Bitcoin Bubble Phenomenon: Beyond the Bubble Narrative

The term “bubble” is often thrown around in discussions about Bitcoin’s price movements. Traditionally associated with unsustainable and irrational market exuberance that eventually leads to a catastrophic collapse, the concept of a bubble might not entirely align with the nature of Bitcoin’s price dynamics.

The term “bubble” is often thrown around in discussions about Bitcoin’s price movements. Traditionally associated with unsustainable and irrational market exuberance that eventually leads to a catastrophic collapse, the concept of a bubble might not entirely align with the nature of Bitcoin’s price dynamics.

1. Historical Context:

- Bubbles typically involve a rapid surge in asset prices, followed by an equally swift and dramatic decline. Bitcoin’s price history, however, shows a pattern of significant volatility with periods of rapid ascent followed by corrections. What sets Bitcoin apart is its ability to recover and reach new highs after these corrections.

2. Market Resilience:

- Unlike traditional bubble scenarios where the burst leads to a prolonged period of depression for the asset, Bitcoin has demonstrated resilience. After major corrections, Bitcoin has consistently rebounded and surpassed its previous all-time highs. This resilience challenges the traditional bubble narrative.

3. Adoption and Integration:

- Bubbles are often fueled by speculation without underlying fundamentals. Bitcoin, on the other hand, has seen increasing adoption and integration into the global financial landscape. Institutions, businesses, and even governments are acknowledging its significance, contributing to a more robust ecosystem.

4. Evolving Perception:

- The perception of Bitcoin has evolved over time. Initially considered a speculative asset or a technological novelty, Bitcoin is now viewed by many as a store of value and a hedge against inflation. This shifting narrative suggests a maturation process distinct from traditional bubble dynamics.

5. Limited Supply and Scarcity:

- Bitcoin’s fixed supply of 21 million coins creates a level of scarcity. Unlike traditional bubbles, where oversupply often contributes to the burst, Bitcoin’s scarcity model can act as a stabilizing factor, influencing its long-term value proposition.

6. Long-Term Perspective:

- Bitcoin enthusiasts and advocates often emphasize a long-term perspective. The focus extends beyond short-term price fluctuations, emphasizing the transformative potential of blockchain technology and the role Bitcoin could play in reshaping the financial landscape.

While Bitcoin’s price history does exhibit volatility reminiscent of bubble-like behavior, its ability to recover and establish new highs challenges the conventional narrative. The evolving role of Bitcoin in the global financial ecosystem, coupled with increasing institutional participation, suggests a more complex and nuanced trajectory than a typical asset bubble.

In conclusion, characterizing Bitcoin solely as a bubble might oversimplify its nature and potential. As the cryptocurrency continues to evolve, its resilience, growing adoption, and changing perceptions challenge traditional notions of bubbles. Whether Bitcoin is in a class of its own or adheres to familiar market patterns remains a subject of ongoing debate, contributing to the dynamic discourse surrounding the world’s most well-known cryptocurrency.

Follow for more article about Cryptocurrency & Ai. Thanks

Bitcoin

Bitcoin Bubble

Bitcoin Bull Run

Bitcoin News

Bitcoin Blockchain

Follow

Follow

Written by Crypto Beast

22 Followers

·

Writer for

Coinmonks

Welcome to the Era of Metaverse & AI. Revolutionizing the Digital World with AI, Web3 and Blockchain Innovation. To know more about blockchain & AI follow me.

More from Crypto Beast and Coinmonks

Crypto Beast

Crypto Beast

How to Connect MetaMask to a Flutter App

MetaMask is a popular cryptocurrency wallet that allows users to store, send, and receive Ethereum and other ERC-20 tokens. Flutter is a…

3 min read

·

Oct 6, 2023

6

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

39K

1030

Crypto Beast

Crypto Beast

Understanding and Resolving the “useState is not a function” or “Return Value is not Iterable”

ReactJS has revolutionized the way developers build user interfaces by introducing a declarative and efficient approach to building UI…

3 min read

·

Nov 19, 2023

3

Recommended from Medium

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

94

3 The Pareto Investor

The Pareto Investor

The Beautiful Mathematics Behind Bitcoin

The One and Only Formula You Need to Know to Understand the Genius Behind Satoshi’s Masterpiece.

·

3 min read

·

4 days ago

284

3

Lists

Staff Picks558 stories

Staff Picks558 stories

·

642

saves

Stories to Help You Level-Up at Work19 stories

Stories to Help You Level-Up at Work19 stories

·

420

saves

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1217

saves

Productivity 10120 stories

Productivity 10120 stories

·

1112

saves

Maximilian Schima

Maximilian Schima

in

Financial Reflections

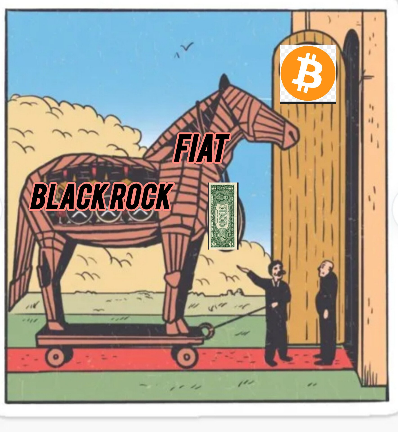

Bitcoin ETF — a Trojan Horse

Why cash-only ETFs contradict the basic idea of Bitcoin

6 min read

·

2 days ago

54

Annabelle Darcie

Annabelle Darcie

in

NFT Daily Dose

BRC20 Token Development: A Comprehensive Guide

In the ever-evolving landscape of blockchain and cryptocurrency, the development of tokens has become a pivotal aspect of decentralized…

9 min read

·

Sep 11, 2023

19

4

Crypto Rookies

Crypto Rookies

Bitcoin versus Gold ETF

Abstract

8 min read

·

6 days ago

68

Captain Crypto

Captain Crypto

These 5 Cryptocurrencies Could Make You A Millionaire By 2024-End

2021 was a monumental year of crypto. The industry empowered many individuals to make their first million through digital assets. 2022…

3 min read

·

Dec 14, 2023

3

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)