The Road to $1 Million: Jack Dorsey's Bullish Prediction for Bitcoin's Price.

In cryptocurrency, few figures

carry as much weight as Jack Dorsey, co-founder of Twitter and Square. On May 9, in an interview with journalist Mike Solana on Pirate Wires, Dorsey shared a bold prediction: he believes Bitcoin (BTC) could skyrocket to at least $1 million by 2030. Such a statement from someone of Dorsey's stature can't be dismissed lightly. In this blog, we delve into Dorsey's reasoning, the factors influencing Bitcoin's price, and the potential implications of such a monumental surge.

Understanding Dorsey's Perspective:

To comprehend Dorsey's bullish outlook on Bitcoin, it's essential to understand his relationship with the cryptocurrency. Dorsey has long been a vocal advocate for Bitcoin, viewing it as a transformative force in the financial world. His companies, Twitter and Square, have also shown significant support for Bitcoin adoption. Dorsey's belief in Bitcoin's potential to reach $1 million by 2030 stems from his confidence in its fundamental principles, including decentralization, scarcity, and utility as a store of value.

The Factors Driving Bitcoin's Price:

Bitcoin's price is influenced by a myriad of factors, both intrinsic and extrinsic. Dorsey's prediction takes into account several key drivers:

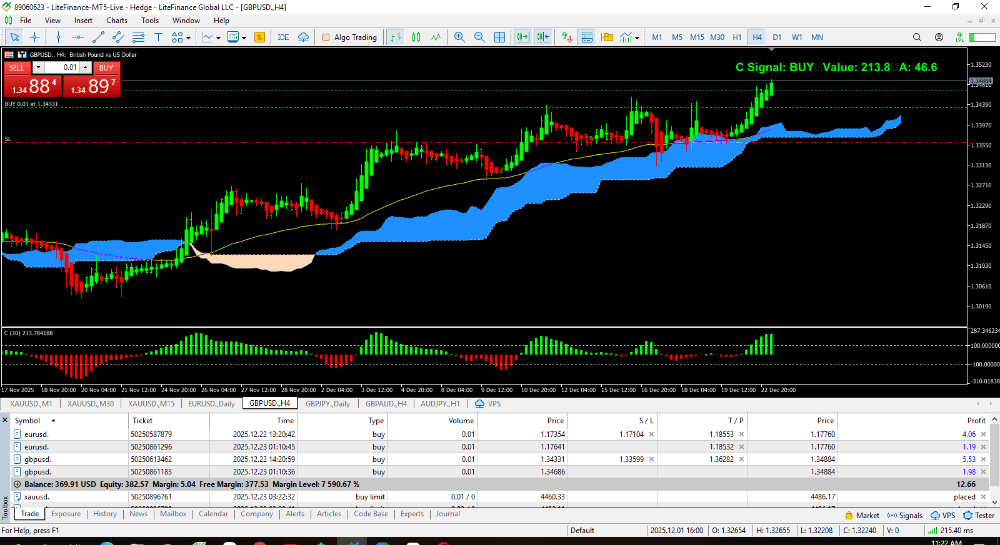

1. Institutional Adoption: The increasing acceptance of Bitcoin by institutional investors, such as Tesla, MicroStrategy, and Square, lends credibility to its status as a legitimate asset class.

2. Scarcity: With a capped supply of 21 million coins, Bitcoin's scarcity is a fundamental driver of its value. As demand outstrips supply, scarcity contributes to price appreciation.

3. Network Effects: As the largest and most widely recognized cryptocurrency, Bitcoin benefits from network effects. As more users and businesses adopt Bitcoin, its value proposition strengthens.

4. Macro Trends: Economic uncertainty, inflation concerns, and geopolitical tensions can drive investors towards Bitcoin as a hedge against traditional financial risks.

5. Technological Advancements: Ongoing improvements in Bitcoin's infrastructure, such as the Lightning Network for faster and cheaper transactions, enhance its utility and appeal.

Challenges and Risks:

While Dorsey's prediction is optimistic, it's important to acknowledge the challenges and risks that Bitcoin faces on its path to $1 million:

1. Regulatory Uncertainty: Evolving regulatory landscapes in various jurisdictions could impact Bitcoin's adoption and price trajectory.

2. Technological Limitations: Scalability, energy consumption, and governance remain areas of concern for Bitcoin's long-term viability.

3. Market Volatility: Bitcoin's price is notoriously volatile, subject to sudden fluctuations driven by market sentiment and external factors.

4. Competing Technologies: Emerging cryptocurrencies and blockchain platforms pose potential competition to Bitcoin's dominance in the digital asset space.

Implications of a $1 Million Bitcoin:

If Bitcoin were to reach $1 million by 2030, the implications would be profound:

1. Wealth Creation: Early adopters and long-term holders of Bitcoin stand to reap substantial rewards, potentially ushering in a new class of millionaires and billionaires.

2. Financial Disruption: A $1 million Bitcoin could disrupt traditional financial systems, challenging the supremacy of fiat currencies and central banks.

3. Socioeconomic Impact: Greater financial inclusion, wealth distribution, and economic empowerment could result from widespread Bitcoin adoption.

4. Regulatory Scrutiny: Regulators may intensify their oversight of Bitcoin and other cryptocurrencies in response to their growing influence on global finance.

The Overview:

Jack Dorsey's bullish prediction for Bitcoin's price underscores the transformative potential of cryptocurrency in reshaping the future of finance. While achieving a $1 million valuation by 2030 is an ambitious goal, it's not beyond the realm of possibility given Bitcoin's fundamentals and the evolving dynamics of the digital asset ecosystem. Whether Bitcoin ultimately reaches this milestone or not, its journey will continue to captivate the attention of investors, technologists, and policymakers worldwide. As the saying goes, "time will tell," and in the case of Bitcoin, the journey is just as exhilarating as the destination.

Thank you for reading.