Bitcoin Volatility: What to Expect in the Coming Days

Bitcoin, the world’s leading cryptocurrency, is experiencing heightened turbulence in the markets, and recent data suggests that the situation could become even more volatile. With overall market uncertainty and fluctuations driving fear across the crypto landscape, many investors and traders are preparing for a potentially chaotic period.

Several key indicators point toward Bitcoin volatility, indicating that sharp price swings might be imminent, potentially leading to significant liquidations that could impact the broader market.

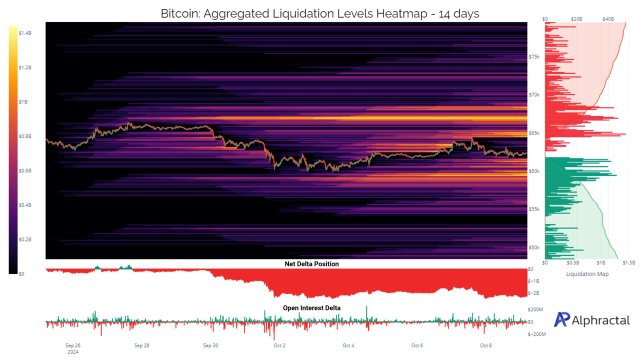

Bitcoin’s Aggregated Liquidation Levels Heatmap metric points to high volatility | Source: Alphractal on X

Bitcoin’s Aggregated Liquidation Levels Heatmap metric points to high volatility | Source: Alphractal on X

Bitcoin Volatility: A Looming Threat

The current market environment for Bitcoin is marked by a growing sense of unease as the digital asset nears crucial levels that historically result in abrupt price changes. Platforms like Alphractal, known for their sophisticated investment data analysis, have identified critical warning signs.

According to Alphractal, Bitcoin is likely to encounter high volatility in the coming days, creating a hazardous scenario for both investors and traders.

The platform’s predictions are based on data gathered from the Aggregated Liquidation Levels Heatmap metric, which tracks patterns of long and short positions in the crypto market. Over the past 7 and 14 days, the heatmap has revealed large concentrations of long positions on major cryptocurrency exchanges.

These positions create multiple sizable liquidation pools, which amplify the risk of rapid price declines. The most notable of these liquidation levels is just below $60,000 a point that Alphractal refers to as the "maximum pain point" for the market. If Bitcoin’s price dips below this threshold, it could trigger a wave of liquidations that would send shockwaves through the crypto market.

Alphractal’s data also highlights another significant liquidation level at $67,000. While Bitcoin’s current price hovers around $61,970 (a 1% decline from the previous day), its broader performance shows some resilience, with a 1.35% increase over the past week and a 12% rise over the past month. However, these figures may not be enough to stave off the risks posed by these massive liquidation levels, which could create a perfect storm for market volatility.

Liquidation Pools and the Role of Market Markers

One of the primary factors driving the heightened volatility in Bitcoin’s price is the development of liquidation levels both above and below the market price. This phenomenon is typical in the cryptocurrency market, where liquidity traces left by market makers are eventually revisited over time with remarkable accuracy. Alphractal has observed that as Bitcoin’s price approaches critical support and resistance levels, new liquidation levels begin to form, creating a cycle of volatility.

The Aggregated Liquidation Levels Heatmap illustrates this cycle by showing where long and short positions are concentrated. When the market price of Bitcoin falls near one of these levels, it can trigger a cascade of liquidations, forcing traders to exit their positions. These liquidations, in turn, exacerbate the price movement, leading to sharp fluctuations.

Alphractal's analysis indicates that this pattern of liquidation is not limited to one direction. As Bitcoin’s price rises, new liquidation levels form above the market price, creating an equally volatile environment. Conversely, when the price declines, liquidation levels emerge below the market price, leaving market markers to chase liquidity traces. This cyclical nature of liquidation is a key driver of Bitcoin volatility and a critical factor for investors to monitor.

The Broader Market Context: Bulls vs. Bears

Bitcoin’s current volatility comes at a time of broader market uncertainty, where bulls and bears are locked in a fierce competition for dominance. As Bitcoin approaches its key support and resistance levels, the question remains whether it will break through to new all-time highs or face a period of consolidation. The battle between these two forces has created a precarious environment for traders, with significant risks on both sides.

