but these are still impressive figures — especially when we consider the competition.

Speaking of competition. Here’s Arbitrum (optimistic rollup) — which retained only 2.8% of its users over the same 10-month period. Next we have OP Mainnet (optimistic rollup) which had 3.8% of its users still interacting with its smart contracts 10 months after onboarding.

Next we have OP Mainnet (optimistic rollup) which had 3.8% of its users still interacting with its smart contracts 10 months after onboarding. Up next is Starknet (a zero-knowledge Ethereum rollup) — with 17.8% user retention in December from the February 2023 cohort. With that said, user retention is dropping with each subsequent onboarding month.

Up next is Starknet (a zero-knowledge Ethereum rollup) — with 17.8% user retention in December from the February 2023 cohort. With that said, user retention is dropping with each subsequent onboarding month. Finally, below we have Ethereum — with just 2.0% of users retained as they move to L2. Keep in mind that even when users leave Ethereum for the L2, their economic activity is still ultimately anchored to the L1. At least for now as new data availability solutions could change this in the future (a topic we’ll explore further in the Q4 update of The Ethereum Investment Framework).

Finally, below we have Ethereum — with just 2.0% of users retained as they move to L2. Keep in mind that even when users leave Ethereum for the L2, their economic activity is still ultimately anchored to the L1. At least for now as new data availability solutions could change this in the future (a topic we’ll explore further in the Q4 update of The Ethereum Investment Framework). Summary: 10-month user retention

Summary: 10-month user retention

- zkSync = 33.1%

- Arbitrum = 2.8%

- OP Mainnet = 3.8%

- Starknet = 17.8%

- Ethereum = 2.0%

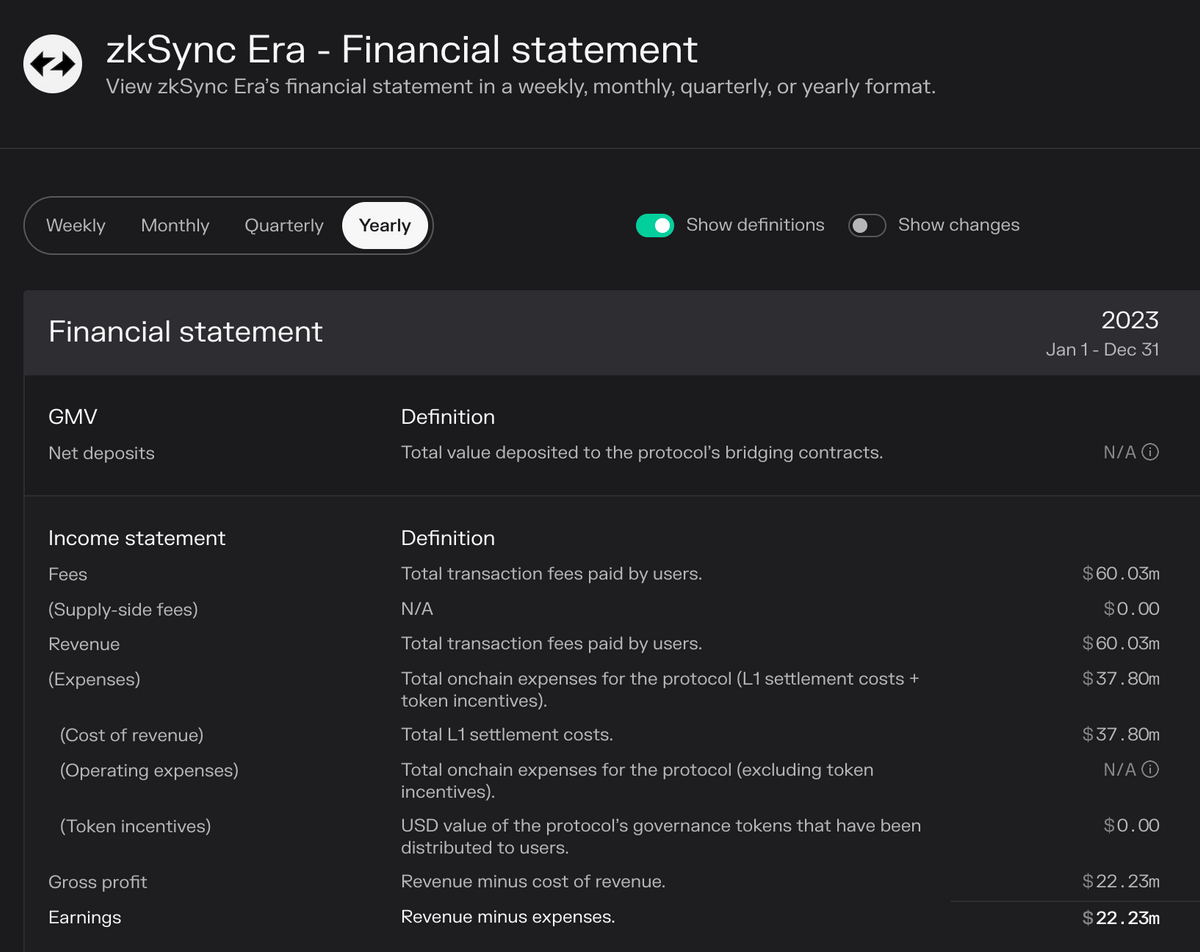

Financials

ı will share the rest in the evening so that my article will not be too long. ıf you lıke it do not forgot to support it

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)