The Role of Hot Wallets in the Crypto Market: Decentralization and Security Considerations

In the vast and ever-evolving landscape of the cryptocurrency market, the discussion surrounding hot wallets, their significance for decentralization, and the strategies for ensuring asset security is of paramount importance. This blog post aims to explore the role of hot wallets in the crypto market, their relevance to decentralization, and the measures users can take to secure their assets.

Understanding the Role of Hot Wallets:

- Defining Hot Wallets:

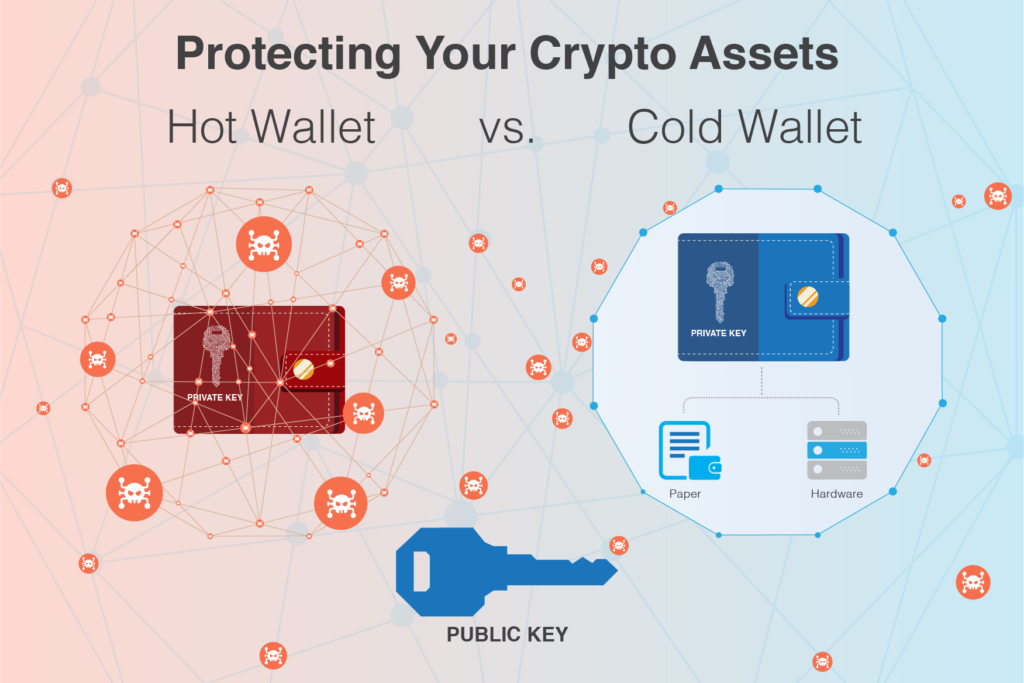

Hot wallets refer to cryptocurrency wallets that are connected to the internet, allowing for quick and convenient access to funds. They are in contrast to cold wallets, which are offline and often used for long-term storage.

- Convenience in Trading and Transactions:

Hot wallets are favored for their accessibility and immediacy, making them ideal for daily transactions, trading activities, and quick fund transfers. Their online nature enables users to react swiftly to market movements.

Decentralization and the Significance of Hot Wallets:

- Decentralization in Crypto:

The decentralization ethos in the crypto space emphasizes reducing reliance on centralized entities. Hot wallets contribute to decentralization by enabling users to have direct control over their funds, eliminating the need for intermediaries.

- User Empowerment:

Hot wallets empower users to manage their assets independently, aligning with the core principles of decentralization. This model fosters financial inclusivity, giving users around the globe access to the benefits of cryptocurrency.

Ensuring Asset Security with Hot Wallets:

- Best Practices for Security:

To safeguard assets held in hot wallets, users should implement robust security practices. This includes using strong, unique passwords, enabling two-factor authentication (2FA), and regularly updating software and firmware.

- Limiting Exposure:

While hot wallets are valuable for day-to-day activities, users can limit exposure to potential risks by keeping only a portion of their funds in these wallets. The remainder can be stored in cold wallets, providing an added layer of security.

- Regular Audits and Monitoring:

Regularly auditing transactions and monitoring account activity can help users detect any unauthorized access promptly. Being vigilant and proactive in reviewing wallet activity adds an extra layer of defense against potential threats.

Balancing Accessibility and Security:

- Hybrid Approaches:

Users can adopt a hybrid approach by combining the convenience of hot wallets with the security of cold storage. This involves keeping a portion of assets in a hot wallet for daily use while storing the majority in a cold wallet for long-term safety.

- Continuous Education:

Staying informed about evolving security threats and best practices is essential. Continuous education empowers users to make informed decisions, adapt to new security measures, and navigate the ever-changing landscape of crypto security.

Conclusion:

Hot wallets play a crucial role in the cryptocurrency market, providing users with immediate access to their assets and contributing to the decentralization ethos. While their convenience is undeniable, users must prioritize security through best practices, monitoring, and a thoughtful balance between hot and cold storage. By understanding the nuances of hot wallet usage and security considerations, participants in the crypto space can navigate the digital landscape with confidence and resilience against potential threats.

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)