Investment Theme: DeFI 3.0

DeFi is one of the most matured investing themes in the crypto space. The entire DeFi space has been evolving over time, and we have witnessed some great innovations from emerging DeFi projects.

These emerging DeFi projects, which promise to bring more liquidity to DeFi, provide a better user experience, offer higher yields, and provide incentives for end-users, fall under the investing theme of DeFi 3.0.

RWA, Liquid Staking, and Derivatives are expected to be the top three key categories to watch in this theme during the upcoming bull market. Projects that bring innovations and address fundamental problems by introducing new design-level primitives will eventually emerge as winners.

In this collaborative edition with wajahat mughal , I've covered the top 10 DeFi 3.0 projects that have the potential to shine in the upcoming bull run.

Eigen Layer

Category: Ethereum Restaking

Ethereum Restaking is the hottest DeFi primitive of this year. It offers crypto-economic security to middleware services and new chains by harnessing the staked supply of Ethereum.

This is achieved through allowing validators to restake within a set of smart contracts referred to as restaking contracts. Validators can earn additional rewards by restaking their ETH to support those in need of bootstrapping economic security.

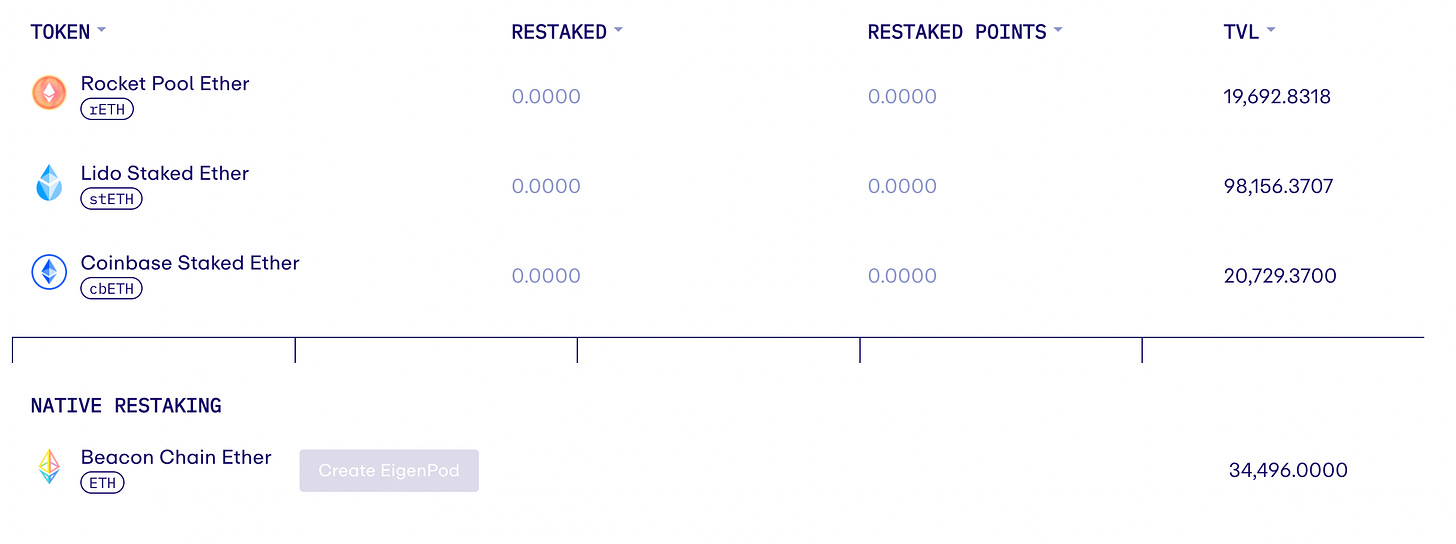

Eigen Layer introduced the restaking primitive to the world. They allow validators/stakers to stake their ETH in batches within their restaking contract.

They intend to onboard a range of middleware services and chains to the ecosystem that can utilize the aggregated staked supply from validators to bootstrap security. Upon opting in for restaking, users also grant Eigen Layer the slashing rights.

Eigen Layer is developing its own DA Solution called EigenDA, which will ultimately leverage the pooled security from validators who participate in restaking. Currently, $57M worth of ETH has been restaked on Eigen Layer, with much more to come!

