Solana (SOL) Price Primed For 50% Leap: Experts Turn Bullish

Crypto analysts are turning increasingly bullish on Solana (SOL), with forecasts suggesting a potential 50% surge in the near future. Following SOL’s 11% surge in the past 24 hours, several renowned analysts came forward to express their bullish stance.

Solana Price Poised For Rally Towards $250

On X, crypto trader Bob Loukas (@BobLoukas) has provided an optimistic outlook, stating, “SOL now based and fuel up for leg to $250.” This statement is based on a thorough analysis of the weekly SOL/USD chart.

The chart exposes that SOL has transformed its March 2022 resistance level of around $140 into a robust support zone. Previously, this level served as a strong resistance from mid-December last year until the beginning of March.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

Related Reading: Solana Demand Soars As Institutions Buy Up SOL At A Massive 870% Premium

By converting this resistance into support, SOL is now poised for a rally towards $250. This price target is just $10 shy of Solana’s all-time high at around $260 from late October 2021. SOL/USD weekly chart analysis | Source: X @BobLoukas

SOL/USD weekly chart analysis | Source: X @BobLoukas

Adding to the bullish sentiment, crypto analyst Byzantine General (@ByzGeneral) remarked, “SOL looks pretty good to me. Leverage in the system has actually gone down while price is up and at the same time Coinbase has been buying a lot of spot.” Solana analysis, 4-hour chart | Source: X @ByzGeneral

Solana analysis, 4-hour chart | Source: X @ByzGeneral

Notably, not only the SOL/USD charts look ultra strong, but also the chart of SOL against its most fierce competitor in the fight for the superior layer-1 network, Ethereum. According to several analysts, SOL/ETH is primed for a major breakout.

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!

Christopher Inks, the founder of TexasWest Capital, shared his analysis, noting, “SOL/ETH on the weekly looks amazing. It doesn’t get much better than this with the wedge breakout while Stoch RSI is crossing bullishly in oversold and threatening to break out and RSI has bounced at neutral and is nearing a bullish cross. Breaking out above 0.04597 adds confidence to the rally toward a minimum expected target of 0.07231.”

Related Reading: UNIBOT Crashes 37% Following End Of Cooperation With Solana Team

This technical breakdown suggests a very optimistic future for SOL in comparison to ETH. If this technical setup plays out, SOL could outperform ETH by more than 70%.

