Top 5 DePIN Crypto Gems Ready to Explode in 2024

Top 5 DePIN Crypto Gems Ready to Explode in 2024

In the rapidly evolving landscape of decentralized finance (DeFi), identifying promising projects early can lead to significant gains. As we look ahead to 2024, several DeFi projects stand out as potential gems poised for explosive growth. These projects, often referred to as “DePIN” (Decentralized Projects with Incredible Potential), embody the innovative spirit of the DeFi space and offer unique value propositions that could disrupt the industry.

From novel blockchain protocols to revolutionary decentralized applications, these projects are attracting attention from savvy investors seeking the next big opportunity. By exploring the top 5 DePIN crypto gems, investors can gain insights into emerging trends and position themselves for success in the dynamic world of DeFi. Join us as we delve into these projects and uncover the potential that they hold for the future of decentralized finance.

What are DePIN Crypto Gems?

DePIN (Decentralized Physical Infrastructure Networks) crypto gems are innovative projects within the decentralized finance (DeFi) space that show exceptional promise for future growth and impact. These projects often offer unique value propositions, such as novel blockchain protocols, revolutionary decentralized applications, or innovative solutions to existing problems in the DeFi ecosystem.

What sets DePIN crypto gems apart is their potential to disrupt the industry and drive significant returns for investors who recognize their value early on. Identifying DePIN crypto gems requires a deep understanding of the DeFi landscape, as well as the ability to spot trends and innovations that have the potential to reshape the future of finance. By investing in DePIN crypto gems, investors can position themselves at the forefront of the DeFi revolution, potentially reaping substantial rewards as these projects grow and mature.

Features of DePIN Crypto Gems

DePIN Crypto Gems is a concept that combines decentralized finance (DeFi) with non-fungible tokens (NFTs), creating a unique and valuable asset class. Here are some potential features of DePIN Crypto Gems:

- NFT-backed DeFi Tokens: Each DePIN Crypto Gem represents ownership of a unique NFT, which is backed by a reserve of DeFi tokens. These tokens could be stablecoins, governance tokens, or other assets.

- Dynamic Yield Farming: Holders of DePIN Crypto Gems can participate in dynamic yield farming pools. The yield generated from these pools is distributed to Gem holders based on their ownership stake.

- Exclusive Access: Some DePIN Crypto Gems could provide exclusive access to DeFi protocols, services, or events. Holders of these Gems may enjoy special privileges within the DeFi ecosystem.

- Limited Edition Gems: Certain DePIN Crypto Gems could be issued as limited editions, making them rare and more valuable. These Gems may offer unique benefits or features compared to regular Gems.

- Gamification: DePIN Crypto Gems could incorporate gamification elements, such as challenges, quests, or leaderboards, to engage users and enhance the overall experience.

- Interoperability: DePIN Crypto Gems could be designed to be interoperable with other NFTs or DeFi platforms, allowing for seamless integration and transfer of value.

- Community Governance: Gem holders could participate in the governance of the DePIN ecosystem, influencing decisions such as protocol upgrades, asset allocations, or fee structures.

- Asset Backing: Each DePIN Crypto Gem could be backed by a diverse portfolio of DeFi assets, providing stability and value to Gem holders.

Overall, DePIN Crypto Gems aims to create a novel and engaging DeFi experience, combining the unique properties of NFTs with the utility of decentralized finance.

Factors Driving the Growth of DePIN Crypto Gems in 2024

Several factors could drive the growth of DePIN Crypto Gems in 2024:

☛ Increasing Interest in NFTs:

- The NFT market has been growing rapidly, attracting mainstream attention. DePIN Crypto Gems, combining NFTs with DeFi, could leverage this interest and attract a new wave of users looking for innovative ways to engage with digital assets.

☛ Rising Popularity of DeFi:

- DeFi has seen significant growth in recent years, with more users participating in various DeFi protocols. DePIN Crypto Gems could tap into this growing user base by offering unique DeFi-based NFTs that provide additional value and utility.

☛ Unique Value Proposition:

- DePIN Crypto Gems offer a unique value proposition by combining the characteristics of NFTs (uniqueness, ownership, and scarcity) with the utility of DeFi (yield farming, governance, and access to exclusive services). This hybrid model could attract users looking for new and exciting opportunities in the crypto space.

