Navigating the Shift: Exploring the Decline of Bitcoin Dominance and the Rise of Altcoins

Unraveling Bitcoin's Market Dominance: Altcoins on the Horizon

The cryptocurrency market is witnessing a notable shift in dynamics as Bitcoin, the flagship digital asset, experiences a decline in its market dominance. Recent price fluctuations and on-chain data suggest a waning interest in Bitcoin, prompting speculation about the potential resurgence of altcoins. In this analysis, we delve into the factors contributing to Bitcoin's diminishing dominance, explore insights from market analysts, and assess the implications for the broader cryptocurrency landscape. As investors brace for a potential altcoin surge, the stage is set for a dynamic period of market activity and opportunity.

The Decline of Bitcoin Dominance

Bitcoin dominance refers to the percentage of the total cryptocurrency market cap that Bitcoin represents. Historically, Bitcoin has maintained a dominant position in the market, often comprising a significant majority of the total market capitalization of all cryptocurrencies. However, in recent times, this dominance has been on the decline.

Several factors contribute to the declining Bitcoin dominance:

1. Altcoin Resurgence: Altcoins, or alternative cryptocurrencies, have gained traction in recent years, offering unique features, use cases, and investment opportunities beyond Bitcoin. As investors seek diversification and higher returns, they allocate capital to a broader range of cryptocurrencies, reducing Bitcoin's relative dominance.

2. Market Sentiment: Market sentiment plays a crucial role in determining the dominance of Bitcoin. Periods of bullish sentiment may lead to increased demand for altcoins, driven by the belief that they offer greater growth potential compared to Bitcoin. Conversely, bearish sentiment may prompt investors to flock to Bitcoin as a safe haven asset, temporarily boosting its dominance.

3. Technological Developments: The cryptocurrency ecosystem is constantly evolving, with new projects and innovations emerging regularly. Altcoins often introduce novel technologies, such as smart contracts, decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs), which attract investor interest and contribute to the diversification of the market.

4. Regulatory Environment: Regulatory developments can impact the relative dominance of Bitcoin and altcoins. Uncertainty or unfavorable regulations surrounding Bitcoin may lead investors to explore alternative cryptocurrencies with perceived regulatory advantages or innovative compliance features.

Understanding the background and context of Bitcoin's declining dominance provides valuable insights into the broader dynamics of the cryptocurrency market and the potential opportunities and challenges that lie ahead. As Bitcoin faces increasing competition from altcoins, investors must stay informed and adapt their strategies accordingly to navigate this evolving landscape effectively.

Unveiling Bitcoin Dominance Trends

Bitcoin, the pioneer cryptocurrency, has long held the throne as the dominant player in the digital asset space. However, recent market dynamics have sparked discussions among analysts regarding shifts in Bitcoin dominance. As market conditions evolve, some analysts are suggesting that altcoins may be poised to assert themselves more prominently in the crypto market.

Analyst Insights on Bitcoin Dominance

Analysts closely monitor Bitcoin dominance, which refers to Bitcoin's market capitalization as a percentage of the total cryptocurrency market capitalization. Historically, Bitcoin dominance has fluctuated, influenced by factors such as market sentiment, technological developments, regulatory changes, and the emergence of new altcoins.

According to recent analysis by prominent crypto analysts, Bitcoin dominance has exhibited signs of peaking. This observation stems from several factors, including the increasing diversity of altcoins, growing adoption of decentralized finance (DeFi) platforms, and the rise of non-fungible tokens (NFTs). As alternative blockchain projects gain traction and showcase unique use cases, investors are beginning to diversify their portfolios beyond Bitcoin, contributing to a potential decline in Bitcoin dominance.

Potential Implications for Altcoins

If Bitcoin dominance indeed reaches a peak and begins to decline, it could pave the way for altcoins to take charge in the crypto market. Altcoins, referring to all cryptocurrencies other than Bitcoin, encompass a diverse range of projects, including Ethereum, Solana, Cardano, and numerous others. These altcoins often offer innovative features, such as smart contracts, decentralized applications, and unique utility tokens, catering to different use cases and industries.

As investors seek opportunities for higher returns and exposure to emerging technologies, they may increasingly turn to altcoins that demonstrate strong fundamentals and growth potential. Altcoins have historically exhibited greater price volatility compared to Bitcoin, presenting both opportunities and risks for investors seeking to capitalize on market movements.

Navigating Market Trends

While the potential rise of altcoins may present opportunities for investors, it also underscores the importance of prudent risk management and due diligence. As with any investment, it is crucial for investors to conduct thorough research, assess the fundamentals of individual projects, and carefully consider their risk tolerance and investment objectives.

Diversification remains a cornerstone of sound investment strategy, and allocating a portion of one's portfolio to altcoins can help mitigate risks associated with Bitcoin dominance fluctuations. Additionally, staying informed about market trends, regulatory developments, and technological advancements can empower investors to make informed decisions and navigate the dynamic landscape of the cryptocurrency market effectively.

Conclusion: A Dynamic Crypto Landscape

In conclusion, the recent discussions surrounding Bitcoin dominance peak and the potential rise of altcoins underscore the dynamic nature of the crypto market. While Bitcoin continues to serve as a foundational pillar of the cryptocurrency ecosystem, the growing prominence of altcoins reflects the ongoing innovation and evolution within the industry. As investors adapt to changing market conditions, maintaining a balanced approach and staying vigilant are essential for navigating the opportunities and challenges presented by shifting trends in Bitcoin dominance.

Bitcoin Dominance Wanes: Analysts Eye Altcoin Surge

Bitcoin's dominance in the cryptocurrency market has faced a notable decline, signaling a potential shift in investor sentiment towards alternative digital assets. As Bitcoin struggles to maintain its price momentum, analysts are observing a resurgence in interest in altcoins, suggesting that these alternative cryptocurrencies may be poised to take charge in the market.

