Indicators Point Towards Crypto Bull Run in 2024

Crypto bull run predicted in 2024 based on indicators.

The year 2023 started with hopes for a recovery in the crypto market, after the bear market in 2022. The events of this year have taken some by surprise large market players with a surge in the price of Bitcoin and many other altcoins.

Period of high volatility in the market crypto appears to be gaining momentum with an expected bull run in 2024. Here are three indicators that show that a bull run will occur next year.

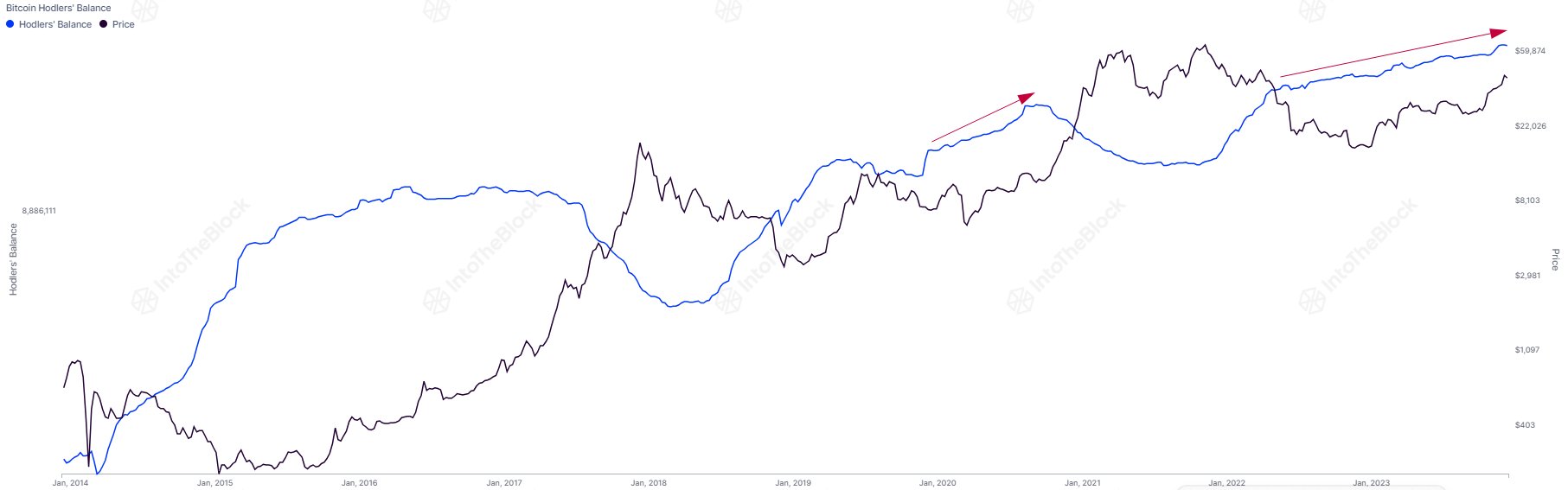

Investors Are Accumulating Bitcoin

According to the data IntoTheBlock, there is an increase in the number and number of holders Bitcoin, showing their confidence in BTC by increasing their BTC holdings.

More importantly, whale Bitcoins with at least 1,000 BTC are showing signs of accumulation which historically occurs first before significant price spikes .

Recently (28/12/23), MicroStrategy again added to its Bitcoin holdings after purchasing an additional 14,620 BTC at an average price of US$42,110 per coin, bringing its total holdings to 189,150 BTC.