IPOR

Category: Interest Rate Derivatives

Lending remains one of the most significant categories in DeFi, with a TVL of $14B & holds the potential to surpass $100B in future. The interest rates for borrowing stablecoins and other assets fluctuate across various money markets like AAVE.

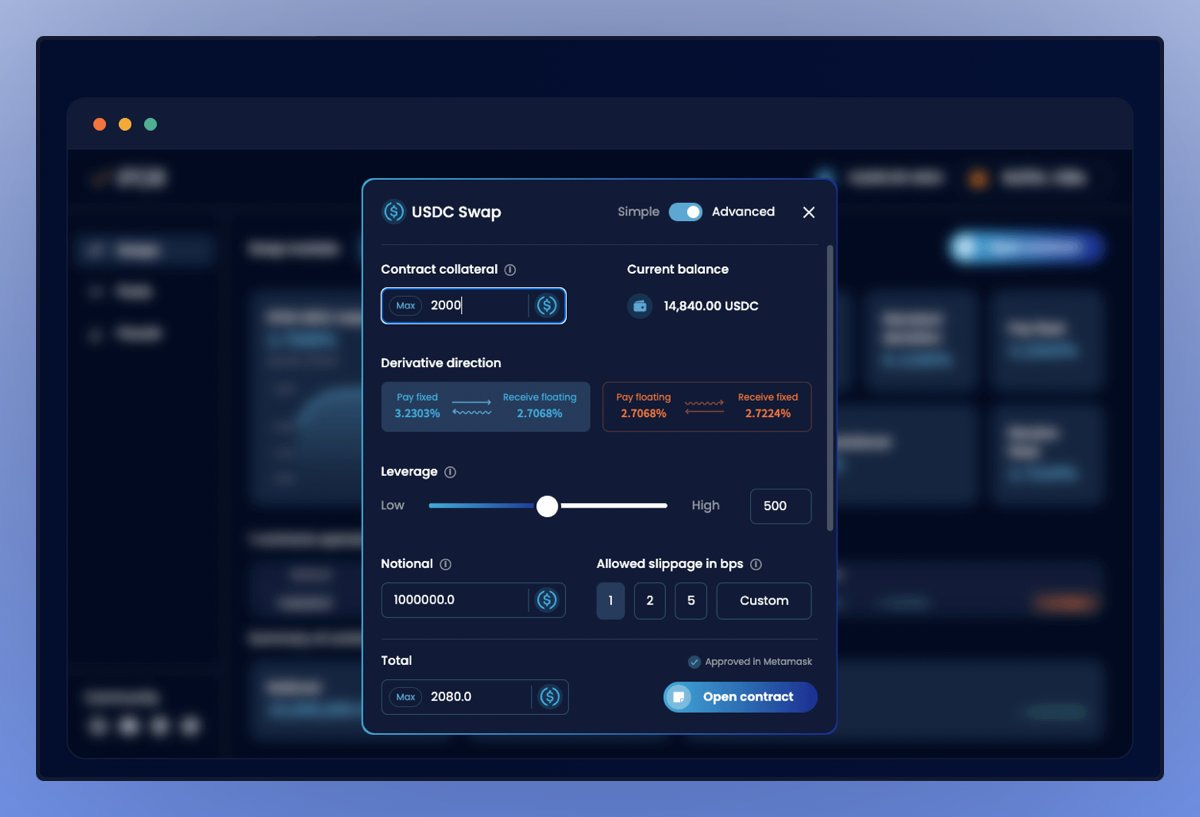

These rates tend to rise during bull markets and decrease during bear markets. Interest rate derivatives serve as instruments that enable speculation on rate changes. DeFi investors can employ these instruments to hedge their loan positions by acquiring interest rate swaps.

IPOR emerged as the prominent interest rate derivatives platform that has introduced this innovative DeFi primitive. It offers options to either lock in an interest rate or hedge exposure by utilising on-chain IPOR derivatives.

IPOR has unveiled the IPOR Index, which tracks benchmark interest rates from various DeFi money market protocols. The AMM Model is employed by IPRO to provide liquidity for interest rate swaps. As of now, the IPOR Protocol has successfully amassed a TVL exceeding $13M.

GMX

Category: Perpetual DEXs

Perpetual DEXs have emerged as one of the most successful DeFi primitives in recent times. These platforms enable traders to engage in leveraged trading of various crypto assets directly from their self-custody wallets.

In Perpetual DEXs, traders participate in trading against a communal liquidity pool sourced from liquidity providers, who, in turn, earn a share of fees for each trade conducted.

