Kamino Finance: Revolutionizing DeFi

Kamino Finance is a decentralized lending platform built on the Solana blockchain. It aims to provide a fast, simple, and secure way for users to access various DeFi services, such as lending, borrowing, liquidity provision, multiplication, and long/short strategies. Kamino Finance leverages the power of Solana’s high-performance and low-cost network, as well as its growing ecosystem of projects and partners. In this article, we will explore the features and innovations that Kamino 2.0 introduces with its public launch, and how Kamino can benefit the DeFi users and the Solana community.

In this article, we will explore the features and innovations that Kamino 2.0 introduces with its public launch, and how Kamino can benefit the DeFi users and the Solana community.

Kamino’s Safety Net: Smart Risk Management

Kamino Finance takes risk management seriously and implements a number of mechanisms to ensure the safety and stability of the platform. One of these mechanisms is the Risk Dashboard, which monitors the risk level of each asset and the overall market. The Risk Dashboard provides various tools and features, such as Risk Overview, Detailed Risk Metrics, Value at Risk Analysis, Loans Analysis, Market Risk Analysis, Price Shock Analysis, Single Loan Analysis, and Leaderboard. Users can use these tools and features to make informed decisions and manage their risk exposure.

K-Lend incorporates an innovative risk management feature known as Automated Deleverage, a mechanism meticulously designed to mitigate risks associated with both borrowers and assets. This feature dynamically adjusts the supply and borrow amounts of each asset based on its risk level, prioritizing the protection of lender funds within the protocol.

K-Lend proactively identifies and addresses elevated risks by triggering a protocol-wide deleverage when a specific asset poses a potential threat. Users holding positions with the at-risk asset receive timely notifications, granting them a 72-hour grace period to strategically adjust positions and avoid liquidation. Failure to take corrective action within this timeframe prompts K-Lend to autonomously initiate a partial unwinding of positions, ensuring ongoing loan safety and maintaining sufficient collateral to protect lender interests.

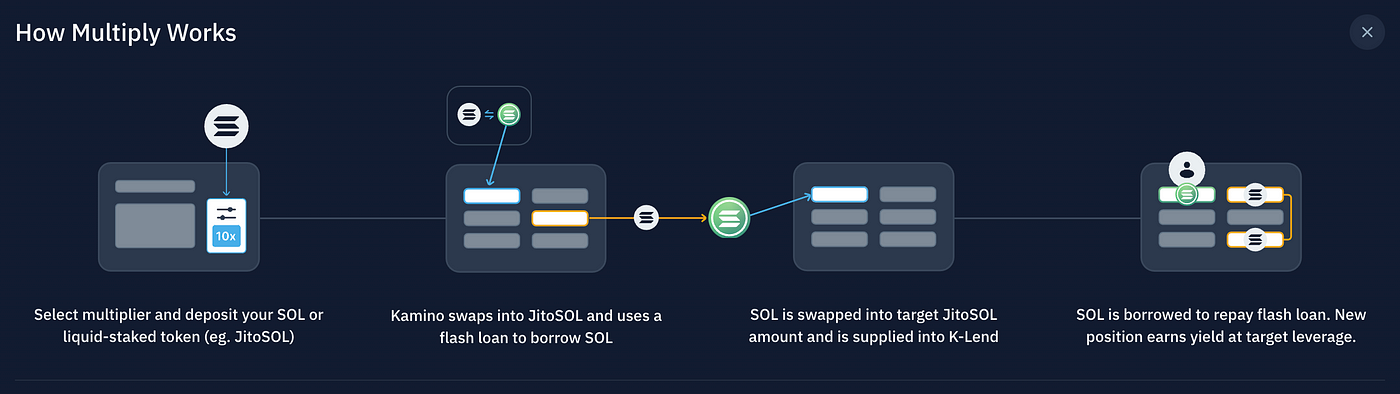

Kamino Multiply: Streamlined Leverage with a Click

Kamino Multiply revolutionizes leveraging SOL liquidity pool (LP) positions by providing users a seamless, one-click solution. With a variety of vaults, users can effortlessly navigate their preferences. Kamino Multiply automates position creation and management for users, leveraging flash loans and swaps to optimize the process. Yield generation stems from LP fees and the underlying assets’ price appreciation.

