De-Fi On Solana: Introducing Kamino

If you’re looking at starting De-Fi on SOL, Kamino should be your first stop.

One of the great things about SOL is that it’s extremely functional. With fast transactions and low-cost gas, it’s perfect for many projects. One of the coolest use cases of the chain though is in leveraging Decentralized Finances services or De-Fi. Allowing users to use their crypto for lending, borrowing and liquidity means that users can earn off their crypto and engage with different protocols while doing so.

While there are many great De-Fi services on SOL one of our favourites is Kamino Finance. With a good interface that’s easy to use and plenty of information to help beginners get started, it is the star of today's article. We’ll look at De-Fi, and share why we think Kamino is currently the hottest De-Fi project on SOL.

What Is De-Fi?

Decentralized Finance (De-Fi) is a new-era financial ecosystem built on blockchain technology, aiming to reshape traditional financial services by removing intermediaries and enabling peer-to-peer transactions. In DeFi, users can access a wide range of financial services, including lending, borrowing, trading, and yield farming, directly from decentralized applications (DApps) without the need for traditional financial institutions. Smart contracts, which are programmable self-executing agreements deployed on blockchains like Ethereum, govern the rules and processes of DeFi protocols, ensuring transparency, security, and automation. DeFi opens up financial opportunities to anyone with an internet connection, offering greater financial inclusion, access to global markets, and the potential for higher returns, albeit with some inherent risks due to the evolving nature of the crypto ecosystem.

Why The Solana Network

While De-Fi started on chains like Ethereum, the cost of gas for performing transactions can often exclude users or limit their ability to conduct transactions. With one of the main features of SOL being low-cost gas, this becomes less of an issue and allows even small players to enter the De-Fi market, experimenting with new protocols and possibly even earning some money along the way via lending or airdrops.

However, if you’re going to participate in De-Fi, it’s a good idea to do some research on the types of things you might be looking at, as well as a look at some of the risks involved as well. Like anything in crypto, tokens can be volatile and there are inherent risks around using smart contracts that users should understand before participating.

Why Kamino?

We’ve talked in previous articles about how the team behind Web3 projects can contribute strongly to the success or downfall of a project. While some teams have a strong community focus and are responsive to feedback from their users, others neglect this path and fail to build community at all. And it’s fair to say that when this occurs, it’s usually pretty visible in the end product. Kamino is one of the good eggs, with an active community on Discord and a track record of implementing changes where required, including those that are often based on community feedback. While some parts of the platform are still in beta or in ongoing development the core functions are there and work pretty well compared to other players competing in the space.

You’ll also find a vast array of information to help you get started. So for those that are new to the De-Fi ecosystem, you’ll find a bunch of written information to assist you as well as plenty of vocal users in the discord that can assist you on your way. It’s not everything you’ll need to get started, but there's enough there to get yourself established and trading.

The Platform

Getting started on Kamino is extremely easy, but if you’re a newbie we’ll include a quick walkthrough on how to set up a few things, earn some points and have a dabble inside the ecosystem. We’ll do this by lending, borrowing and adding some liquidity to various pools.

Remember that before you get involved, you should research projects on your own and assess their suitability for your situation rather than relying on the word of others.

First, we’ll be looking to pair our Solana wallet with the platform. We’ll do this in the usual way however, it is good practice to use a fresh wallet for De-Fi rather than relying on your main. So set up a fresh wallet on the interface of your choice and ensure that you’ve given it some SOL for trading and gas purposes.

Secondly, any transaction on Kamino is eligible to earn points. Because of this, we’ll be looking to transact in a way that maximises the earning of these points. More on this later. Earn Kamino points for participating in various activities. Source: Kamino Finance.

Earn Kamino points for participating in various activities. Source: Kamino Finance.

