Understanding Bitcoin Halving: What It Is and Why It Matters

In the world of cryptocurrency, few events capture the attention and speculation of enthusiasts quite like Bitcoin halving. This significant occurrence, programmed into the very fabric of Bitcoin's protocol, has profound implications for its supply dynamics, mining ecosystem, and ultimately, its price. In this blog, we'll delve into what Bitcoin halving is, why it's essential, and how it impacts the crypto market.

What is Bitcoin Halving?

Bitcoin halving refers to the process by which the reward for mining new blocks on the Bitcoin blockchain is reduced by half. This event occurs approximately every four years or after every 210,000 blocks mined. The purpose behind halving is to gradually decrease the rate at which new Bitcoins are created, ultimately capping the total supply at 21 million coins. This scarcity model is a fundamental aspect of Bitcoin's design, aiming to mimic the scarcity of precious metals like gold and instill confidence in its value over time.

Why Does Bitcoin Halving Matter?

- Supply and Demand Dynamics: Halving reduces the rate at which new Bitcoins are introduced into circulation, effectively slowing down the supply growth. With a fixed supply cap, halving increases scarcity, potentially leading to increased demand as Bitcoin becomes more scarce. Basic economic principles dictate that when demand exceeds supply, prices tend to rise.

- Mining Economics: Bitcoin mining, the process by which new Bitcoins are created and transactions are validated, is central to the network's security and functionality. Miners dedicate computational power to solve complex mathematical puzzles, and in return, they are rewarded with newly minted Bitcoins and transaction fees. Halving directly affects miners by slashing their rewards in half, forcing inefficient miners out of the market and increasing competition among those remaining.

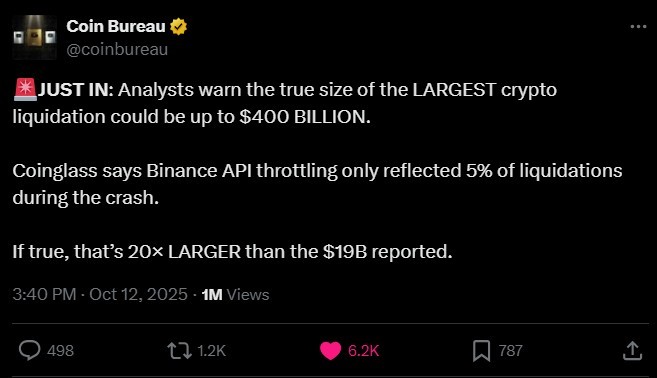

- Market Speculation: The anticipation and aftermath of Bitcoin halving often trigger speculation and volatility in the cryptocurrency market. Historically, halving events have been associated with significant price rallies as investors speculate on the potential impact of reduced supply. However, the actual effects on the market can vary, influenced by various factors such as market sentiment, adoption trends, and macroeconomic conditions.

The Impact of Bitcoin Halving:

- Price Volatility: In the months leading up to and following a halving event, Bitcoin's price tends to experience heightened volatility. Speculative buying and selling activity can lead to rapid price fluctuations, creating opportunities for traders and investors but also increasing risk.

- Mining Hash Rate: Bitcoin halving can also affect the network's mining hash rate, which represents the total computational power dedicated to mining and securing the blockchain. Some miners may find it no longer profitable to continue mining after the reward reduction, leading to a temporary drop in hash rate until difficulty adjustments occur, stabilizing the network.

- Long-Term Growth: Despite short-term fluctuations, Bitcoin halving is ultimately designed to promote long-term growth and stability. By gradually reducing the inflation rate and increasing scarcity, halving events reinforce Bitcoin's value proposition as a store of value and hedge against inflation, attracting long-term investors seeking to preserve wealth.

Conclusion:

Bitcoin halving is a fundamental aspect of the cryptocurrency's protocol, designed to regulate its supply and incentivize network participation. While halving events may generate excitement and speculation within the crypto community, their primary function is to ensure the integrity and sustainability of the Bitcoin network over the long term. Understanding the dynamics of halving events can provide valuable insights for investors, miners, and enthusiasts alike as they navigate the ever-evolving landscape of digital assets.