The Pros and Cons of Early Retirement

Retirement is often viewed as the long-awaited reward for years of hard work. However, the concept of early retirement has gained significant traction in recent years, fueled by the rise of the FIRE (Financial Independence, Retire Early) movement. Early retirement offers the promise of escaping the daily grind and enjoying life while still young and healthy.

Retirement is often viewed as the long-awaited reward for years of hard work. However, the concept of early retirement has gained significant traction in recent years, fueled by the rise of the FIRE (Financial Independence, Retire Early) movement. Early retirement offers the promise of escaping the daily grind and enjoying life while still young and healthy.

But with that freedom comes a complex array of challenges that need to be carefully considered. This article will explore the potential advantages and disadvantages of early retirement, providing a comprehensive overview of what it entails.

Financial Freedom: The Ultimate Reward of Early Retirement

One of the most attractive aspects of early retirement is the opportunity for financial freedom. When individuals retire early, they no longer have to rely on a paycheck and can instead live off their savings, investments, or passive income streams. This opens up an array of possibilities for personal and financial growth.

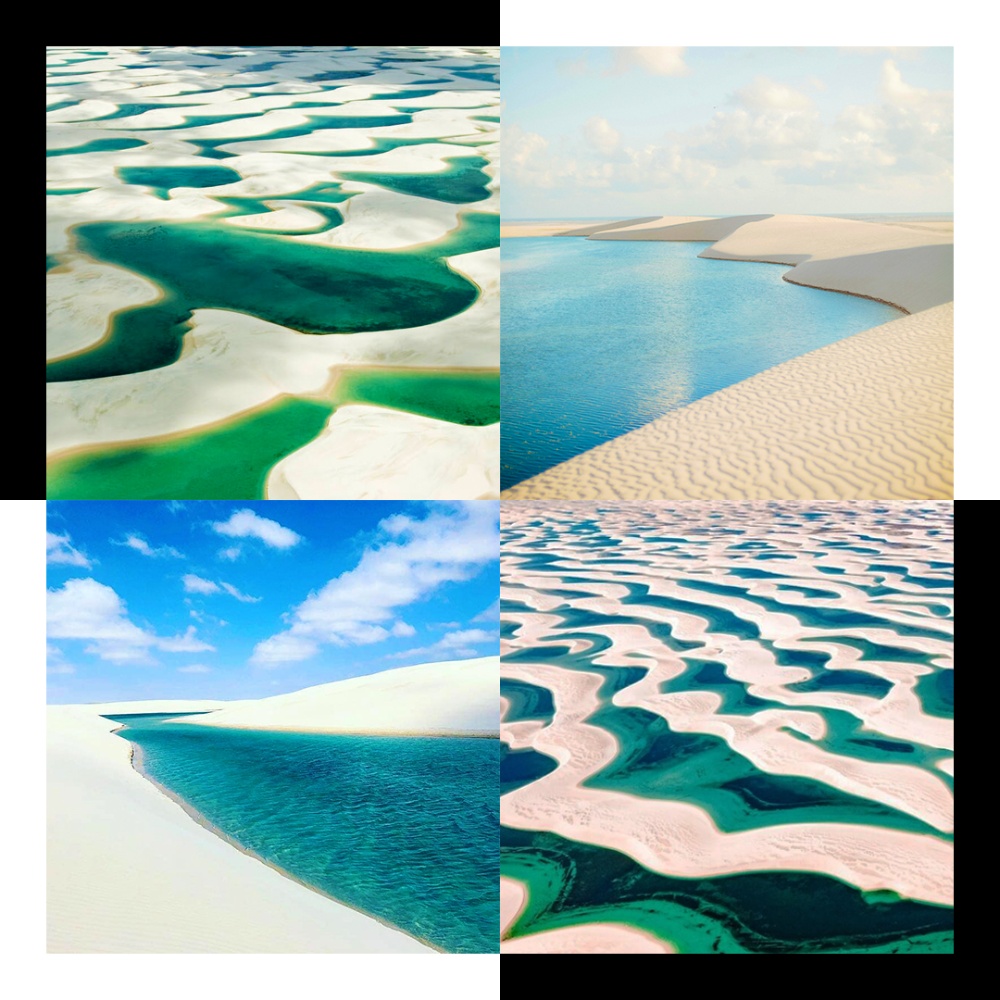

- More time for personal pursuits: Early retirees have the luxury of time to focus on hobbies, travel, and passion projects that they may not have had time for during their working years.

- Less work-related stress: The daily pressures of work—deadlines, office politics, and the constant race for promotions—are significantly reduced or eliminated altogether.

- Freedom to pursue entrepreneurial ventures: Early retirement often provides the chance to explore new ventures, such as starting a small business or pursuing consulting work in a field of interest.

However, while financial independence sounds ideal, early retirement requires a high degree of planning and self-discipline.

Financial Challenges and Risks

While the dream of financial independence is compelling, early retirement comes with its own set of financial challenges. Retirees need to plan carefully to ensure their wealth lasts for the remainder of their lives.

- Increased longevity risk: Early retirees may need their savings to last for 30, 40, or even 50 years. This requires careful financial planning to ensure that they don’t outlive their resources.

- Inflation risk: The cost of living is likely to increase over time, which means that the money saved for retirement today may lose value in the future unless properly managed.

