What is Chainlink? LINK rose as much as 132% in one month

Some time ago, the oracle network Chainlink token LINK experienced an astonishing increase. The low price in October was US$7.1, and it rose to a high of US$16.6 a month later, an increase of 132%.

Although the price has dropped back to US$14 in the past two days, LINK’s popularity continues unabated, with a 24-hour transaction volume of US$537 million on the BN platform. LINK daily trend

LINK daily trend

What is Chainlink?

Chainlink is a decentralized data oracle network on the Ethereum blockchain designed to connect blockchain smart contracts with trusted, tamper-proof real-world data sources in real time.

The blockchain is decentralized, and all operations are automatically executed through pre-written smart contracts, but there is still an important question, how does the information on the chain and off the chain communicate with each other?

For example, a protocol on the chain automatically sells when ETH rises to $2,500, and automatically buys when ETH falls to $1,800. However, the price of ETH fluctuates in real time. How does the protocol on the chain know whether ETH has reached the corresponding price and trigger the execution of the contract?

At this time, it is necessary to use an oracle similar to Chainlink to “feed” the ETH price to the on-chain protocol so that the protocol can be executed automatically.

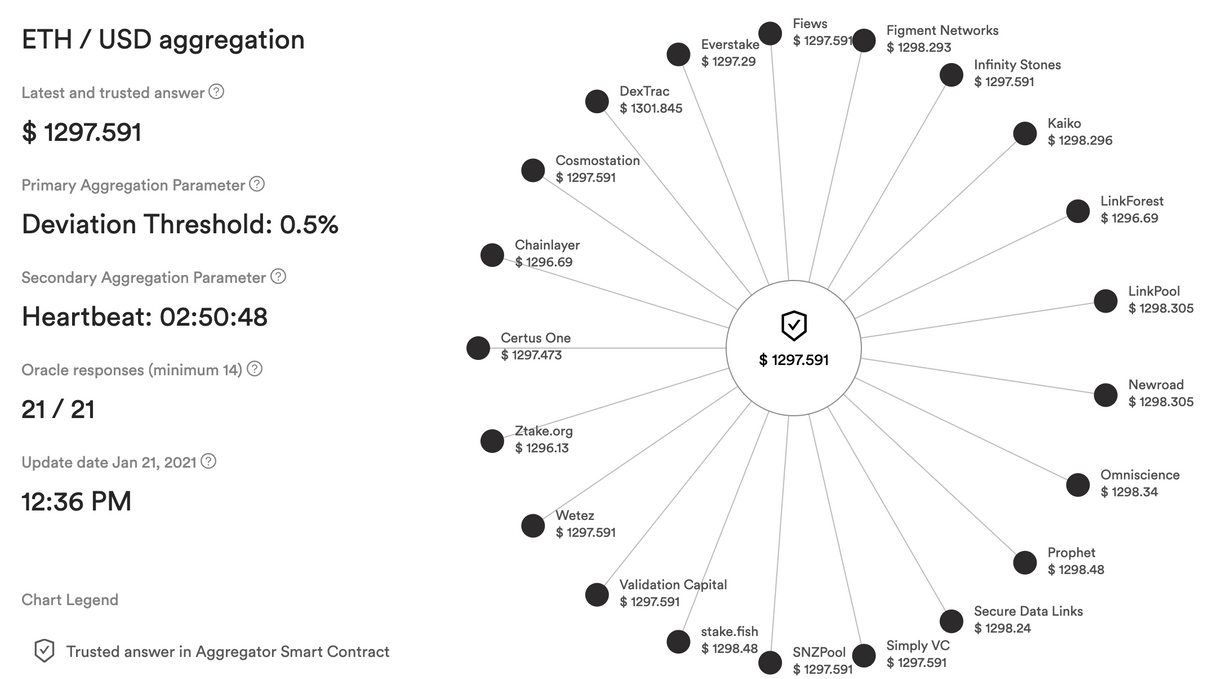

Chainlink price feed uses many independent oracle nodes and data sources to obtain and transmit price data to the protocol. The on-chain protocol obtains the current ETH price through the ETH/USD price oracle and executes the contract. Chainlink ETH price data source