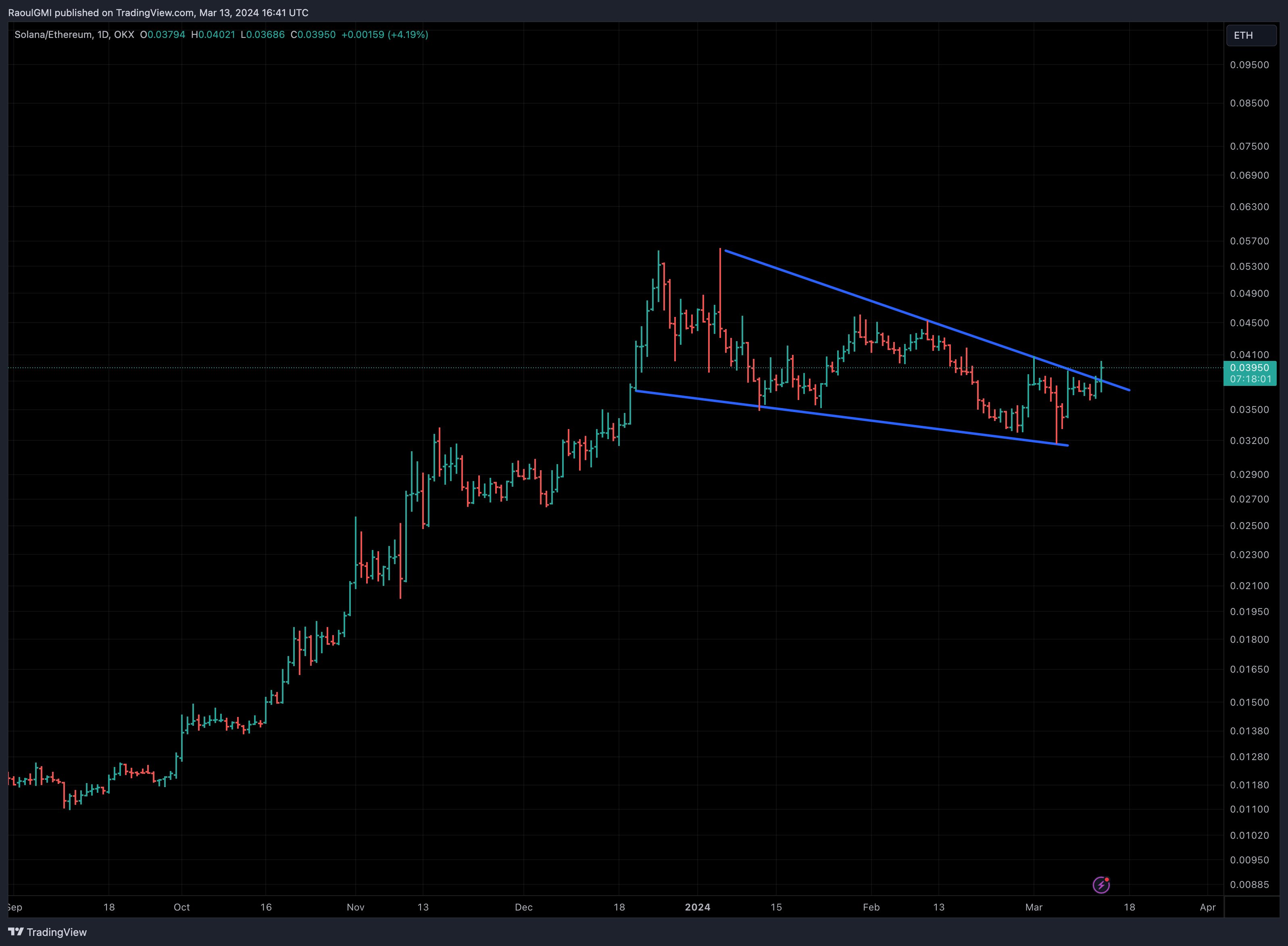

Macro expert Raoul Pal has also chimed in, stating, “SOL/ETH is looking like a breakout after a perfect consolidation… SOL is likely to take the lead again soon.” Pal’s analysis is based on a falling wedge correction pattern, a bullish signal, which SOL/ETH has already broken out from.

BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

SOL/ETH falling wedge pattern | Source: X @RaoulGMI

SOL/ETH falling wedge pattern | Source: X @RaoulGMI

However, it is important to note that this breakout needs to be confirmed to avoid being considered a fakeout, indicating a potential major breakout against ETH. Renowned trader Peter Brandt, commenting on Pal’s analysis, identified the pattern as a “Classic Schabacker falling wedge correction,” a bullish signal typically indicating a potential reversal or continuation of the trend.

The Falling Wedge pattern, characterized by converging trend lines, decreasing volume, and a breakout with increased volume, suggests that SOL’s current pattern positions it for significant upward movement.

At press time, SOL traded at $168.59, surpassing the 0.618 Fibonacci retracement level in the weekly chart. SOL price, 1-week chart | Source: SOLUSD on TradingView.com

SOL price, 1-week chart | Source: SOLUSD on TradingView.com

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: SolSOL PriceSolanaSolana PriceSolana Price predictionSOLETHSOLUSD

Solana (SOL) to Hit ATH, But There's Major Problem

Mar 14, 202415:31 GMT+6:30SOLUSDT

+2.62%

The Solana network is on the verge of reaching a significant milestone, its market capitalization all-time high (ATH) nearing the $80 billion mark. However, this achievement may be overshadowed by an underlying concern that is not garnering much attention: the supply of SOL tokens has inflated from approximately 300 million to 443 million since the last bull market. This increase in supply can have far-reaching implications for the token's value and investor sentiment.

When a cryptocurrency's supply increases significantly without a commensurate rise in demand, it can lead to the dilution of the token's value. For long-term holders of SOL, this inflation of the circulating supply means that their share of the network's market capitalization has diminished. It is akin to a company issuing more shares; the value of existing shares tends to drop unless the company's market valuation increases proportionately.SOLUSDT

Chart by TradingView

Turning to the Solana price chart, we observe a strong uptrend. The price of SOL has been on a steady climb, consistently finding support at its moving averages, which are well-aligned and sloping upwards, a bullish indicator. Particularly, the 50-day moving average has acted as a support for the price, aiding its upward trajectory.

