Bitcoin halving this time will be very different - Crypto correction awaits ahead

There are signs that the Bitcoin halving event taking place this April will be “unprecedented”.

ETFs and supply/demand imbalance

Recently, the crypto market has had a recovery, mainly led by Bitcoin. It can be said that the US approval of a spot Bitcoin ETF in January played a big role in this change of landscape.

Since January 10, total market capitalization has increased 60%, from $1.5 trillion to $2.4 trillion. However, crypto is still a niche and young asset class – its size is only 10% of gold and smaller than Microsoft (3.1 trillion USD).

Many predicted ETF approval would be a “buy the rumor, sell the news” model – meaning the price tends to rise when the “rumor” spreads and fall when the rumored event occurs (“ news"). However, with the recent strong price increase, the above prediction was not accurate.

The question now is: What's next? US ETFs alone have attracted capital inflows of about $19 billion. Blackrock's IBIT (iShares Bitcoin Trust) ETF is the fastest ETF to reach $10 billion in assets. In just two months, this ETF has accumulated more Bitcoin than Microstrategy has since 2020.

These large capital inflows created a supply/demand imbalance, thereby increasing the underlying asset prices. In the US alone, Bitcoin ETFs account for ~4% of all Bitcoin in circulation. Add in the fact that ~29% of the total Bitcoin supply has been untouched for over 5 years or may be lost forever, so ETFs represent a significant source of demand right now.

It is likely that this supply-demand dynamic will become more serious after the Bitcoin halving taking place in mid-April. In the traditional world, an action that has been announced in advance by the organization will not cause price fluctuations.

However, in crypto, if we look at the past, we see halving cycles acting as psychological catalysts for price increases, launching a rally not only in Bitcoin but also in the altcoin market

Speaking specifically about the halving, there are signs that this event will be different. Bitcoin researcher Pete Rizzo noted that this is the first time Bitcoin has increased in price before a block reward cut event. All three previous halvings (2020, 2016, 2012) were followed by a bull market.

No one can say for sure how this Bitcoin halving will affect crypto prices; We are currently in uncharted territory in terms of technical analysis.

There are also a number of other factors that make this Bitcoin halving unprecedented.

Transaction fees

Not only was this the first halving where Bitcoin prices increased before the event, but it was also the first time transaction fees accounted for a significant portion of miners' revenue. Transaction fees are tied to network usage, and since the introduction of the Ordinals protocol, Bitcoin network usage has been increasing.

While this doesn't say anything about the price of Bitcoin, it could affect the number and type of mining equipment that remains in operation after the halving. Typically, halvings are like a forest fire that eliminates obsolete ASICs (specialized integrated circuits) that are no longer profitable after the block reward is cut in half.

Block becoming more valuable than ever?

The halving will occur when the network reaches block 840,000, and everyone predicts this will be the most valuable block mined to date. This is related to the point mentioned above: Ordinals operates by assigning a serial number to each satoshi (or sat, the smallest denomination of Bitcoin) to turn a fungible asset like Bitcoin into something that has origin, identity, and scarcity.

Tristan, founder of Ordiscan.com, which tracks Ordinals projects, predicts that collectors of these “rare sats” could value the data in block 840,000 at $50 million.

According to “Rodarmor Rarity”—a system that assigns value to events that occur on the Bitcoin network such as adjustments in mining difficulty and halvings—the first satoshi in which block alone could be worth up to $1 million, Tristan said. wrote in a blog post.

Runes

Because the halving is such a momentous event for the crypto community, many companies plan product launches or announcements to coincide with this time. This year is no different, except the project being announced is a new primitive token for Bitcoin: Casey Rodarmor's latest protocol design called Runes.

In short, Runes are another way to launch Bitcoin-based tokens (not too different from how altcoins launch on Ethereum). The protocol attracted a lot of attention thanks to the previous success of Ordinals. There have also been several projects announcing their intention to launch their Runes tokens on the first sat of the halving block.

Ability to reorganize the chain

Additionally, because the block halving has the potential to become extremely valuable, Tristan predicts miners will compete fiercely to obtain this block by any means necessary.

“The value of block 840,000 is at least 100 times higher than any previous block,” he wrote. “This is unprecedented and dangling such a huge pot of money in front of miners will make it difficult for them to play by the normal rules.”

It is possible that miners will use MEV to try to front-run and get this block, Tristan is not the only one predicting the possibility of a chain "reorg". Recently, the idea of “snipping” transactions also appeared on Will Foxley's “Mining Pod”, with the halving's “rare sat” being priced at a more conservative level of 10 Bitcoin.

