The Future of Banking with Big Tech: The Next Frontier for Non-Bank Innovation

An evolution of banking services

Changes have been brewing in the financial industry due to a rising increase in non-bank financial services offered by big tech companies.

This disruption has created an entirely new array of competitors that are offering consumers more choices for banking convenience, reduced fees, and attractive options.With this explosive growth of non-bank services from large technology companies, is the future of banking services destined to become big tech?

The big names of digital financial products

Consider the range of financial products that are being offered by big technology companies.

Google offers a suite of cloud-based financial products including Google Finance for real-time market quotes and financial news, Google Wallet for managing credit cards, tickets, and rewards, and Google Pay for seamless online payments.Apple offers services including Apple Card for interest-free payment of services and Apple Pay for providing mobile payment and digital wallet services.Meta provides a variety of financial literacy content, an online payment service Meta Pay, and has previously been involved in blockchain and cryptocurrency with Libra.

Variety in non-bank services

Amazon and Alibaba have their own payment systems including Amazon Pay and Alipay, the latter of which has become a major competitor to PayPal as the world’s largest mobile payment platform.

A vast number of tech companies are involved in non-bank services.

- PayPal and Stripe — online payment processors.

- Square and Zelle — digital payment providers, the latter of which is backed by major banks.

- Venmo — mobile payment services.

- WeChat Pay — digital wallet services.

- Coinbase — cryptocurrency platform.

- Robinhood and Betterment — online trading platforms.

- SoFi — mortgage, student, and personal loan refinancing.

- Upstart, Prosper, and LendingClub — peer-to-peer lending services.

Complement or compete

The growing number of big tech companies becoming involved in financial services is creating an environment that complements, and even, competes with traditional banking services.

Traditionally, the financial industry has consisted of both large and small banks, credit unions, and other regulated banking services. In addition to banks, non-banks have also contributed to diversity, by offering their own services for loans, credit lines, and private investments.Non-banks provide a valuable service to consumers by not only diversifying the available services that can be chosen from, but also by providing competition within the financial industry, adding downward pressure on rates, fees, and enhancing services.

A benefit to consumers

As the growing number of big tech companies offering their own financial products increases, further competition is bound to take place between bank and non-bank offerings.

Such competition can have serious implications to the current state of the financial market including payments, lending, savings, and insurance.The trend of non-bank services offered by big tech is likely to bring about regulatory implications, ranging from leveling the playing field, consumer protection, data privacy, and even financial stability.

Inflating valuations

Big tech companies have exceedingly large valuations when compared to traditional banks.

A report by McKinsey & Company indicated that as recently as 2020, the market capitalization of the seven largest technology companies has exceeded $8 trillion dollars. This is nearly double the market capitalization of the top 200 banks combined.Clearly, this is demonstrating that investors are valuing technology companies significantly more than the banking industry. This change in valuation is reshaping many investment strategies.

Advantages over traditional banks

It may not be a surprise that big tech companies and non-bank offerings have been able to grow to such an extent beyond traditional banking services.

Advantages that technology companies are able to leverage include access to a large and loyal customer base, vast amounts of consumer data, advanced analytics including artificial intelligence, machine learning, large language models, and other intelligence capabilities.In addition to out-competing banks on systems and performance, technology companies are often able to leverage low-cost digital platforms to provide services to consumers.

A perfect storm of capabilities

The range of advantages available to big tech companies can certainly seem impressive.

In fact, this perfect storm of capabilities is what allows tech companies to offer financial services to consumers with enhanced personalization, convenience, and most notably, a lower cost than traditional banks.Combining these advantages with the ability to cross-sell related technology products provides big tech companies with the capability to steadily surpass traditional banks.Of course, this type of growth does not come without its own unique set of risks and challenges. Photo by Jeffrey Blum.

Photo by Jeffrey Blum.

Risks and challenges

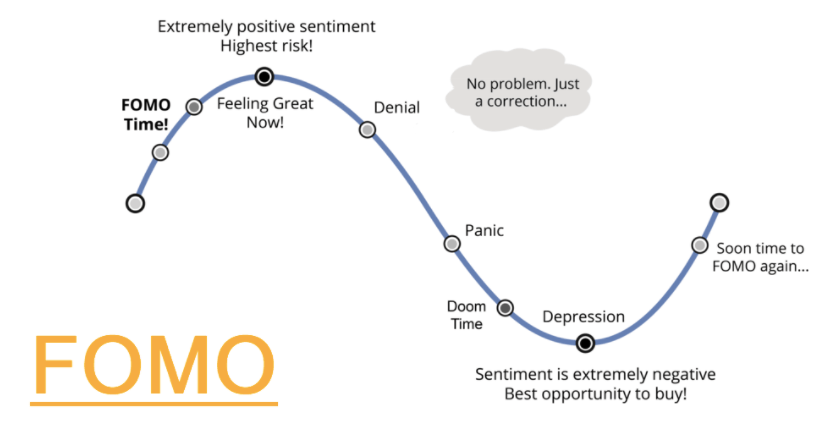

As big tech companies grow in valuation and combine their offerings with non-bank services, there is an increasing concern of systemic risks to the financial system, similar to that during the Great Recession.

