Bitcoin's Scalability Foreseen by Satoshi Nakamoto to Outpace Visa, Historic Email Reveals

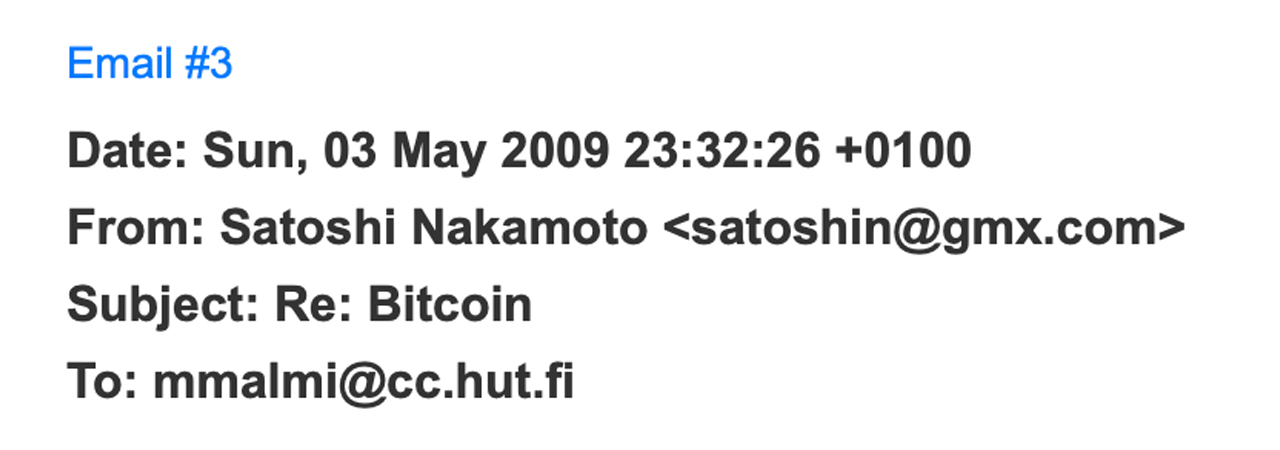

This week, crypto enthusiasts and historians alike have found themselves enraptured by the wealth of newly released emails from Satoshi Nakamoto, uncovering the visionary’s early efforts with Bitcoin. Specifically, one email, identified as number #3, offers unparalleled glimpses into Nakamoto’s considerations regarding Bitcoin’s scalability, economic framework, and prospects.

Emails Suggest Satoshi Nakamoto Was Quite Confident in Bitcoin’s Abilities

Satoshi Nakamoto, in a detailed correspondence with Martti ‘Sirius’ Malmi, outlines the essential features of Bitcoin, emphasizing its potential to secure wealth with strong encryption and the importance of backing up private keys. Nakamoto highlights the prioritization of features based on the evolving value of bitcoins, underscoring the developmental focus on security and user accessibility. The email, labeled number #3, reveals Nakamoto’s plans for implementing an escrow feature to facilitate safer physical trades and the eventual settlement of the digital currency with fiat money. This strategic approach showcases Nakamoto’s forward-thinking in creating a robust framework for Bitcoin’s integration into the broader economy.

The email, labeled number #3, reveals Nakamoto’s plans for implementing an escrow feature to facilitate safer physical trades and the eventual settlement of the digital currency with fiat money. This strategic approach showcases Nakamoto’s forward-thinking in creating a robust framework for Bitcoin’s integration into the broader economy.

“I plan to work on the escrow feature next, which is needed to make actual trades for physical stuff safer and before backing the currency with fiat money can begin,” Nakamoto explained on May 3, 2009.

Addressing network connectivity and the importance of node participation, Nakamoto thanks Sirius for his consistent support. The discussion transitions to technical support for users and frequently asked questions (FAQ), illustrating Nakamoto’s commitment to fostering a user-friendly environment and the importance of community contribution to Bitcoin’s infrastructure.

Through a question-and-answer format, Nakamoto explains the Bitcoin blockchain’s inner workings, emphasizing the transparent and decentralized verification process. This section demystifies the blockchain for newcomers, showcasing Nakamoto’s powerful ability to simplify complex concepts. When Nakamoto was told by a newcomer that they were “not clear what the ‘blocks’ figure describes,” Bitcoin’s inventor provided a succinct answer.

“It’s the total number of blocks in the block chain, meaning the network’s block chain, which everyone has a copy of,” Nakamoto said. “Every Bitcoin node displays the same number and it goes up about every 10 minutes whenever someone generates a block.” The inventor continued:

When you haven’t had it running for a while, once you’re connected it spins up rapidly as it downloads what was generated while you were gone to catch up. I’m not sure exactly how to describe it (that would fit on the status bar in 1 word, maybe 2 words max), any ideas?

On Bitcoin’s scalability, Nakamoto confidently states that Bitcoin can surpass existing payment networks like Visa in transaction capacity, with Moore’s Law ensuring the network’s ability to handle growth. The inventor’s optimism about scalability contradicts today’s common criticisms, providing a solid rebuttal to concerns over Bitcoin’s future performance.

“There is only one global chain,” Nakamoto said. “The existing Visa credit card network processes about 15 million Internet purchases per day worldwide. Bitcoin can already scale much larger than that with existing hardware for a fraction of the cost. It never really hits a scale ceiling. If you’re interested, I can go over the ways it would cope with extreme size. By Moore’s Law, we can expect hardware speed to be 10 times faster in 5 years and 100 times faster in 10. Even if Bitcoin grows at crazy adoption rates, I think computer speeds will stay ahead of the number of transactions.”

Nakamoto: ‘The security of the Network Grows as the Size of the Network and the Amount of Value That Needs to Be Protected Grows’

Nakamoto further discusses onchain transaction fees as an optional mechanism for prioritizing transactions, indicating a market-driven approach to network maintenance. The creator of Bitcoin noted then that they hadn’t anticipated the necessity for onchain fees “anytime soon,” but acknowledged that should the need arise, it was feasible to operate a node dedicated to processing transactions that included a fee. “The fee the market would settle on should be minimal,” Nakamoto stressed. “If a node requires a higher fee, that node would be passing up all transactions with lower fees.”

Bitcoin’s creator added:

It could do more volume and probably make more money by processing as many paying transactions as it can. The transition is not controlled by some human in charge of the system though, just individuals reacting on their own to market forces.

The email also touches on the security of the Bitcoin network, stressing that its robustness increases with network growth. Nakamoto acknowledges the system’s initial vulnerabilities but argues that the network’s design inherently discourages theft through its economic model.

“A key aspect of Bitcoin is that the security of the network grows as the size of the network and the amount of value that needs to be protected grows,” Nakamoto detailed. “The downside is that it’s vulnerable at the beginning when it’s small, although the value that could be stolen should always be smaller than the amount of effort required to steal it. If someone has other motives to prove a point, they’ll just be proving a point I already concede.”

In essence, Satoshi Nakamoto’s perspective on Bitcoin uncovers an extensive blueprint for a digital currency that is decentralized, capable of scaling, and secure, all distilled into just one of Malmi’s many emails. Nakamoto’s recently released writings of over 100 emails will probably undergo a thorough examination and significant scrutiny throughout 2024.

What do you think about Nakamoto’s emails? Do you think they still hold importance today and could be helpful? Share your thoughts and opinions about this subject in the comments section below.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)