GMX stands at the forefront of Perpetual DEXs, offering traders the opportunity to engage in futures trading across various pairs such as BTC, ETH, ARB, SOL, and more.

GMX distinguishes itself with its support for low swap fees and minimal price impact during trades. The GMX ecosystem introduces two distinct tokens: GMX for governance purposes and GLP for trading liquidity. Both GMX and GLP tokens can be staked to unlock incentives.

Over the past 30 days, GMX has achieved remarkable milestones, including a trading volume of $1.29 billion, trading fees surpassing $5 million, and a user base exceeding 120,000 active traders.

Ondo Finance

Category: RWA Tokenisation

Tokenising real-world assets to bring them onto the blockchain & enabling DeFi investors to invest presents a significant opportunity for DeFi to explode. RWA can come in many forms including treasuries, bonds, real estate and even luxury items.

RWAs are the fastest growing DeFi primitive, with over 1000% growth in TVL in the past 7 months. We expect this to continue, no doubt.

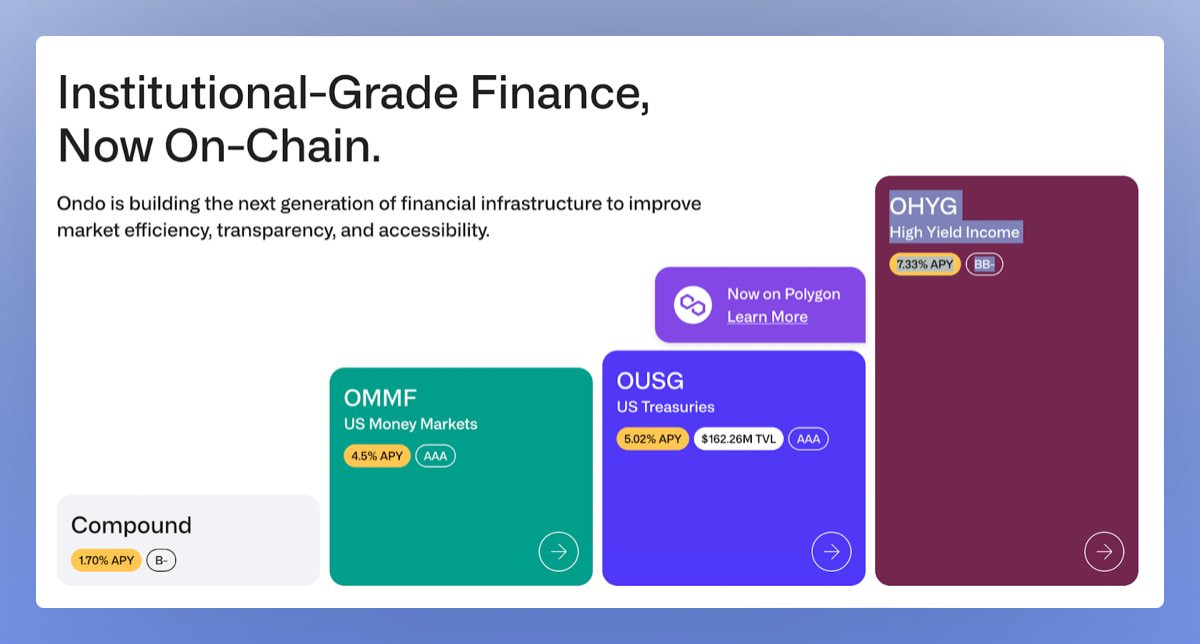

Ondo Finance specializes in the tokenization of US dollar-denominated corporate bonds, US Money Market assets, and US Treasuries, allowing DeFi investors to invest in these diversified assets based on their preferred risk level.

Ondo Finance has played a pivotal role in the tokenization of US Treasuries. Launched in February 2023, Ondo Finance has witnessed a continuous increase in TVL since its inception, amassing a current TVL of over $160M.

Frax Finance

Category: Liquid Staking Derivatives

Liquid staking derivatives have been the talk of the year especially following the launch of Ethereum’s transition from Proof of Work, to now Proof of Stake.

As ETH can be staked, many protocols have created these liquid staked tokens which represent the underlying ETH staked in the smart contract but also the yield that comes with staking.

Interestingly some protocols have gone above and beyond to figure out some of the most innovative ways to introduce monetary premiums and enable their users to extract the maximum yield for their staking products.

