Navigating the Regulatory Landscape of Cryptocurrency

Introduction

cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2] A logo for Bitcoin, the first decentralized cryptocurrency

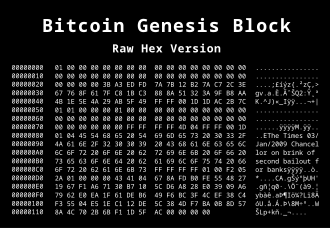

A logo for Bitcoin, the first decentralized cryptocurrency The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite their name, cryptocurrencies are not considered to be currencies in the traditional sense, and while varying treatments have been applied to them, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12] Throughout their existence, cryptocurrencies have been involved in criminal activities and multi-billion-dollar fraud schemes. Some economists and investors, such as Warren Buffett, considered cryptocurrencies to be a speculative bubble.

Cryptocurrency, once a niche interest for tech enthusiasts, has evolved into a global phenomenon with the potential to reshape the financial landscape. However, alongside its rapid growth, the issue of regulation has become increasingly prominent. Governments around the world are grappling with how to regulate this new digital asset class effectively. Let's delve into the complexities of cryptocurrency regulation and explore the various approaches taken by different countries.

The Need for Regulation

The decentralized nature of cryptocurrencies, such as Bitcoin and Ethereum, presents both opportunities and challenges. On one hand, it offers financial inclusivity and the potential for borderless transactions. On the other hand, it raises concerns about security, investor protection, and its potential for facilitating illegal activities like money laundering and tax evasion. Regulation is essential to address these concerns and provide a framework for the responsible use of cryptocurrencies. It aims to strike a balance between fostering innovation and protecting consumers and the broader financial system.

Diverse Regulatory Approaches

Governments worldwide have taken varied approaches to cryptocurrency regulation, reflecting their differing attitudes and priorities.

- Prohibition: Some countries have outright banned cryptocurrencies or imposed severe restrictions on their use and trading. China, for example, has banned initial coin offerings (ICOs) and cracked down on cryptocurrency exchanges, citing concerns about financial stability and capital outflows.

- Laissez-faire: Other jurisdictions have opted for a hands-off approach, allowing the cryptocurrency market to develop with minimal intervention. Countries like Switzerland and Singapore have embraced cryptocurrencies, establishing themselves as hubs for blockchain innovation while implementing regulations to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Regulatory Frameworks: Many countries have chosen to regulate cryptocurrencies within existing financial frameworks or have introduced specific legislation tailored to digital assets. The United States, for instance, has a patchwork of regulations at the federal and state levels, with agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) playing key roles in overseeing different aspects of the cryptocurrency market.

Key Regulatory Considerations

- Consumer Protection: Regulations should aim to protect investors from fraud, scams, and market manipulation. This may involve licensing requirements for cryptocurrency exchanges, mandatory disclosure of risks, and measures to ensure the security of digital assets.

- Market Integrity: Maintaining the integrity of the cryptocurrency market is crucial for fostering trust and confidence. Regulators may impose rules to prevent insider trading, market abuse, and the dissemination of false or misleading information.

- AML/KYC Compliance: Cryptocurrencies have been associated with illicit activities due to their pseudonymous nature. Regulatory frameworks typically include provisions for AML and KYC compliance to prevent money laundering, terrorist financing, and other forms of financial crime.

- Taxation: Tax treatment of cryptocurrencies varies across jurisdictions and can have significant implications for investors and businesses. Clear guidance on the taxation of digital assets is essential to ensure compliance and minimize tax evasion.

- Innovation and Competitiveness: Regulations should strike a balance between safeguarding the public interest and fostering innovation. Excessive or overly burdensome regulations could stifle technological advancement and drive innovation offshore to more permissive jurisdictions.

The Road Ahead

As the cryptocurrency market continues to evolve, regulatory frameworks will need to adapt to keep pace with technological developments and emerging risks. Collaboration between governments, industry stakeholders, and international organizations will be crucial to harmonizing regulatory approaches and addressing global challenges such as cross-border transactions and regulatory arbitrage.

Ultimately, effective regulation can help unlock the full potential of cryptocurrencies while safeguarding against abuse and promoting financial stability. Finding the right balance will require ongoing dialogue and a nuanced understanding of the opportunities and risks associated with this transformative technology.

- Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:

- a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

- ^ Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.

- ^ "Bitcoin not a currency says Japan government". BBC News. 7 March 2014. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ "Is it a currency? A commodity? Bitcoin has an identity crisis". Reuters. 3 March 2020. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ Brown, Aaron (7 November 2017). "Are Cryptocurrencies an Asset Class? Yes and No". www.bloomberg.com. Archived from the original on 1 April 2022. Retrieved 25 January 2022.

- ^ Bezek, Ian (14 July 2021). "What Is Proof-of-Stake, and Why Is Ethereum Adopting It?". Archived from the original on 5 August 2021. Retrieved 5 August 2021.

- ^ Allison, Ian (8 September 2015). "If Banks Want Benefits of Blockchains, They Must Go Permissionless". International Business Times. Archived from the original on 12 September 2015. Retrieved 15 September 2015.

- ^ Matteo D'Agnolo. "All you need to know about Bitcoin". timesofindia-economictimes. Archived from the original on 26 October 2015.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)