Chainlink ETH price data source

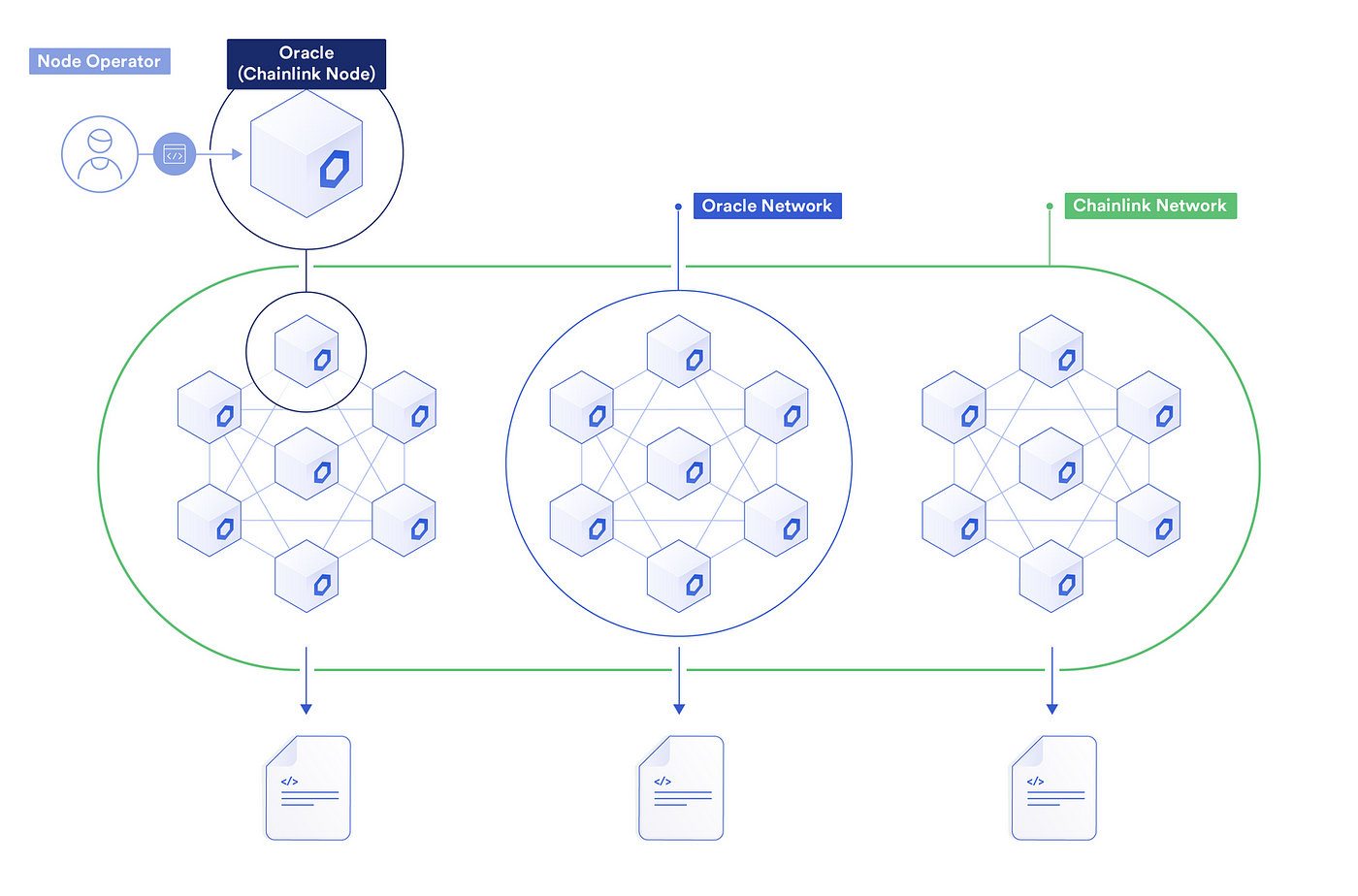

The oracle machine in the Chainlink network jointly obtains data from multiple data sources, aggregates the data, transmits the verified aggregated data to the smart contract, and triggers contract execution. The entire process is decentralized.