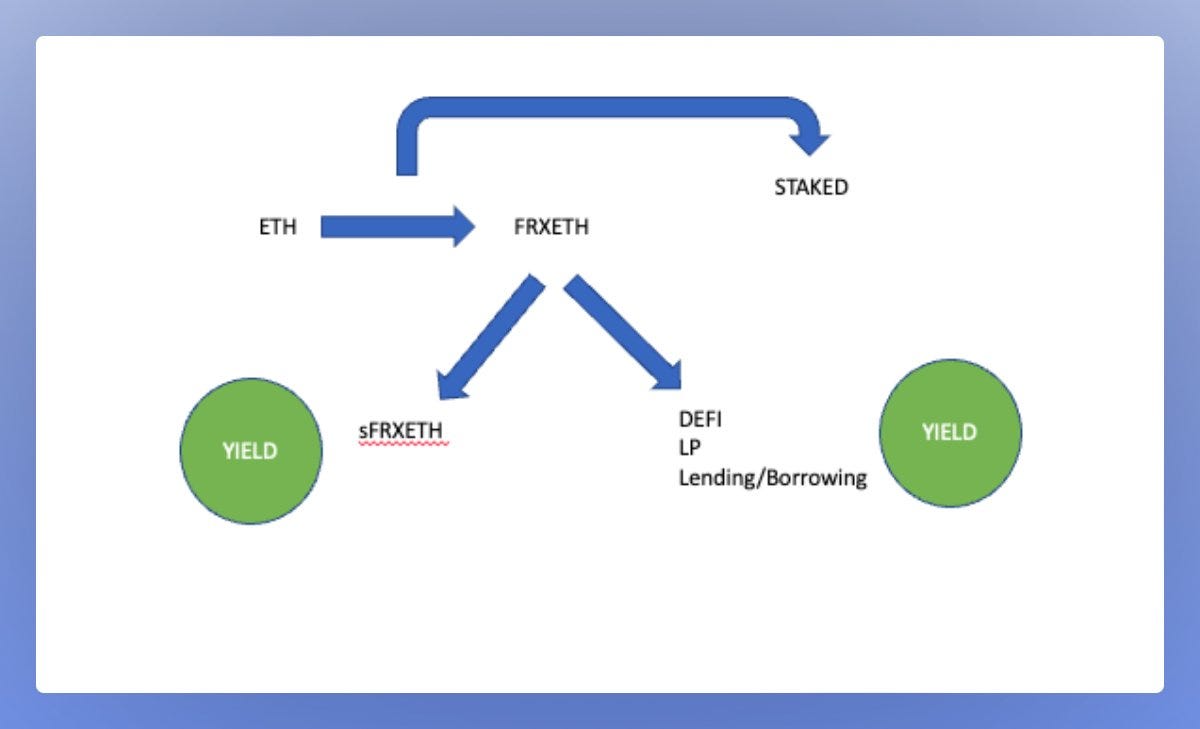

Frax has been the place to find innovation in DeFi and no doubt they have this via their ETH staking product. A User can ‘stake’ their ETH by converting it into ‘frxETH’ however, this itself does not earn the staking yield.

frxETH is meant to be used across DeFi for lending, liquidity and collateral but can be converted into ‘sfrxETH’ which then earns the full staking rate.

The two token model enables a monetary premium. sfrxETH earns the highest yield today because all the underlying ETH is staked but not all is converted into sfrxETH.

Pendle Finance

Category: Yield Trading

Category: Yield Trading

Following the launch of Ethereum PoS, we now have a variety of liquid staking derivative products all working on creating a design which can generate the highest yield. But did you know the yield that comes with these LSDs can also be speculated on itself?

Think of an apple tree. It consists of 2 components, the principle tree itself which should remain present for decades and decades to come and secondly the apples which can picked every year to be eaten - the yield.

Imagine there was a way to speculate on the number of apples growing on a particular year. Think there will be good weather and more apples will grow, go long. On the contrary, if you think the season will be plagued with disease, rain and poor soil, go short.

You can apply these same principles to Pendle and their Yield trading products. With a variety of assets including $stETH, $rETH, $sfrxETH but also non ETH products like Stargate USDT and GLP from GMX theres a whole range of yield generating assets.

These assets can then be split into yield tokens and principle tokens of which you can speculate on if you think the yield for some of these tokens will go up or down.

