Using Aave

Good morning/evening

What is Aave?

https://aave.com/docs

I have mentioned a few times that I have been using Aave so I thought it would be good to highlight some of the pros and cons of this. I also researched thoroughly before I invested and I am aware that I have risk on top of risk. I am also aware that Aave could go the same way as Celsius, it's crypto so anything can happen. Also I did not throw my whole bag into this.

It is a borrow/lend Defi protocol that supports many ERC20 chains and tokens but some chains have less token choices. I have used Polygon to keep fees down and there are a lot of tokens you can borrow or lend, but I have also used Optimism and Arbitrum where there are less token choices. The founder and CEO of Aave ( an open source liquidity market protocol) is Stani Kulechov.

A very small selection of tokens displayed.

What does Aave do?

Aave lets you earn interest on deposits and borrow crypto.

So I deposit BTC, then take a load out using my BTC as collateral and buy a stable coin (it does not have to be a stable coin but I prefer to have a pair with a stable coin as opposed to 2 volatile assets) I then use that stable coin to buy more BTC. I have also used this same 'trade' with my OP from Publish0x and some LINK and ARB I have.

The BTC is actually WBTC so yet another risk!

Actually wrapping the BTC

OK so wrapping BTC actually changes your BTC into an ERC20 token and don't get me wrong I am not a fan of ETH or wrapping your BTC but again I used a small percentage of my BTC and as you may be aware by now, I test a lot of things in crypto. I learn about something and then try it out (within reason). By wrapping my BTC I can now use it on Aave.

The process of creating WBTC involves several steps

BTC is deposited into an account managed by a DAO of custodians, institutions and merchants. (Yes I know!)

WBTC is minted in an equivalent amount on the Ethereum blockchain and is backed on a 1-1 basis.

So now you have an ERC token. I know, I can hear the sighs, my BTC is no longer BTC.