Chainlink has set up a reward and penalty mechanism so that the node that provides accurate data as quickly as possible will receive fees paid by the smart contract, and nodes that provide better information and have a higher reputation will charge higher fees.

On the contrary, if the information provided by the node is incorrect, the LINK pledged by the node will be deducted. This mechanism ensures that the information provided by the Chainlink network is accurate, reliable, and decentralized. Chainlink’s many decentralized nodes

Chainlink’s many decentralized nodes

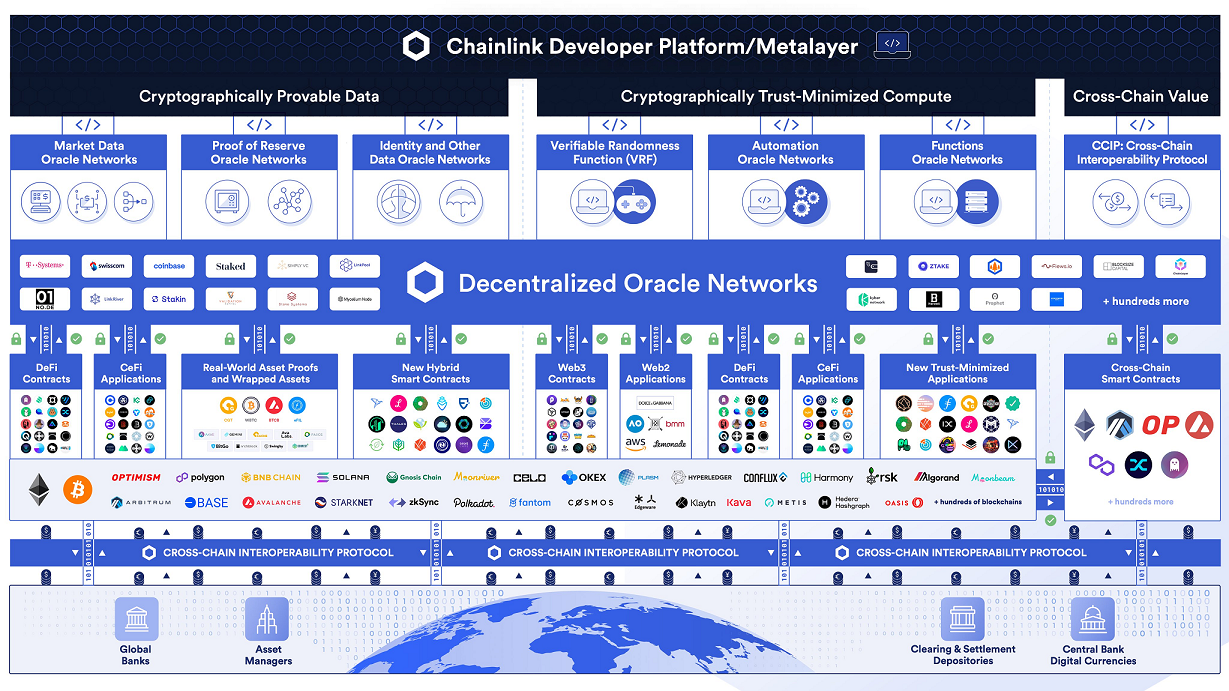

What are the applications of Chainlink?

The biggest pain point of smart contracts is the inability to avoid counterparty risks while accessing off-chain data and systems. Chainlink connects blockchain smart contracts to off-chain systems safely and reliably.

At present, Chainlink oracles have been applied to more than 77 smart protocols such as Defi, NFT, RWA, insurance, and games, etc., solving the need for objective external data during the execution of the protocol.

Applications on the defi protocol.

