From Tradition to Revolution: Is BlockDAG Shaping the Future of PoW Coins?

Since the first Bitcoin was mined in 2008, the crypto space has seen a number of ledger technologies. In particular, distributed ledger technology (DLT) adopted by blockchains such as Bitcoin is one of the mainstream implementations of distributed ledgers today. However, this technology suffers from a major drawback: poor scalability.

In the case of Bitcoin, the network’s lack of scalability is evident in its inadequate throughput. On average, the Bitcoin network can only process seven transactions per second. With a block time of ten minutes and six confirmations (i.e., six confirmed blocks) per transaction, it takes at least 60 minutes to complete a BTC transaction. In contrast, VISA, a global payment network, can process an average of 24,000 transactions per second, enabling near-instant confirmations. Its limited throughput makes it challenging for Bitcoin to carry the commercial use cases of today’s world.

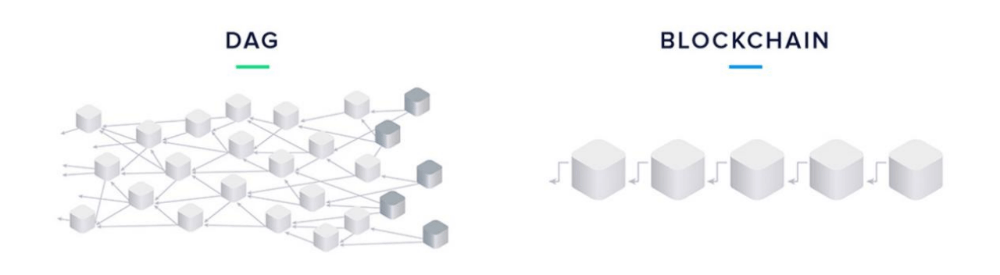

Given the current state of technology, it is not that difficult to upgrade the throughput of a blockchain. While some solutions, such as increasing block size or reducing block time, have been adopted by projects like BCH and LTC, mere parameter adjustments cannot fundamentally solve the problem facing Bitcoin. A better approach is to redesign the protocol architecture, and the incorporation of DAG (Directed Acyclic Graph) technology represents a novel way to achieve that. By shifting from a single-chain structure to a DAG architecture, blockchains can avoid the limitation of serialized inputs facing single chains, which enables high concurrency.

The advent of BlockDAG has eliminated the performance bottleneck of conventional blockchains and may even resolve the blockchain trilemma.

BlockDAG’s Technological Advantages

On blockchain networks like Bitcoin, except for the genesis block, each block has only one predecessor block (parent) and one successor block (child), giving rise to a single-chain structure. Under such a structure, a fork happens when two blocks are generated at the same time. According to the longest chain rule, only one block will ultimately stay on the main chain, while the other will be discarded, depending on which camp of miners produces the next block first.

The direct harms caused by this serialization are as follows:

1. Whenever a conflict arises, one fork inevitably loses its advantage, and its block becomes an orphan outside the main chain. This not only wastes the hashrate used to generate that block but also squanders the hashing power of other miners who chose that fork.

2. Blockchain forks provide dishonest miners with opportunities for selfish mining, allowing them to gain extra rewards beyond their fair share. More critically, such behaviors severely compromise the security of the network.

3. To mitigate the problems associated with serialization conflicts, two solutions have been proposed to boost throughput: expanding block size or reducing block time. However, both face limitations. Large blocks introduce delays to the broadcasting process, while a faster rate of block production increases the probability of conflicts. In a nutshell, blockchains with a single-chain structure cannot escape from the scalability bottleneck created by serialization conflicts.

With the BlockDAG structure, however, each basic unit of the ledger can reference one or multiple predecessor units and can be referenced simultaneously by one or more successor units. This gives BlockDAG inherent advantages in terms of scalability. It’s important to note that the support for concurrency has to do with BlockDAG’s transaction confirmation strategy.

In the world of blockchain, the transactions included in a block are always valid, and conflicting transactions such as double-spending do not coexist on the same chain. BlockDAG employs an optimistic, inclusive strategy for potentially conflicting transactions. When two units are generated at the same time, as long as they adhere to the basic protocol rules, both can be included in the ledger. If certain transactions in the two units conflict with each other, their validity will be determined through a consensus algorithm. Essentially, this process describes a deferred conflict resolution strategy, which avoids the hashrate waste and scalability constraints brought by the serialization conflict on conventional chains.

BlockDAG Projects in the Crypto Space

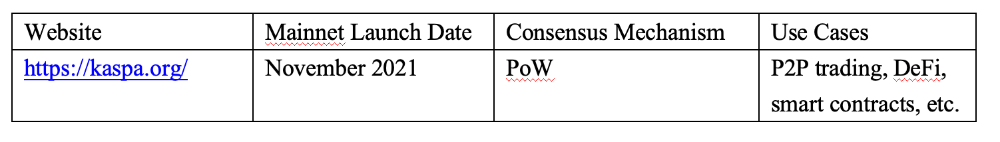

Kaspa (KAS)

Kaspa (KAS) is now the most iconic BlockDAG-based project. Besides, Yonatan Sompolinsky, the founder of Kaspa, is also one of the key proponents of the BlockDAG concept.

Kaspa is now available on several mining pools. Check out the mining tutorial provided by ViaBTC Pool to learn how to mine KAS: https://support.viabtc.com/hc/en-us/articles/7207398646799

Kadena (KDA)

Kadena’s core technology, ChainWeb, incorporates elements of sharding and DAG while introducing its own innovations.

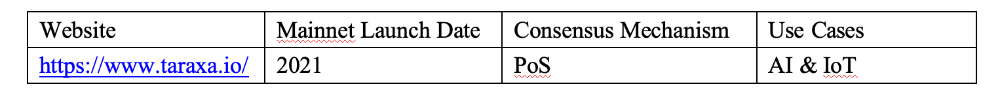

Taraxa (TARA)

Taraxa is an EVM-compatible smart contract platform based on BlockDAG’s t-Graph consensus, enabling Web3 to address real-world issues.

While the concept of DAG has been around for years, the developer team behind Kaspa introduced BlockDAG. This innovative solution not only marks a major milestone in the crypto space over the past decade but is also a key innovation in transforming the conventional format of blockchain ledgers based on the PoW consensus.

The success of projects like Bitcoin and Ethereum has laid a solid foundation for the rise of traditional blockchains. They have demonstrated the security and reliability of blockchain, which has become an increasingly viable alternative in the legacy financial system. The emergence of BlockDAG, on the other hand, has provided a solution to the most pressing issues facing conventional blockchains today.

Future PoW projects may not all choose it as the model of their chain, but BlockDAG has undoubtedly proven its potential in addressing the performance and scalability challenges of traditional blockchains. Moving ahead, BlockDAG will play an essential role in the future of blockchain.

*Disclaimer: The article is for reference only and offers no financial advice.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)