Analyst Perspectives on Bitcoin Dominance

Prominent crypto analyst Michaël van de Poppe recently highlighted the diminishing dominance of Bitcoin, suggesting that it may have already peaked. Van de Poppe's assessment coincides with observations of increased activity and strength in altcoin trading pairs against Bitcoin. This phenomenon, often referred to as a "rotation," typically occurs when investors reallocate their capital from Bitcoin to altcoins, anticipating greater potential returns.

Matthew Hyland, another seasoned trader, echoed similar sentiments, noting a significant loss of support in Bitcoin dominance. This observation aligns with the broader narrative of a potential altcoin resurgence, as investors seek opportunities beyond the confines of Bitcoin's market dominance.

On-Chain Data Indicates Bitcoin Weakness

Behind Bitcoin's declining dominance lies a confluence of factors contributing to its recent price weakness. On-chain data analysis suggests a slowdown in demand growth for Bitcoin, as evidenced by reduced accumulation among long-term holders and diminishing interest in spot Bitcoin ETFs. Additionally, a surge in short positions in the futures market further underscores the prevailing bearish sentiment surrounding Bitcoin.

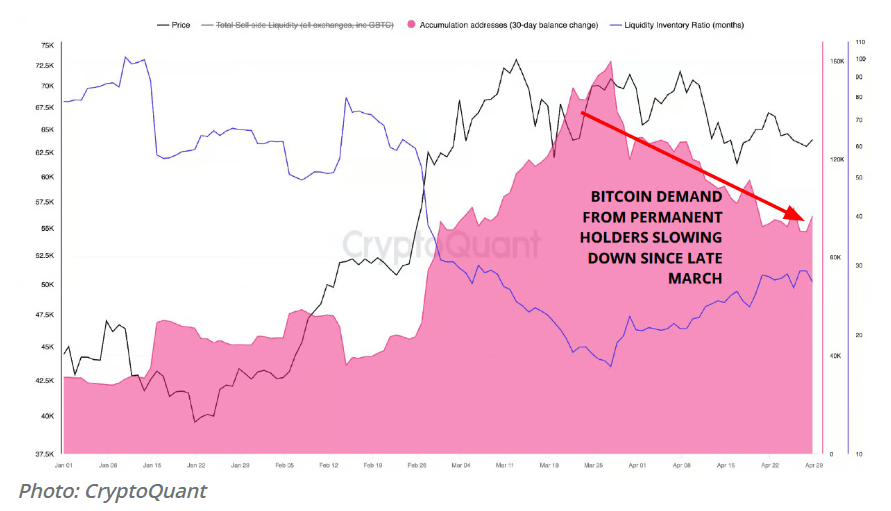

Data from CryptoQuant indicates that demand from long-term holders, defined as investors who consistently accumulate Bitcoin without selling, decreased by 50% in April. Balances went from over 200,000 BTC in late March to approximately 90,000 BTC.

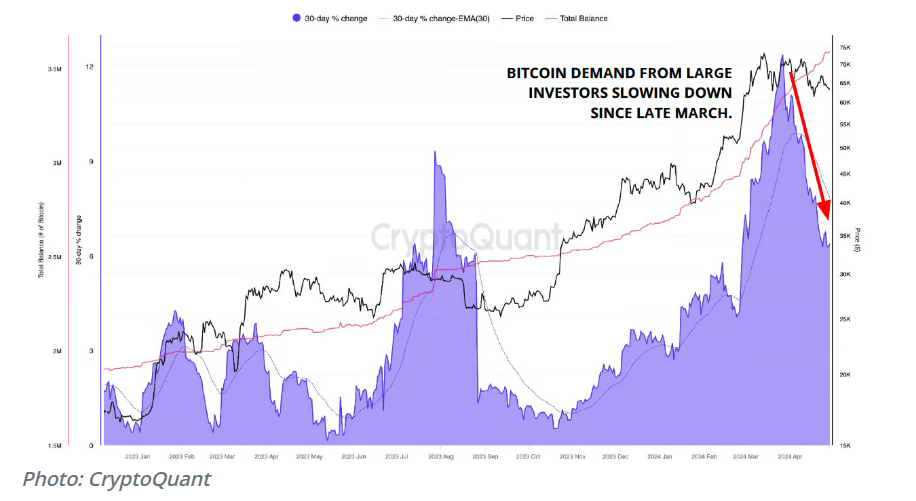

On the other hand, the demand from Bitcoin whales has also been on a decline since March. CryptoQuant notes: “Bitcoin whale demand growth (purple area) peaked at a monthly growth rate of 12% in late March and has now slowed down to 6%.”

Altcoin Potential Amid Bitcoin Uncertainty

As Bitcoin grapples with its current price correction, analysts and traders are closely monitoring key support levels to gauge the extent of further downside risk. Despite the recent pullback, analyst Scott Melker remains optimistic about Bitcoin's short-term prospects, highlighting the resilience of the daily Relative Strength Index (RSI) and the relatively shallow nature of the correction within the broader bull market context.

Conclusion: Altcoins on the Rise?

The evolving dynamics of Bitcoin dominance and the resurgence of interest in altcoins underscore the fluidity of the cryptocurrency market. While Bitcoin remains a cornerstone of the digital asset space, the growing appeal of alternative cryptocurrencies presents new opportunities and challenges for investors. As the market landscape continues to evolve, astute investors will remain vigilant, adapting their strategies to capitalize on emerging trends and navigate the ever-changing terrain of the crypto market.

Thank you for Reading.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)