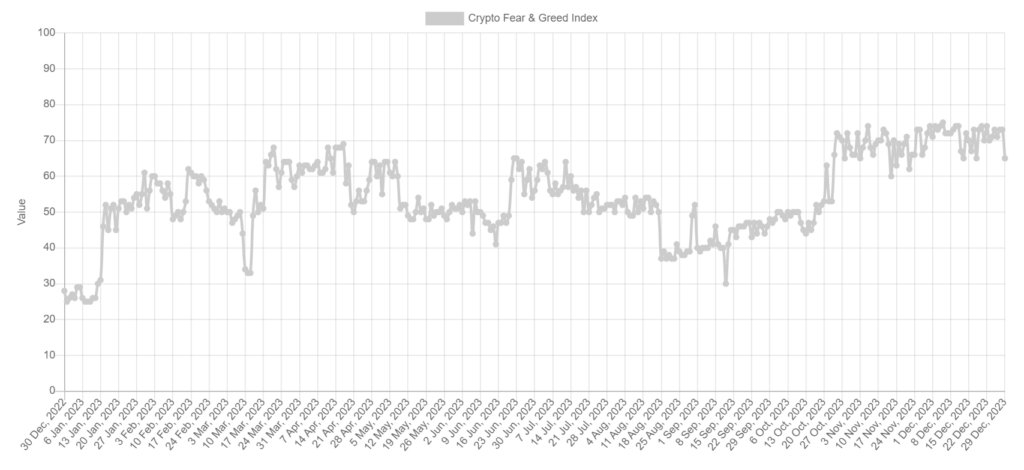

Crypto Market Sentiment Continues to Rise

Index fear and greed, a barometer of investor sentiment towards crypto, shows a score of 73 (28/12/23) which shows that the crypto market is < /span>.bullish It is noteworthy that this index has been above a score of 50 for most of 2023, indicating the positive sentiment that market players have towards the crypto market as a whole. This pattern of market sentiment has been a precursor to price spikes in the past and could be an indicator of an upcoming bullrun .

It is noteworthy that this index has been above a score of 50 for most of 2023, indicating the positive sentiment that market players have towards the crypto market as a whole. This pattern of market sentiment has been a precursor to price spikes in the past and could be an indicator of an upcoming bullrun .

For comparison, in 2019 before the 2020 Bitcoin halving, this index showed the highest score of 82 with most scores above 50 throughout 2019. Furthermore, the crypto market in 2020 continued the sentiment bullish to bullrun 2021.

With comparable comparisons, 2023 is before the halving in 2024, seeing this pattern it is hoped that the crypto market can continue the bullish trend in 2024.

Technical Indicators Show Bullish Trend

Crypto market capitalization has exceeded the 50-week exponential moving average (EMA), namely reaching US$1.1 trillion on October 23, 2023. Furthermore, the market capitalization value remains above the EMA50 indicating a moderate trend .bullish Picture: EMA50 (orange), EMA100 (blue)

Picture: EMA50 (orange), EMA100 (blue)

The EMA50 has also produced a bullish cross above the week EMA100. In addition, the relative strength index (RSI) has entered overbought territory at 80. This strengthens the dominance of bulls in the market.

Furthermore, if the capitalization market value of crypto can build support above the US$1.75 trillion level with positive volume, then the bullish trend can continue in 2024.

Other Supporting Factors

On the other hand, there are two other factors that can support these three indicators. Among these are Bitcoin ETFs and historical Bitcoin halvings.

Chances of Spot Bitcoin ETF Approval

According to Bloomberg ETF analysis, James Seyffart, the chance of a spot Bitcoin ETF approval on January 10, 2023, which is the SEC's deadline for determining a decision, is 90%.

Okay, we're nearing in on deadline dates for 3 spot #Bitcoin ETF applications. I want to get ahead of it because there's a pretty good chance we'll see delay orders from the SEC. Delays WOULD NOT change anything about our views & 90% odds for 19b-4 approval by Jan 10, 2024 pic.twitter.com/LE7sOlHAHM

— James Seyffart (@JSeyff) November 14, 2023

If approved, the ETF could attract more institutional investors into crypto and have a positive impact not only on BTC but also on the prices of other cryptos.

Spot Bitcoin ETF approval could be Wall Street's biggest development in three decades according to Bitcoin maxi, Michael Saylor.

Historis Halving Bitcoin

Bitcoin price trends often depict cyclical patterns. Analysts have drawn correlations between current prices and historical patterns, suggesting bullish cycles similar to those that occurred in 2013, 2017, and 2021.

Bullish movements historically tend to follow a four-year cycle triggered by the Bitcoin halving event, which reduces the rate of creation and acceptance of new Bitcoins by a>.miners

The next halving will occur around April 2024, and in general the bullrun can start several months before the halving and continue until the price of Bitcoin reaches a new record high .

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)