☛ Gamification and Engagement:

- The gamification elements integrated into DePIN Crypto Gems could enhance user engagement and retention. Gamified experiences are known to attract and retain users, which could contribute to the growth of the DePIN ecosystem.

☛ Interoperability and Integration:

- DePIN Crypto Gems could be designed to be interoperable with other NFTs and DeFi platforms, allowing for seamless integration and transfer of value. This interoperability could attract users looking for flexibility and convenience in managing their digital assets.

☛ Community and Governance:

- DePIN Crypto Gems could involve the community in governance decisions, giving users a sense of ownership and control over the ecosystem. Community involvement could lead to a more vibrant and sustainable ecosystem, driving further growth.

☛ Market Demand for Innovation:

- The crypto market is known for its appetite for innovation and new ideas. DePIN Crypto Gems, being a novel concept that combines two popular trends (NFTs and DeFi), could attract attention from investors and users looking for the next big thing in crypto.

Overall, the growth of DePIN Crypto Gems in 2024 could be driven by a combination of factors, including the increasing interest in NFTs and DeFi, the unique value proposition of DePIN Crypto Gems, gamification and engagement features, interoperability and integration capabilities, community involvement, and the market demand for innovation in the crypto space.

Top 5 DePIN Crypto Gems

1. World Mobile Token (WMT)

World Mobile Token (WMT) is a strong player in the DePIN (Decentralized Physical Infrastructure Networks) crypto space. Here’s what you should know:

What is DePIN?

DePIN stands for Decentralized Physical Infrastructure Networks. These are blockchain projects that use crypto tokens to incentivize the building and sharing of real-world infrastructure, like internet connectivity, storage, and even energy grids.

Why is WMT a leader in DePIN?

- Focus on Connectivity: World Mobile’s core mission is providing internet access to underserved areas through a shared network.

- Tokenized Sharing Economy: The WMT token fuels their network. Users who share connectivity through special nodes are rewarded with WMT.

- Real-World Traction: World Mobile has already deployed its network in Zanzibar, Pakistan, and the US, with significant user growth projections.

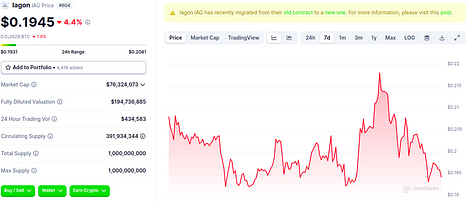

2. Iagon (IAG)

Iagon (IAG) is a strong contender in the Decentralized Physical Infrastructure Networks (DePIN) space, specifically built on the Cardano blockchain. Here’s a quick rundown:

- Function: Iagon is a decentralized cloud storage network that aims to connect users who need storage with those who have extra storage space on their devices.

- DePIN focus: It bridges the gap between decentralization and compliance, making it suitable for Web 3.0 applications.

Iagon’s goal is to create a decentralized marketplace for cloud computing resources. In this marketplace, users can buy and sell cloud computing resources from all over the world. Iagon uses the IAG token to incentivize users to participate in the network. Users can earn IAG tokens by providing cloud computing resources or by staking their IAG tokens.

Here are some of the benefits of using Iagon:

- Decentralization: Iagon is a decentralized network, which means that it is not controlled by any single entity. This makes it more resistant to censorship and fraud.

- Transparency: All transactions on the Iagon network are transparent and can be viewed by anyone. This helps to ensure that the network is fair and efficient.

- Efficiency: Iagon can help to improve the efficiency of cloud computing by matching users with the resources they need. This can help to reduce costs and improve performance.

Iagon is a new project with a lot of potential. The DePIN market is a large and growing market, and Iagon is well-positioned to take advantage of this growth. If you are interested in learning more about Iagon, you can visit their website or join their community on Telegram or Discord.

Here are some additional details about Iagon (IAG) as of today, April 10, 2024:

- Price: $0.2029

- Market cap: $79,490,076

- Circulating supply: 390 Million IAG

3. WiFi Map (WIFI)

WiFi Map (WIFI) is a prime example of a DePIN (Decentralized Physical Infrastructure Network). Here’s a breakdown of WiFi Map’s involvement in the DePIN space:

- Community-Driven Network: WiFi Map leverages a crowdsourced approach to build its vast database of WiFi hotspots. Users contribute by adding new hotspots, verifying existing ones, and testing internet speeds. This collaborative effort ensures a wider reach and reliable information for everyone.

