The Crypto Countdown: What the Bitcoin Halving 2024 Means for You and Your Wallet

The Bitcoin Halving: What It Is, How It Works, and Why It Matters for the Crypto Market

Bitcoin halving is one of the most anticipated events in the cryptocurrency world, as it affects the supply and price of the digital currency. But what exactly is bitcoin halving, and why does it matter? In this post, we will explain the concept of bitcoin halving, how it works, and what impact it has on the bitcoin network and market. We will also look at the history of bitcoin halving and what to expect from the next one in 2024. Whether you are a beginner or an expert in cryptocurrency, this article will help you understand the significance and implications of bitcoin halving.

To understand how bitcoin halving works, we need to first understand how bitcoins are created and distributed. Bitcoins are generated by a process called mining, which involves using computers or specialized hardware to solve complex mathematical problems and validate transactions on the bitcoin network. Miners who successfully solve a problem and add a new block of transactions to the network are rewarded with a certain amount of bitcoins. This reward is called the block reward, and it is the main incentive for miners to participate in the network and secure it. However, the block reward is not fixed, but rather decreases over time according to a predetermined schedule. This is what bitcoin halving is: a periodic event that cuts the block reward in half every 210,000 blocks, or roughly every four years.

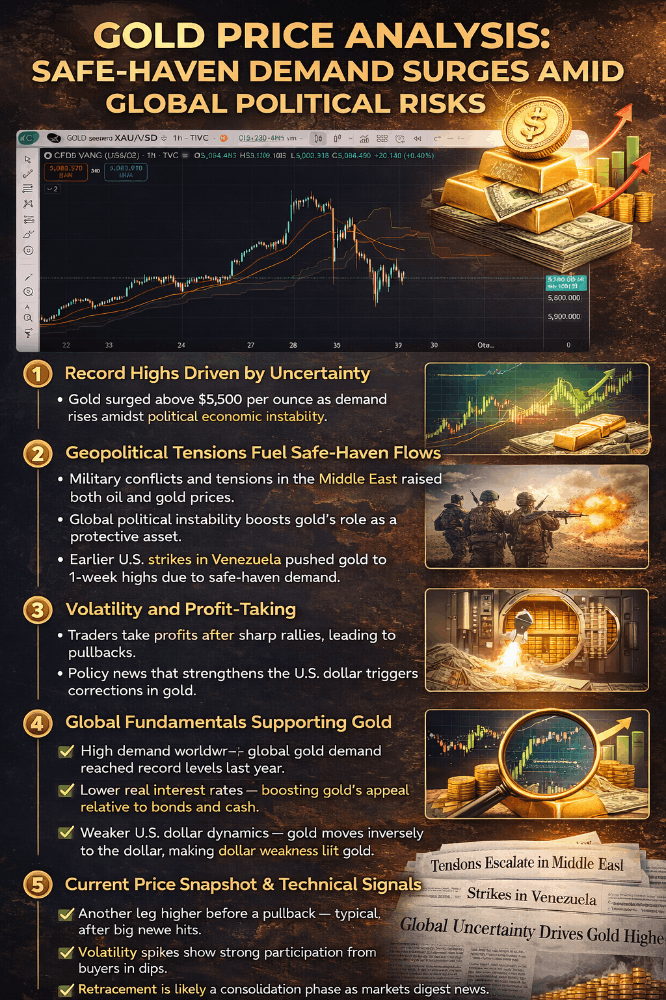

The History of Bitcoin Halving and Its Price Impact

Bitcoin halving is not a new phenomenon, as it has occurred three times since the inception of the network in 2009. It was designed to be a key part of the coin's inflation control mechanism as it helps to keep the supply of new coins finite and therefore helps to maintain Bitcoin's value over time. The first halving occurred on **November 28, 2012**, when the price of a Bitcoin was a mere **$12** – one year later, Bitcoin had skyrocketed to around **$1,000**. On **July 9, 2016** the second halving took place – Bitcoin had fallen to **$670** per coin by then, but it shot up to **$2,550** by July 2017. The third and most recent halving occurred on **May 11, 2020**, when the block reward dropped from **12.5 BTC** to **6.25 BTC**. The price of Bitcoin on that day was **$8,821**, and it reached an all-time high of over **$64,000** in April 2021. As you can see, each halving has been followed by a significant increase in the price of Bitcoin, although not immediately or consistently. This suggests that halving has a positive effect on the demand and scarcity of Bitcoin, but other factors also influence its market dynamics.