Established defi protocols Aave, Compound, and Liquidity are examples of on-chain money market protocols that use Chainlink Price Feeds to obtain market data for dozens of different on-chain cryptocurrencies.

Using this real-time pricing data, these lending protocols can calculate a valuation of each user’s collateral and debt to determine when liquidation should be initiated.

This ensures that money market protocols always have sufficient collateral, protecting tens of billions of dollars worth of user deposits.

There is also the application of Chainlink on NFT.

When a user generates NFTs of different rarities in a game, how to ensure that the generated NFT results are random?

These game protocols utilize Chainlink VRF’s verifiable random number generation technology to ensure that the results of each user’s NFT synthesized on the chain are random and cannot be tampered with.

The NFT generated by each user is random, cannot be changed and cannot be intervened, ensuring openness and transparency in game execution. Application of Chainlink in different projects

Application of Chainlink in different projects

Chainlink Risks and Opportunities

LINK is the native token of the Chainlink project, with a total supply of 1 billion. It was launched in the ICO in September 2017. 350 million LINK were sold and US$32 million was raised, accounting for 35% of the total supply.

LINK tokens are mainly used to pay off-chain data providers, node operators and other online service providers as service fees.

Each node needs to pledge LINK as a guarantee. Nodes that provide accurate and fast data feedback will be rewarded with links. On the contrary, if a node does evil and provides wrong data or service errors, the pledged LINK will be deducted as a penalty.

With a technical development team, you can become a Chainlink network data provider, provide different data sources for the ecosystem, and receive project rewards; or you can become a node operator, follow the development of the project, and gain more benefits.

