PRISMA: Narratif DeFi x LSD

Liquid Staking Season (LSD or LST) is about to happen with dozens of protocols competing in the largest DeFi category today, with a TVL of almost $24M according to DeFiLlama. The LST narrative will grow.

Prisma Finance is designing various mechanisms that could help unlock the full potential of Ethereum's liquid staking tokens. With funding from major entities in the DeFi space such as Curve and Convex, questions arise about Prisma's prominence. The answers are in this article!

What is ESG and Prisma Finance?

LST has emerged as a popular solution for Ethereum asset holders, offering opportunities for ETH staking while maintaining liquidity. Various ETH liquid staking issuers are in the following image, with their respective fee structures (Fee and Yield).

All these different platforms contribute to the growth of liquid staking in the Ethereum ecosystem. Liquid staking protocols have seen an increase in TVL due to the trend of using LST as collateral for stablecoins. Lybra and Prisma Finance are two prime examples. Both protocols focus on accepting LST as collateral and issuing stablecoins based on it.

Prisma's code is inspired by Liquity, but seeks to stand out with flexible DeFi governance principles. Liquity is facing challenges, prompting users to explore alternatives like Prisma, which is developing new modules to address Liquity issues and to improve the UX and liquidity provider experience. An audit will be conducted soon for these Prisma innovations.

Prisma is supported by founders Curve Finance, Convex Finance, FRAX Finance, Conic Finance, Tetranode, Llama Airforce, Michael B. (LlamaNodes), CoinGecko, Amplice and Ivan (GearBox), OKX Ventures, DeFiDad, MrBlock, Impossible Finance, 0xMaki, GBV, Agnostic Fund, Swell Network, Magnus (Dialectic Fund), Carlos (BITKRAFT), Adam Cochran, Eden (The Block), Kinnif (Fisher8), Tascha (Stella), Ankr, Sam (NodeGuardians), MCEG, Eric Chen, Mirza (Injective), and many more.

mkUSD Stablecoin and Usage

Users can mint Prisma's native stablecoin, mkUSD, by utilising the listed Liquid Staking Tokens (LST). This provides capital efficiency to LST token holders, while earning staking rewards from Ethereum that help pay for loan repayments.

The integration of Curve's liquidity pool provides opportunities for staking stablecoins and receiving extra rewards in the form of CRV and CVX tokens. Prisma actively incentivises participation in "Curve Wars".

One notable feature of mkUSD is its cross-blockchain functionality. With the integration with LayerZero, Prisma makes mkUSD an OFT (Omnichain Fungible Token), allowing it to be bridged to various blockchains such as Arbitrum, OP Mainnet, Base, and BNB Chain.

The value proposition of mkUSD lies in its ability to 'leverage'-i.e. maintain ETH holdings while using the stablecoin to siphon off more ETH. While LUSD (Liquity's stablecoin) offers something similar, Prisma exclusively accepts LST for stablecoin minting, leading to the potential for collateral value to increase.

Many lending protocols accept LST, so there are various leverage options. But, Prisma stands out with user-friendly fees, lower than other protocols like Curve.

The loan interest is 1%, and ETH staking tends to yield rewards of around 3.5%. So, Tetranode's tweet above saying "free loan" is spot on. Please enjoy these lower-than-market-average fees while they last. These loan fees are set by the DAO, with the expectation that they will match the market later.

In addition, there are minting and redemption fees for stablecoins. This means that users tend to be more interested in maintaining positions rather than frequently exiting and entering positions.

What makes Prisma Finance different?

- Multi-collateralisation. Rather than focusing solely on stETH and its market-leading position, Prisma will welcome five different ESGs from Rocket Pool, Coinbase, Binance, and Frax. Prisma has one shared stability pool, but still allows users to take out loans independently from different collateral.

- veTokenomic. Users can lock their tokens to receive vePRISMA voting rights that vary by time period (from a week to a year). Users can also lock assets with different time periods in parallel, as well as "freeze" locked assets. ESG War. Curve 'gauges' allow stablecoin issuers to incentivise liquidity to a specific pool, often referred to as "Curve Wars". vePrisma holders will be allowed to incentivise certain actions across the Prisma protocol. This means that LST providers can incentivise the minting of mkUSD with their own LST.

