3 Critical Signs Toncoin (TON) May Fall Below $5

The value of Toncoin is facing a period of volatility as a mix of increasing supply on exchanges and reduced whale activity is poised to push its price below the $5 mark. Toncoin (TON), linked to Telegram, has seen a consistent downward trend since September, declining by 10%.

With its supply on exchanges rising by 7% over the past week, selling pressure continues to grow, and the potential for further losses looms. This report delves into the factors contributing to TON’s possible price dip, analyzing market signals and whale movements.

Growing Supply on Exchanges

One of the critical factors behind Toncoin’s ongoing bearish momentum is the notable increase in its supply on cryptocurrency exchanges. Over the past week, the supply of TON tokens held on exchanges has surged by 7%, totaling approximately 1.6 million tokens.

According to data from Santiment, this influx of tokens into exchanges typically signals potential sell-offs, as it makes the asset more accessible for trading. When more tokens are moved from private wallets to exchanges, they become easier to sell, which can create increased selling pressure and drag down the price.

This shift in the balance of Toncoin tokens between private wallets and exchanges adds to the overall bearish sentiment. Currently, 9.93 million tokens remain held outside exchanges, which is a slight decline of 0.3% over the past week, further confirming that holders are engaging in profit-taking activities.

Decline in Whale Activity

The drop in large holder activity has been another factor fueling the bearish outlook for Toncoin. Whales, or large holders who own significant portions of an asset, typically play a substantial role in shaping market sentiment.

A notable 143% decrease in the net flow of large TON holders—those who own more than 0.1% of the circulating supply—has been observed in the past week.

According to IntoTheBlock’s data, this drastic reduction suggests that whales are selling off their holdings, creating an environment of uncertainty and fear among smaller investors, who often follow their lead.

This behavior further exacerbates the likelihood of a prolonged downtrend. As whales sell off, smaller investors may panic and begin to sell their holdings as well, reinforcing the downward momentum in TON's price.

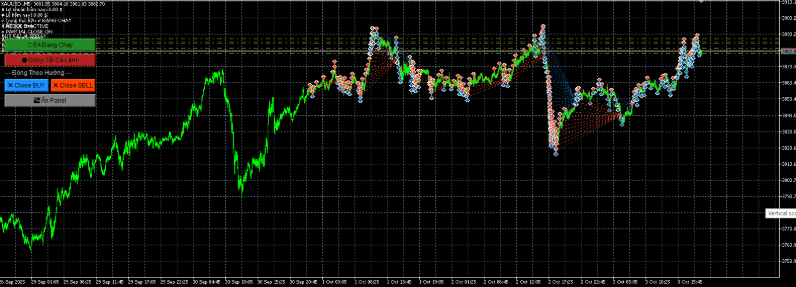

Price Analysis: Will TON Dip Below $5?

Toncoin is facing increasing pressure as both on-chain data and technical analysis point towards further price declines. As of now, Toncoin has dropped nearly 19% since its recent peak and is hovering around the $5 support level. While it has seen some recovery after touching this mark, the overall outlook remains bearish.

Looking at the technical setup, the market indicators suggest that TON may soon break through the critical $5 support level. If it does, the price could decline by another 16%, potentially reaching a monthly low of $4.42—a price not seen since early September.

However, if market sentiment improves and the selling pressure eases, Toncoin could see a reversal in its trend, with the possibility of attempting to break through the $5.90 resistance. Should TON successfully break past this resistance, it could trigger a rally, driving the price towards the next target of $6.81.

Outlook for Toncoin Investors

Investors in Toncoin should brace for further volatility. The combination of increased supply on exchanges, declining whale activity, and bearish technical signals suggests that the cryptocurrency could continue to struggle in the short term. Should the sell-off persist and whales continue to exit their positions, TON’s price may experience more downside pressure, with sub-$5 prices on the horizon.

However, there is a silver lining for long-term investors. While the short-term outlook remains grim, a successful defense of the $5 support level could lead to a recovery. If sentiment shifts and market conditions improve, TON may attempt to retest its resistance zones and stage a potential rally. For now, though, caution is advised, as the risk of further declines remains high.

This article has detailed the primary drivers behind Toncoin's potential price drop, including increased supply on exchanges and declining whale activity. Investors should remain vigilant as the cryptocurrency navigates these bearish conditions and monitors the key price levels of $5 and $5.90 for signs of recovery.

Sources used in the article:

- Increased Supply on Exchanges Contributing to Toncoin’s Price Decline:

- Whale Activity Decline and Market Analysis:

- CCN AnalysisCCN.com

- .

- On-Chain Data Indicating Large Holder Net Flow Drop: