LEARN THIS AND YOU WILL THOUSANDS OF DOLLAR IN FOREX TRADES

Why Do Forex Traders Lose Money?

Forex trading, also known as foreign exchange trading, can be a lucrative business. Many traders, however, lose money in the markets. In this article, we will look at some of the reasons why traders may lose money in forex markets.

Lack of a Trading Plan One of the most common reasons why traders lose money in the forex markets is that they don’t have a trading plan. A trading plan is a set of rules and guidelines that outline a trader’s approach to the markets. Without a trading plan, traders are more likely to make impulsive decisions based on emotions, rather than logic and analysis.

Lack of Discipline Another reason why traders lose money in the forex markets is that they lack discipline. Trading is a discipline, and traders must be disciplined to succeed. This means sticking to a trading plan, even when the markets are volatile or unpredictable. It also means taking a long-term approach to trading, rather than trying to make quick profits.

Lack of Knowledge A lack of knowledge is another common reason why traders lose money in the forex markets. The forex markets are complex and there is a lot to learn. Traders must have a good understanding of technical and fundamental analysis, as well as the economic and political factors that can impact the markets.

Overtrading is another common reason why traders lose money in the forex markets. This occurs when traders enter too many trades, or hold onto losing trades for too long. Overtrading can lead to increased losses, as well as emotional and mental exhaustion.

Risk Management Risk management is a crucial aspect of forex trading, but many traders neglect it. Traders must be able to manage their risk by setting stop-loss orders, and by not risking too much of their trading capital on any one trade. Without proper risk management, traders can easily lose all of their trading capital in a short period of time. Conclusion Forex trading can be a highly profitable endeavor, but it also comes with a high degree of risk. Traders who lose money in the forex markets often do so because of a lack of a trading plan, lack of discipline, lack of knowledge, overtrading, and poor risk management.

By understanding these common reasons for failure, traders can take steps to improve their chances of success in the forex markets. In summary, to avoid losing money in Forex trading, traders should develop a solid trading plan, maintain discipline, educate themselves, avoid overtrading and manage their risk properly.

Emotions play a big role in forex trading and can often lead to poor decision-making. Fear and greed are the two most common emotions that traders experience.

Fear can cause traders to exit trades prematurely or not enter trades at all, while greed can cause traders to hold onto losing trades for too long or to over-leverage their account.

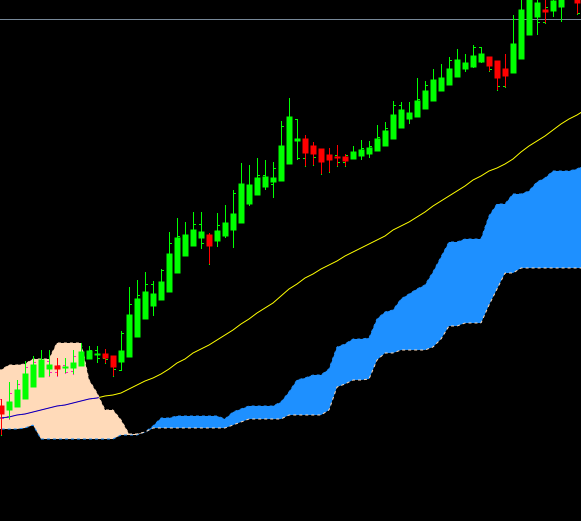

Not Following the Trend Another reason why traders lose money in the forex markets is that they don’t follow the trend. The trend is your friend, as the saying goes, and traders should always trade in the direction of the trend. This means that if the market is in an uptrend, traders should look for buying opportunities, and if the market is in a downtrend, traders should look for selling opportunities.

Not Adapting to Changing Market Conditions Markets are constantly changing and traders must be able to adapt to these changes. This means that traders must be able to adjust their trading plan and strategy as market conditions change. For example, if a currency pair that was previously in a strong uptrend, suddenly begins to trend downwards, traders should adjust their strategy accordingly.

Not Learning from Mistakes Another common reason why traders lose money in the forex markets is that they don’t learn from their mistakes. Every trader makes mistakes, but it’s important to learn from them. Traders should keep a trading journal to record their trades, and to analyze their mistakes. This will help them to identify their weaknesses and to improve their trading.

Not Having Patience Finally, traders often lose money in the forex markets because they don’t have patience. Forex trading is a long-term endeavor and traders must be patient. This means that traders should not try to make quick profits, but should instead focus on building a long-term trading strategy.

ALL THE BEST