Stablecoin Development Market Booms in 2024: Surpassing $150 Billion Market Cap, $122 Billion Daily

Welcome to our comprehensive guide on the booming stablecoin development market in 2024. In this article, we’ll dive deep into the world of stablecoins, exploring their definition, distinguishing features, and their significance in the ever-evolving cryptocurrency landscape. Join us as we unravel the mysteries behind stablecoins and shed light on their remarkable journey to surpassing a $150 billion market cap and facilitating $122 billion in daily trades.

What are Stablecoins?

Stablecoins have emerged as a vital component of the cryptocurrency ecosystem, offering stability and reliability amidst the volatility that often plagues other digital assets. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are subject to erratic price fluctuations, stablecoins are designed to maintain a stable value by pegging their worth to a reserve asset, such as fiat currency or commodities like gold.

These digital currencies serve as a bridge between the worlds of traditional finance and decentralized blockchain networks, providing users with a familiar medium of exchange while harnessing the efficiency and security of blockchain technology. By mitigating the extreme price swings associated with conventional cryptocurrencies, stablecoins offer a sense of stability and predictability, making them an attractive option for a wide range of users, from traders and investors to businesses and consumers.

In essence, stablecoins represent a new paradigm in the evolution of digital currencies, combining the best elements of both traditional and decentralized finance to create a versatile and resilient form of value transfer.

Now, let’s delve deeper into the intricacies of stablecoins, starting with a clear definition of what sets them apart from their cryptocurrency counterparts.

Types of Stablecoins

Stablecoins come in various forms, each utilizing different mechanisms to maintain stability and peg their value to a reserve asset. Let’s explore some of the most common types:

1. Fiat-Collateralized Stablecoins:

Fiat-collateralized stablecoins are backed by traditional fiat currencies like the US dollar, euro, or yen, held in reserves by a centralized entity. For every stablecoin issued, an equivalent amount of fiat currency is deposited as collateral, ensuring a one-to-one backing and stability in value. Examples of fiat-collateralized stablecoins include Tether (USDT), USD Coin (USDC), and TrueUSD (TUSD).

2. Crypto-Collateralized Stablecoins:

Unlike fiat-collateralized stablecoins, crypto-collateralized stablecoins are backed by other cryptocurrencies held as collateral. These stablecoins rely on smart contracts and algorithms to maintain stability by adjusting the collateralization ratio based on market conditions. While they offer decentralization and transparency, they may be more susceptible to volatility in the crypto market. Examples of crypto-collateralized stablecoins include DAI and sUSD (Synthetix USD).

3. Algorithmic Stablecoins:

Algorithmic stablecoins, also known as non-collateralized stablecoins, use algorithmic mechanisms to stabilize their value without relying on any external collateral. These stablecoins adjust their token supply dynamically in response to changes in demand, aiming to keep their price stable. While algorithmic stablecoins offer decentralization and independence from traditional assets, they may face challenges in maintaining stability during extreme market conditions. Examples of algorithmic stablecoins include Terra (LUNA) and Ampleforth (AMPL).

Importance in the Cryptocurrency Ecosystem

Stablecoins play a crucial role in bridging the gap between traditional finance and the crypto world, offering stability, liquidity, and efficiency in transactions.

One of the primary reasons for their importance is their ability to provide a stable store of value in a highly volatile cryptocurrency market. Traders and investors often use stablecoins as a safe haven to protect their funds during market downturns or periods of uncertainty, mitigating the risk of significant losses.

Moreover, stablecoins serve as an essential medium of exchange within the cryptocurrency ecosystem, facilitating seamless transactions and enabling access to decentralized finance (DeFi) platforms. Users can easily transfer stablecoins across borders, conduct peer-to-peer transactions, and participate in various DeFi protocols such as lending, borrowing, and yield farming.