- $WIFI Token: They have their cryptocurrency, $WIFI, built on the Polygon network. This token fuels the entire WiFi Map ecosystem. Users can earn $WIFI by contributing to the network and using it for various purposes within the app, like premium services or cashback on eSIM mobile data purchases.

- Focus on Accessibility: WiFi Map’s core mission aligns with the DePIN philosophy of promoting internet access for all. By providing a comprehensive database of free WiFi hotspots, they empower users to stay connected regardless of location or financial limitations.

What is a WiFi Map?

WiFi Map is a super app with a core asset of a community-driven decentralized wireless network. It boasts a massive database of over 4.5 billion WiFi hotspots worldwide [depinscan wifi map].

Key features of WiFi Map:

- Find and connect to free WiFi: The app helps users locate and connect to free WiFi hotspots, providing internet access on the go.

- Crowdsourced network: Users contribute by adding new WiFi networks or running speed tests. They earn points for their contribution which can be used to unlock perks like:

- VPN access for secure browsing

- Offline maps for navigation without the internet

WiFi Map in the DePIN landscape:

- Focus area: Wireless. DePINs encompass various areas, and WiFi Map falls under the wireless category, crucial for Web3 applications and blockchain networks to function effectively.

- Token ($WIFI): WiFi Map utilizes an ERC-20 token ($WIFI) built on the Polygon network. This token serves as the backbone of the entire WiFi Map ecosystem.

Current Status:

- Live devices: Over 14.7 million WiFi Map devices are active.

- Market cap: $45,410,211 for WIFI tokens.

- Price per WIFI token: $0.149378.

4. NYM (NYM)

NYM (NYM) is directly involved with DePIN, playing a key role in privacy for decentralized infrastructure. Here’s a breakdown:

NYM and DePIN:

- NYM’s DePIN contribution: NYM offers a mixnet, which acts as a DePIN for secure and private online traffic routing. This mixnet functions as an overlaying privacy network for any online traffic, making it suitable for various applications including:

- dApps (decentralized applications)

- Wallets

- Blockchains

- Regular applications (including their NymVPN)

- DePIN focus: NYM’s DePIN excels at protecting message-based traffic and general communication channels (emails, messages, etc.). It also effectively safeguards cryptocurrency transactions while they’re in transit and during point-to-point transmissions on blockchains and rollups. This helps prevent issues like:

- MEV attacks (Maximal Extractable Value)

- Censorship by centralized sequencers

NYM as a general-purpose privacy platform:

- NYM’s DePIN, the mixnet, has a wider range of use cases beyond the points mentioned earlier. It’s a general-purpose privacy platform, making it highly versatile.

Benefits of NYM’s DePIN solution:

- Enhanced Privacy: Protects user data and browsing activity from surveillance and tracking.

- Decentralized Network: Reduces reliance on centralized entities for privacy, promoting censorship resistance.

- Open Infrastructure: Can be integrated with various applications and services to build a more private internet.

Current Status:

- NYM Token (NYM): Powers the Nym network, used for staking and incentivizing mixnode operators who anonymize data traffic.

- Market Cap: $163,167,755 (as per CoinGecko)

- Price per NYM token: $0.2275 (as per CoinGecko)

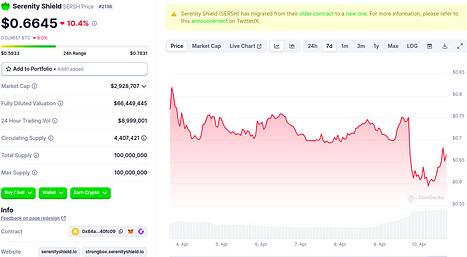

5. Serenity Shield (SERSH)

Serenity Shield (SERSH) is indeed a DePIN project, focusing on secure data storage solutions. Here’s a breakdown of what Serenity Shield brings to the DePIN table:

What is Serenity Shield?

