Real-World Assets (RWAs) Explained

Real-world assets (RWAs) in blockchain are digital tokens that represent physical and traditional financial assets, such as currencies, commodities, equities, and bonds.

Real-world asset (RWA) tokenization is one of the largest market opportunities in the blockchain industry, with a potential market size in the hundreds of trillions of dollars. In theory, anything of value can be tokenized and brought onchain.

This is why tokenized RWAs are a growing market segment in the digital asset industry, with an increasing number of projects looking to tokenize a wide variety of assets, including cash, commodities, real estate, and much more.

In this article, we’ll explain what tokenized RWAs are, how they are created, and how Chainlink is the only platform that can provide a comprehensive solution for fulfilling the requirements of tokenized assets.

What Are Real-World Assets (RWAs)?

Tokenized real-world assets (RWAs) are blockchain-based digital tokens that represent physical and traditional financial assets, such as cash, commodities, equities, bonds, credit, artwork, and intellectual property. The tokenization of RWAs marks a significant shift in how these assets can be accessed, exchanged, and managed, unlocking an array of new opportunities for both blockchain-powered financial services and a wide variety of non-financial use cases underpinned by cryptography and decentralized consensus.

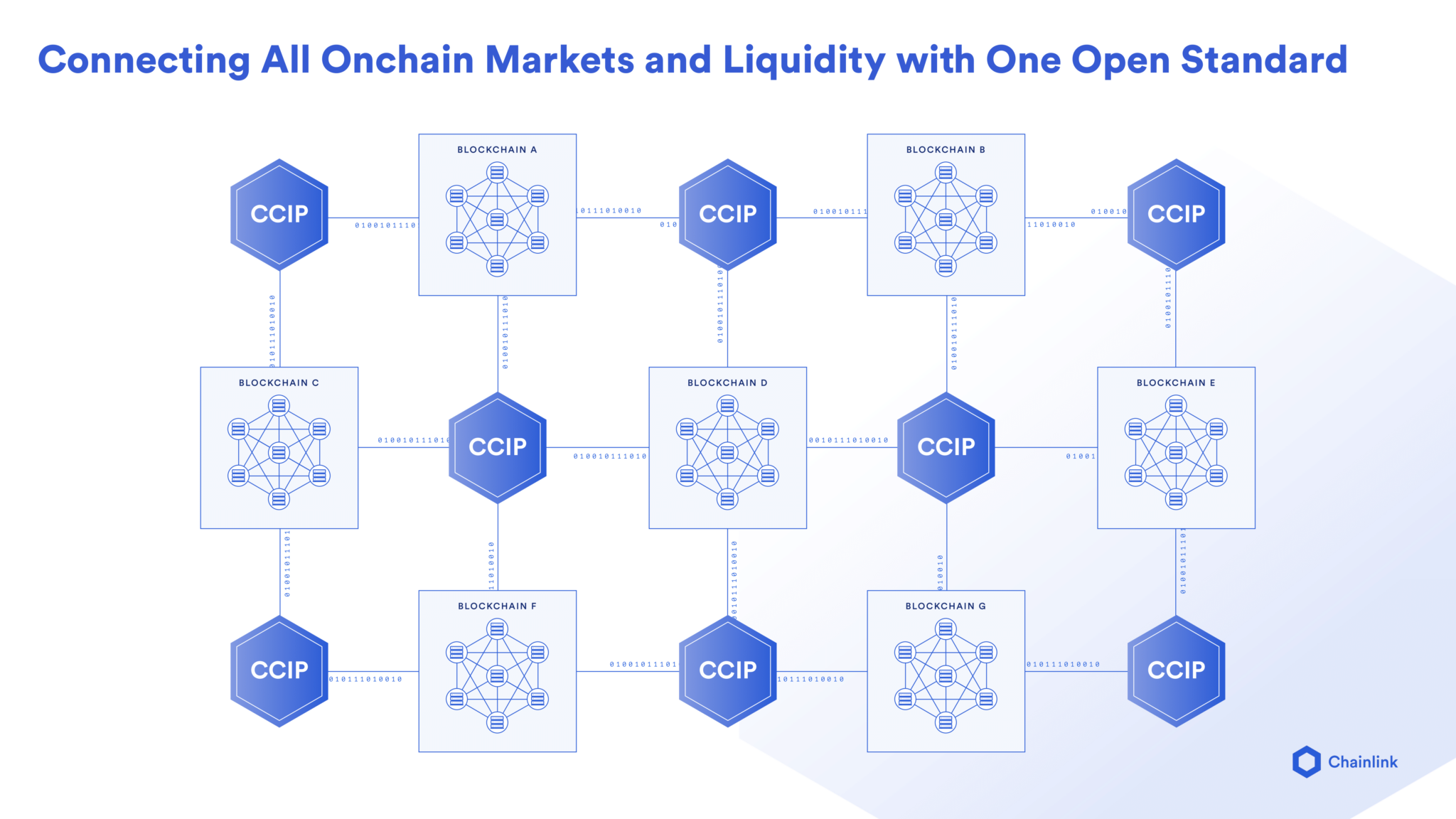

Asset tokenization is among the most promising use cases for blockchain technology, with its potential market size encompassing nearly all human economic activity. The future of finance is onchain, and it’s likely to feature hundreds of blockchains supporting trillions of dollars of tokenized RWAs on a common substrate consisting of blockchain and distributed ledger technology-based networks connected by a universal interoperability standard. Chainlink CCIP provides interoperability between a wide variety of onchain environments.

Chainlink CCIP provides interoperability between a wide variety of onchain environments.

Tokenizing Real-World Assets

Tokenizing real-world assets involves representing the ownership rights of assets as onchain tokens. In this process, a digital representation of the underlying asset is created, enabling onchain management of the asset’s ownership rights and helping to bridge the gap between physical and digital assets.

Tokenized assets benefit from enhanced liquidity, increased access, transparent onchain management, and reduced transactional friction compared to traditional assets. In the case of financial assets, the tokenization of RWAs also consolidates the distribution, trading, clearing, settlement, and safekeeping processes into a single layer, enabling a more streamlined onchain financial system with decreased counterparty risk, where capital can be more efficiently mobilized.

