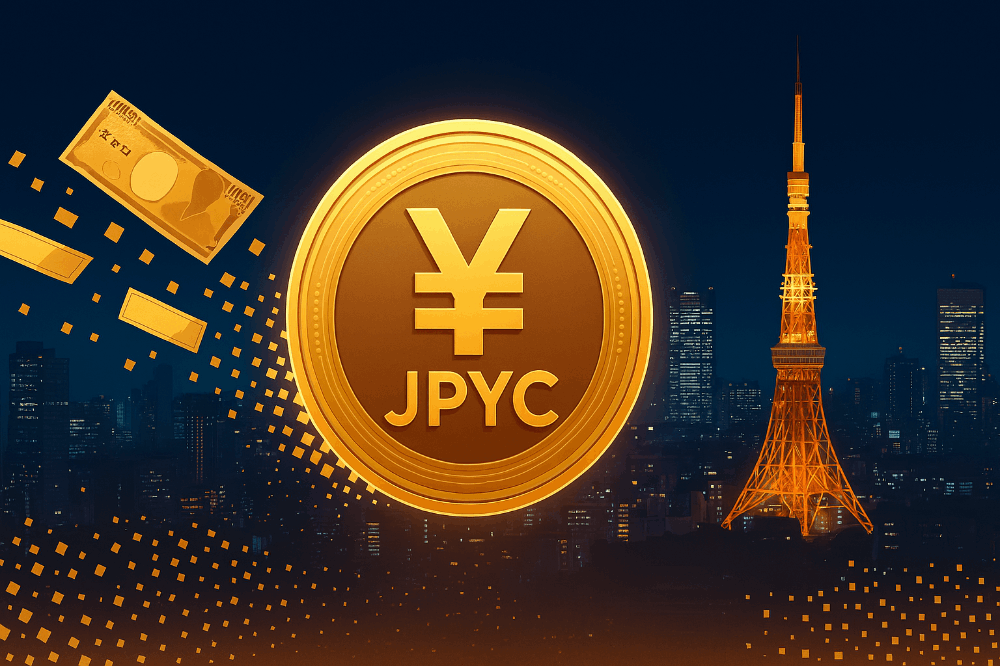

How to stop losing money in crypto ?

The cryptocurrency market's inherent volatility makes it both a lucrative and risky venture for investors. To safeguard your capital and prevent unnecessary losses, it's crucial to adopt a strategic approach. Here's a summary of effective strategies to stop losing money in the crypto space.

Risk Management

Determine the amount of capital you're willing to risk on a single trade or investment. Implement stop-loss orders to automatically sell assets when they reach a predefined price, limiting potential losses.

Diversify Your Portfolio

Spread your investments across different cryptocurrencies rather than putting all your funds into one. Diversification helps mitigate the risk associated with the price fluctuations of a single asset.

Avoid Emotional Trading

Emotional decisions often lead to losses. Develop a disciplined and rational approach to trading, sticking to your predetermined strategies rather than succumbing to fear or greed.

Regularly Review Your Portfolio

Periodically reassess your portfolio to ensure it aligns with your investment goals. If a cryptocurrency no longer meets your criteria or if market conditions change, be ready to adjust your holdings accordingly.

Continuous Learning

The cryptocurrency landscape evolves rapidly. Stay engaged in the community, attend conferences, and read up on the latest developments. Continuous learning positions you to adapt to market changes effectively.