Serenity Shield offers a secure and decentralized ecosystem for data storage, with their flagship product being StrongBox®. StrongBox® is a decentralized application (dApp) that allows users to:

- Store data securely with strong encryption.

- Inherit data to designated recipients after a set period of inactivity.

SERSH Token Utility:

- Fueling the Ecosystem: The SERSH token is the utility token that powers the Serenity Shield ecosystem.

- Incentives and Governance: Users can use SERSH tokens for various purposes, including:

- Paying for data storage within StrongBox®.

- Participating in network governance by voting on proposals.

- Staking to earn rewards and contribute to network security.

Benefits of Serenity Shield as a DePIN:

- Decentralized Storage: Eliminates reliance on centralized cloud storage providers, offering greater control and privacy for users.

- Strong Security: StrongBox® utilizes robust encryption mechanisms to safeguard user data.

- Data Inheritance: Provides a secure way to ensure data gets passed on to designated recipients.

Current Status of Serenity Shield:

- SERSH Price: $0.6131 (as per CoinGecko)

- Market Cap: $3,791,718 (as per CoinGecko)

- Circulating Supply: Approximately 6.2 Million SERSH tokens (information may vary depending on the source)

How to Invest in DePIN Crypto Gems

Investing in DePIN Crypto Gems involves several steps:

❱❱Research and Understanding:

Before investing, it’s essential to research and understand the DePIN Crypto Gems ecosystem. This includes understanding the concept, tokenomics, governance, and potential risks.

❱❱ Acquire DePIN Crypto Gems:

To invest in DePIN Crypto Gems, you’ll need to acquire the Gems through a decentralized exchange (DEX) or a platform that supports the Gems. You may need to use a compatible wallet to store your Gems.

❱❱Participate in Yield Farming:

Once you have acquired DePIN Crypto Gems, you can participate in yield farming pools to earn rewards. Make sure to understand the risks and rewards associated with yield farming.

❱❱ Monitor and Manage Your Investment:

Keep track of your investment in DePIN Crypto Gems and make adjustments as necessary based on market conditions and your investment goals.

❱❱Stay Informed:

Stay informed about the DePIN Crypto Gems ecosystem, including any updates, changes, or news that could impact your investment.

❱❱Diversify Your Portfolio:

Consider diversifying your investment portfolio to manage risk effectively. Don’t invest more than you can afford to lose.

❱❱Consider Professional Advice:

If you’re new to investing in DePIN Crypto Gems or the crypto space in general, consider seeking advice from a financial advisor or investment professional.

Investing in DePIN Crypto Gems can be rewarding but also comes with risks. It’s essential to do thorough research, understand the risks involved, and make informed decisions based on your financial goals and risk tolerance.

Investment Potential and Risks

Investing in DePIN (Decentralized Physical Infrastructure Networks) crypto gems offers both significant investment potential and risks. These projects often operate within the rapidly evolving landscape of decentralized finance (DeFi), where innovative ideas can lead to explosive growth. By identifying promising DePIN projects early, investors can potentially capitalize on their growth and earn substantial returns. However, investing in DePIN crypto gems also comes with risks.

The DeFi space is known for its volatility and the potential for projects to fail or face regulatory challenges. Additionally, the high level of competition and the fast-paced nature of DeFi can make it challenging to identify projects with genuine long-term potential. As such, investors should conduct thorough research, diversify their portfolios, and stay informed about the latest developments and trends in the DeFi space to mitigate these risks and maximize their chances of success.

Conclusion

In conclusion, the top 5 DePIN crypto gems offer a glimpse into the future of decentralized finance, showcasing the innovative potential of blockchain technology. These projects have the fundamentals and momentum to make a significant impact in 2024 and beyond. As investors navigate the ever-changing landscape of DeFi, keeping an eye on these projects could prove lucrative. However, it’s crucial to conduct thorough research and due diligence before investing in any cryptocurrency.

The DeFi space is known for its volatility and rapid changes, so staying informed and adaptable is key. By staying abreast of the latest developments and trends in DeFi, investors can position themselves to capitalize on the growth of these exciting projects. As we look forward to 2024, these DePIN crypto gems are poised to take the DeFi world by storm, offering innovative solutions and opportunities for those willing to take the plunge into the decentralized future.

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)