Velodrome

Category: Ve (3,3) Governance

ve(3,3) represents the next generation DEX model, seamlessly integrating the vote escrow (ve) mechanism from Curve, and the (3,3) game theory from Olympus DAO.

The ve(3,3)-based DEX empowers native DEX token holders to participate in earning incentives, such as a share of trading fees by locking their tokens for specified durations. The longer the lockup period, the greater the potential rewards.

Velordrome has taken the ve(3,3) model to new heights by introducing enhanced tokenomics, an integrated incentive system, and a concentrated liquidity approach.

Having gone live on the Optimism Layer 2 network last year, Velordrome swiftly emerged as a dominant DeFi protocol, currently boasting a substantial $142M in TVL and generating over $1.39M in fees within the past month.

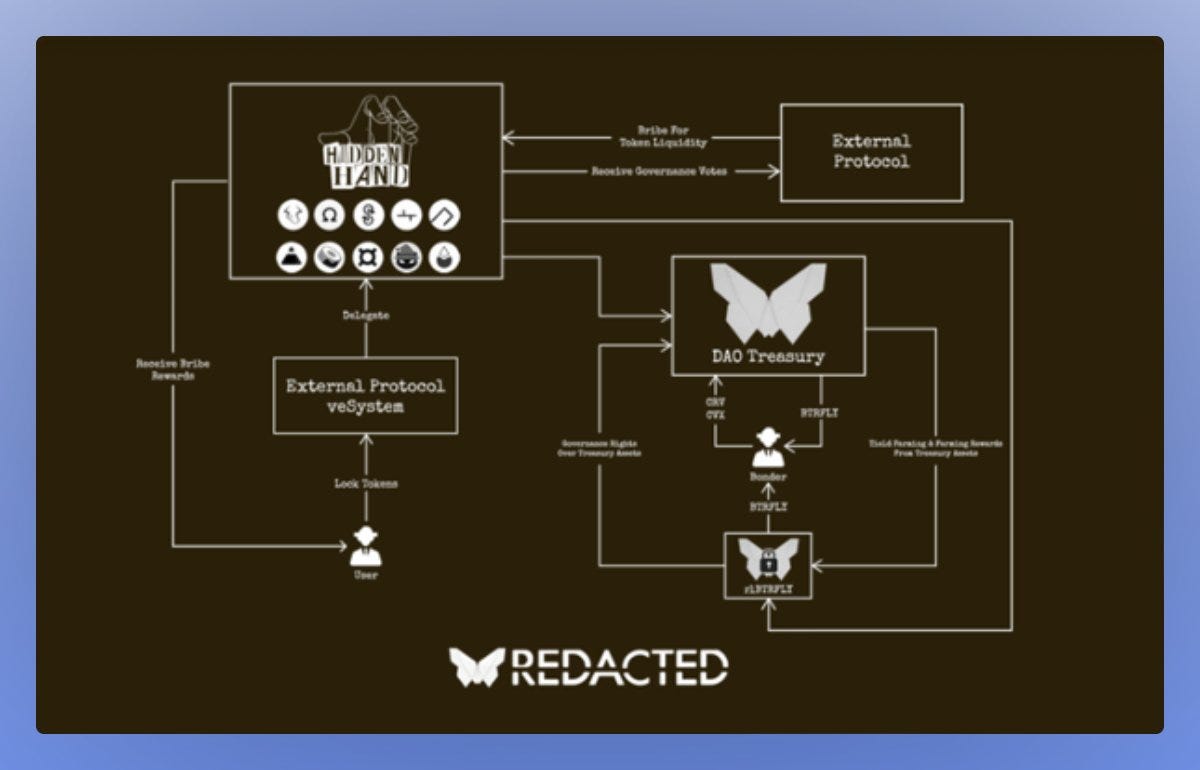

Redacted Cartel

Category: Governance Wars

Governance in crypto is sometimes laughed at, however, there are a number of protocols where governance actually plays a key role in how the protocol functions. In fact, these are growing every single day as we continue to develop how tokens function in DeFi.

With many of these DeFi protocols often fighting with one another to get control of emissions, for example, the curve wars perhaps there should be a place where all of these governance tokens could have a hub?

The Hidden Hand product offers a governance bribes market for DeFi protocols to distribute their gov tokens in exchange for votes which are often used across other protocols to increase liquidity by increasing emissions which drives trading volume.

