The Ascendance of Bitcoin: A Comprehensive Examination of Factors Driving its Phenomenal Growth

Examining factors leading to Bitcoin's significant growth thoroughly.

Bitcoin, since its inception in 2009, has captivated the financial world with its unprecedented growth and volatility. As the pioneer of cryptocurrencies, Bitcoin's trajectory has been shaped by a confluence of technological, economic, and socio-political factors. This article delves into the multifaceted reasons behind Bitcoin's remarkable ascent, employing a scientific lens to dissect its evolution and implications.

1. Technological Foundation:

Bitcoin's underlying technology, blockchain, revolutionized the concept of digital transactions by introducing decentralization, transparency, and immutability. The cryptographic principles upon which blockchain operates ensure security and trust in a trustless environment, laying the groundwork for Bitcoin's emergence as a viable alternative to traditional financial systems.

2. Scarce Supply and Halving Mechanism:

Central to Bitcoin's value proposition is its capped supply of 21 million coins, a feature that imbues it with scarcity akin to precious metals like gold. The halving mechanism, occurring approximately every four years, systematically reduces the rate at which new bitcoins are issued, diminishing inflationary pressures and fostering a deflationary monetary policy that enhances Bitcoin's store of value properties.

3. Institutional Endorsement and Investment:

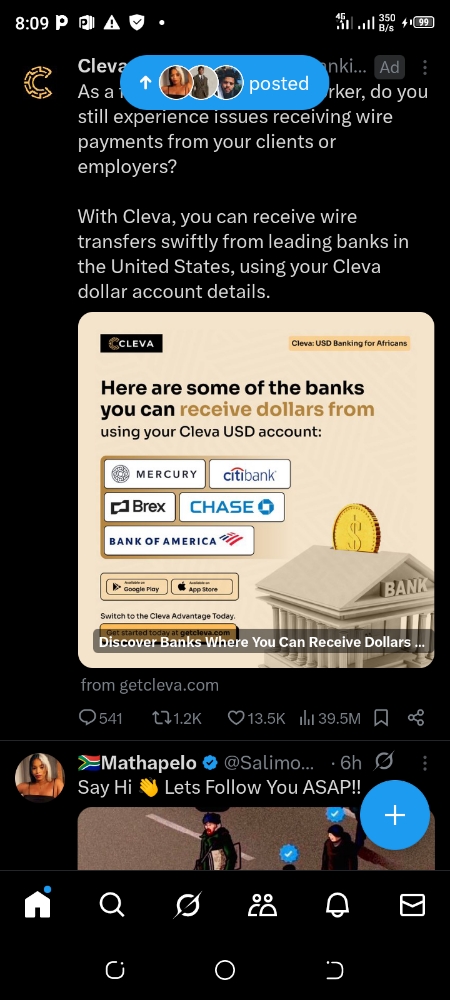

The gradual acceptance of Bitcoin by institutional investors, hedge funds, and corporations has contributed to its mainstream legitimacy and adoption. Notable endorsements from industry titans, along with the emergence of regulated investment vehicles such as Bitcoin futures and exchange-traded products, have facilitated greater institutional participation in the Bitcoin market, providing liquidity and stability.

4. Macro-Economic Forces and Monetary Policy:

Bitcoin's growth trajectory is intricately linked to broader macro-economic trends, including monetary policy decisions by central banks and geopolitical developments. Amidst concerns of currency debasement and inflationary pressures, Bitcoin has emerged as a hedge against fiat currency depreciation, attracting capital inflows during periods of economic uncertainty and financial instability.

5. Network Effects and Adoption Dynamics:

The network effects inherent in Bitcoin's decentralized ecosystem have fueled its adoption and proliferation across diverse demographics and geographic regions. As more users join the network as miners, investors, or merchants, the network's resilience and utility increase, reinforcing Bitcoin's status as the premier cryptocurrency and store of value.

6. Regulatory Environment and Legal Frameworks:

The regulatory landscape surrounding Bitcoin has evolved significantly, exerting both positive and negative influences on its growth trajectory. While regulatory clarity and institutional acceptance have bolstered investor confidence and market sentiment, regulatory ambiguity and government crackdowns in certain jurisdictions have posed challenges and contributed to market volatility.

Conclusion:

Bitcoin's ascendance from a niche digital experiment to a globally recognized asset class is a testament to its disruptive potential and enduring relevance in the digital age. Its decentralized architecture, scarcity, and utility as a hedge against economic uncertainty have positioned it as a transformative force in the evolution of money and finance. However, challenges persist, including scalability concerns, regulatory uncertainties, and environmental implications associated with energy-intensive mining activities. As Bitcoin continues to evolve and mature, ongoing research, innovation, and collaboration will be essential to unlocking its full potential and realizing its vision of a decentralized, inclusive financial ecosystem.