Supply

Once we’re connected to Kamino, we’ll head over to the lending centre so we can contribute some SOL to the lending pool. We can then start to earn the first of our Kamino points. All the current stats are available at your fingertips. Source: Kamino Finance

All the current stats are available at your fingertips. Source: Kamino Finance

The interface shows us the amount of SOL currently being supplied and borrowed. To join the party, we’ll simply hit supply and then input an amount of SOL you’re comfortable with risking. Once that’s done, we’ll sign the transaction and it’s that easy! We’re now supplying SOL and earning Kamino points for doing so. Next up, we’ll look at borrowing. Stablecoins are pretty useful in the world of De-Fi. Source: Kamino Finance

Stablecoins are pretty useful in the world of De-Fi. Source: Kamino Finance

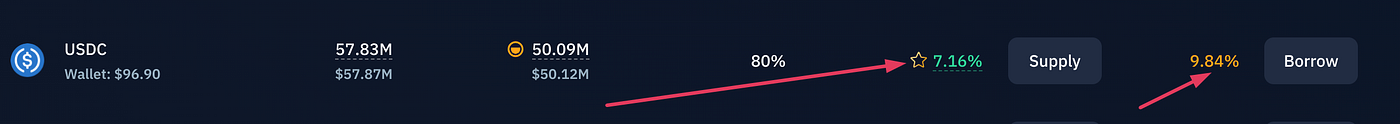

Borrowing

Before we borrow, there are a few things to be aware of. Firstly, with either supply or borrow, stablecoins are king. This is because they demand a higher APY all while providing greater price stability in doing so. Because of this, the concept of earning points on a multiplier usually means that if you're using stable coins for some of your transactions you’ll typically earn more points for doing so.

Secondly, when we are borrowing funds we’re using our supplied funds as collateral. So when we borrow, we must preserve the health of the loan as this is what keeps our funds safe. To do this, we’ll look at something called the LTV ratio.

Effectively what this refers to is the balance of funds we’ve borrowed compared to the funds we’ve supplied. If you’re using something other than stablecoins then market fluctuations may change this LTV ratio and if things get bad enough your position will be “liquidated” meaning you’ll eventually lose the funds you held as collateral. Because of this, it’s good practice to be conservative with your ratios and check in on your LTV ratio daily. This ensures your funds will stay safe.

Next, we’ll look at borrowing some USDC to build up our multiplier. To do this, we’ll stay in the same lending and borrowing portal and simply hit ‘Borrow” on the USDC line.

Once this is done, we’ll need to sign the transaction like we did previously. When the transaction is signed, your portfolio should update and you should be able to see the borrowed funds sitting in your wallet. At this point, we’ll observe the LTV ratio so we can compare it when we check things later on. Liquidity Pools can be a great way to earn rewards, but they still come with some risk. Source: Kamino Finance.

Liquidity Pools can be a great way to earn rewards, but they still come with some risk. Source: Kamino Finance.

