Bitcoin spot ETF trading volume on day 3 decreased by half compared to the first two days

On the third day of the US stock market trading ETF Bitcoin spot, the volume reached 1.8 billion USD, lower than previous days.

Bitcoin spot ETF trading volume on day 3 decreased by half compared to the first two days. Photo: CCN

Bitcoin spot ETF trading volume on day 3 decreased by half compared to the first two days. Photo: CCN

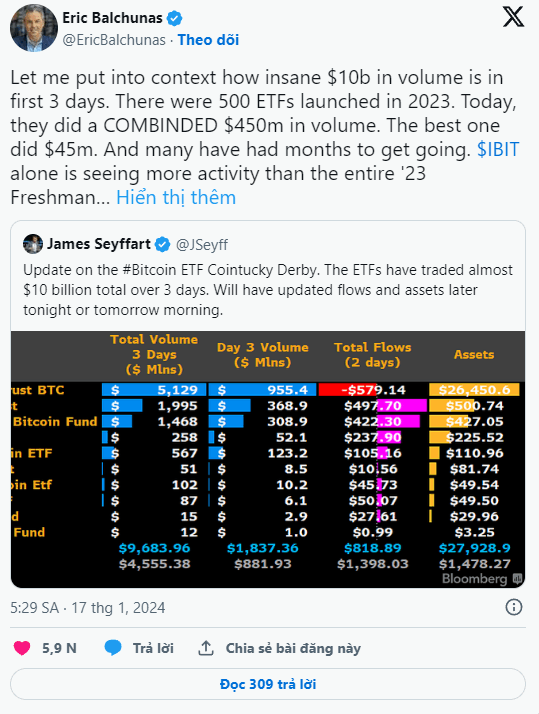

Ending the trading session on January 16, 2024 (US time), theETF Bitcoin spotnewapproved by the US Securities Commission (SEC).January 11 recorded a trading volume of 1.9 billion USD, bringing the total volume of the first 3 days to 9.6 billion USD.

ETF'sGrayscale, BlackRockand Fidelity continued to account for the majority of trading volume on January 16, reaching 1 billion USD, 371 million USD and 300 million USD, respectively.

However, what can be seen is that the volume on the third day has decreased by half compared to the number4.6 billion USDand3.1 billion USDof the first two days, continuing the downward trend.

However, analysts say that this is just the beginning, and recording a trading volume of nearly 10 billion USD after just 3 years of launch is an incredible success, far exceeding the standards commonly seen in the market. ETF sector.

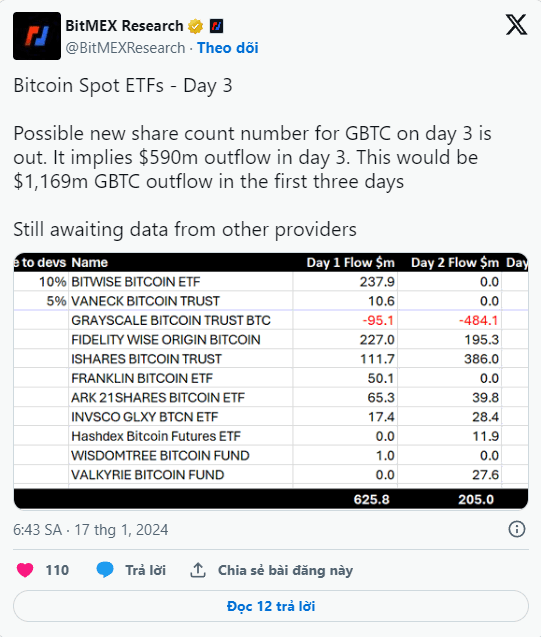

Preliminary statistical data by BitMEX Research showsGrayscale's GBTC fundcontinued to record cash outflows of up to 590 million USD, higher than two days ago and bringing the total amount withdrawn from the fund to 1.17 billion USD.As explained by Coin68, American investors are tending to withdraw money from Grayscale's GBTC to take profits after a long period of suffering losses, or switch to other Bitcoin spot ETFs with management fees lower than the highest 1.5%/year in the market. of this unit.

Because investors asked them to convert their shares back to cash, Grayscale on June 12Transfer up to 4,000 BTC (183 million USD) to Coinbase, causing Bitcoin price to be sharply adjusted.

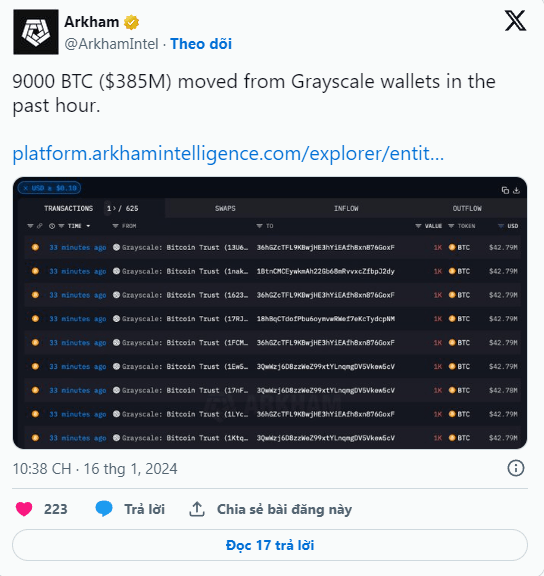

By the evening of January 16, the company continued to transfer another 9,000 BTC (384 million USD) out, making the community speculate that this was a preparation step for selling transactions to get money for customers, according toArkham.

Bitcoin was initially strongly affected by the above news, falling from $42,950 to $42,000 in just 15 minutes. However, in the following hours, the world's largest cryptocurrency recovered strongly and sometimes rose to 43,580 USD in the early morning of January 17.

15m chart of BTC/USDT pair on Binance at 08:10 AM on January 17, 2024

15m chart of BTC/USDT pair on Binance at 08:10 AM on January 17, 2024

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)