Bitcoin Rebounds Off $49k as Over $1 Billion Liquidated in 24 Hours

The cryptocurrency market has once again demonstrated its notorious volatility, as Bitcoin experienced a dramatic decline from $61,000 to $49,000 within a 24-hour period.

This rapid drop, followed by a rebound to approximately $52,000, underscores the inherent risks and dynamic nature of the crypto market.

The substantial liquidations that ensued highlight the precarious position of leveraged traders amidst such turbulence.

The Extent of the Liquidations

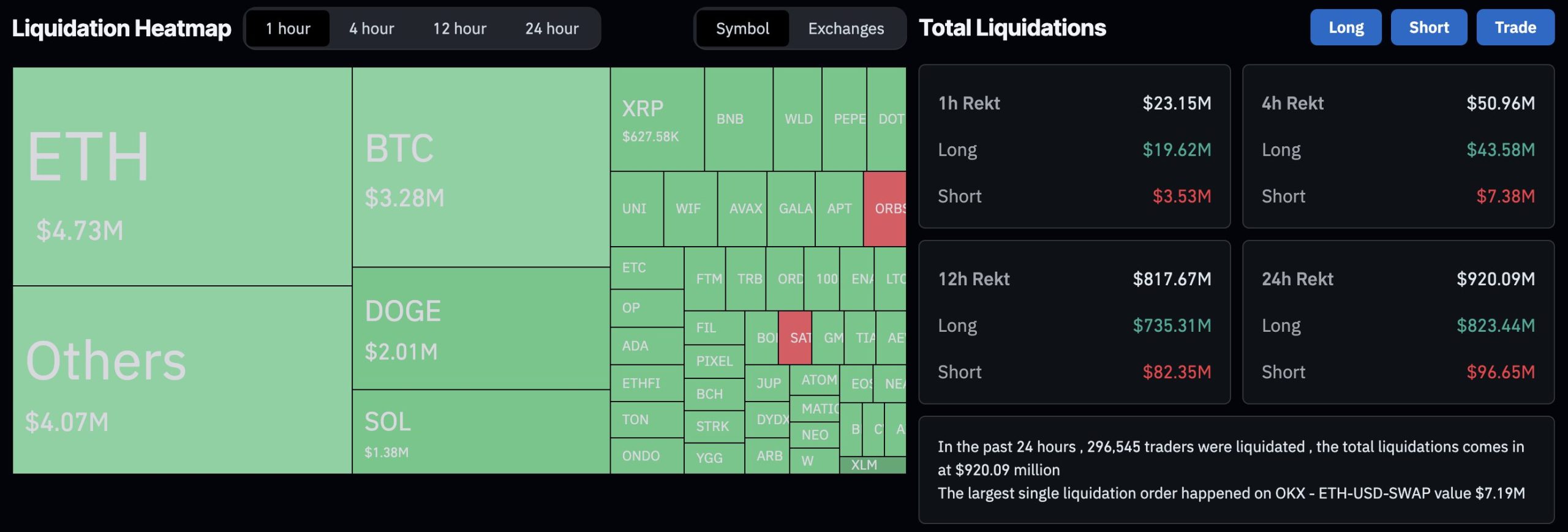

According to Coinglass, the total market liquidations amounted to a staggering $1.06 billion. Long positions bore the brunt of these liquidations, with losses totaling $902.44 million. In contrast, short positions accounted for $153.50 million in liquidations.

Total Liquidation

This disproportionate impact on long positions reflects the market's unexpected downturn and the subsequent strain on traders who had bet on continued upward momentum.

Breakdown by Asset

Bitcoin, being the market leader, saw significant liquidations totaling $359.06 million. Ethereum also faced substantial liquidations, with $344.33 million wiped out.

This steep decline in Ethereum’s value, over 20% within the same period, further exemplifies the intense market correction that occurred.

Analyzing the Market Correction

The rapid decline and subsequent rebound of Bitcoin can be attributed to several factors. The initial drop from $61,000 to $49,000 was likely fueled by a combination of profit-taking, market over-leverage, and broader economic factors.

As Bitcoin’s price plummeted, it triggered a cascade of liquidations, exacerbating the downward movement.

However, the rebound to $52,000 indicates a potential stabilization point, suggesting that buyers saw the lower price as an attractive entry point, thereby providing upward pressure on the price.

Broader Economic Impact

The market volatility is not occurring in isolation. Global economic instability and fluctuations in currency markets have significant ramifications for the crypto market. The Japanese yen, for instance, has surged to a seven-month high, trading at approximately 145.25 per dollar. This surge is largely due to weak US jobs data, which has increased fears of an economic slowdown and the likelihood of deeper rate cuts by the Federal Reserve.

The appreciation of the yen has disrupted the yen carry trade, where investors borrow in low-yielding yen to invest in higher-yielding assets. The unwinding of these trades has led to a global sell-off, impacting markets beyond cryptocurrencies. Japan’s Nikkei 225 index plummeted nearly 7%, and other Asian markets followed suit. Emerging market currencies have also felt the impact, with the Mexican peso falling as much as 2% against the dollar.

Implications for Leveraged Traders

The recent market movements serve as a stark reminder of the risks associated with leveraged trading in the cryptocurrency market. Leveraged positions amplify both gains and losses, and during periods of high volatility, the potential for significant losses increases dramatically. Traders who had taken long positions at higher prices were particularly vulnerable during the rapid decline, leading to substantial liquidations.

This event underscores the importance of risk management in trading. Utilizing tools such as stop-loss orders and maintaining appropriate leverage ratios can help mitigate potential losses. Additionally, traders should remain vigilant and be prepared for sudden market shifts, which are not uncommon in the cryptocurrency space.

Conclusion

The recent fluctuations in Bitcoin’s price and the substantial liquidations that followed highlight the volatile nature of the cryptocurrency market. While the rebound to $52,000 suggests a potential stabilization, the event serves as a reminder of the importance of risk management and the broader economic factors that can influence market dynamics.

As global economic instability persists, traders must navigate these challenges with caution and strategic foresight.

By understanding these dynamics and incorporating robust risk management practices, traders can better position themselves to navigate the uncertainties of the cryptocurrency market. The lessons learned from this market correction are invaluable for those looking to participate in the high-stakes world of crypto trading.

References

- Coinglass - Liquidations Data

- CryptoSlate - Market Insights

- Bloomberg - Economic Data

- CoinDesk - Cryptocurrency News

- Reuters - Market Analysis

- Yahoo Finance - Market Trends

- Investopedia - Risk Management

- MarketWatch - Financial News

- The Wall Street Journal - Economic Reports

- The Financial Times - Global Markets