Let's tokenize wine

Introduction

Wine as an alternative asset class

Getting more popular as an alternative investment, wine has a number of advantages:

- Its low correlation to traditional assets, such as equities. Over years, wine has exhibited low correlation to S&P 500, the benchmark for US stock market and most investor portfolios.

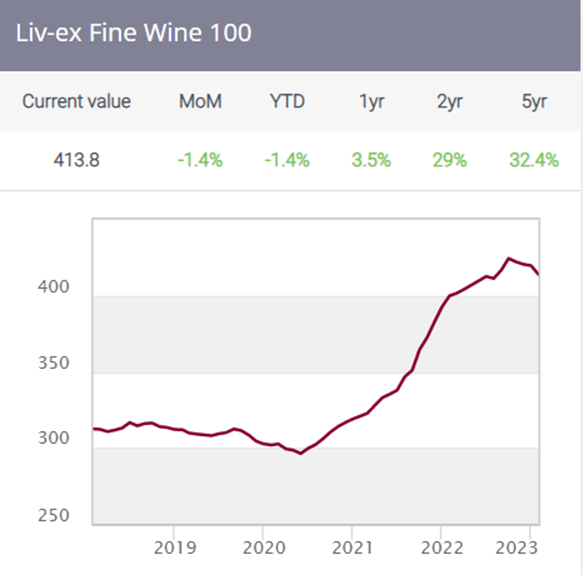

- Low volatility. Wine is a moderately stable investment being not as volatile as stocks or commodities. The chart of Liv-ex Fine Wine 100 Index reflects this. Liv-ex Fine Wine 100 is the most popular benchmark of the industry tracking the prices of 100 most coveted, highly regarded fine wines on the secondary market. Though during COVID-19, the Index did fall, its drop was much lower than, for example, S&P500 which lost about 30% of its value; Brent fell to 20-year low during that period.

- High demand (and limited supply). Climate change affects soils which in its turn impacts wine production. This makes fine wine scarcer. Add to this increased demand which is what Liv-ex index shows, and we get an asset class which has a good profit potential.

- High demand (and limited supply). Climate change affects soils which in its turn impacts wine production. This makes fine wine scarcer. Add to this increased demand which is what Liv-ex index shows, and we get an asset class which has a good profit potential.

Protocols

Vinsent

There are a few problems with buying high quality wine. To spot a counterfeit wine is hard especially you purchase it online. Fake wine sales are estimated to account for 20% of all wine sales worldwide. Even if you believe that wine you’ve purchased is genuine, logistics and storage can cause problems for the buyer. Wine can easily lose its flavor if they are transported and/or stored at bad temperatures.

These problems are what the technology startup Vinsent aims to solve. Their mobile app directly links consumers to wineries effectively disintermediating the process. The blockchain technology guarantees “what you get is what you see”: buying wine through the app means that you will get the wine you have purchased. Besides directly buying wine from wineries, Vinsent creates a secondary wine market where you can resell your bottled wine, and wine futures. Wine futures are what their name suggests — the wine still in the barrels that is not yet “ready to ship”.

The platform will benefit investors by providing them with verified, genuine wine which can be authenticated by a token. The main advantage for the producers (wineries) is the sale of wine futures. Receiving funds from customers early in the production cycle helps wineries finance their operations and better predict which vintages will be profitable. Furthermore, cutting off intermediaries from the supply chain will result in more cash per bottle for winemakers.

Winechain

Winechain is a platform for authenticating and tracking the supply chain of wines from the vineyard directly to the customer. The platform is simple to use. Once you sign up and connect your wallet to the platform, you can purchase wine with your wallet which will display an NFT that is backed by your physical wine order. You can choose to store your wine. Or you can order it to be shipped to you in which case you burn the NFT authenticating the bottle. Like Vinsent, Winechain also has a secondary market where you can trade your wine if you choose to do so.

The advantage of Winechain, other than mentioned above in the Vinsent section, is that it generates data for winemakers. Since there are a number of middlemen between a customer and a winery, winemaker usually doesn’t have any data or profiling of his customer. Protocols such as Winechain changes this by bringing the customer data onto the chain. Wineries can make use of the data in several ways. For example, customers burning their NFTs, thus receiving their bottles instead of trading them in the secondary market can be rewarded.

Minerva

One of the notable mentions building in the field of wine investments was Minerva. The reason why I’m writing “was” is that the protocol was going to be launched on the terra blockchain which failed spectacularly in 2022 May. UST depeg event impacted Minerva like all other projects building on Terra. Though temporarily suspended, the protocol will not be totally ditched. In fact, in their last tweet they write that the protocol will be launched either on Cosmos or one of Ethereum L2s. Most likely, it will be Polygon.

Minerva claims that it will present additional yield opportunities to customers. Since wine on the platform is sold int the early production cycle, users will be able to see how their purchase is doing. When the protocol was being developed on Terra, its whitepaper stated that this yield would come from Anchor protocol, a lending and borrowing protocol offering ~20% in its native stablecoin UST. After the Terra collapse, I’m not sure what source(s) will generate this yield for customers.

Once you buy wine, an NFT will be minted. This NFT is a tradable asset which means that you can resell it without receiving your wine bottle. In this case, your ownership will be transferred to the buyer of NFT. If you decide to hold your NFT to maturity, i.e., when wine you purchased is ready to ship, the winemaker will send it to you. Once wine is delivered, customer can withdraw all unclaimed yield. Or he may not to do so in which case he’ll get discount on his next purchase on the platform.

Farandole

Another platform that integrates NFTs and wine is Farandole. It is a marketplace where one can buy fine wine and spirits NFTs either with a credit card or with AVAX (I believe but am not sure that purchasing with other cryptocurrencies will be available).

The novelty Farandole brings to the space is what is called Initial Harvest Offering (IHO) in their whitepaper. Initial Harvest Offering allows a winemaker to create or emit NFTs before the harvesting. Cash inflow from the sale of NFTs will finance their harvest. Once IHO is close, NFTs can be traded which will increase revenue for wineries through trading fees. To participate in Initial Harvest Offering, an investor should stake $FAR, the platform token. It is an ERC-20 token built on the Avalanche blockchain.