The recent price candles show an accelerated pace in the appreciation of SOL's value, hinting at bullish market sentiment. However, the increasing volume bars accompanying the price rise could be a double-edged sword: while it indicates strong buying interest, it also raises concerns about potential overbought conditions, especially as the Relative Strength Index (RSI) is trending toward overbought territory.

As of the latest candle on the chart, SOL is trading just below the $170 mark. While this points to strong short-term momentum, investors should be wary of potential pullbacks, given the RSI levels and the increased supply of tokens on the market. If the market begins to factor in the diluting effects of the inflated supply, the bullish momentum might wane, leading to price corrections.

Solana (SOL) Leaves Ethereum (ETH) In The Dust: Is $250 The Next Stop?

Table Of Contents

Solana (SOL), the native token of the Solana blockchain, has been on a remarkable bullish run, with its price recently surpassing the $170 mark.

Several key factors have contributed to Solana’s impressive price performance. Firstly, blockchain tracker Whale Alert has observed substantial whale activity surrounding SOL over the past few days. This spike in on-chain whale activity, coupled with the prevailing bullish market sentiment, indicates a growing confidence among large investors in the asset.

TLDR

- Solana (SOL) price surges, crossing the $170 mark and showing strong bullish momentum

- Burgeoning whale activity, positive derivatives data, and recent advancements in the Solana ecosystem contribute to the price rally

- Technical indicators suggest a strong buying sentiment, with SOL trading at $168.57 and a 24-hour trading volume exceeding $6.6 billion

- Experts and analysts predict a potential 50% surge in SOL price, with targets ranging from $250 to $500 or even $1,000

- SOL/ETH chart shows signs of a major breakout, suggesting SOL could outperform ETH by more than 70%

Derivatives data from Coinglass has revealed a noteworthy uptrend for SOL, further reinforcing its bullish stance. With a 15.33% increase in open interest and a 20.10% surge in trading volume, Solana has witnessed a significant influx of money and heightened market activity, supporting the token’s rally.

Recent advancements within the Solana ecosystem have also played a crucial role in fueling optimism around the token. The community recently announced that the first Israeli Shekel-backed stablecoin, BILS, will be launched using token extensions on Solana. This development, along with the project securing approval from Israeli regulators for its pilot, has strengthened Solana’s position in the cryptocurrency landscape.

As of writing, SOL is trading at $172, with a 24-hour trading volume exceeding $6.6 billion. The token has experienced a 10.83% increase in the last 24 hours, contributing to its overall market capitalization of around $74.78 billion. Solana Price at Coingecko

Solana Price at Coingecko

Technical indicators suggest a strong buying sentiment, with the Relative Strength Index (RSI) hovering around 84, indicating an overbought condition. While this aligns with the ongoing price rally, traders and investors remain cautious, as a consolidation phase might be on the horizon.

Crypto analysts and experts have expressed increasingly bullish views on Solana’s future prospects. Bob Loukas, a well-known crypto trader, has predicted that SOL is poised for a rally towards $250, just shy of its all-time high of around $260 set in late October 2021.

$SOL now based and fuel up for leg to $250. https://t.co/nIpcbScR4j pic.twitter.com/IP1CidZfyw

— Bob Loukas ???? (@BobLoukas) March 13, 2024

Additionally, crypto analyst Byzantine General has noted that leverage in the Solana ecosystem has decreased while the price has risen, and Coinbase has been actively buying SOL spot, further supporting the bullish outlook.

Interestingly, the SOL/ETH chart also shows signs of a potential major breakout. Christopher Inks, founder of TexasWest Capital, has analyzed the weekly SOL/ETH chart, suggesting that SOL could outperform ETH by more than 70% if the technical setup plays out as expected.

Macro expert Raoul Pal has also highlighted the bullish falling wedge correction pattern in the SOL/ETH chart, indicating a potential reversal or continuation of the upward trend.

As Solana continues its impressive price performance and gains support from analysts and experts, the cryptocurrency community eagerly awaits further developments in the Solana ecosystem.

With strong fundamentals, growing adoption, and positive market sentiment, SOL remains well-positioned to maintain its bullish trajectory in the near future.

The post Solana (SOL) Leaves Ethereum (ETH) in the Dust: Is $250 the Next Stop? appeared first on Blockonomi.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)