Solana explains outage as SOL continues to pump

he recent disruption was the first in a year since the 20-hour network jam recorded in February 2023.

- The bug was the cause of a Devnet outage seen in the previous week.

- SOL has risen 17% since the incident on the 6th of February.

The recent outage that halted transactions on the Solana [SOL] mainnet for five hours was due to a known bug identified by developers last week, Solana Labs admitted in an elaborate root cause report.

The bug was the cause of a Devnet outage seen previously. While developers issued a fix for one of the triggers of the bug, the fix for the other trigger was supposed to go into the version 1.18 cycle. The fix for the latter was eventually released as part of version 1.17.20.

Solana stated in the report that a “more complete fix” would be released in the future and align with the regular release cycle.

Solana’s goal: Speed + Stability

Solana, which prides itself on its lightning fast transaction speeds, theoretically up to 50,000–65,000 transactions per second (TPS), has often received brickbats over its lack of stability and network glitches.

In fact, co-founder Anatoly Yakovenko went to the extent of terming network outages as “Solana’s curse” in one of his older interviews.

Having said that, the recent disruption was the first in a year since the 20-hour network jam recorded in February 2023. In between these incidents, the Solana network maintained a 100% uptime, according to AMBCrypto’s examination of Solana network status.

SOL shrugs off FUD in style

The disturbance impacted native token SOL in the immediate aftermath, causing a 2.1% drop in market value, as per CoinMarketCap. However, as the network came back up and FUD started to subside, these losses were reversed.

In fact, the fifth-largest cryptocurrency has risen 17% since the incident on the 6th of Febdruary, indicating significant investor support.

As the prices surged, so did speculative bets on SOL. According to AMBCrypto’s analysis of Santiment data, the money invested into SOL futures market jumped by 20% in the last four days. Source: Santiment

Source: Santiment

How much are 1,10,100 SOLs worth today?

Additionally, SOL’s funding rate on Binance continued to be positive, suggesting the dominance of bullish-leveraged traders.

However, to much surprise, weighted sentiment was still in the negative territory. This implied that the broader market was still pessimistic about SOL’s prospects.

What next for Avalanche as AVAX rises 8% in 24 hours

2min Read

Avalanche’s network activity was on the rise while the token’s price surged by more than 8% in the last 24 hours.

- Both Avalanche’s network activity and captured value increased over the last week.

- Market indicators looked bullish on AVAX.

Avalanche [AVAX] investors were rejoicing as the token’s price increased considerably in the last few hours. However, data suggested that the case with Avalanche’s network activity was different, as it dropped last week.

Is Avalanche’s network activity dropping?

AVAX Daily, a popular X handle that gives updates related to the Avalanche ecosystem, posted the blockchain’s weekly highlights on 8th February. The tweet showed that AVAX’s active addresses had dropped over the last few weeks.

Avalanche Subnet Weekly Stats

Total Subnets: 103

Total Blockchains: 76

Total Validators: 1730

Total Stake Amount: 246.23M AVAX#AVAX #Avalanche $AVAX pic.twitter.com/fOLxt8Ll4R

— AVAX Daily 🔺 (@AVAXDaily) February 8, 2024

Apart from that, the tweet also mentioned quite a few key metrics. For instance, AVAX’s number of subnets reached 103, while its total number of validators reached 1,700.

The blockchain processed over 7.6 million transactions last week, with a maximum of 215 transactions per second.

Since the daily active users’ graph dropped, AMBCrypto checked Artemis’ data to better understand the state of Avalanche’s network activity. Surprisingly, we found that Avalanche’s daily active addresses actually went up in the recent past. Source: Artemis

Source: Artemis

Thanks to that, the blockchain’s number of daily transactions also gained upward momentum. Things in terms of captured value also looked pretty optimistic. This was evident from the rise in both Avalanche’s fees and revenue.

AVAX’s performance in the DeFi space also looked promising, as its TVL went up last week. Source: Artemis

Source: Artemis

AVAX is pumping

AMBCrypto reported earlier that if AVAX managed to overcome the resistance level at $36.2, the possibility of the token touching $43 was high.

AVAX did gain bullish momentum in the last few hours as its price rallied. According to CoinMarketCap, in the last 24 hours alone, AVAX was up by more than 8%.

At the time of writing, AVAX was trading at $39.16 with a market capitalization of over $14.3 billion, making it the ninth largest crypto.