Additionally, stablecoins play a vital role in enhancing financial inclusion by providing access to digital assets for individuals and businesses in regions with unstable fiat currencies or limited banking infrastructure. They offer a reliable alternative to traditional banking systems, allowing users to store and transfer value with greater efficiency and lower costs.

The Rise of Stablecoins: Surpassing $150 Billion Market Cap

The milestone of stablecoins surpassing the $150 billion market capitalization mark is more than just a number; it signifies a monumental achievement within the cryptocurrency realm. This exponential growth underscores the increasing significance of stablecoins in the broader digital currency landscape.

Milestone Achieved Reaching a market capitalization of over $150 billion is a testament to the growing adoption and acceptance of stablecoins. This milestone signals a maturation of the market and solidifies stablecoins as a formidable player in the cryptocurrency ecosystem. Investors and enthusiasts alike are taking note of this achievement, recognizing the stability and reliability that stablecoins offer amidst the volatile nature of other cryptocurrencies.

Reaching a market capitalization of over $150 billion is a testament to the growing adoption and acceptance of stablecoins. This milestone signals a maturation of the market and solidifies stablecoins as a formidable player in the cryptocurrency ecosystem. Investors and enthusiasts alike are taking note of this achievement, recognizing the stability and reliability that stablecoins offer amidst the volatile nature of other cryptocurrencies.

Market Dynamics

The growth of stablecoins can be attributed to several key factors driving demand and adoption. One significant factor is the increasing volatility of traditional cryptocurrencies like Bitcoin and Ethereum. As investors seek a more stable store of value, stablecoins emerge as an attractive option due to their pegged value to fiat currencies or other assets. Additionally, the rise of decentralized finance (DeFi) platforms has fueled demand for stablecoins, as they provide liquidity, enable efficient transactions, and serve as collateral for various DeFi protocols.

Tether Dominance

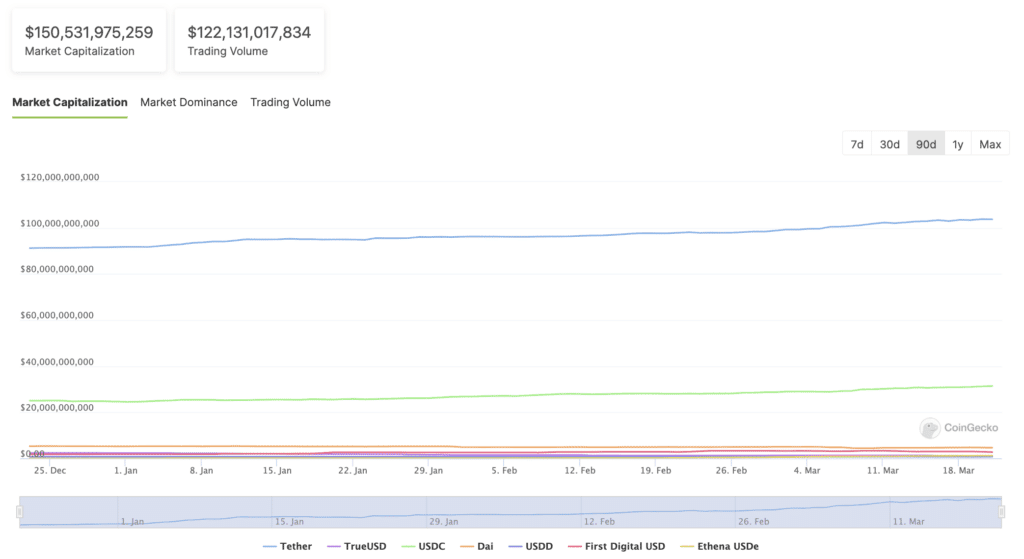

Among stablecoins, Tether (USDT) stands out as a dominant force, with a market capitalization exceeding $100 billion. Tether’s widespread adoption and liquidity have played a pivotal role in driving the growth of the stablecoin market. Despite facing scrutiny and regulatory challenges, Tether has maintained its position as the leading stablecoin, highlighting its resilience and enduring appeal among users and investors.

