Liquidity Pool Version 3 (DLMM) for dummies and critical review

Uniswap Liquidity pool (LP) Version 1 (V1) model is for any token that swap with the Ethereum coin, Version 2 (V2) is allowing different pairs of coins of LP other than with just Ethereum. This article is about Version 3 (V3) which shows how to concentrate LP capital on a specified price range to earn more trading fees, Dex Meteora named this Dynamic Liquid Market Maker (DLMM), this is allowing more efficient use of LP capital and provide much higher return rate than previous versions of LP, but there is no free lunch, investors have to understand the concepts behind from this article to be a smarter LP provider.

How is LP return improved on V3 (DLMM) ?

Crypto trading on DEXs are swapped at certain price range, say SOL has been trading around 80-110 USD in the last few weeks. When you put your capital into the LP of type V1 or V2 you are basically allocating your capital for trading on infinite price spread, that means it covers any price range fluctuation, LP providers are set and forget for it to generate trading fees. This link shows the Type V1/V2 LP that you can invest into as a LP provider on Meteora site. https://app.meteora.ag/pools/5yuefgbJJpmFNK2iiYbLSpv1aZXq7F9AUKkZKErTYCvs

But the down side is that your capital is spread out thin with many other LP participants in different DEXs for the entire price spread of 80-110 USD say for SOL. At one stage SOL was trading at around 100-102 USD for a long time, and if you are concentrating your capital on this range in a V3 DLMM LP, then you are using your capital more efficient than other LP providers who spread out their capital thinner over the 80-110 USD price range. This is because a DEX’s ALGORITHM will only pick up the LP capital within the current price range to trade and earn trading fees, LP capital outside this range will be idled there and waiting for the price movement. If you were one of the LP providers who forecast the price range right, you earn more fees and be whom that use your capital more efficient than others, many pairs earn between 0.2%-2% return per day, so if you multiply that by 365 days that's a lot. Let’s dive into the real-life example.

Practical example

A rising Dex named Meteora has launched this V3 LP in its Beta phase, they named this V3 Dynamic Liquid Market Maker (DLMM). It was used to launch the Jupiter’s token $JUP. It was named DLMM because providers need to move their LP around in different price range to capture the LP on demand for trading fees as market maker, it is dynamic interaction. Also DLMM LP provider can collect base fees and dynamic fees which compensate impermenant loss due to market volatility.

Click this site https://app.meteora.ag/dlmm and click the JUP-UDSC pair for the demonstration.

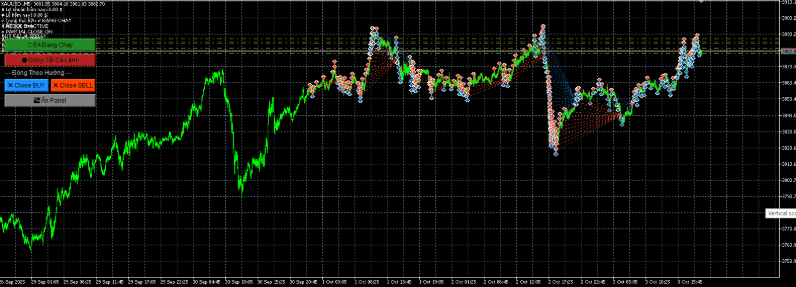

I invested 66 USDC into this JUP-USDC. Unlike the V1 and V2 LP, where you have to deposit equal amount of USD in 50:50 ratio. In DLMM you can deposit any amount in any ratio from 0-100% or just deposit one token type. I think Meteora is the first mover in the market for this flexibility innovation. The above diagram shows that I provide 66 USDC for the LP by entry at A, I choose the Bid/Ask curve for the distribution of my capital at B. I want to participate in the $JUP price range between 0.5211-0.5228 USDC at D, I can set this range by shifting the two buttons at C. This setting will allow me to capture fees between this price range with capital concentration. The black line is where the current price trading in the market.

The DLMM allow traders to trade with zero slippage because they are quoted based on the current price bin, inside the price bin there are concentration of liquidity based on how much the LP participants put in. When the bin has much capital, it will be swapped many times without slippage before moving to another price bin with more liquidity for different price quote. Compare to V1 and V2 LP which is only a single pool for infinite price range and price changes on every swap, therefore causes slippage on every trade. V3 is a market efficiency improvement and allow LP providers to earn much higher rate of return, well only if they guess the price range right, that's the pitfall of this investment option.

What are the pitfalls of DLMM and how to avoid ?

The first objective in investment into DLMM LP is "Don't lose your capital" then consider how to game it to gain profit from it.

- In a volatile crypto world which the price of one token can move out of range very quickly and the LP provider are forced to swap out the strong token and hold a bag of the weak token. The high fees earned might not be enough to offset the loss value. In this loss sitiuation then you have to be patient and then wait for the price of your bag of tokens to get back to positive territory. To avoid this strong for weak token swap, choose LP pair of tokens that are stable coins or correlated in value like USDC/USDT and SOL/mSOL-liquid staked SOL respectively which can be swapped at very close to constant rates, so that your LP capital can be preserved with certainty then the trading fees will become your real return in profit. Another strategy is to select a DLMM token pair that you want to HODL for a long term, so that the swapped token remained one of your favourite tokens.

- The LP providers need to constantly watch the market and reposition the tokens within the active price range to earn fees otherwise the capital will be idled. DLMM investment might be worse than investing into V1/V2 which set and forget then wait to harvest the return in trading fees. One way to prevent the active bin from moving out of your set price range is to have large bin steps (eg. 100 bin steps) for setting wider active price range.

- Arbitrage trading bots are everywhere that cause impermanent loss (IL) to LP providers. That is one important issue that LP industry particpants like Meteora need to address. Trading Bots free in Meteora will be a huge competitive advantage. At least for now the zero slippage in DLMM lessen the IL.

- Risk of losing funds with bugs in the Algorithm or from hackers, so don't put all eggs in one basket.

- When LP provider creates a position of new bin prices (bin arrays), there is a cost of approx 0.3 SOL charge per position which non-refundable, while the bin storage rent cost of 0.057 SOL per position is refundable. Investors need to incluse the actual cost in the % return calculation.

Conclusion

DLMM will be an innovative investment option if you have capital in stable coins (USDC/USDT) on hand that you want to earn trading fees or a pair of tokens that are correlated to each other in value like SOL/mSOL, then DLMM certainly provides much better yield than bank interest or bond.

DLMM is also a very good tool if you want to swap out the tokens at the price you desired at the same time earn high trading fees.

It is also an excellent tool if you want to buy/sell certain token at a Dollar Cost Average (DCA) price. For example, the bid/ask curve option allow users to buy or sell at much better swap prices with desirable price settings. This allows investors to "buy low sell high".

In DLMM it is easy to get your strong tokens swapped out for a bag of weak tokens. In a capital loss sitiuation then you have to be patient and need wait for the price of your bag of tokens to get back to positive territory. Therefore token pairs and bin step selection can become vital in DLMM investment to suit your investment appetite.

Meteora needs to address the arbitrage trading bots issue to gain competive advantage, and DLMM can be a fun game to play and earn profit for LP investors.

Foot note:

The above article is about more advanced knowledge on Liquidity Pool (LP), please learn the basics of LP from this link Liquidity Pool 101 for dummies which based on Uniswap’s version 1 and 2. This article will show you how LP works and how price is determined on your swap.

Sources :

- Meteora site information https://docs.meteora.ag/dlmm/dlmm-overview

- Learning from actual LPing DLMM in last few weeks.