Bitflow Finance - Decentralized exchange for Bitcoiners

Introduction

Bitflow Finance is a DEX where you can trade Bitcoin and Bitcoin-related assets. These assets can be in various forms: from Bitcoin-backed stablecoins to digital assets 1:1 pegged to BTC. To fully understand how Bitflow works we’ll write about not only what Bitflow is and what the DEX strives to achieve, but also how these Bitcoin-related digital assets.

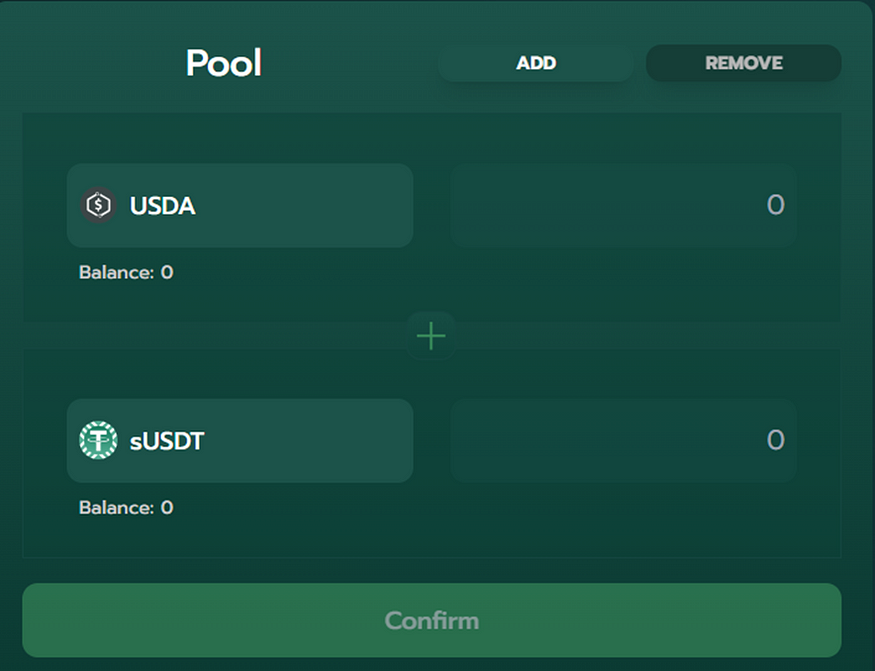

Bitflow StableSwap

The crucial component of the DEX is Bitflow StableSwap which is the first protocol within the Bitcoin ecosystem allowing to trade stable digital assets. At the time of writing, the DEX supports only one stableswap pair: USDA — sUSDT, and two other stable pairs: STX — stSTX and aBTC — xBTC. Bitflow StableSwap uses a mathematical formula which is a combination of constant sum and constant product curves. This minimizes price slippage and maximizes liquidity which works especially efficiently for stablecoin trading. Apart from trading, you can also earn yield on stablecoins on Bitflow. Its single-sided liquidity infrastructure will allow to earn yield on USDA by providing liquidity to the USDA pool.

Bitflow StableSwap uses a mathematical formula which is a combination of constant sum and constant product curves. This minimizes price slippage and maximizes liquidity which works especially efficiently for stablecoin trading. Apart from trading, you can also earn yield on stablecoins on Bitflow. Its single-sided liquidity infrastructure will allow to earn yield on USDA by providing liquidity to the USDA pool.

Bitcoin-backed stablecoins

Unlike USDA, which is backed by STX reserves, there are stablecoins backed by Bitcoin itself. Despite what the name may suggest, these stablecoins are not pegged to Bitcoin but to a fiat currency, mostly US Dollar. These assets are backed by Bitcoin reserves held as collateral. Sovryn Dollar (DLLR), Dollar on Chain (DoC), and Fuji USD are some examples of Bitcoin-backed stablecoins. Though these digital assets may and do differ in implementation details, the main idea is the same in all cases: once bitcoin has been locked into a smart contract, new stablecoins are minted in the form of dollar-denominated loan against the collateral. That these are almost always overcollateralized stablecoins ensures that the Bitcoin collateral has more value than the outstanding stablecoin claims. Stablecoins can always be redeemed for $1 of BTC which preserves their peg.

Bitflow will enable to trade multiple Bitcoin-backed stablecoins in the Bitcoin ecosystem.

Bitflow Finance aims to be an integral part of the nascent Bitcoin DeFi ecosystem. Its collaboration with StackingDAO, a liquid stacking protocol built on Stacks, enables users to earn yield through their stSTX which is a liquid token for stacked STX. Once you stack your STX tokens in StackingDAO, you get stSTX tokens which then can be used to provide liquidity in Bitflow stSTX pool which will increase yield on your STX holdings. Though this article is on Bitflow Finance, I want the role of StackingDAO in the Bitcoin economy as well. Holding stSTX, lending it on a DeFi protocol, or adding liquidity to STX-stSTX pool on Bitflow earns 1, 1.5, and 2.5 points respectively. And whenever, there’s a points system, there is a potential airdrop. To repeat, stacking STX on StackingDAO and receiving stSTX in return, and then add both STX and stSTX to the Bitflow liquidity pool will make you most bang for your buck by enabling you to be positioned to receive airdrops from two different Bitcoin protocols.