What to Expect from the 2024 Bitcoin Halving: Risks and Rewards

The next bitcoin halving is expected to take place in April or May 2024, when the block reward will drop from 6.25 BTC to 3.125 BTC. This will be the fourth halving in Bitcoin’s history, and it will reduce the annual inflation rate of Bitcoin from around 1.8% to 0.9%. Many analysts and investors anticipate that the halving will have a positive effect on the price of Bitcoin, as it will create more scarcity and demand for the digital asset. However, there are also some challenges and uncertainties that could affect the outcome of the halving, such as the mining profitability, the network security, and the regulatory environment. Some experts predict that Bitcoin could reach new highs of over $50,000 or even $100,000 after the halving, while others are more cautious or skeptical about the impact of the event. As history shows, Bitcoin’s price tends to fluctuate significantly before and after each halving, and there is no guarantee that the past patterns will repeat themselves.

The Use Cases and Benefits of Bitcoin Halving

Bitcoin halving is not only a technical event, but also a social and economic one. It affects the incentives and behavior of various actors in the Bitcoin ecosystem, such as miners, investors, developers, and users. Some of the potential use cases and benefits of Bitcoin halving are:

• It preserves the scarcity and value of Bitcoin by limiting its supply and creating deflationary pressure.

• It reduces the inflation rate of Bitcoin and makes it more predictable and transparent than fiat currencies.

• It encourages innovation and efficiency in the mining industry by forcing miners to upgrade their hardware and software and optimize their energy consumption.

• It attracts more attention and adoption to Bitcoin by generating media coverage and public interest.

• It creates a positive feedback loop for the Bitcoin price by increasing the demand and reducing the supply of new bitcoins.

• It aligns the interests of miners and users by rewarding those who secure the network and penalize those who try to attack it.

The Pitfalls and Perils of Bitcoin Halving

Bitcoin halving may sound like a technical and boring event, but it has far-reaching consequences for the miners and the users of the network. It is not all sunshine and rainbows, as there are also some dark clouds and storms looming on the horizon. Here are some of the potential pitfalls and perils of Bitcoin halving:

• It could spell doom for some miners, who may find it hard to survive on the reduced block rewards and higher costs. They may have to quit the network or switch to other coins, leaving Bitcoin less secure and more prone to attacks.

• It could make Bitcoin transactions a pain in the neck, as miners charge higher fees to compensate for their losses. This could make Bitcoin transactions more costly and sluggish, and discourage its use and adoption.

• It could trigger a roller coaster ride for the market, as investors and traders gamble on the price movements and expectations of the halving. This could lead to wild price swings and crashes, as well as manipulation and fraud.

• It could face a backlash from the authorities, who may try to crack down on Bitcoin and other cryptocurrencies. This could limit the availability and growth of Bitcoin, and expose its users to legal risks and sanctions.

The Final Word: How Bitcoin Halving Shapes the Future of Crypto

Bitcoin halving is a complex phenomenon that has significant implications for the cryptocurrency market and its participants. It is a key feature of Bitcoin’s design that ensures its scarcity and value over time. It also affects the incentives and behavior of various actors in the Bitcoin ecosystem, such as miners, investors, developers, and users. Bitcoin halving has historically been followed by a substantial increase in the price of Bitcoin, although not immediately or consistently. However, it also poses some challenges and risks for the network and the market, such as reduced profitability and security, increased fees and volatility, and regulatory and legal hurdles. Bitcoin halving is not a guarantee of success or failure, but rather a catalyst for change and innovation. It is up to the Bitcoin community to adapt and evolve with the halving and make the most of its opportunities and benefits.