With stablecoin development services gaining momentum, the crypto community is abuzz with excitement and anticipation for the innovative solutions and opportunities they bring to the digital finance landscape. As stablecoins continue to garner attention and investment, they are poised to play an increasingly significant role in shaping the future of decentralized finance and global payments.

Exploring Market Trends and Growth Factors

As the cryptocurrency market continues to evolve, stablecoins have emerged as a beacon of stability amidst the unpredictable price fluctuations of traditional digital assets like Bitcoin and Ethereum. Let’s delve into the key trends and factors fueling the growth of stablecoins in 2024.

Growing Demand

In the midst of a volatile crypto market, the demand for stable assets has witnessed a significant surge. Investors seeking refuge from the rollercoaster ride of crypto prices are turning to stablecoins for stability and predictability. With their value pegged to fiat currencies or other assets, stablecoins offer a safe harbor during market downturns, attracting both seasoned traders and newcomers to the crypto space.

The statistics speak for themselves: the market capitalization of stablecoins has surpassed $150 billion, with daily trading volumes reaching an impressive $122 billion. These figures underscore the growing demand for stable assets and highlight the pivotal role that stablecoins play in reshaping the digital currency landscape.

Decentralized Finance (DeFi) Impact

Decentralized finance (DeFi) has emerged as a driving force behind the adoption of stablecoins. DeFi platforms leverage blockchain technology to offer a wide range of financial services, including lending, borrowing, and trading, without the need for traditional intermediaries like banks. Stablecoins serve as the lifeblood of the DeFi ecosystem, providing liquidity for various protocols and enabling seamless transactions across different platforms.

The rise of DeFi has propelled the demand for stablecoins to new heights, as users flock to these platforms to earn yields on their holdings or access liquidity for trading purposes. With DeFi protocols attracting billions of dollars in total value locked (TVL), stablecoins have become indispensable tools for participants in the DeFi space, driving further adoption and innovation in the ecosystem.

Investor Sentiment

Despite regulatory uncertainties and occasional market volatility, investor sentiment towards stablecoins remains overwhelmingly positive. The allure of stablecoins lies in their ability to offer stability and liquidity in a rapidly changing financial landscape. During periods of market turbulence, stablecoins serve as a safe haven for investors, allowing them to preserve capital and mitigate downside risk.

Moreover, the bullish sentiment surrounding stablecoins extends beyond short-term market dynamics. Many investors view stablecoins as long-term investments, recognizing their potential to facilitate cross-border transactions, streamline payment processes, and unlock new avenues for financial inclusion. As institutional adoption of stablecoins continues to grow, driven by factors such as regulatory clarity and improved infrastructure, the future looks bright for these digital assets.

Celebrating Stablecoin Success: Community Response

The cryptocurrency community is abuzz with excitement as stablecoins achieve unprecedented milestones in 2024. With the market cap of stablecoins surpassing $150 billion, enthusiasts and investors alike are cheering for this remarkable achievement. It’s not just about the numbers; it’s about what these numbers represent. The surge in stablecoin market cap signifies a growing recognition of stablecoins as a reliable and essential component of the digital currency landscape.

Crypto Community Cheers

From seasoned traders to newcomers, the entire crypto community is celebrating the success of stablecoins. The surge in stablecoin market cap reflects a growing trust and confidence in these digital assets. As stablecoins continue to gain traction, they are reshaping the way we perceive and interact with cryptocurrencies. The excitement within the community is palpable, with many enthusiasts seeing stablecoins as a harbinger of mainstream adoption and financial innovation.

Market Cap Metrics

Analyzing the numbers and trends behind the growth of stablecoin market capitalization reveals a fascinating story. The steady ascent of stablecoin market cap over recent months highlights the increasing demand for stable assets in the volatile cryptocurrency market. With each milestone reached, the community grows more optimistic about the future of stablecoins and their potential to revolutionize the way we transact and store value in the digital age.