- Governance. vePRISMA holders will have the ability to customise the parameters of each collateral since launch. This is for the purpose of managing risk and incentivising protocol issuance. Governance can adjust stablecoin minting and redemption fees, raise or lower lending rates, set maximum limits, and add or remove collateral.

- Boost. Holders of vePRISMA will benefit from the 'boost' that PRISMA generates when performing actions such as minting mkUSD, keeping loans open, or providing liquidity in certain incentivised asset pairs. Based on their voting weight, users will be awarded a bonus of up to 100% of their PRISMA rewards. This boost will be delegated to protocols such as Convex to collect and sell at a rate they can set themselves.

PRISMA Token and Airdrop

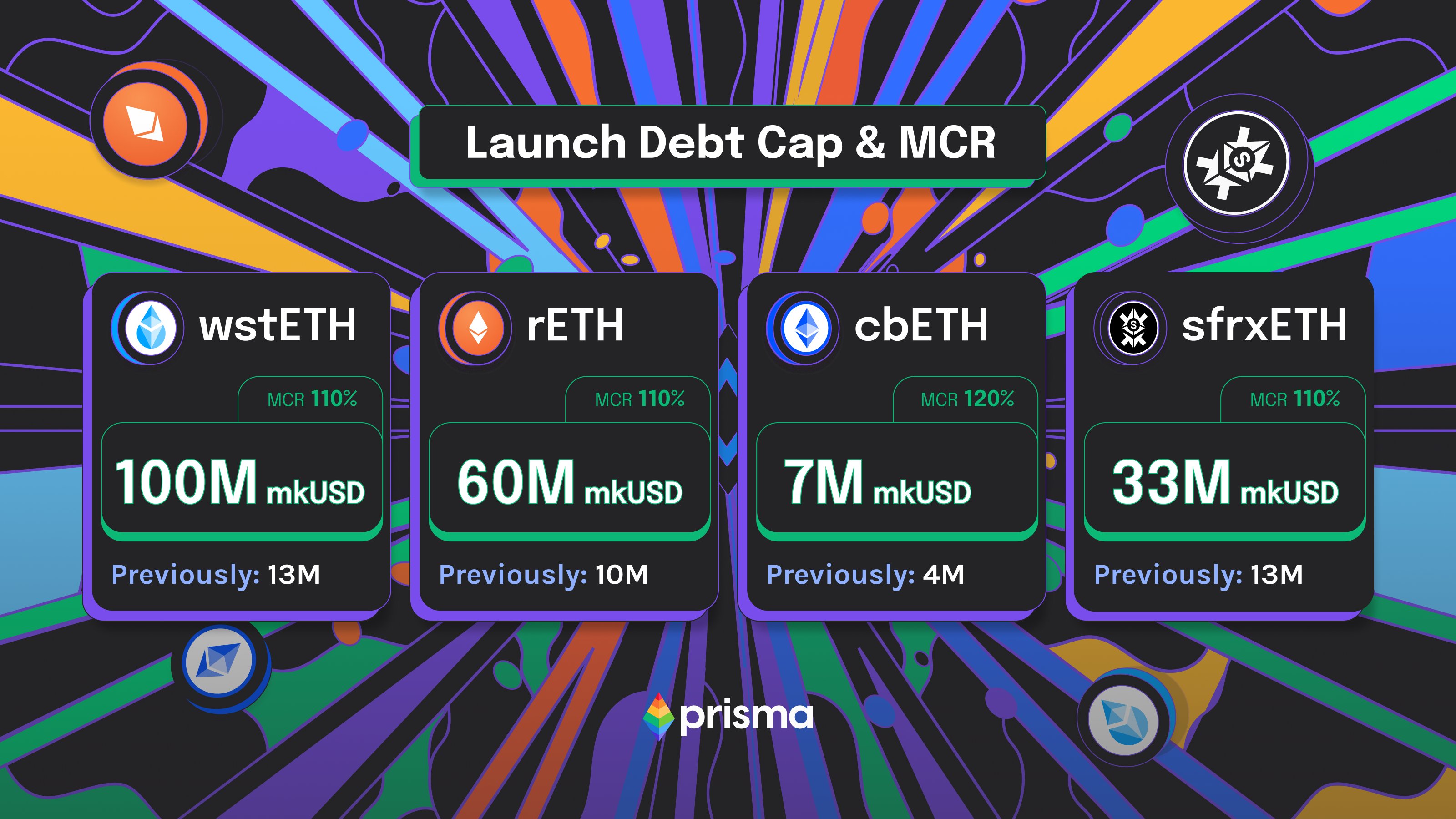

On 2 November, Prisma Finance released their $PRISMA token. They also increased the debt ceiling and adjusted parameters for a smooth launch. Convex also came out with their wrapper an hour later. TVL immediately broke $250 Million. In addition, I witnessed activity from speculators who were clamouring for this new opportunity. Even the price of the mkUSD stablecoin spiked amidst the excitement.

Two days later, Prisma revealed the Prisma Retroactive Airdrop on 4 November. With the introduction of the Prisma governance token, 9 Million PRISMA was distributed to holders of veCRV and Prisma Points.

The Prisma DAO has been created to be responsible for the future of Prisma, and with this airdrop the community can control PRISMA emission and various protocol parameters.

If you have already voted to whitelist Prisma on Curve or have been collecting Prisma Points for the past few weeks, check out this blog post for more details.

PRISMA Tokenomic

One of the key differentiators between Liquity and Prisma is the veTokenomi layer that the team has embedded in the protocol.

Despite the lack of specific details at the beginning, the notable lineup of early investors and their efforts in drawing attention to this airdrop signify that the team is committed in carefully crafting their tokenomi strategy.

PRISMA will have a maximum supply of 300 Million, and will be distributed as follows:

- 62% (186M PRISMA) is allocated for emissions managed by the Prisma DAO to incentivise certain actions within the Prisma protocol. Emissions can also be used to incentivise liquidity.

