Affiliate Fees & Perma-Pools on Leo DEX

The modular chains, multi - chain projects and cross - chain operations are no longer a new thing in the crypto ecosystem. The boundries of a single chain is not enough for demanding nature of tech - driven markets.

Catching up with the advancement of the technology and getting the spotlights on your project get harder and harder as we live in the abundance of chains, L2s, and platforms. To be able to survive and evolve, it is a must to compete against the rivals on the market so that we get a higher percentage of shares on the liquidity and market capitulation. The Leo team is doing their best to make HIVE & LEO a part of the new world of the crypto market with its strict rules. The chains need to find a way to be secure, scalable and cheap in addition to operating with other Layer 1 and Layer 2 solutions. Hive blockchain has been doing very well with the first three items and the Maya Protocol integration on Leo DEX is likely to make it possible to go cross - chain via HAT (Hive Aggregation Technology).

The Leo team is doing their best to make HIVE & LEO a part of the new world of the crypto market with its strict rules. The chains need to find a way to be secure, scalable and cheap in addition to operating with other Layer 1 and Layer 2 solutions. Hive blockchain has been doing very well with the first three items and the Maya Protocol integration on Leo DEX is likely to make it possible to go cross - chain via HAT (Hive Aggregation Technology).

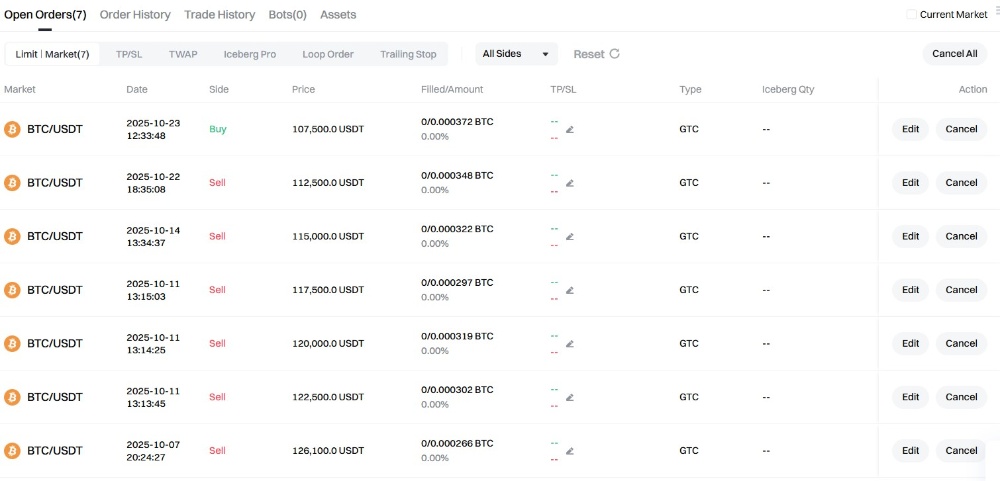

Today the LEO team announced the Open Beta of Leo DEX to let everyone test the cross - chain transactions with small amount of money. You can swap, provide liquidity and transfer assets on Maya Protocol with a couple of clicks. Now that we have launched the system, let's discuss the sustainablility of it.

Perma Pools -> Buying Pressure & Less Volatility

The biggest problem that new projects face is the high volatility of the prices due to the shallow market conditions on the side of makers and takers. When an investor wants to put some money in LEO, $10,000 may easily make the price 2x - 3x instantly. Contrarily, a single FUD and sell of in a low liquidity market may crash the price by more than 30% in a day.

To deal with the problem, the liquidity means a lot. What Eigen Layer, Swell, and many other liquid staking platforms try to do is leveraging to prevent the volatility, and loss of value in swaps and provide better market conditions. The perma - pool system can be the main factor that can diminish the unnecessarily high volatility of the price and open doors for investors to put a bigger amount of money in a bull market. The sustainability of the mechanism comes from the authenticity of the model. Every transaction on LEO - CACAO pool buys a small amount of coins and adds up on the liquidity pool. Slowly but firmly, the demand for LEO on the market will increase and there will be an arbitrage opportunity for those who use LEO DEX. Similarly, the more they use the platform, more LEO will be bought.

The sustainability of the mechanism comes from the authenticity of the model. Every transaction on LEO - CACAO pool buys a small amount of coins and adds up on the liquidity pool. Slowly but firmly, the demand for LEO on the market will increase and there will be an arbitrage opportunity for those who use LEO DEX. Similarly, the more they use the platform, more LEO will be bought.

There is no inorganic push to make the price go up or no force to use LEO DEX. Basically and organically, the more a stakeholder of LEO project uses the platform, the more useful it will be for the future of the value of the token, the popularity of the platform, and further earning opportunities.

You can see cases like taxes on your expenditures but, contrary to the majority of the governments, this blockchain - based system uses every single penny of it for the stakeholders. Maybe, for the first time, a self - fulfilling mechanism will be working for your financial growth. I see a similar mechanism in Launch Pad tokens such as SFUND and DAO Maker. Their working system always drives the power to organically add value to the token from the purchases of the investors. It has been organic and sustainable for several years even in the bear and bull market cycles.

What do you think about affiliate fees and the perma pools on LEO - CACAO LP?