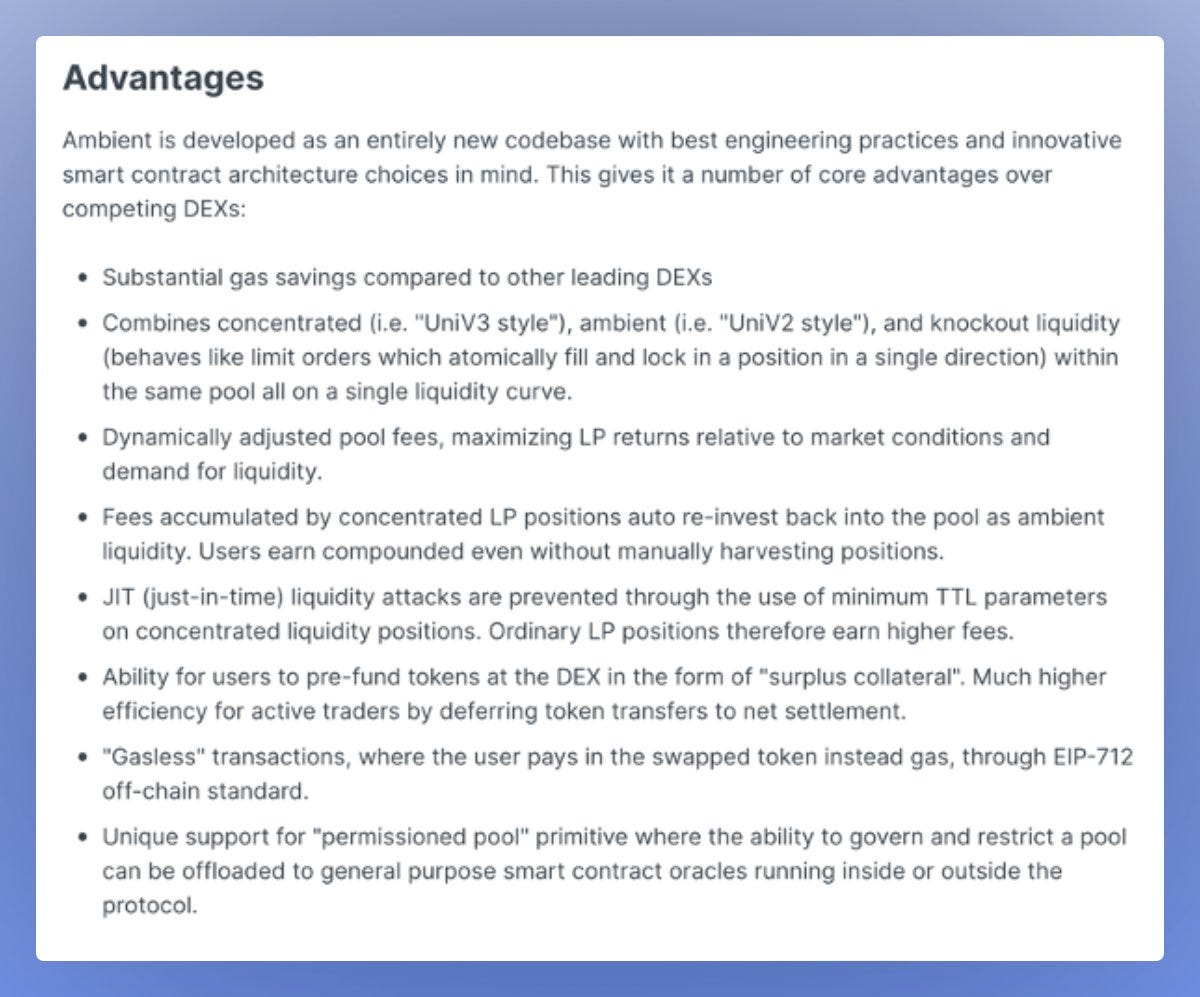

Ambient Finance

Category: AMM Improvements

While AMMs are highly advantageous, they do come with a couple of design and business model challenges. Some teams are currently reimagining AMMs by introducing new designs, innovative mechanics for liquidity pools, and enhanced business models for protocols.

Ambient previously known as CrocSwap - are building a DEX AMM within a single smart contract. They employ data structures for their AMM, allowing for a novel design that enhances efficiency, gas fee savings, liquidity, & dynamically adjustable fees.