- 20% (60 Million PRISMA) is allocated to Core Contributors. These tokens will be unlocked linearly over 12 months starting from Genesis.

- 10% (30 Million PRISMA) is allocated to Early Supporters who assist with costs related to the initial development of the Prisma protocol. These tokens will be unlocked linearly over 12 months starting from Genesis.

- 5% (15 Million PRISMA) will be held in the Prisma DAO Treasury.

- 3% (9 Million PRISMA) will be distributed to veCRV and Prisma Points holders.

The 62% (186 Million PRISMA) allocation for issuance will be distributed as follows:

- Weeks 1-4 : 2,250,000 tokens per week

- Weeks 5-13 : 1.2% of remaining emission tokens per week

- Weeks 14-26 : 1% of remaining emission tokens per week

- Week 27-39 : 0.9% of remaining emission tokens per week

- Week 40-52 : 0.8% of remaining emission tokens per week

- Year 1-2 : 0.7% of remaining emission tokens per week

- Years 2-3 : 0.6% of remaining emission tokens per week

- Year 3+ : 0.5% of remaining emission tokens per week

Below is an illustration of the token release schedule for the first few weeks, as per the official Prisma Finance article.

Note that due to Prisma's 'boost' system, the figure above is the maximum amount that can be claimed in that week. Actual claims are between 50-100% of the above figures, and unclaimed amounts will be returned to the unallocated supply.

The PRISMA lock gives users the ability to direct token emissions and vote on DAO proposals.

Most early PRISMA recipients had their tokens locked and released gradually, which reduced selling pressure.

After the Prisma UI was launched, immediate innovation was evident in its veTokenomi. They introduced a "freeze" function that automatically locks PRISMA, preventing the weekly depletion of votes like the veTokenomi Curve (veCRV). In addition, there is an early exit option with a significant penalty.

A differentiating feature that has also been alluded to above is the implementation of Boost Delegation. This incentivises locking tokens and receiving rewards, rather than selling the tokens outright. Early token lockers enjoy a boost of around 3% currently.

Lastly, PRISMA's Yield Farming opportunity entices users to purchase PRISMA for access to various yields. While the initial yield often drops over time, this opportunity is still tantalising... at least so far.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)