10 Best Passive Income Ideas for Financial Freedom

In today’s fast-paced world, achieving financial freedom is a goal for many. Passive income is a great way to get there, as it allows you to earn money with minimal ongoing effort. By investing time, money, or skills upfront, you can create a source of revenue that continues to pay you over time. Here are ten powerful passive income ideas that can help you on your journey toward financial independence.

1. Dividend Stocks

Dividend stocks are one of the most popular ways to earn passive income. By investing in dividend-paying stocks, you get paid regularly, usually quarterly, just for holding the stock. Companies like Coca-Cola, Johnson & Johnson, and other blue-chip stocks have a history of paying dividends consistently.

Cons: Requires capital, stock market volatility

2. Real Estate Investments

Real estate has long been a solid passive income source. You can invest in rental properties, which bring in monthly rental income, or look into Real Estate Investment Trusts (REITs), which allow you to invest in real estate without buying physical properties.

Cons: High initial investment, property management responsibility

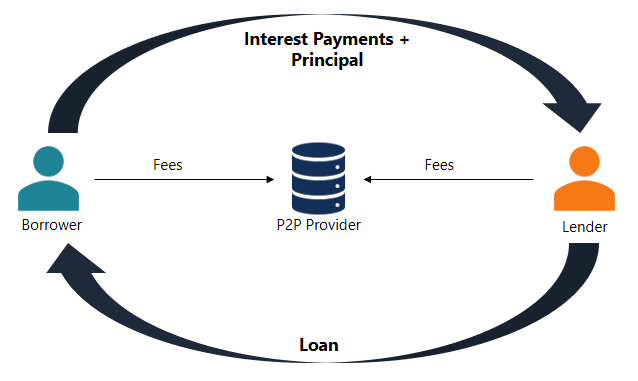

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with lenders, allowing you to lend money in return for interest. Popular platforms like Prosper or LendingClub make it easy to get started with as little as $25.

Cons: Risk of borrower default, limited liquidity

4. Create a YouTube Channel or Blog

Creating content can generate income through ads, sponsorships, or affiliate marketing. It takes time and effort initially, but once you have a steady audience, the income becomes passive.

Cons: Time-intensive in the beginning, revenue depends on audience engagement

5. Invest in Cryptocurrency Staking

Crypto staking lets you earn rewards for holding certain cryptocurrencies in your wallet. Many platforms offer staking, allowing you to earn interest by securing the network. This is becoming increasingly popular with coins like Ethereum and Solana.

Cons: High volatility, risk of losing initial capital

6. Royalties from Digital Products

If you’re creative, consider creating digital products, like stock photos, music, e-books, or software, and selling them on platforms like Etsy, Amazon, or Gumroad. Once created, they continue to generate income whenever someone buys or downloads them.

Pros: Scalable, low upfront cost

Cons: Requires skill, may need promotion

7. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission on sales made through your referral link. By setting up a blog, YouTube channel, or social media profile, you can promote relevant products to your audience and earn a passive income.

Pros: Flexible, minimal startup costs

Cons: Requires building an audience, income may fluctuate

8. High-Interest Savings Accounts & CDs

Although interest rates on savings accounts and certificates of deposit (CDs) are relatively low, they’re safe options for generating passive income with minimal risk. Many online banks offer competitive interest rates on high-yield savings accounts.

Pros: Low risk, predictable returns

Cons: Low yield, returns can be eroded by inflation

9. Renting Out Assets

If you own assets like a car, equipment, or even a spare room, renting them out can be a great passive income stream. Websites like Airbnb allow you to rent your property, while platforms like Turo let you rent out your vehicle.

Pros: Utilizes idle assets, potentially high returns

Cons: Wear and tear, variable demand

Follow Me For More

10. Create an Online Course

If you’re an expert in any field, consider creating an online course on platforms like Udemy or Skillshare. After the initial effort of recording your course, students can continue enrolling and providing you with passive income over time.

Pros: High demand, scalable

Cons: High upfront effort, requires regular updates

Conclusion

Achieving financial freedom through passive income requires careful planning, investment, and patience. Start small, experiment with different strategies, and diversify your income streams to minimize risk. Whether you’re saving for retirement, a rainy day, or simply want more financial security, these passive income ideas can help you work toward a financially independent future.