Bitcoin wallets holding $1,000 or more increased by 20% in early 2024, hitting 10.6m.

Bitcoin Wallets with $1K Balances Jump 20% Since Start of 2024: Fidelity

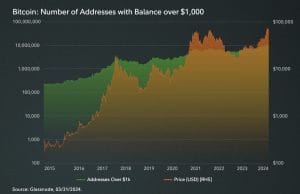

The number of Bitcoin wallets holding $1,000 or more has shot up 20% since the beginning of 2024, according to Fidelity Digital Assets.

In a report released Monday, Fidelity indicated ongoing accumulation among these smaller addresses, reaching a record high of 10.6m on March 13. Compared to 2023, the number of addresses holding over $1,000 has nearly doubled, rising about 101% from 5.3m.

This indicates a sustained increase in the number of smaller addresses acquiring and holding Bitcoin, despite the upward trend in prices.

“This may be representative of a growing distribution of bitcoin and its adoption among the “average” person,” the report said. Source: Fidelity Digital Assets

Source: Fidelity Digital Assets

However, Fidelity cautioned that the accuracy of the figure might be affected by price appreciation during the period and address consolidation.

As of April 25, Bitcoin has surged by 89% in the past six months and last traded around $64,150.

Self-Custody Gains Traction After Exchange Issues

The report also revealed the amount of Bitcoin held on exchanges, which has been decreasing since its peak in 2020.

Driven by various exchange failures in 2022 and other problematic exchange practices, self-custody has become increasingly popular among Bitcoin holders throughout 2023. This trend persisted in Q1 2024, with exchange balances declining further to nearly 2.3m BTC.

This marks a nearly 30% decrease from all-time highs and a 4.2% decline over Q1 2024. However, the decrease in exchange balances does not necessarily indicate a corresponding increase in self-custody.

Fidelity said the drop in available Bitcoin on exchanges will be a significant measure to monitor in 2024, emphasizing the importance of alternative custody methods like self-custody.

Hodler Outflows Challenge Traditional Bitcoin Halving Pattern

The report also discussed changes in the net position of hodlers, who typically hold Bitcoin for the long term.

From Q3 to Q4 2023, the average net position dropped from 40,442 Bitcoin to 31,376, with a notable decline at the end of 2023. Despite a slight recovery in late February, this group continued to experience significant outflows, possibly influenced by Bitcoin’s new all-time high.

This occurrence before the halving is unusual compared to past cycles, suggesting that these investors may perceive Bitcoin as being heavily overvalued before the halving. Current outflows amount to about 124,001 Bitcoin.

Bitcoin Price Prediction: BTC Hits $64,165 Amid Market Fluctuations and ETF Inflows in Play

Bitcoin Price Prediction Today, Bitcoin (BTC/USD) shows modest growth, trading at $64,165. This Bitcoin price prediction explores this slight uptick in detail, highlighting the cryptocurrency’s resilience in a fluctuating market.

Bitcoin Price Prediction Today, Bitcoin (BTC/USD) shows modest growth, trading at $64,165. This Bitcoin price prediction explores this slight uptick in detail, highlighting the cryptocurrency’s resilience in a fluctuating market.

Key resistance lies at $67,687 while support hovers around $63,654, indicating potential fluctuations in Bitcoin’s near-term market trajectory.

Bitcoin ETFs See Turnaround with $59.7M Inflows: Market Sentiment Shifts

Thirteen years after Satoshi Nakamoto’s last communication, the Bitcoin landscape continues to evolve.

On Friday, U.S. spot Bitcoin ETFs reported $59.7 million in inflows, reversing a trend of outflows over the previous five days.

Satoshi Nakamoto Delivered Final Words on Bitcoin 13 Years Ago Today.

Thirteen years ago, on April 23, the enigmatic figure known as Satoshi Nakamoto delivered his final instructions on the Bitcoin (BTC) ecosystem. This landmark moment, occurring just four months after… pic.twitter.com/L5eWahNJuO

— WeLLiMeLbz10 (@WeLLiMeLbz10) April 23, 2024

In contrast, Grayscale’s GBTC experienced a decline, with Blackrock’s IBIT nearing GBTC’s Bitcoin holdings.

Collectively, these funds now manage 2.93% of all circulating Bitcoin. Despite recent withdrawals, Friday’s inflow spike indicates a potential market rebound.

- Strategic Impact: The activity of these ETFs plays a pivotal role in Bitcoin’s market dynamics.

- Market Recovery: Signs point towards a rejuvenating interest in Bitcoin, suggesting a positive future price movement.

This scenario underscores sustained investor interest and strategic fund management, both vital for influencing Bitcoin’s market sentiment and price trajectory.

Bitcoin’s New BIP Editors Aim to Accelerate Development and Enhance Governance

Bitcoin is transforming its BIP (Bitcoin Improvement Proposal) editing process by introducing five new editors, moving away from the previous single-editor system led by Luke Dashjr.

This development aims to expedite the review and integration of new proposals, reflecting Bitcoin’s commitment to decentralization and community involvement in its updates.

The new multi-editor approach could enhance the efficiency and diversity of decision-making.

- Governance Evolution: The change suggests a more mature governance model within Bitcoin’s ecosystem.

- Potential Impact: This could significantly affect the direction and pace of future Bitcoin enhancements and innovations.

This shift is designed to foster a broader consensus and streamline Bitcoin’s development, though debates about the criteria for proposal acceptance continue.

Bitcoin Price Prediction

Bitcoin (BTC/USD) is currently trading at $64,165, marking a slight increase of 0.10%. Today’s trading hovers around the pivot point of $65,825, with Bitcoin facing immediate resistance at $67,687. Further resistance is observed at $69,232 and $71,068.

On the downside, Bitcoin has immediate support at $63,654, with additional support levels at $61,387 and $59,746.

Technical Analysis:

- The RSI is currently at 38, suggesting that Bitcoin might be underbought and potentially due for a rebound.

- The 50-day Exponential Moving Average (EMA) at $65,223 signals that the market trend leans slightly bearish as it sits above the current price.

Bitcoin Price Prediction Despite recent challenges, Bitcoin shows potential resilience. The presence of a double-bottom pattern around the $63,650 level may provide a robust support zone.

Bitcoin Price Prediction Despite recent challenges, Bitcoin shows potential resilience. The presence of a double-bottom pattern around the $63,650 level may provide a robust support zone.

Overall, the market stance is cautiously optimistic; Bitcoin could maintain bullish momentum if it stays above $63,000. However, falling below this threshold could trigger a sharp decline.

Unlock Cryptocurrency Rewards: Join the 99Bitcoins Presale Now!

99Bitcoins, a trailblazer in digital education, innovates cryptocurrency learning with its ‘learn-to-earn’ system. Participants engage with educational modules and earn $99BTC tokens, enhancing their knowledge and wallet simultaneously.

The ongoing presale of $99BTC tokens is creating significant buzz, offering these tokens at a favorable rate for early adopters.

99Bitcoins Presale: A Gateway to Early Benefits

This presale event is a prime opportunity for early investors to acquire $99BTC tokens at lower prices, maximizing potential future gains as the ecosystem grows and evolves.

The tokens not only serve as a reward mechanism but also provide access to additional content and exclusive community benefits.

Don’t Miss Your Chance

To date, $781,300 has been raised towards the $1,136,737 goal. Only 5 days remain until the next price increase. Act now to secure your $99BTC at just $0.00102 each.

Invest today and take advantage of the opportunity to stake your newly purchased tokens immediately.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)