Ambient has successfully accumulated $4.07M in TVL, with a total volume of $13.43M and total fees amounting to $37.17K since its launch. Who knows if a potential airdrop is on the way here too.

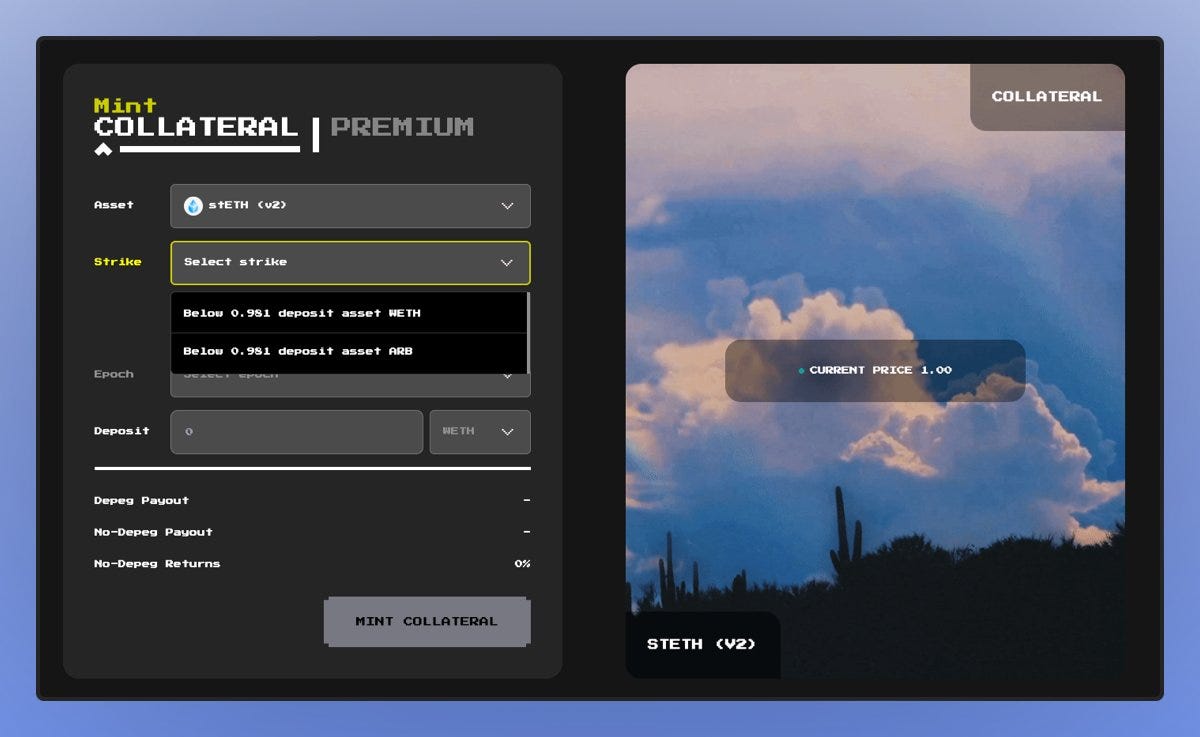

Y2K Finance

Category: Binary Options

Options are only really just getting started in DeFi. One thing we are seeing is the launch of new types of option products including the likes of Binary options. As the name suggests Binary options offer a fixed monetary amount or nothing at all.

Y2K finance is a project live on arbitrum that allows users to speculate in the form of buying or selling insurance on assets based on whether they will depeg or not. This includes many stable coins but also ETH derivatives like stETH.

Users can go either side of this binary option every week with their epochs and winners get the reward whilst losers go home with nothing. Y2K has had good success so far and gained a lot of popularity during the USDC depeg event back in March 2023.

Conclusion

We've covered some of the best projects with positive on-chain growth, but we also have many exciting projects under development. When they are released, they could capture a significant market share. Cross-chain CLOB DEX is one area I am particularly excited about.

I believe projects like Syndr have the potential to disrupt the Perp DEX market, but since the project is not live yet, it's too early to comment on the outcome of such projects.

I am also expecting some great projects in the RWA category. Those that launch with clear regulatory clearance to issue RWA Tokens will have a long-term competitive advantage.

In the liquid staking category, I believe projects with DVT technology and incentives-driven tokenomics will eventually create a positive feedback loop among market participants.

As an investor, you should conduct your due diligence on tokenomics, fundamentals, and on-chain aspects before making any investments in any of the projects discussed above.

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)