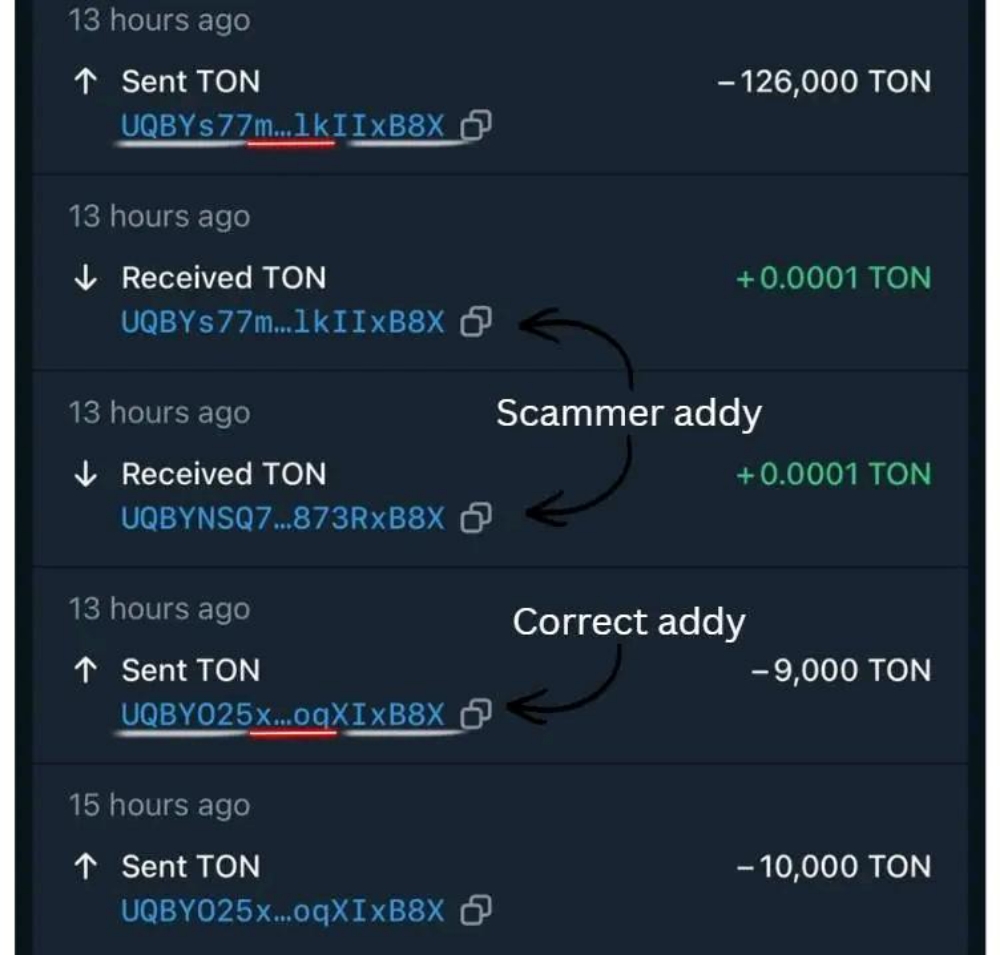

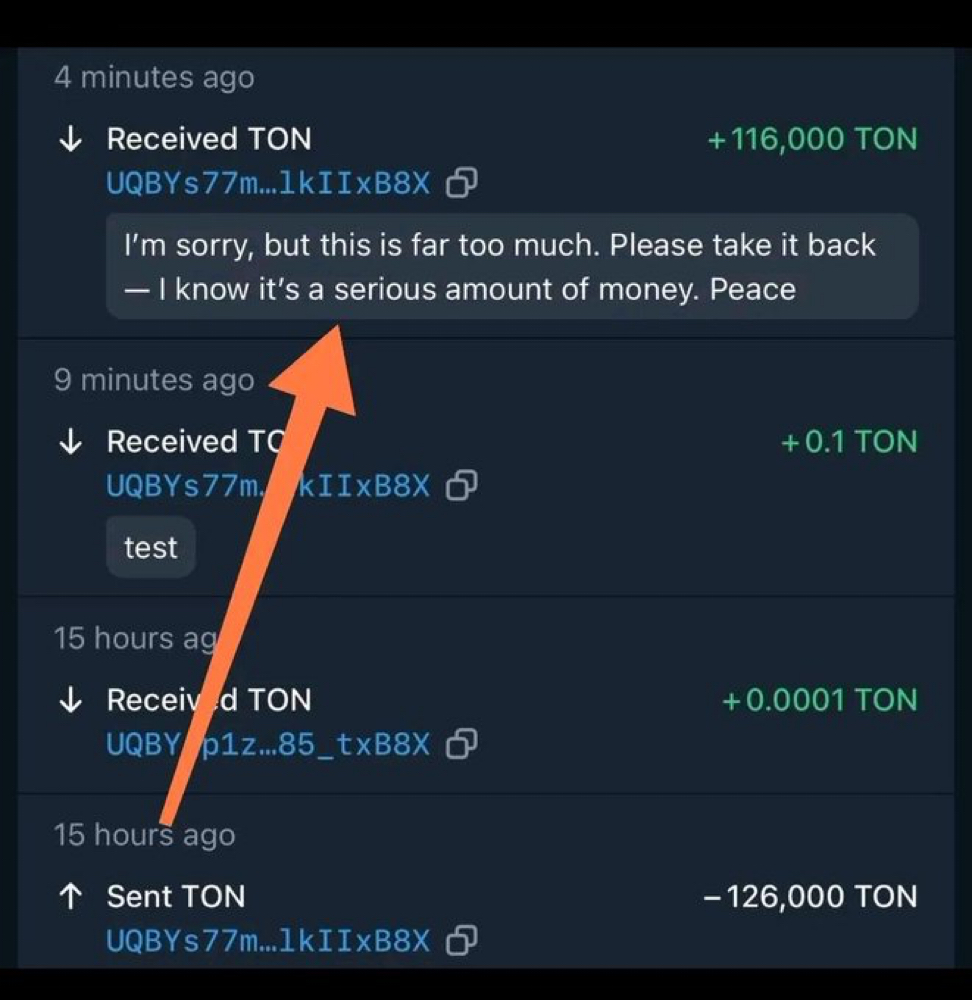

The normal risks with liquidation

If you do borrow and your crypto price goes down you need to be aware of getting liquidated. I by no means borrow up to the limit and like to keep my health score over 2. If my score was getting low I can add more collateral.

smart contract risk

Smart contracts are self executing programs that run on a blockchain, with benefits such as automation, transparency, and efficiency. However, they also come with certain security risks.

One potential risk of smart contracts is the possibility of bugs or vulnerabilities in the code. If these issues are exploited by attackers, it could lead to the loss of funds. Smart contracts should be thoroughly tested and audited by security experts before deployment. Additionally, ongoing monitoring and analysis of the smart contract can help detect any potential security breaches.

Another security risk is the lack of standardization in smart contract development. It can be difficult to ensure that all contracts are secure and reliable.

Timing

As with a lot of things in crypto, timing is important. Would I borrow to buy BTC now it is over $100K no I would not, because when I borrow it is because I expect the price of BTC to go up therefore when it does go up I can then pay back the loan from profits from the value going up. There is also the chance I could get it all wrong and my TA is wrong and the price goes down but I still have to pay back my loan.

Liquidity

I do keep an eye on the available liquidity of course because I may want to withdraw my assets, the available liquidity can vary depending on the asset and the chain.

To conclude, yes this is a high risk strategy and my plan so far has been paying off, I actually took profits from Aave to purchase the car I bought and the withdrawal was quick and simple. I am also aware that IMO it will soon be time to switch everything I have in Aave into a stable coin and withdraw back to my wallet. There is the possibility I may keep some play money in the protocol and reverse this strategy in the bear market (if we get one of those lol).

As with anything DYOR, I could have gotten it all wrong (still could!) and then I would be writing about how I lost a chunk of crypto!

IMPORTANT NOTE/WARNING

Whilst i was going over this article on Friday (24/1/25) I had a notification that RUNE (Thor Chains token) had dropped around 30% and I know some ALTs can and will do that, but it seemed odd, so after further research it seems as though they have some possible insolvency issues. I am not intending to spread FUD but this does highlight risks. Thor chain also has a borrow/lend protocol and it has currently 'paused' withdrawals of BTC and ETH for 90 days while they try and 'restructure' to stabilize the network. Take what you may from this information but it looks to me as there could be trouble ahead. I do hope that any problems get resolved but only time will tell.

Crypto can be risky enough, I just want to highlight again that I have added more risk, but it is up to each person to determine their own appetite for risk.

Thank you for reading and please feel free to comment.

Screenshots from Aave

You can find the Aave documentation on risk here https://aave.com/docs/concepts/risks