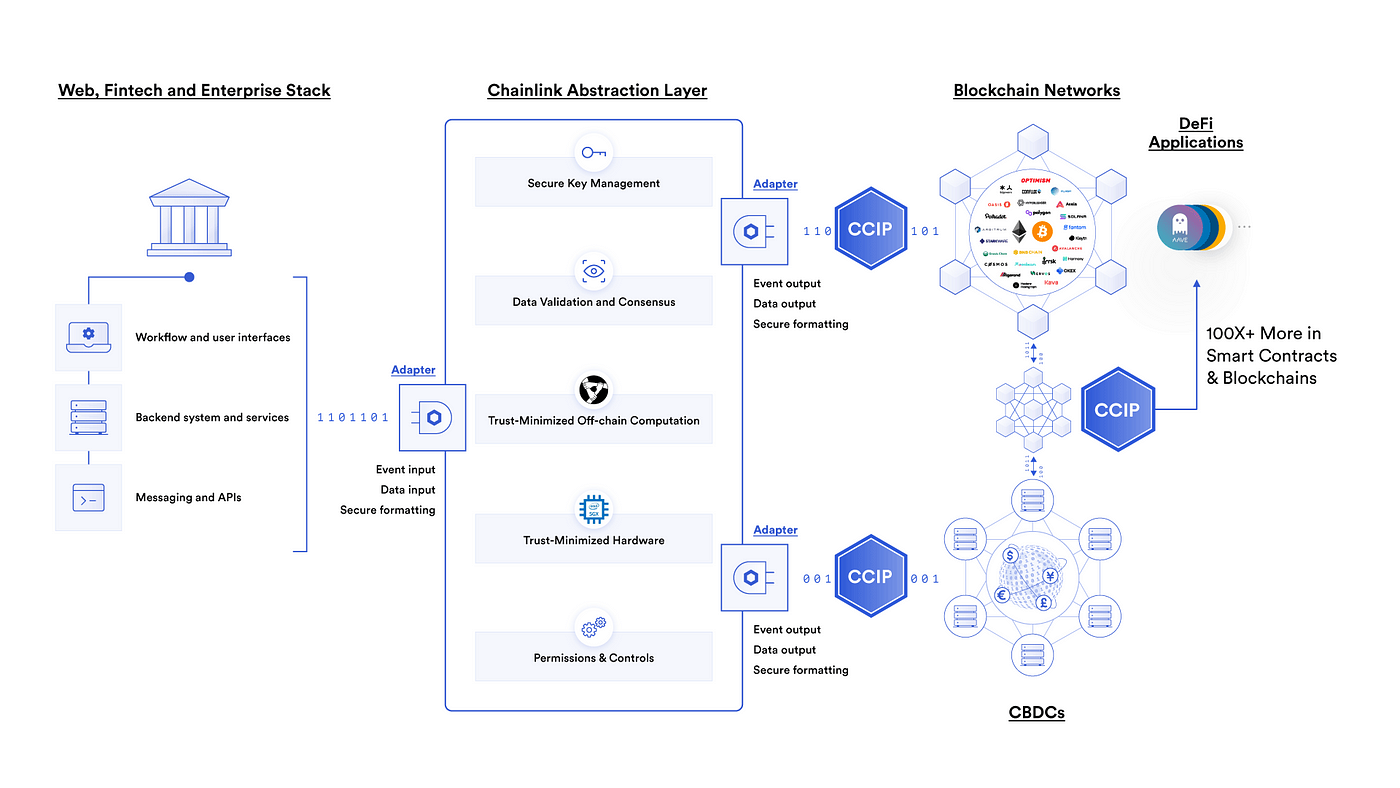

Individual players can only pay attention to the development of Link in the secondary market. If oracles become the standard technology of blockchain in the future, Link will undoubtedly have a larger price space. In the 2021 bull market, LINK price reached as high as $53. Chainlink operation logic

Chainlink operation logic

Blockchain technology is being applied to more fields, and the combination of on-chain and off-chain technologies can better promote the development of the entire market; individual players may wish to pay more attention to projects with practical applications in the bear market of the crypto market in order to survive in the next bull market Gain a harvest.

The above is just my personal opinion, no investment advice. I am CryptoLola, and I am paying attention to the encryption market and web3.

2

Chainlink

Oracle

Web3

2

Follow

Follow

Written by CryptoLola

1K Followers

·

Writer for

Coinmonks

I am a content creator, a self-media. I mainly focus on NFTs, Metaverse, Blockchain, etc.

More from CryptoLola and Coinmonks

CryptoLola

CryptoLola

in

Coinmonks

What are BRC20 and ARC20?

After ORDI was listed on Binance, brc20 quickly emerged from the circle. Ordinary players who do not understand on-chain casting can also…

7 min read

·

Nov 21, 2023

16

1

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

726

4

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

40K

1062

CryptoLola

CryptoLola

in

Coinmonks

What is Blast? How profitable will be the Blast airdrop?

Blast has been very popular in the past two days. The cumulative TVL in the two days since it was launched has exceeded 230 million US…

6 min read

·

Nov 24, 2023

1

Recommended from Medium

Hashim Qamar

Hashim Qamar

As the Injective Unlock Event is About to Take Place, Injective Eyes to New Heights

4 min read

·

Jan 11

16

Smokey the Bera

in

Berachain Foundation

The Bera Era Has Begun

The happy day has arrived. Rejoice, one and all, because if you’re reading this, Berachain Public Testnet “Artio” is live.

8 min read

·

6 days ago

511

10

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

371

saves

My Kind Of Medium (All-Time Faves)58 stories

My Kind Of Medium (All-Time Faves)58 stories

·

185

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

627

saves

Rogers Mayaka

in

Coinmonks

Crafting a Captivating Press Release for Your New Crypto Token

So, your brilliant blockchain brainchild has hatched a revolutionary token, ready to rocket to the moon. But how do you shout its…

4 min read

·

Jan 8

60

Bitcoin Cats

Bitcoin Cats

Updates on Bitcoin Cats NFTs

Dear Bitcoin Cats lovers,

2 min read

·

6 days ago

53

pxd - The WEMIX Team

pxd - The WEMIX Team

in

pxd - The WEMIX Team

[Blockchain Trends 2024] TBA (Token Bound Accounts)

[블록체인 트렌드 2024] TBA(Token Bound Accounts)

4 min read

·

Jan 9

397

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

96

3

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)