For the bulls, the prospect of Bitcoin reaching new highs remains enticing, especially as the asset continues to post long-term gains. The recent 12% increase in Bitcoin’s price over the past month has fueled optimism among bullish investors, who see the digital asset as a potential hedge against inflation and economic instability. On the other hand, bears remain cautious, pointing to the potential for a sharp downturn if the market fails to absorb recent gains.

Alphractal’s data suggests that both scenarios are possible in the near future. If Bitcoin is able to maintain its current momentum, it could push through the $67,000 liquidation level and set a new all-time high. However, if the price falls below the $60,000 threshold, the ensuing wave of liquidations could lead to a significant market correction, resulting in even greater volatility.

Industry Leaders Remain Bullish Despite Volatility

While the prospect of increased Bitcoin volatility may be unsettling for some investors, industry leaders remain confident in the digital asset’s long-term potential. Cathie Wood, CEO of Ark Invest, is one such figure who remains bullish on Bitcoin, even in the face of heightened market uncertainty. In a recent interview with Bloomberg Intelligence, Wood reiterated her forecast that Bitcoin could eventually reach $1 million, citing its role as a hedge against inflation.

Wood’s optimism is rooted in her belief that Bitcoin's volatility is a sign of growth rather than instability. She points to the asset’s performance during recent inflationary periods as evidence of its value as a safe haven for investors. As global economies face rising inflation and supply chain disruptions, Wood argues that Bitcoin will continue to play a crucial role in protecting wealth from the erosive effects of inflation.

"We are only halfway through," Wood stated in her interview, referring to Bitcoin’s ongoing bullish run. According to her, the current market conditions—while volatile—are merely a stepping stone toward even greater gains in the future. Ark Invest’s confidence in Bitcoin remains unshaken, with the firm continuing to accumulate the digital asset as part of its long-term investment strategy.

What Investors Should Expect in the Coming Days

As Bitcoin approaches key price levels, the likelihood of high volatility increases. Investors and traders should be prepared for the possibility of significant price swings in the near future, particularly as the market reacts to the large liquidation pools identified by Alphractal. The data suggests that Bitcoin’s price could experience rapid fluctuations as it moves closer to the $60,000 and $67,000 liquidation levels, with potential consequences for both bulls and bears.BTC trading at $62,038 on the 1D chart | Source: BTCUSDT on Tradingview.com

For those looking to navigate the current market environment, the key will be to stay informed and remain cautious. While Bitcoin's long-term potential remains strong, the short-term risks associated with Bitcoin volatility are significant. Traders should keep a close eye on market indicators and be prepared for sudden price movements, especially as the battle between bulls and bears continues to play out.

Bitcoin is on the verge of a period of high volatility, driven by a combination of market uncertainty, liquidation levels, and broader economic factors. While some investors may see this as an opportunity for growth, others may choose to adopt a more cautious approach, waiting for the market to stabilize before making significant moves. Whatever the strategy, one thing is clear: Bitcoin’s journey is far from over, and the coming days will be critical in determining its next move.

References

Bitcoinist - Bitcoin's High Volatility Potential Grows

- This article discusses Bitcoin's recent market behavior, including fluctuations in price and potential for volatility, making it a solid reference for understanding current trends.

- Bitcoinist

Bloomberg - Cathie Wood's Insights on Bitcoin

- Bloomberg covers Cathie Wood’s predictions regarding Bitcoin's price potential and her perspective on the current market conditions. This source emphasizes the bullish outlook from key industry leaders.

- Bloomberg Interview

CoinDesk - Market Analysis and Bitcoin Trends

- CoinDesk is a trusted source for cryptocurrency news and analysis. They frequently publish articles analyzing market trends and the factors influencing Bitcoin's price.

- CoinDesk

Investopedia - Understanding Cryptocurrency Volatility

- Investopedia offers educational content on the volatility of cryptocurrencies, explaining factors that contribute to price fluctuations and market dynamics.

- Investopedia on Cryptocurrency Volatility

![[Honest Review] The 2026 Faucet Redlist: Why I'm Blacklisting Cointiply & Where I’m Moving My BCH](https://cdn.bulbapp.io/frontend/images/4b90c949-f023-424f-9331-42c28b565ab0/1)