Kamino Long/Short: Crypto Exposure without High Costs

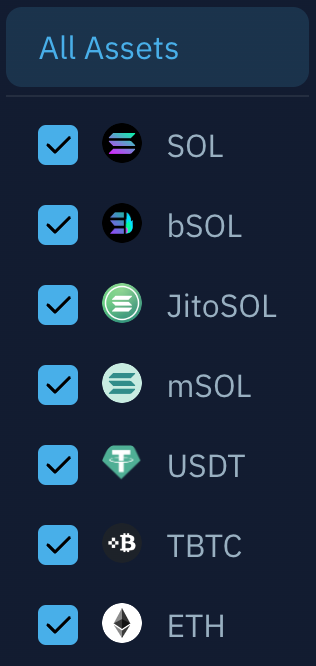

Kamino Long/Short is a product that allows users to take long or short positions on any supported asset without paying high fees or interest rates. Users can choose from a range of strategies that offer different levels of leverage and risk. Kamino Long/Short will automatically execute and manage the positions for the users, using flash loans and swaps to minimize the costs. Users can benefit from the price movements of the underlying assets and close their positions at any time.

currently supported Long/Short assets

What’s elevation Mode?

Elevation Mode, or eMode, is a distinctive feature within K-Lend, a decentralized lending platform, that optimizes loan-to-value ratios (LTV) and facilitates higher leverage between assets that share a pegged price or exhibit high correlation. This mechanism is integral to the Multiply vaults offered by K-Lend.

In practical terms, eMode enables users to achieve more capital-efficient LTV ratio, unlocking greater borrowing power. Unlike traditional vaults with a standard 75% LTV, eMode allows for an elevated LTV of up to 90%, providing the potential for higher leverage, reaching up to 10x.

To understand the significance of eMode, it’s crucial to recognize K-Lend’s unified liquidity market design. Unlike multi-pool structures common in other lending protocols, K-Lend features a single liquidity market. Within this unified market, assets are organized into ‘elevation groups (eGroups)’, each having custom LTV parameters and liquidation thresholds.

For example, consider a JitoSOL/SOL Multiply vault where JitoSOL is supplied, and SOL is borrowed. Normally, these assets would have a 75% LTV, allowing for 4x leverage. However, eMode facilitates an increased LTV of 90%, enabling users to access up to 10x leverage [Kamino docs].

This heightened capital efficiency is achieved within the unified liquidity market, showcasing the power of eMode in tailoring asset parameters for optimized borrowing and lending experiences.

Combined with Kamino’s automation infrastructure, eMode not only enhances capital efficiency but also enables the platform to offer more robust looping products than any other on Solana.

kTokens: Collateral Simplified

Kamino kTokens are tokens that represent the user’s share of a liquidity vault or a Long/Short strategy. Users can use kTokens as collateral on Kamino Lend, without having to add more liquidity or lock their funds. This way, users can access more opportunities and increase their capital efficiency. For example, users can deposit kTokens that represent their leveraged LP positions and borrow SOL to farm more yield or hedge their exposure.

How it Works [Kamino Docs]:

- When we deposit into any of Kamino’s liquidity vaults, you receive a kToken in return, which represents the value of your liquidity position. All the fees & incentives you earn in the liquidity position (trading fees, DEX incentives, and Kamino incentives) are auto-compounded into your kTokens

- kTokens can be deposited as collateral into Kamino Lend, just like any other token like SOL or USDC. While deposited, you continue to earn the yield from the liquidity

- You can borrow assets against these kTokens to loop your liquidity, or even borrow assets to remain delta-neutral

Current LP tokens accepted as collateral [Kamino Docs]:

- UXD-USDC

- JitoSOL-SOL

- mSOL-SOL

- bSOL-SOL

Earning Kamino Points:

While Kamino doesn’t currently have its own token, the introduction of Kamino points adds an exciting layer for users. Points are earned through interactions on the platform, including previous activities. Although there is no official confirmation of a token launch, the potential for an airdrop to early users based on accumulated points has sparked considerable speculation.

Step-by-Step Guide:

- Visit the Kamino website.

- https://app.kamino.finance/

- Connect your Solana wallet.

- Obtain SOL or supported tokens on platforms like Binance.

- Engage in borrowing/lending activities in the “Borrow/lend” section.

- Provide liquidity to pools under the “Liquidity” tab.

- Explore leverage trading using the “Multiply” one-click vault.

- Stay tuned for the potential launch of Kamino’s own token and the associated points system.

Conclusion:

Kamino Finance stands at the forefront of Solana’s DeFi landscape, offering a secure and user-friendly platform that seamlessly integrates lending, liquidity provision, and leverage. With the recent 2.0 update, Kamino aims to provide users with enhanced opportunities to maximize their yields while fostering partnerships with protocols in need of liquidity. While the prospect of Kamino points and a potential token launch adds an extra layer of excitement, users are encouraged to stay informed and explore the diverse features of this groundbreaking DeFi protocol.

To stay updated with the latest news and updates from Kamino Finance, you can follow them on their social media platforms:

![[LIVE] Engage2Earn: Let's keep Sam delivering for Hawke](https://cdn.bulbapp.io/frontend/images/2c5d8b18-5618-4a2a-9051-89ceddbcdfd5/1)