Why Are AI and Crypto a Perfect Match? Discover 15 Use Cases

AI and cryptocurrency represent two cutting-edge technologies that are reshaping industries worldwide. Their convergence opens up a realm of possibilities, showcasing a perfect synergy that enhances efficiency, security, and innovation. One key area where AI and crypto intersect is in trading and investment. AI-driven algorithms can analyze vast amounts of market data in real time, enabling traders to make informed decisions and execute trades with precision.

Additionally, AI-powered chatbots and customer service platforms are revolutionizing user experience in the crypto space, providing instant and personalized assistance to users. Another notable application is in fraud detection and security. AI algorithms can detect suspicious activities and patterns in cryptocurrency development transactions, helping to mitigate risks and protect user funds. Furthermore, AI is playing a crucial role in enhancing the scalability and speed of blockchain networks, addressing key challenges faced by cryptocurrencies like Bitcoin and Ethereum. These are just a few examples of how AI and crypto are a perfect match, revolutionizing industries and opening up new possibilities for the future.

What is AI in crypto?

AI, or artificial intelligence, in crypto, refers to the use of machine learning algorithms and other advanced techniques to enhance various aspects of the cryptocurrency ecosystem. One key application of AI in crypto is trading, where algorithms analyze market data to make predictions and execute trades with speed and accuracy. AI is also used in fraud detection, where it can identify suspicious activities and protect users from scams.

Additionally, AI is employed in blockchain analytics to track transactions and ensure compliance with regulations. In the realm of cybersecurity, AI helps in identifying and mitigating threats to crypto wallets and exchanges. Overall, AI plays a crucial role in enhancing the efficiency, security, and user experience of cryptocurrencies, making it an integral part of the crypto landscape.

Top 15 AI in crypto use cases and applications

1. Market Prediction and Analysis

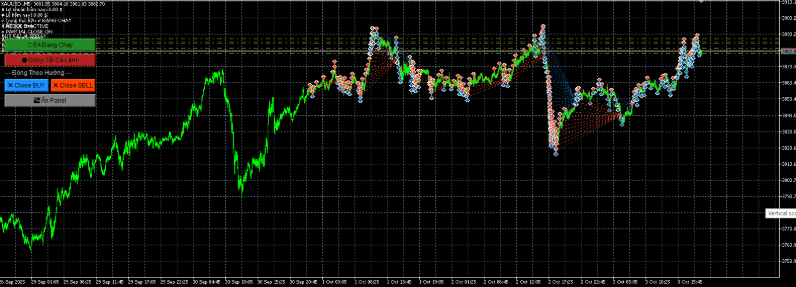

Market prediction and analysis in the cryptocurrency space involve using various tools and techniques to forecast future price movements and trends. This process often incorporates fundamental analysis, which evaluates the underlying factors affecting a cryptocurrency’s value, such as technology, team, and market demand. Technical analysis is also commonly used, involving the study of past price and volume data to identify patterns that may indicate future price movements. Additionally, sentiment analysis gauges the market’s mood by analyzing news, social media, and other sources for insights into investor sentiment. By combining these approaches, traders and investors seek to make informed decisions and navigate the volatile cryptocurrency markets more effectively.

2. Crypto Fraud Detection and Security

Crypto fraud detection and security refer to the processes and technologies used to identify and prevent fraudulent activities in the cryptocurrency ecosystem. This includes unauthorized access to wallets or exchanges, phishing attacks, and fraudulent transactions. Advanced security measures, such as two-factor authentication and multi-signature wallets, are implemented to protect users’ funds. Additionally, blockchain analytics tools are used to track transactions and identify suspicious patterns that may indicate fraudulent behavior. Education and awareness campaigns are also essential in helping users recognize and avoid common scams. Overall, crypto fraud detection and security are crucial for maintaining trust and integrity in the cryptocurrency market.

3. Algorithmic Trading

Algorithmic trading, also known as algo trading, is the use of computer algorithms to automate the process of buying and selling financial assets, including cryptocurrencies, based on predefined criteria. These algorithms analyze market data, such as price, volume, and timing, to execute trades at optimal prices and speeds. Algo trading can be used for various strategies, including arbitrage, market making, and trend following. By removing human emotions from trading decisions and executing trades with precision and speed, algo trading aims to improve trading efficiency and profitability. However, it also poses risks, such as technical failures and algorithmic errors, which require careful monitoring and risk management.

4. AI Agents in Blockchain Transactions

AI agents in blockchain transactions refer to intelligent programs or algorithms that can autonomously perform various tasks related to blockchain networks. These AI agents can analyze blockchain data, such as transaction history and network activity, to identify patterns, detect anomalies, and make decisions based on predefined rules or machine learning models. For example, AI agents can be used for fraud detection, transaction verification, and smart contract management. By leveraging AI, blockchain transactions can be more secure, efficient, and transparent, helping to improve the overall functionality and reliability of blockchain networks.

5. Portfolio Management and Optimization

Portfolio management and optimization in the context of cryptocurrencies involve the strategic allocation and adjustment of assets to maximize returns while minimizing risks. This process includes selecting a diverse range of cryptocurrencies based on factors such as market trends, risk appetite, and investment goals. Optimization techniques, such as modern portfolio theory, are used to construct portfolios that offer the optimal balance of risk and return. Additionally, portfolio management involves regularly reviewing and rebalancing portfolios to adapt to changing market conditions and ensure alignment with investment objectives. By actively managing and optimizing their portfolios, investors aim to achieve long-term growth and stability in their cryptocurrency investments.