Implications for the Crypto Ecosystem

The surpassing of $150 billion in stablecoin market capitalization carries significant implications for the broader cryptocurrency ecosystem. It signifies a maturing and expanding digital economy, where stablecoins have become indispensable infrastructure. As stablecoins continue to gain prominence, they are playing a crucial role in facilitating seamless transactions, cross-border payments, and financial services innovation.

Maturing Ecosystem

The exponential growth of stablecoins signals a maturation of the cryptocurrency ecosystem. With stablecoins surpassing significant milestones, we are witnessing a shift towards greater stability and reliability within the digital currency landscape. This maturation process paves the way for broader adoption and acceptance of cryptocurrencies, bringing us closer to a future where digital assets are seamlessly integrated into everyday life.

Infrastructure Role

Stablecoins serve as the backbone of the digital economy, providing the necessary liquidity and stability for various financial transactions. From cross-border payments to decentralized finance (DeFi) platforms, stablecoins play a crucial role in facilitating innovation and efficiency within the crypto space. As stablecoin market cap continues to grow, so too does their influence on the broader financial landscape, driving forward the evolution of digital finance in 2024 and beyond.

How to Launch a Stablecoin in 2024?

Launching a stablecoin in 2024 can be an exciting venture, but it requires careful planning and execution to ensure success in a competitive market. Let’s explore the step-by-step process of bringing a stablecoin to life in the current market environment.

Conduct Market Research

Before diving into the development process, it’s crucial to conduct thorough market research to understand the demand for stablecoins and identify potential niches or gaps in the market. Analyze existing stablecoin projects, assess competitor strengths and weaknesses, and gather insights into user preferences and market trends. This research will help you refine your stablecoin’s value proposition and target audience.

Define Objectives and Use Cases

Once you’ve identified market opportunities, define clear objectives for your stablecoin project. Determine the purpose and utility of your stablecoin, whether it’s facilitating cross-border payments, providing liquidity for DeFi protocols, or offering a stable store of value for investors. By outlining specific use cases and objectives, you can tailor your stablecoin to meet the needs of your target audience effectively.

Choose a Stablecoin Model

Next, select a stablecoin model that aligns with your project goals and preferences. There are various stablecoin mechanisms to choose from, including fiat-backed, crypto-backed, algorithmic, and commodity-backed stablecoins. Evaluate the pros and cons of each model, considering factors such as stability, scalability, regulatory compliance, and decentralization. Choose the model that best suits your project’s requirements and long-term vision.

Develop a Whitepaper and Roadmap

Craft a comprehensive whitepaper that outlines your stablecoin’s technical specifications, economic model, governance structure, and distribution strategy. Your whitepaper should provide detailed insights into how your stablecoin works and its value proposition to users and investors. Additionally, create a roadmap that outlines key milestones and development timelines for your project, demonstrating your commitment to transparency and accountability.

Build a Strong Team

Building a successful stablecoin project requires a talented and dedicated team with expertise in blockchain development, economics, legal compliance, and marketing. Assemble a team of professionals who are passionate about your project’s mission and possess the skills and experience needed to bring it to fruition. Collaborate closely with your team members to execute your roadmap effectively and navigate challenges along the way.

Secure Funding and Partnerships

Securing funding and strategic partnerships is essential for the success of your stablecoin project. Seek investment from venture capital firms, angel investors, or crowdfunding platforms to fund development costs and operational expenses. Additionally, forge partnerships with exchanges, wallet providers, liquidity providers, and other ecosystem players to enhance the adoption and utility of your stablecoin. Establishing strong partnerships can also help boost credibility and visibility for your project within the crypto community.