Which coin will “win” in the long term?

The majority of inflows into ETFs come from institutional investors, while individual investors prefer to buy coins directly. And this may be the main reason why price increases are still possible.

Unlike individual investors, institutional investors tend to invest for the longer term and are less likely to sell their entire ETF shares during a market correction. Although they occasionally systematically rebalance their portfolios, compared to individual investors, they are less affected by day-to-day fluctuations.

Although the crypto ecosystem is currently very rich with applications used in payments, market making, borrowing/lending, gaming, metaverse, art... it seems that most of these use cases are still in the early stages. start or focus on a niche group. For crypto to become mainstream, there needs to be more practical use cases that have a big impact on people's daily lives.

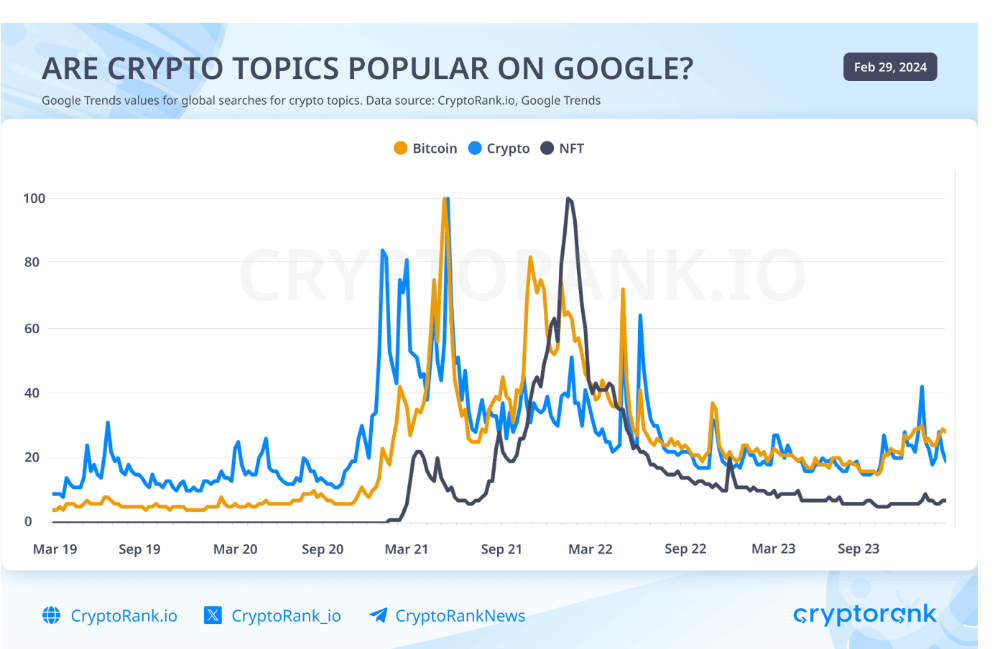

Looking at Google Trends in recent weeks, search results for terms like “crypto” or “Bitcoin” have increased but are still far from their 2021 bull market peak. Furthermore, the rally Recently it mainly happened with Bitcoin and ETH.

Altcoins are still quite quiet and most of them are trading below their ATH in November 2021. Bitcoin's market dominance rate still fluctuates around 50%. In general, altcoins tend to outperform Bitcoin and ETH in the later stages of the cycle.

Talking about the overall market landscape, from a risk/return perspective, it seems like crypto can be compared to early-stage venture capital. With over 9,000 cryptocurrencies in existence, it can be assumed that a relatively small number of them will profoundly impact our daily lives economically, and thus justify investing in them. long-term investment.

How many coins in the top 100 in June 2019 will maintain their position until December 2023? The answer is less than 30, according to CoinDesk.

According to Gregory Mall, Head of Investment Solutions at AMINA Bank, one way to avoid making overly concentrated bets and limit short-sighted chasing of trends, is to invest for the long term in a buy-and-hold strategy ( buy and hold) has a high degree of diversification.

“After spending a significant amount of time designing and constructing an investment index, we will see that the combination of quantitative and qualitative inclusion criteria, along with the smart beta methodology, delivers best results over the entire market cycle,” wrote Gregory Mall.

“Similarly, since the late 1990s, few people have chosen stocks with growth potential that still exist today and have a better investment record than the Nasdaq index. It is hard to imagine a world in which those who choose to invest in individual coins or who arbitrarily time the market to buy or sell can outperform a rigorously designed index over the long term. long".

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)