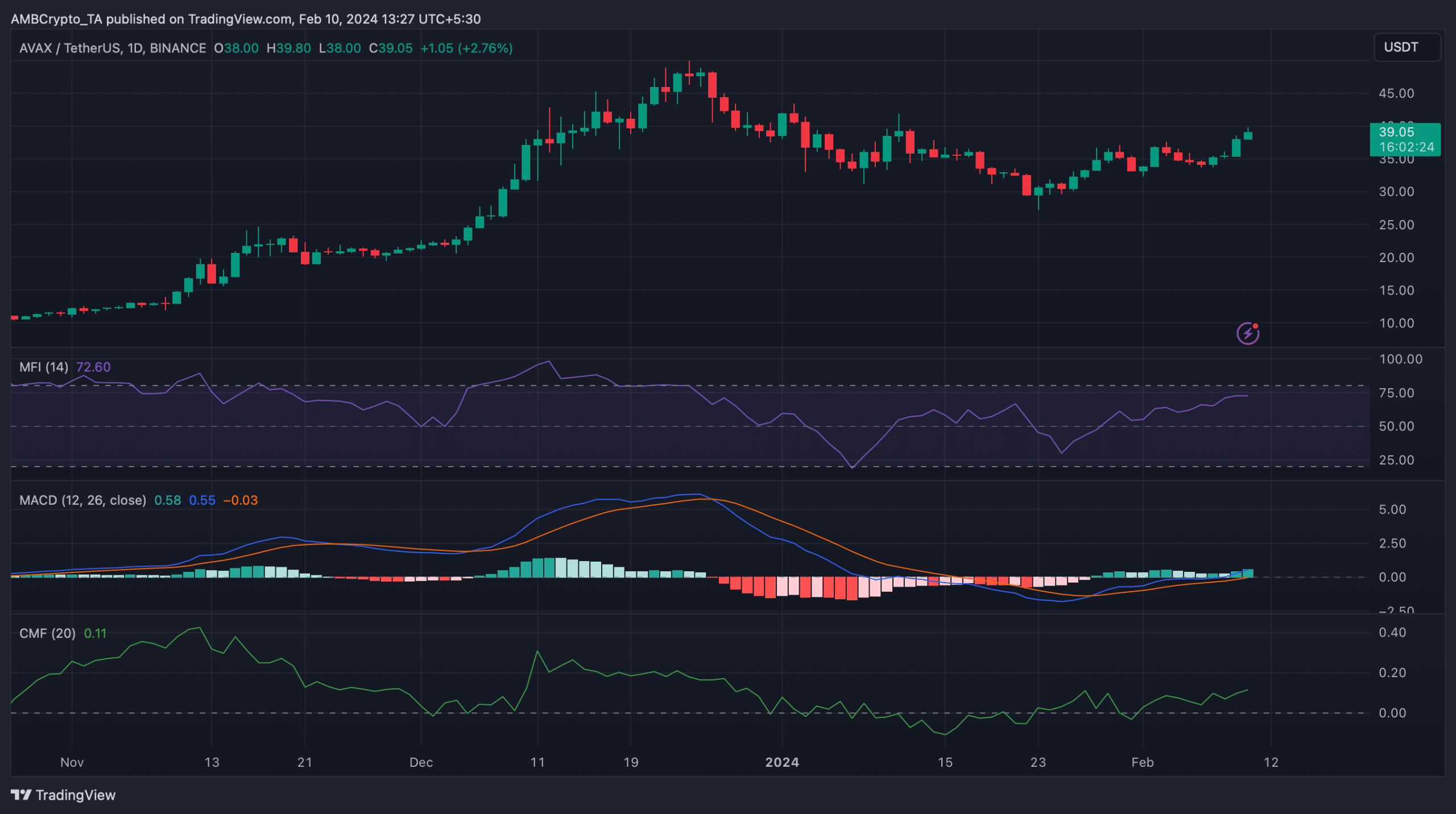

The good news was that the token’s volume also surged along with its price, meaning that investors were trading AVAX at its higher price. To further check whether the uptrend would last longer, AMBCrypt took a look at Avalanche’s daily chart.

Realistic or not, here’s AVAX market cap in BTC‘s terms

The token’s MACD suggested that the bulls were controlling the market. Its Chaikin Money Flow (CMF) also registered an uptick, indicating that investors might witness a continued price uptrend.

However, its Relative Strength Index (RSI) was about to enter the overbought zone. This might increase selling pressure on Avalanche, causing its price to plummet over the coming days. Source: TradingView

Source: TradingView

Previous: Solana explains outage as SOL continues to pump

Next: Ethereum regains NFT sales crown as ETH eyes $2,500

Ethereum regains NFT sales crown as ETH eyes $2,500

2min Read

Though Bitcoin dominated the NFT sales volume briefly, Ethereum has reclaimed the top spot.

- Ethereum leads in NFT sales trade volume.

- ETH price closes in on $2,500.

Bitcoin [BTC] made a significant entry into the NFT scene, causing a shakeup in the rankings and displacing Ethereum [ETH] as the dominant NFT network. However, new data indicates that Ethereum has reclaimed the top spot, particularly in the last 30 days.

Ethereum tops NFT sales volume ranking

Coin98 Analytics data showed that Ethereum has reasserted its dominance in the Non-Fungible Token (NFT) sales volume rankings. The analysis indicates that the sales volume on the network reached $356 million in January.

Bitcoin, with a sales volume of $335 million, was the only other network in the same volume bracket. This suggests an ongoing competition between the two networks, with Bitcoin recently joining the NFT sales volume race.

How Ethereum and Bitcoin sales volume have trended

An analysis of NFT sales volume on Cryptoslam showed that Ethereum has maintained higher sales volume in the last seven days, continuing its momentum from the past month.

