Crypto Market Sees $321M Inflows as Bitcoin and Solana Lead Recovery

The global crypto inflows surged by $321M, with Bitcoin and Solana leading the recovery. Learn more about this significant shift in the digital asset market.

In a significant development for the cryptocurrency industry, global crypto inflows have surged by $321 million over the past week, marking a notable recovery after a period of outflows and market uncertainty.

According to data from CoinShares, a leading digital asset investment firm, Bitcoin and Solana have emerged as the frontrunners in this wave of renewed investor interest, with both digital assets attracting substantial capital. This rebound comes as institutional investors regain confidence in the crypto market, spurred by favorable macroeconomic conditions and evolving investment strategies.

Bitcoin Continues to Lead in Crypto Inflows

Bitcoin remains the dominant force in the market, accounting for $284 million of the total $321 million inflows. This represents the highest single-week inflow for the digital asset since June, reaffirming its position as the go-to investment for institutions looking to gain exposure to cryptocurrencies. The continued demand for Bitcoin can be attributed to its reputation as a "digital gold," offering stability and security in an otherwise volatile market.

James Butterfill, head of research at CoinShares, explained: “This rise in inflows indicates that institutions are showing renewed interest in Bitcoin as a hedge against inflation and as a reliable store of value, particularly as macroeconomic uncertainties continue to unfold.”

The inflows also reflect growing optimism surrounding Bitcoin’s potential to serve as a hedge against traditional financial markets. Amid concerns over inflation and rising interest rates, Bitcoin is being perceived as a safe-haven asset by many institutional investors, similar to how gold is viewed in traditional finance.

Short Bitcoin Products Record Modest Inflows

In addition to long Bitcoin positions, short Bitcoin investment products—designed to profit from a decline in Bitcoin’s price—recorded inflows of $5.1 million. This suggests that while the overall market sentiment is bullish, some investors remain cautious about potential price fluctuations and volatility.

The hedging strategy employed by these investors indicates a measured approach to the recent rally, as they seek to protect their portfolios against downside risks.

Despite the modest inflows into short Bitcoin products, the overall picture remains positive, with long positions overwhelmingly outweighing short positions. This dynamic suggests that confidence in Bitcoin’s future growth trajectory is stronger than any immediate concerns over market corrections.

Solana’s Resurgence Gains Momentum

Solana, often referred to as a competitor to Ethereum due to its fast transaction speeds and lower fees, has also seen significant inflows, totaling $3.2 million. The increase in capital flowing into Solana-based products underscores the growing interest in alternative layer-1 blockchains, particularly those that offer scalability and efficiency advantages over Ethereum.

Solana’s innovative technology, which allows for thousands of transactions per second at a fraction of the cost of Ethereum, has made it an attractive option for both retail and institutional investors. The network’s rapid growth in decentralized finance (DeFi) and non-fungible tokens (NFTs) has further fueled its popularity, with many viewing it as a strong contender in the blockchain ecosystem.

This renewed interest in Solana comes despite the network experiencing several high-profile outages in recent months. However, investors seem to be betting on Solana’s long-term potential, particularly as the project continues to work on improving its infrastructure and scalability.

Ethereum Continues to Struggle with Outflows

In contrast to Bitcoin and Solana, Ethereum has continued to experience outflows, with $29 million leaving Ethereum-based investment products over the past week. This marks the fifth consecutive week of outflows for the second-largest cryptocurrency by market capitalization, bringing the total outflows to $187.7 million during this period.

The persistent outflows from Ethereum highlight the growing competition it faces from alternative layer-1 blockchains like Solana and Avalanche. Ethereum’s high transaction fees and scalability issues have been a source of frustration for investors and developers alike, leading many to explore more efficient blockchain networks.

However, Ethereum’s upcoming upgrade, known as Ethereum 2.0, aims to address these issues by transitioning the network from a proof-of-work to a proof-of-stake consensus mechanism. If successful, Ethereum 2.0 could significantly improve the network’s scalability and reduce transaction costs, potentially reversing the current trend of outflows.