How To Tokenize Real-World Assets

The high-level process of tokenizing a real-world-asset involves several steps.

- Asset selection: Determining the real-world asset to be tokenized.

- Token specifications: Determining the type of token (fungible or non-fungible), the token standard to be used (like ERC20 or ERC721), and other fundamental aspects of the token.

- Blockchain selection: Choosing the public or private blockchain network on which to issue the tokens. Integrating Chainlink Cross-Chain Interoperability Protocol (CCIP) helps make the tokenized RWA available on any blockchain.

- Offchain connection: Most tokenized assets require high-quality offchain data from secure and reliable Chainlink oracles. Using a verification service, such as the industry-standard Chainlink Proof of Reserve (PoR), to verify the assets backing the RWA tokens is essential for maintaining transparency for users.

- Issuance: Deploying the smart contracts on the chosen network, minting the tokens, and making them available for usage.

Real-World Assets in DeFi

Tokenized RWAs have the potential to fundamentally change the landscape of decentralized finance. In many ways, DeFi served as a proof of concept for onchain finance as the superior technological layer for facilitating financial and economic activity. However, an overwhelming majority of assets are outside of the blockchain ecosystem—yet, they could benefit from the technology’s advantages. This is why tokenized RWAs are key for growing the digital asset industry by orders of magnitude by letting a majority of assets that are currently not in the blockchain ecosystem be used with blockchain rails.

Making the assets that are currently outside of the digital asset ecosystem blockchain-enabled will create a financial system with better liquidity conditions, more transparency with decreased systemic risks, and conflict-of-interest-free infrastructure that enables a more equitable environment where a select few can’t take advantage of the system for their own benefit.

Tokenized real-world assets have been a growing segment of the DeFi ecosystem, with RWA total value locked sitting at ~$5B in December 2023, according to DefiLlama.

Real-world assets can also help enable novel financial products. For example, MakerDAO, one of the largest DeFi protocols by total value locked, uses a variety of real-world asset collateral to collateralize the stablecoin DAI, which represents a novel way of creating new financial assets using both traditional and blockchain-based assets and technology.