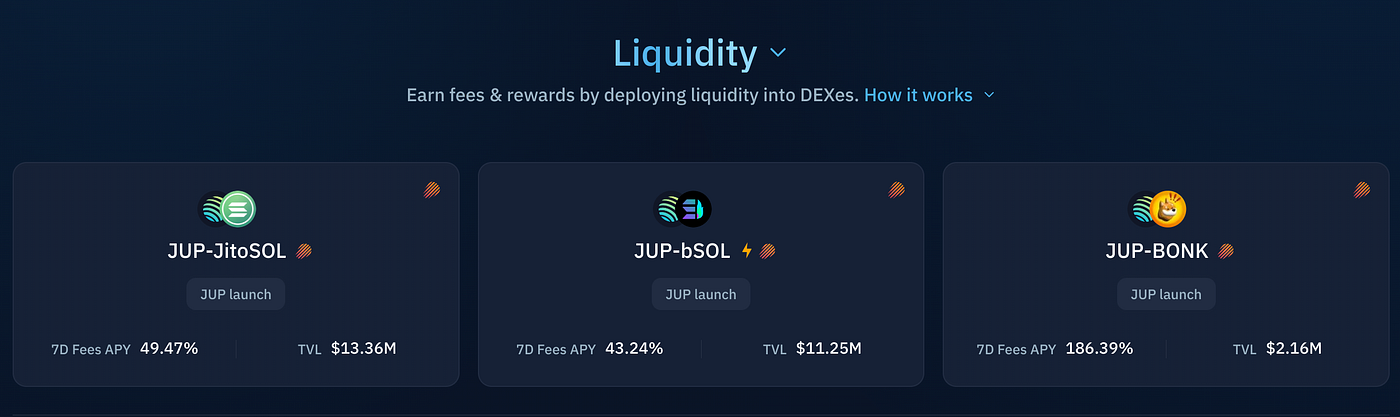

Liquidity Pools

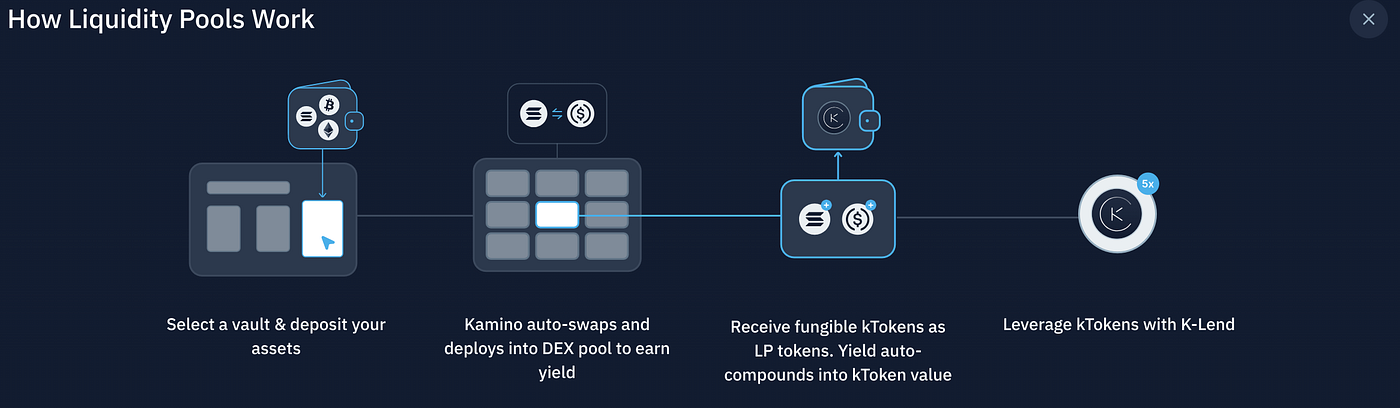

The concept of liquidity pools can be a bit confusing for newcomers. However like we said earlier, there’s plenty of supplied data to help you understand how it all works. Realistically though, the platform will manage the pool, so all you’ll really need to do is contribute and then wait to earn on your supplied products. If you’re looking to understand the mechanism behind the concept though, here’s a short graphic from Kamino that should help. A graphic that shows how liquidity pools work. Source: Kamino Finance

A graphic that shows how liquidity pools work. Source: Kamino Finance

Effectively though, you’ll be able to give liquidity and will receive K tokens in return. There’s a large range of memecoin pools available but it’s usually good practice to stick with something that's reasonably stable and somewhat safer than a volatile meme coin.