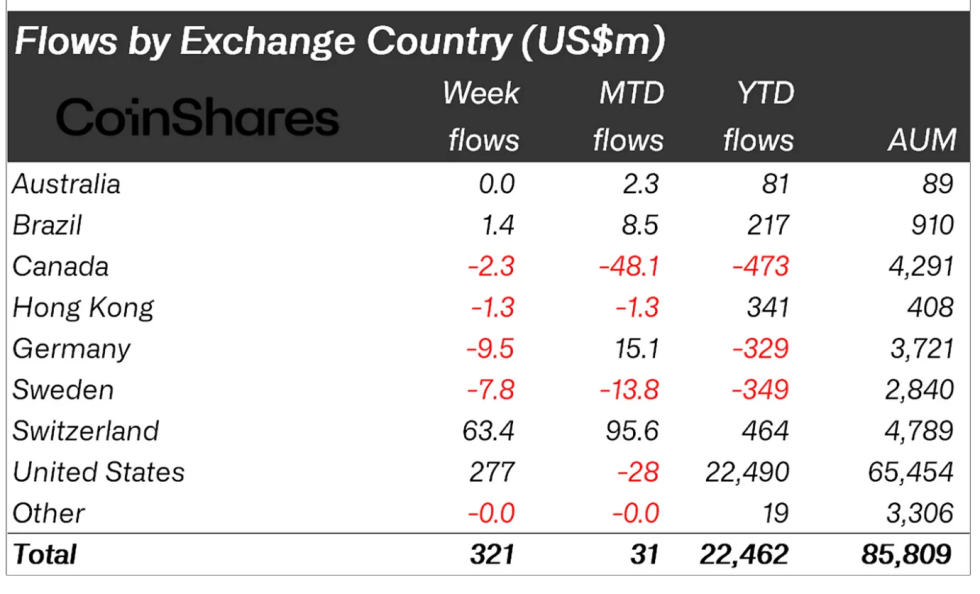

Regional Breakdown of Crypto Inflows

The recent surge in crypto inflows has been largely driven by the United States, which accounted for $277 million of the total inflows. Switzerland followed with $63 million in net inflows, while countries like Germany, Sweden, and Canada saw net outflows, reflecting more cautious sentiment in these regions.

The strong inflows in the U.S. can be partially attributed to favorable macroeconomic conditions, including the Federal Reserve’s recent decision to pause interest rate hikes. This has encouraged investors to seek out higher-risk assets, such as cryptocurrencies, in search of better returns. Additionally, regulatory clarity in the U.S. has provided institutional investors with more confidence to allocate capital to digital assets.

Switzerland’s position as a hub for crypto investment has also played a role in the recent inflows, with the country continuing to attract institutional capital due to its crypto-friendly regulatory environment and established financial infrastructure.

Impact on the Broader Market

The $321 million inflow into crypto investment products has had a ripple effect across the broader market, with total assets under management (AUM) for digital assets reaching $39.8 billion. This represents a 10% increase from the previous week, signaling a broader recovery in the crypto market after a period of stagnation.

Bitcoin’s price has also responded positively to the inflows, with the cryptocurrency trading above $60,000 for the first time in months. As of the time of writing, Bitcoin is trading at approximately $62,775, reflecting a strong upward trend in its market value.

Solana, too, has seen its price rise in response to the inflows, with the cryptocurrency currently trading at around $158, up from $140 just a week ago. This price increase has been driven by both institutional inflows and growing interest in the network’s DeFi and NFT ecosystems.

Future Outlook for Crypto Inflows

The recent surge in crypto inflows suggests that institutional interest in digital assets remains strong, particularly as traditional financial markets continue to face uncertainty. With Bitcoin and Solana leading the charge, it is likely that other cryptocurrencies will also benefit from renewed investor confidence in the coming weeks.

However, the market is not without risks. The potential for regulatory crackdowns, particularly in regions like Europe and Asia, could dampen investor sentiment and lead to renewed outflows. Additionally, the inherent volatility of the crypto market means that price fluctuations could lead to short-term corrections, even in the face of positive inflows.

Despite these risks, the overall trend appears to be one of cautious optimism. As Butterfill noted: “While some investors remain wary of short-term volatility, the long-term outlook for digital assets remains positive, particularly as more institutions recognize the potential of cryptocurrencies as an asset class.”

The $321 million inflow into crypto investment products represents a significant milestone for the market, signaling renewed confidence among institutional investors. With Bitcoin and Solana leading the charge, the stage is set for continued growth in the digital asset space, even as challenges remain on the horizon.

As the crypto market continues to evolve, investors will be closely watching for further developments, particularly with Ethereum’s upcoming upgrade and the broader regulatory environment. For now, however, the focus remains on the strong performance of Bitcoin and Solana, both of which have proven to be resilient in the face of market volatility.