Why Bitcoin is the Best Crypto Asset Ever

Bitcoin, the pioneer of cryptocurrencies, has carved a unique niche in the ever-evolving financial landscape. Since its inception in 2009, it has garnered immense interest and sparked a global debate.

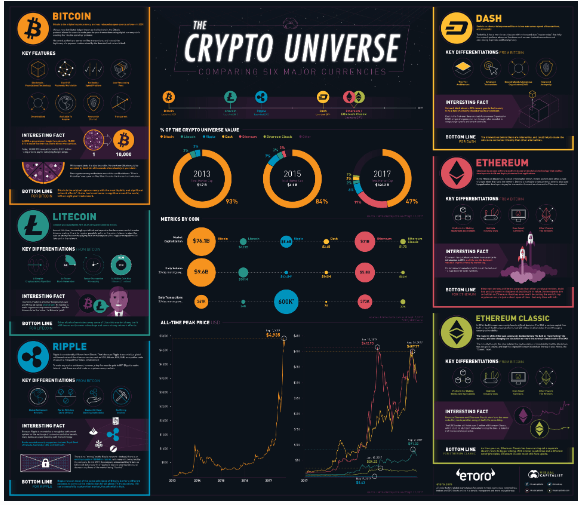

While a plethora of cryptocurrencies have emerged, vying for dominance, Bitcoin continues to hold the crown as the most valuable and influential digital asset.

This begs the question: what makes Bitcoin stand out from the crowd?

One of the most compelling features of Bitcoin is its decentralized nature. Unlike traditional currencies controlled by governments and central banks, Bitcoin operates on a peer-to-peer network, eliminating the need for intermediaries. This empowers users, fostering a sense of transparency and security. Transactions are validated and recorded on a public ledger, known as the blockchain, ensuring immutability and reducing the risk of manipulation.

Bitcoin's limited supply is another factor that contributes to its value proposition. Unlike fiat currencies, which can be printed at will by central banks, there will only ever be 21 million Bitcoins in existence. This scarcity creates a sense of digital gold, potentially driving its value upwards in the long run.

Furthermore, Bitcoin boasts a level of portability and divisibility unmatched by traditional assets. It can be easily transferred across borders without the constraints of geographical limitations or exchange rate fluctuations. Additionally, Bitcoins can be divided into smaller units (Satoshis), allowing for microtransactions and facilitating wider adoption.

The security provided by Bitcoin's underlying technology is another key advantage. The blockchain network is secured by cryptography, making it virtually impossible to counterfeit Bitcoins or tamper with transaction records. This robust security system fosters trust and confidence amongst users.

Beyond its technical prowess, Bitcoin has emerged as a symbol of financial freedom and independence. It provides an alternative financial system for individuals residing in countries with unstable economies or limited access to traditional banking services.

However, Bitcoin isn't without its challenges. The most significant hurdle is its notorious volatility. The price of Bitcoin can fluctuate dramatically, making it a risky investment for the faint of heart. Additionally, the energy consumption required for Bitcoin mining has raised concerns about its environmental impact.

Despite these drawbacks, Bitcoin's impact on the financial landscape is undeniable. It has paved the way for a new era of digital assets and decentralized finance (DeFi). As the technology matures and regulations evolve, Bitcoin is poised to play a significant role in the future of finance.

The Network Effect and First Mover Advantage

Bitcoin enjoys a significant advantage due to the network effect. As more users adopt Bitcoin, its value proposition strengthens. This creates a self-reinforcing cycle, where increased adoption leads to higher perceived value, attracting even more users.

Being the first mover in the cryptocurrency space, Bitcoin has established a strong brand recognition and enjoys a loyal community of supporters.

Bitcoin as a Store of Value

Bitcoin's limited supply and decentralized nature make it a potential hedge against inflation. Unlike fiat currencies, which can be devalued by governments printing more money, Bitcoin's supply remains fixed.

This characteristic has drawn comparisons to gold, another traditional store of value. However, unlike gold, Bitcoin offers advantages in terms of divisibility, portability, and security.

The future of Bitcoin remains shrouded in some uncertainty. Regulatory frameworks for cryptocurrencies are still evolving, and the impact of these regulations on Bitcoin's adoption and value is yet to be fully understood.

Scalability

Is another ongoing challenge. The current transaction processing speed of the Bitcoin network limits its ability to handle large volumes of transactions. However, advancements like the Lightning Network are being developed to address this issue and pave the way for wider adoption.

Despite the uncertainties, Bitcoin's influence on the financial world is undeniable. It has challenged the status quo and continues to inspire innovation in the digital asset space. As the technology matures and regulations are established, Bitcoin has the potential to become a mainstream financial instrument, shaping the future of finance.

Conclusion

Bitcoin's pioneering spirit, coupled with its unique features, has cemented its position as the most valuable and influential cryptocurrency. While challenges remain, Bitcoin's potential to transform the financial landscape is undeniable. Whether it reigns supreme in the long run or serves as a stepping stone for future innovations, Bitcoin's legacy as the disruptive force that ignited the cryptocurrency revolution is secure.