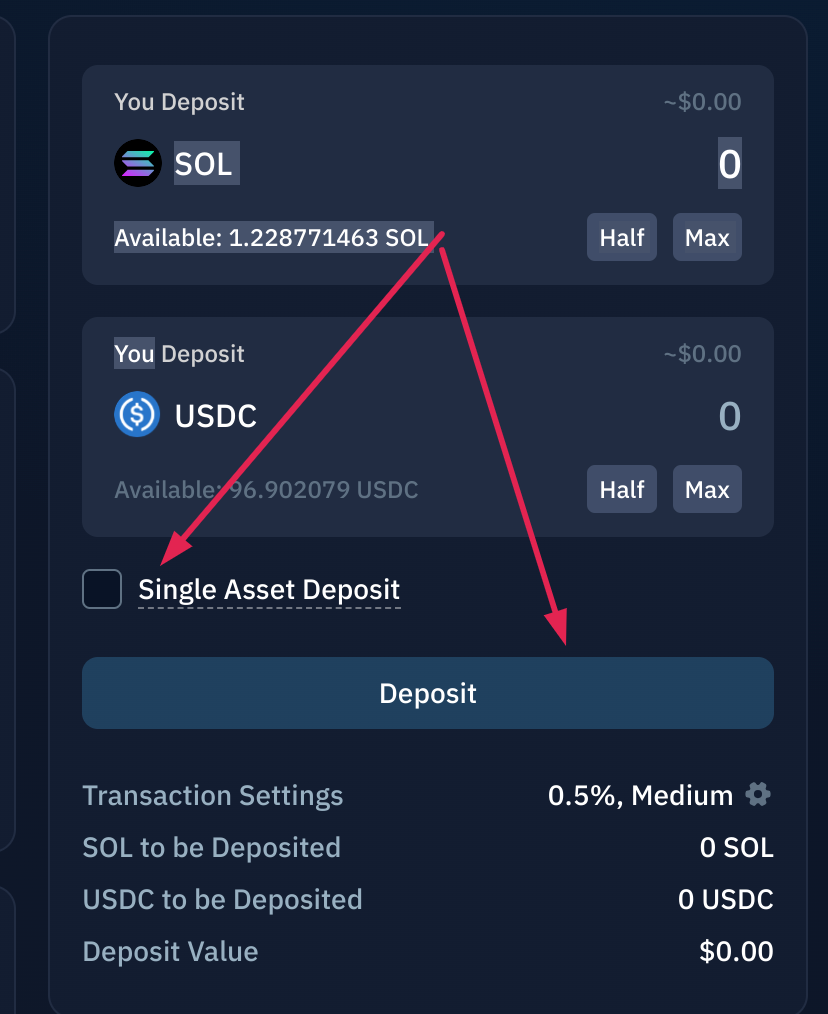

To contribute to a pool, we’ll simply hit deposit. We’ll use SOL-USDC as an example for today's article Once we’ve done that we’ll be taken to the deposit menu and given additional information about our pool of choice. We can also choose to add a single asset to the pool or a combination of both.

Once we’ve done that we’ll be taken to the deposit menu and given additional information about our pool of choice. We can also choose to add a single asset to the pool or a combination of both. We can deposit using a single asset or a mixture of both. Source: Kamino Finance

We can deposit using a single asset or a mixture of both. Source: Kamino Finance

Once we’ve selected our amount and asset type we’ll simply hit deposit and then sign our transaction. We should see our allocated funds withdrawn from our wallet and our Ktokens being added as replacements.

Multipliers

So thus far, we’ve supplied, borrowed and given liquidity. This means that when we go to our portfolio, we should see points starting to accrue as well as multipliers being added as a bonus for using certain protocols. Our USDC transactions, for instance, have given us extra bonuses over lending tokens of a different type.

These points are important as they’ll help reflect your activity and loyalty within the platform, something that may become more important later on. To check these, we’ll use the main menu at the top with the gold star Find your points and multipliers in the top star menu. Source: Kamino Finance

Find your points and multipliers in the top star menu. Source: Kamino Finance

Clicking this should give us our multiplier level as well as our number of daily points and our season ranking.

Final Words

So if you’ve been following allowing you should now be supplying borrowing and adding liquidity, all things that will get you started in the world of De-Fi. However, when you explore the top menu, you may have noticed a few additional options there. We can also multiply or use Long/Short transactions to help perform some additional trades. Source: Kamino Finance

We can also multiply or use Long/Short transactions to help perform some additional trades. Source: Kamino Finance

While we won’t be covering that in today's article, stay tuned for a future piece where we look at these features in a little more detail.

In the meantime, you can accrue plenty of Kamino Points while you wait.

If you’re one of those data-driven folk, you may find that reviewing some of the documentation for the various types of De-Fi might be useful before you start. Also, if you’re a Discord user you should take a look at joining the Kamino Discord, where you’ll be able to stay ahead of all the latest news, updates and protocol changes.

Join the Kamino Discord via this link

Review the Kamino Documentation here

Learn More about some of the risks involved with De-Fi

Follow Kamino on X

And, a final word for creators. If you’re a meme lord or writer yourself, remember that under the new promotion by Kamino, you can earn additional points by making content or presenting tutorials, just like this one. Find all the information you’ll need in the tweet included below.

Medium has recently made some algorithm changes to improve the discoverability of articles like this one. These changes are designed to ensure that high-quality content reaches a wider audience, and your engagement plays a crucial role in making that happen.

If you found this article insightful, informative, or entertaining, we kindly encourage you to show your support. Clapping for this article not only lets the author know that their work is appreciated but also helps boost its visibility to others who might benefit from it.

🌟 Enjoyed this article? Support our work and join the community! 🌟

💙 Support me on Ko-fi: Investigator515

📢 Join our OSINT Telegram channel for exclusive updates or

📢 Follow our crypto Telegram for the latest giveaways

🐦 Follow us on Twitter and

🟦 We’re now on Bluesky!

🔗 Articles we think you’ll like:

- Software Defined Radio & Radio Hacking Pt 1

- OSINT Investigators Guide to Self Care & Resilience

✉️ Want more content like this? Sign up for email updates

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)