At the time of this writing, the total seven-day volume was over $182.8 million. Further examination showed a wash trade volume of over $39.5 million, resulting in an actual volume of over $143.3 million.

In comparison, Bitcoin recorded a total seven-day volume of over $54.7 million, with a wash trade volume of around $746,000, bringing the total volume to about $54 million.

Notably, Ethereum dominated the sales volume at the time of this writing, with a volume of around $25 million and a wash trade volume of about $3.5 million. Bitcoin’s volume was around $6.4 million.

How much are 1,10,100 ETHs worth today

Ethereum moves up in price

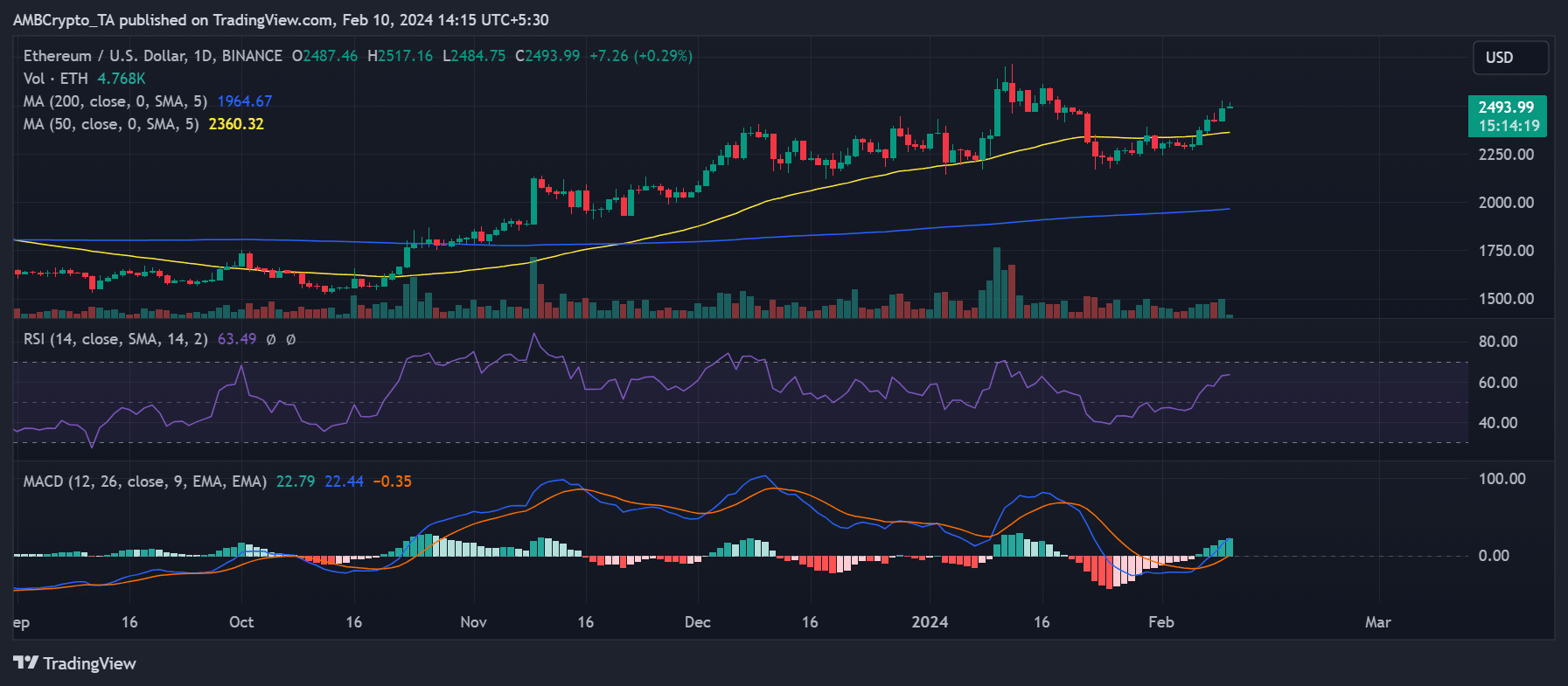

An analysis of the Ethereum price trend on a daily timeframe showed its proximity to entering the $2,500 price range. The chart showed a consistent uptrend over the past few days, with a 2.75% increase on 9th February, reaching a trading value of $2,486.

At the time of this writing, ETH continued its uptrend, trading at about $2,491. The Relative Strength Index (RSI) has crossed the 60 threshold at the time of this writing, signifying a bull trend. If the upward momentum persists, Ethereum could enter the overbought zone. Source: Trading View

Source: Trading View

Previous: What next for Avalanche as AVAX rises 8% in 24 hours

Next: Why Dogecoin needs to come out of Elon Musk’s shadow in 2024

Aniket is a full-time journalist at AMB Crypto. With experience in news publishing and content management, he is now increasingly tangled up in the web of cryptocurrencies and blockchains. His focus lies on the intersection between cryptos and traditional finance. He prefers DC over Marvel, cats over dogs and Hyderabadi Biryani over Kolkata Biryani.