6. Risk Management and Compliance

Risk management and compliance in the cryptocurrency industry are crucial for ensuring the security, stability, and legality of transactions. This involves identifying, assessing, and mitigating potential risks associated with cryptocurrency investments and operations. Compliance with regulatory requirements is also essential to prevent illegal activities, such as money laundering and fraud. Effective risk management strategies include implementing security measures, such as encryption and multi-factor authentication, and conducting regular audits and assessments. Compliance efforts focus on adhering to relevant laws and regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, to maintain transparency and trust in the cryptocurrency ecosystem.

7. Decentralized Finance (DeFi) Applications

Decentralized Finance (DeFi) applications refer to financial services and products built on blockchain technology that operate without traditional financial intermediaries. These applications aim to provide users with more accessible, transparent, and inclusive financial services compared to traditional banking systems. Some common DeFi applications include decentralized exchanges (DEXs), lending and borrowing platforms, stablecoins, and yield farming protocols. These applications allow users to trade assets, earn interest on deposits, and access loans without the need for a central authority. DeFi is considered revolutionary as it enables anyone with an internet connection to participate in the global financial system, potentially disrupting traditional finance.

8. Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance are regulatory processes designed to verify the identities of customers and prevent illegal activities, such as money laundering and terrorist financing. KYC requires financial institutions and businesses to collect and verify information about their customers’ identities, including their names, addresses, and identification documents. AML, on the other hand, involves implementing policies and procedures to detect and report suspicious activities that may indicate money laundering or terrorist financing. Both KYC and AML compliance are essential for maintaining the integrity of the financial system and preventing illicit activities.

9. Personalized User Experience

Personalized user experience refers to tailoring products, services, and content to meet the specific needs and preferences of individual users. In the context of cryptocurrency and blockchain technology, personalized user experience can include customized investment recommendations, targeted marketing messages, and tailored user interfaces. By leveraging data analytics and artificial intelligence, companies in the cryptocurrency space can create more engaging and relevant experiences for their users, leading to increased satisfaction, retention, and loyalty.

10. Content Creation and Curation

Content creation and curation in the context of cryptocurrency and blockchain technology involve the development and management of informative and engaging materials for users. This includes creating original articles, blog posts, videos, and infographics that educate users about various aspects of cryptocurrencies, blockchain technology, and related topics. Content curation involves selecting and organizing existing content from different sources to provide users with a comprehensive and curated collection of information. Both content creation and curation play a crucial role in informing and engaging users, building brand awareness, and establishing thought leadership in the cryptocurrency space.

11. Smart Contract Optimization

Smart contract optimization refers to the process of improving the efficiency, cost-effectiveness, and performance of smart contracts deployed on blockchain networks. This can involve various strategies, such as reducing the complexity of the contract code, optimizing gas usage to minimize transaction fees, and enhancing security to prevent vulnerabilities and exploits. By optimizing smart contracts, developers can improve the overall functionality and usability of decentralized applications (dApps), leading to a better user experience and increased adoption of blockchain technology.

12. Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) are organizations that are run and governed by code on a blockchain, rather than by a centralized authority. DAOs operate through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. DAOs allow for decentralized decision-making, where members of the organization can vote on proposals and changes to the organization’s rules and operations. This enables a high degree of transparency and autonomy, as well as potentially lower costs and greater efficiency compared to traditional centralized organizations. However, DAOs also face challenges such as security vulnerabilities and regulatory uncertainty.

13. Non-Fungible Token (NFT) Valuation and Analysis

Non-fungible token (NFT) valuation and analysis involve determining the worth of a particular NFT based on various factors such as rarity, demand, utility, and historical sales data. Valuing NFTs can be challenging due to their unique nature and the subjective value placed on digital assets. However, some common methods used for NFT valuation include comparing similar NFTs that have been sold in the past, analyzing the creator’s reputation and popularity, evaluating the scarcity and uniqueness of the NFT, and assessing the potential future demand for the NFT. Additionally, analyzing the underlying blockchain technology and smart contracts of an NFT can provide insights into its authenticity and ownership rights, which can also affect its value.

14. Metaverse Applications

Metaverse applications refer to virtual reality (VR) and augmented reality (AR) experiences that users can interact with in a shared online space. These applications allow users to create avatars, explore virtual worlds, socialize with others, and engage in various activities such as gaming, shopping, and attending events. The concept of the metaverse is to create a digital universe where users can seamlessly navigate between different virtual environments, much like in the real world. Metaverse applications are gaining popularity in areas such as gaming, entertainment, education, and social networking, offering new ways for people to connect, collaborate, and experience content in immersive and interactive ways.

15. Educational Tools and Resources

Educational tools and resources in the context of cryptocurrency and blockchain technology include a wide range of materials and platforms designed to help users learn about these complex subjects. These can include online courses, tutorials, articles, podcasts, videos, and interactive workshops. Educational tools may also include simulation platforms that allow users to experiment with blockchain technology in a safe environment. These resources aim to provide users with a comprehensive understanding of cryptocurrencies, blockchain technology, and related concepts, helping them to make informed decisions and participate more effectively in the cryptocurrency ecosystem.

Conclusion

In conclusion, the integration of AI and cryptocurrency is not just a trend but a transformative force driving innovation across industries. The 15 use cases discussed highlight the diverse ways in which AI complements and enhances crypto technologies, paving the way for a more efficient, secure, and accessible financial future. As AI continues to evolve, so too will its impact on the crypto coin development, unlocking new opportunities and capabilities that were previously unimaginable.

From trading and investment to fraud detection and network scalability, the collaboration between AI and crypto is reshaping the landscape of finance and technology. The synergy between AI and crypto is not just beneficial but essential for the continued advancement and adoption of both technologies. As we look ahead, the partnership between AI and crypto holds the promise of even greater innovation and transformation, solidifying their status as a perfect match in the digital age.