Benefits of Real-World Asset Tokenization

Tokenized real-world assets offer numerous benefits, including:

- Liquidity: By enabling globally accessible liquidity conditions on a unified substrate—the blockchain ecosystem with cross-chain activity supported by Chainlink CCIP—tokenized RWAs enable increased market liquidity for traditionally illiquid assets.

- Transparency: Since the tokenized assets are represented onchain, transparency and auditable asset management are ensured, which decreases overall systemic risks, as the amount of leverage and risk in the entire system can be more accurately determined.

- Accessibility: Tokenized RWAs can broaden the potential user base of certain asset types by enabling easier access through blockchain-based applications and allowing a broader set of users to utilize assets that would otherwise be unavailable to them through fractional ownership.

Navigating the Risks of RWA Tokenization

Tokenized RWAs also present some risks, mainly on the side of the custody of physical assets, which must be reliably done, and the connection to the outside world. In addition, there’s scope for smart contract bugs and vulnerabilities. Finally, it isn’t enough just to issue an asset, there must also be good market liquidity or demand for it in order for it to thrive.

The Chainlink Platform’s Role in Tokenized RWAs

As a decentralized computing platform that has enabled trillions of dollars in transactional value, Chainlink is the only fully featured platform that can solve each of these requirements for tokenized real-world assets while maintaining the high level of security required by financial institutions and capital markets.

To realize the full benefits of onchain finance, tokenized RWAs require three key capabilities. They must be able to:

- Be enriched with real-world information.

- Be securely transferred cross-chain.

- Connect to offchain data regardless of which chain they’re moved to.

Chainlink delivers data points about the RWA across any onchain environment that the RWA is transferred to.

Chainlink delivers data points about the RWA across any onchain environment that the RWA is transferred to.

Having brought billions of data points onchain, Chainlink services are the industry standard for enriching RWAs with offchain data. Some of these services include:

- Proof of Reserve—Autonomous, reliable, and timely verifications enable users, asset issuers, and onchain applications to monitor the cross-chain or offchain reserves backing tokenized RWAs. This provides them with enhanced transparency and enables circuit breakers to be implemented, protecting users if the value of offchain assets diverges from assets tokenized onchain.

- Identity—Establishing secure onchain identity systems is necessary for banks, asset managers, and their customers to be able to transact with each other. DECO is a privacy-preserving oracle protocol in development that utilizes zero-knowledge technology to enable institutions and individuals to prove the provenance and verify the ownership of tokenized RWAs without revealing personal information to third parties.

- Data Streams and Data Feeds—Users can underpin onchain markets with a secure and decentralized source of financial market data around commodities, equities, forex, indices, economic data, business financials, cryptocurrencies, and more.

- Functions—Any offchain event or data can be synchronized or published onchain, such as standing settlement instructions, corporate actions, proxy voting, ESG data, dividends and interest, and NAV.

Once the tokenized RWAs are enriched with real-world data, they need to be able to be moved across blockchains while keeping updated with all relevant information, such as price, identity, and reserves value, as they move. Therefore, a secure solution is needed that offers both offchain and cross-chain connectivity for a wide variety of public and private blockchains. Chainlink is the platform that solves this problem by providing complementary services that span both offchain data connectivity and cross-chain interoperability while maintaining the high security guarantees required by institutions and capital markets.

This is why the some of world’s largest banks and financial market infrastructures are exploring the Chainlink platform’s capabilities for a variety of blockchain and tokenization use cases:

- Swift, the standard messaging network connecting 11,000+ banks, collaborated with Chainlink and over 10 large financial institutions—including Euroclear, Clearstream, BNP Paribas, BNY Mellon, and Citi—to demonstrate a secure and scalable way to connect multiple blockchains using Chainlink CCIP.

- DTCC, the world’s largest securities settlement system that processes $2+ quadrillion annually, is working with Chainlink to bring capital markets onchain.

- ANZ Bank, a leading Australian bank with $1T+ in AUM, utilized Chainlink CCIP to demonstrate a cross-currency, cross-chain purchase of tokenized assets.

- ARTA TechFin, a Hong Kong-based financial institution, is using Chainlink’s decentralized computing platform to unlock mission-critical features for the company’s tokenized funds.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)