Launch and Market Your Stablecoin

Once your stablecoin is developed and tested, it’s time to launch it to the market. Coordinate a comprehensive marketing campaign to generate buzz and attract users and investors to your platform. Utilize social media, community forums, press releases, and influencer partnerships to raise awareness about your stablecoin and differentiate it from competitors. Engage with your target audience, gather feedback, and iterate on your product to ensure ongoing success and growth in the dynamic crypto market.

Key Considerations for Launching a Stablecoin

Launching a stablecoin in 2024 is an exciting endeavor, but it comes with its own set of challenges and considerations. Let’s explore some key factors that entrepreneurs and developers should keep in mind when embarking on this journey.

Regulatory Compliance

One of the most crucial aspects of launching a stablecoin is ensuring compliance with regulatory requirements. Given the evolving regulatory landscape surrounding cryptocurrencies, it’s essential to conduct thorough research and seek legal counsel to navigate the complex regulatory environment. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is particularly important, as regulators worldwide scrutinize stablecoin projects for potential risks related to money laundering and financial stability.

Market Positioning

Another important consideration is the positioning of your stablecoin within the market. With numerous stablecoins already in existence, it’s essential to differentiate your project and offer unique value to users and investors. Consider factors such as the stability mechanism, collateralization model, issuance and redemption process, and target market segment when defining your stablecoin’s positioning strategy. By clearly articulating your stablecoin’s value proposition and competitive advantages, you can attract users and build trust in your project.

Technology and Security

The technology behind your stablecoin is another critical aspect to consider. Choose a robust blockchain platform that offers scalability, security, and interoperability to support your stablecoin infrastructure. Implement rigorous security measures to protect user funds and mitigate the risk of hacks or vulnerabilities. Conduct thorough code audits and penetration testing to identify and address potential security flaws before launching your stablecoin to the public. Additionally, consider factors such as transaction speed, network congestion, and gas fees when selecting a blockchain platform for your stablecoin project.

Stakeholder Engagement

Engaging with stakeholders is essential for the success of your stablecoin project. Collaborate with regulators, financial institutions, exchanges, and other ecosystem players to foster trust and build partnerships that support the adoption and growth of your stablecoin. Communicate transparently with users and investors, providing regular updates on project milestones, development progress, and regulatory compliance efforts. By fostering a supportive and collaborative ecosystem, you can enhance the credibility and viability of your stablecoin project in the competitive cryptocurrency market.

Best Practices for Launching a Stablecoin in 2024

Launching a stablecoin successfully requires careful planning, strategic decision-making, and effective execution. Here are some best practices to guide you through the process and maximize the chances of success:

- Conduct comprehensive market research to understand user needs, competitor landscape, and regulatory requirements.

- Define clear objectives and use cases for your stablecoin project to align development efforts and marketing strategies.

- Choose a robust technology stack and prioritize security to protect user funds and maintain trust in your project.

- Collaborate with regulators and industry stakeholders to ensure compliance with legal and regulatory requirements.

- Communicate transparently with users, investors, and partners, providing regular updates and addressing concerns promptly.

- Foster a supportive and engaged community around your stablecoin project, leveraging social media, forums, and other channels to build awareness and drive adoption.

- Continuously iterate and improve your stablecoin based on user feedback, market trends, and technological advancements, adapting to changing market conditions and user preferences.

Conclusion

As the stablecoin market continues to experience rapid growth and widespread adoption, it’s clear that these digital assets have cemented their role as essential infrastructure in the cryptocurrency ecosystem. With a market cap surpassing $150 billion and daily trades exceeding $122 billion, stablecoins have demonstrated their resilience and utility, providing users with stability, liquidity, and accessibility in the volatile world of digital finance.

Looking ahead, the future of stablecoins appears promising, with opportunities for further innovation and expansion into new use cases and markets. However, challenges such as regulatory scrutiny, technological advancements, and market competition will need to be addressed to ensure the continued success and evolution of stablecoins. Despite these challenges, the potential for stablecoins to revolutionize the way we transact, invest, and store value in the digital age is undeniable, making them a key player in shaping the future of finance.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)