- Healthcare expenses: For those retiring before the age of 65, access to affordable healthcare can be a significant concern. Medicare in the United States, for example, doesn’t kick in until 65, and private insurance premiums can be costly for early retirees.

The Psychological Impact of Early Retirement

Retirement is often associated with feelings of relief and joy as individuals look forward to living a stress-free life. However, the psychological impact of early retirement is often underestimated.

While financial stability is important, a fulfilling retirement requires more than just a healthy bank balance.

- Loss of identity and purpose: Many individuals find purpose and identity through their careers. When this part of life is removed prematurely, some retirees may struggle with feelings of boredom or a lack of direction.

- Social isolation: Work is a significant source of social interaction. Without regular contact with colleagues or clients, early retirees may find themselves more isolated than they anticipated.

Ways to Mitigate Psychological Challenges

Retirement doesn’t have to mean a loss of purpose or social interaction. Many retirees find new ways to stay active and engaged. Here are a few strategies to ease the transition:

- Volunteering: Many early retirees find fulfillment in giving back to their communities through volunteer work.

- Continuing education: Retirement can provide the opportunity to pursue lifelong learning. Taking courses, attending workshops, or even pursuing new certifications can provide mental stimulation and personal satisfaction.

- Part-time work or consulting: For those who still desire some connection to their professional identity, working part-time or offering consulting services can be a great way to stay engaged while maintaining a flexible schedule.

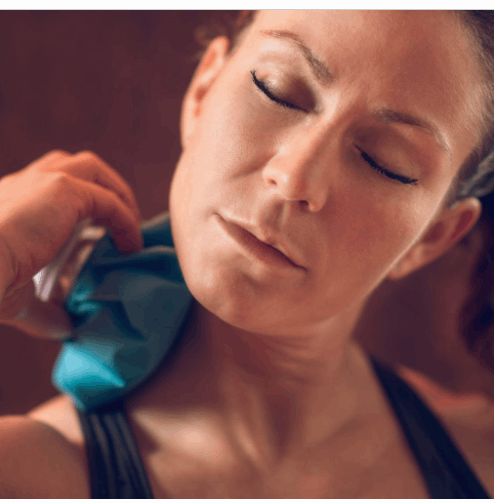

Health Considerations: Time for Wellness or Early Decline?

Early retirement offers the promise of more time to focus on personal health and well-being. Without the constraints of a 9-to-5 job, retirees can devote more time to exercise, rest, and maintaining a balanced lifestyle.

However, for some, the transition into early retirement can lead to unforeseen health complications.

- Improved physical health: Early retirees often have more time to focus on maintaining an active lifestyle. Regular exercise, nutritious meals, and better sleep schedules are all easier to incorporate when work is no longer a primary concern.

- Mental health benefits: Reduced stress from no longer having to meet work demands can lead to improved mental health. Retirees may experience less anxiety, improved mood, and a greater sense of relaxation.

However, retirement isn’t always a panacea for health.

- Decline in mental stimulation: Without work to challenge the mind, some retirees may find themselves at risk of cognitive decline. Keeping mentally active through hobbies, travel, or socializing is crucial for long-term mental well-being.

- Sedentary lifestyle risks: Those who don’t remain physically active after retirement may fall into unhealthy habits, leading to weight gain, heart issues, or other health concerns.

Strategies for Maintaining Health in Retirement

- Develop a structured routine: Setting aside specific times for physical activity, meals, and hobbies can help maintain both mental and physical health.

- Stay socially active: Regular social interaction is key to mental well-being. Join clubs, participate in group activities, or stay in close contact with family and friends.

- Engage in lifelong learning: Continued intellectual stimulation through books, puzzles, or even new hobbies can help maintain cognitive health.

The Social and Emotional Implications of Early Retirement

Retiring early can have a significant impact on relationships, social interactions, and emotional well-being. These social and emotional aspects are often overlooked but play a crucial role in the overall success of early retirement.

- Impact on relationships: Early retirement can put a strain on relationships, particularly if one partner retires earlier than the other. Adjusting to more time together or the imbalance in daily routines can require careful navigation.

- Generational gaps: Early retirees may feel disconnected from their peers, who are still working and may have less time for social interactions. This can create a sense of isolation or loneliness.

- Shift in social status: The social aspect of work often goes beyond mere employment. Work provides structure, a sense of accomplishment, and a feeling of belonging. Losing that social identity can sometimes lead to feelings of insecurity or loss.

Managing Social and Emotional Challenges

- Open communication with family: Early retirees should have open discussions with their partners and family about their goals and expectations during retirement. This helps align everyone’s vision for the future.

- Develop new social circles: Joining clubs, volunteering, or participating in community activities can provide new social interactions and a sense of belonging outside the workplace.

- Embrace new roles: Many early retirees find that shifting their focus to new roles—such as becoming more involved in family life or their communities—helps to fill the void left by leaving the workforce.

Conclusion

Early retirement can be a double-edged sword, offering the potential for financial freedom, improved health, and personal growth while also posing significant financial, psychological, and social challenges. Individuals considering early retirement should carefully weigh these pros and cons, ensuring they have not only the financial resources but also the mental and emotional resilience to make the most of this next phase in life. With proper planning and a balanced approach, early retirement can be an enriching and rewarding experience, but it is not without its complexities.