Consider the risk of concentration in one particular area of investment by big tech companies, such as online mobile payments or peer-to-peer lending services. Such a scenario could create a strain on financial markets and an increased risk for investors.

Contagion

Big tech companies could pose a contagion risk, resulting from a failure in one particular company’s offerings that may affect the entire banking industry as a result. Consider a collapse of a crypto exchange which could have the potential to affect a much larger population that the originating tech company.

Cyber attack

Cyber risk and data protection are also a concern. As more big tech companies leverage consumer data and analytics in order to offer financial products and services, the storage and use of sensitive consumer data is put at risk for cyber theft.

Data privacy

Consumer data privacy, especially as related to non-bank offerings, is becoming increasingly important for consumer protection. Additionally, big tech companies may need to be monitored with regard to market power and fair competition.

Fair markets

Since big tech companies may be able to operate financial services outside of the traditional regulatory perimeter or even exploit regulatory arbitrage to their advantage, it will become ever more important to create a fair market with traditional banks.

Regulation to protect stability

Government regulation will likely need to adapt to these changes in non-bank offerings in order to ensure a fair market for banks, big tech, and consumers.

Policy responses to big techs in financial services may include adoption of a more holistic and cross-sectoral approach to regulation and supervision of big tech. Regulation might take into account business models, activities, and the scope of consumer and market impact.Similar to bank requirements for liquidity and cash-flow in order to reduce the risk of failure and contagion, big tech companies may be placed under similar scrutiny in order to protect the stability of markets.

Balancing innovation and competition

A balance in the trade-offs of innovation and competition is also an important consideration to ensure financial stability and consumer protection as a whole.

Concerns including types of activity, handling of data, and platform regulation combined with international coordination will become increasingly important.It may seem that an all, but certain future is guiding big tech. However, how are traditional banks reacting?

Responding to competitors

Traditional banks are not standing aside while big tech companies advance with banking services.

The banking industry is responding to big tech’s competition with non-bank services by combining strategic tactics, improved customer interaction, assurances of regulatory compliance, and even collaboration with big tech themselves.Banks can leverage these various strategies to ensure profitability against big tech offerings and are even reviewing analyses of financial impact scenarios with plans to counteract competition.

Diversification, profitability, and collaboration

Strategies that might be leveraged by banks include diversification into adjacent financial businesses, even if those areas are not directly profitable for the banks.

Diversified offerings have the potential attract and lock-in new customers. A bank expanding from consumer finance into retail or mobile banking can offer a whole new suite of services for existing consumers.Additionally, banks may leverage a reduction in profit margins. These may be reduced to a point of unprofitability for competing tech firms, due to cost of investment.As an example, consider if banks were to reduce loan payment fees beyond a threshold. This could make it more difficult for merchants to switch to big tech company offerings, and thus, remain with a traditional bank. Photo: DALLE.

Photo: DALLE.

A common goal for a successful future

Regardless of competition between banks and big tech, the continued incursion of technology into banking services is determined to change the industry as a whole.

Over the short term, consumers will undoubtedly benefit from increased competition between banks and big tech. However, a careful watch will need to be placed on both sides in order to prevent monopolies from emerging.As with many technology revolutions, with careful implementation and a fair market, both banking and big tech can work together to ensure the consumer is ultimately the one to benefit.

About the Author

If you’ve enjoyed this article, please consider following me on Medium, Twitter, and my website to be notified of my future posts and research work.

References

Dietz, M., et al. (2023). Big techs versus big banks: Battle for the customer. McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/big-techs-versus-big-banks-battle-for-the-customer

Dietz, M. & Yasenovets, I. (2019, Nov 11). How banks can react to big tech’s entry into financial services. McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/how-banks-can-react-to-big-techs-entry-into-financial-servicesErlebach, J., et al. (2020, Nov 24). The Sun Is Setting on Traditional Banking. Boston Consulting Group. https://www.bcg.com/publications/2020/bionic-banking-may-be-the-future-of-bankingMano, M. & Padilla, J. (2019, Apr 8). Big Tech Banking. Journal of Competition Law & Economics. Volume 14, Issue 4, 2018, Pages 494–526. https://doi.org/10.1093/joclec/nhz003Marous, Jim. (2017, Aug 28). Technology Giants Pose Major Threat to Banking Industry. The Financial Brand. https://thefinancialbrand.com/news/banking-technology/technology-giants-fintech-banking-threat-67061/World Economic Forum. (2017, Aug 22). Big Tech, Not Fintech, Causing Greatest Disruption to Banking and Insurance. World Economic Forum. https://www.weforum.org/press/2017/08/big-tech-not-fintech-causing-greatest-disruption-to-banking-and-insurance/Wyman, Oliver. (2020, Jul 1). Big Banks, Bigger Techs? Oliver Wyman. https://www.oliverwyman.com/our-expertise/insights/2020/jul/big-banks-bigger-techs.html