You can also escrow STX-stSTX LP tokens in liquidity pools to boost the yield even more.

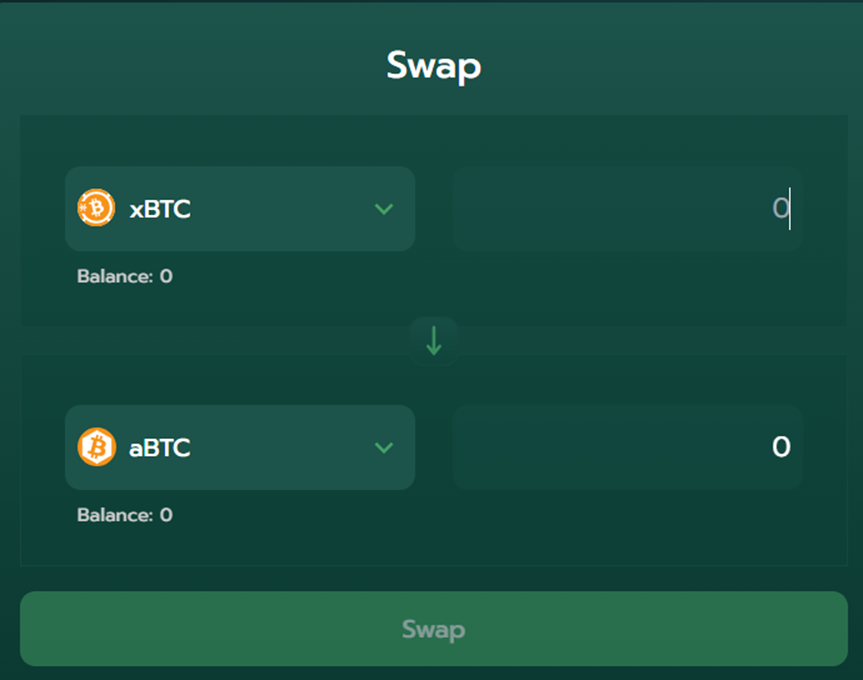

One of the most important functions of Bitflow Finance is Bitcoin Swaps. There barely existed a non-custodial way of transferring Bitcoin. Bitflow enables trading different pegged and wrapped versions of Bitcoin:

- sBTC. sBTC is an asset pegged 1:1 to BTC on the Stacks blockchain. Unlike the most popular pegged representation of BTC, wBTC, sBTC is decentralized and doesn’t rely on a third party. sBTC is a solution to build DeFi on top of Bitcoin and improve the network’s scalability. Due to performance and security reasons the Bitcoin base layer should remain simple without any unnecessary complexities. So, it isn’t a bug but a feature that Bitcoin blockchain doesn’t support smart contracts. But in order to build DeFi on top of Bitcoin, which is the most decentralized and the most secure blockchain network, we need assets representing BTC. This is what sBTC in a nutshell is — a decentralized, secure asset pegged to BTC built on a layer-2 blockchain, Stacks. sBTC has a two-way peg to BTC. When BTC is locked on the Bitcoin layer, an amount of sBTC equivalent to it is issued on the Stacks layer. When the opposite action is executed, i.e., when sBTC is destroyed, the equal amount of BTC is programmatically released on the Bitcoin layer.

- aBTC. aBTC, a solution from ALEX, is pegged 1:1 to Bitcoin. It’s a SIP010 token on Stacks, and is enabled by Bitcoin Bridge and Bitcoin Oracle. The first component is bridge allowing to transfer Bitcoin and Bitcoin L2s, such as STX. The second one is an oracle indexing events of Bitcoin L1 assets.

- xBTC. It is similar to wrapped Bitcoin on the Ethereum network. xBTC is a wrapped BTC implemented on the Stacks layer, and is backed 1:1 by Bitcoin reserves. To enable swapping xBTC with other Bitcoin-backed assets Biflow uses Magic Protocol which bridges Bitself with xBTC in a decentralized and trustless manner.

Conclusion

Conclusion

Bitcoin economy thrives and with so many upcoming catalysts we expect the ecosystem to boom even further. Though not fully functional at the time of writing, Bitflow Finance may be one of the most effective ways to get exposure to the Bitcoin economy.

Bitflow Finance is “the Decentralized Exchange for Bitcoiners.” It enables trading Bitcoin assets, such as pegged and wrapped versions of BTC, and stable asset pairs in a non-custodial way, much like in alignment of Bitcoin ethos itself. And it strives to achieve it with minimum slippage and low fees. You can also earn yield on your BTC, STX or stablecoin assets by providing liquidity to its pools. Note that Bitflow doesn’t have a token at the moment and will likely have airdrop in the future. Using the DEX in one or more ways can make you eligible for the airdrop.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)